High Premiums and High Deductibles Going into 2016

People of all income levels, news sources, insurers, and providers have expressed frustration over rising health premiums and deductibles going into 2016. There are the grim and ominous warnings by the Congressional Budget Office (CBO) and Join Committee on Taxation (JCT) in regards to interest on national debt (and the 184 page report that goes along with it that points at healthcare as one of the star players in causing debt).

The above leads naturally to a few simple and obvious questions like:

“Why are health premium and high deductibles so expensive?” and “If people’s pocket books, both parities, health insurers, health providers, and the federal and state Governments are all stressed out over money… where the heck is the money going?”

In other words, “How is it that a law that seeks to ensure affordable accessible health insurance has managed to shock everyone with its high cost?”

Below we provide a few answers to those questions, a few tips for those dealing with the core problem on a personal level, and some suggestions for what can be done about it as a nation.

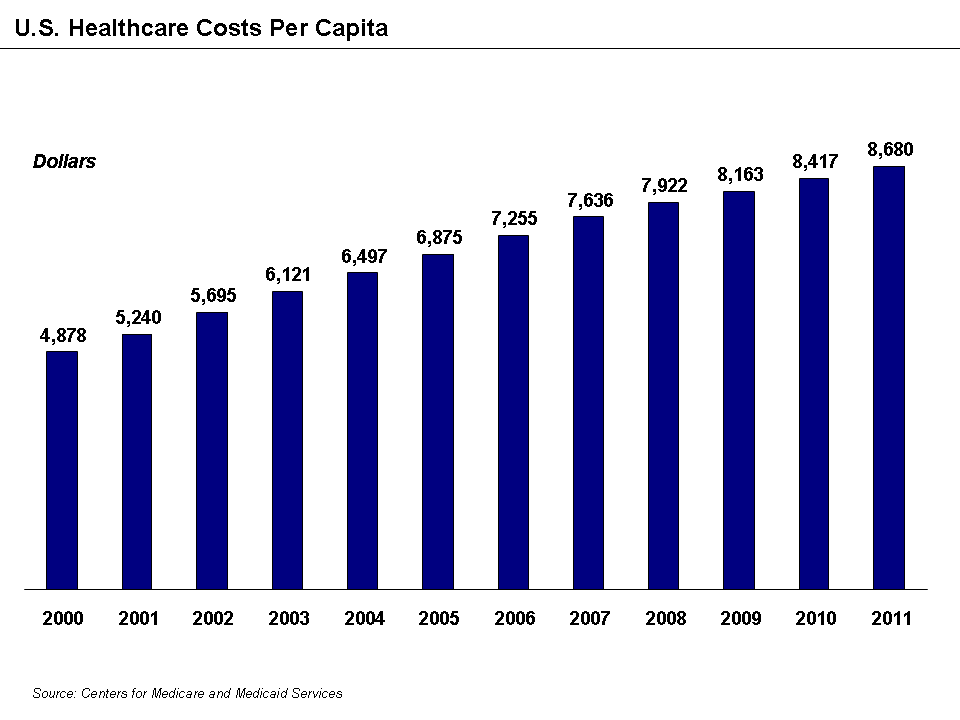

FACT: Despite the current problems with health care costs, the PPACA has created many benefits. 1 in 6 Americans got a Marketplace plan for $100 or less in 2015. The uninsured rate is at a historic low, and under the ACA health care spending grew at the slowest rate on record since 1960. Cost curbing measures are real and are working, but curbing long-term costs does little to curb the frustrations of the present day.

Reasons why Health Insurance Premiums and Deductibles are High

In it’s simplest form the answer to the above question is: The bulk of the $3 trillion dollars system is centered in a for-profit model. This means that we need about twenty cents on the dollar in profit for each middleman. At least, if we don’t hit that 20% profit, our huge health market providers and all of those who profit from the industry, including those of us who have savings, pensions, or investments are unhappy.

The healthcare sector of the economy also expects those profits to grow each year, or they are unhappy (especially stockholders, and it’s worth noting there hasn’t been an unhappy stockholder for years as the growth from 2009 to now has been staggering). This is a factor that some insurers are struggling with under the ACA due to more old and sick people enrolling than young and healthy people. This is something that doctors and hospitals struggle with: cheap ACA plans from new insurers, Medicaid, and Medicare where claims aren’t always processed at top dollar.

To make up the losses, and to keep stockholders happy, insurers and providers increase rates every year. Medicare, Medicaid, and ObamaCare subsidies pay rates that can’t be paid by people, and we borrow money as a country to make up the difference (we don’t actually have enough money to cover our projected spending over the next ten years).

If we were projecting a surplus this might be a good solution, but we aren’t. We are projecting dangerous levels of debt. We have to pay interest on debt. Over time we will need to borrow more and more money to pay off that interest. It’s not just healthcare that is to blame (think Military spending, college loans, 30 year mortgages, etc.), but healthcare is an undeniably big chunk of the fiscal problem and the focal point here.

It seems hopeless, but we are Americans and we don’t stand for hopeless, so we need to look harder. Stockholders and profits may be cogs in the wheel of unsustainability, but they aren’t the whole machine. What are we missing?

The Underlying Cost of HealthCare

Insurers aren’t the only ones who need to profit from the healthcare system, and want to see profits increasing every year. Drug companies, healthcare innovators, and manufacturers are also for-profit companies that want to see profits (as do their investors). Before insurers and hospitals know how much they have to increase prices, they have to know what the base prices of healthcare will be and compare that to the projected needs of their policyholders.

In other words, underneath the whole health insurer and provider system is another system that is pushing pressure upwards trying to ensure their 20% growth of profits.

So, healthcare companies raise rates, insurers must raise rates in return, and in order to insure near 100% coverage under the current system we must pay out-of-pocket and subsidize these increases to keep the machine rolling.

Of course there is always a bureaucracy that processes cash flow, claims, billing, and litigation.

It Was All Essentially True Before ObamaCare. The Difference is that ObamaCare Pressured the System to Include More Sick People and Poor People.

It used to be that only the relatively well off took part in healthcare. The poor received sub-standard or no care. Even without the pressure to add the sick and poor into the healthcare system, the machine was breaking down we’ll before the patient protections and subsidization of PPACA. In fact, in large part, the PPACA was a last ditch response to the rising costs of healthcare and the rising numbers of uninsured Americans.

The whole thing was completely unsustainable before the ACA, and apparently after it as well, according to many. There is data to show the existence of a happy, healthy, but less vocal, tens of millions enjoying their now affordable healthcare and health insurance.

In a sense we have a dangerous game of hot potato. The hot potato being the increasing expectation of profits from the healthcare system, when considered along with our democratic imperative to provide everyone with a reasonable level of healthcare.

What Can Be Done on a Personal Level?

On a personal level, the best thing a family can do is being smart about tax breaks and legal loopholes. Max out an HSA, consider starting a small business and enjoying the tax perks of being self employed, really shop around for healthcare (prices are all over the place), lower your premiums with the right HMO, protect against costs when traveling with the right PPO, get a Marketplace silver plan and take advantage of cost sharing reduction subsidies, the list goes on. Essentially we suggest you read the information we wrote on the topic.

What Can Be Done on a National Level?

Costs can’t rise forever; people can’t afford it. The Government can’t afford it. At some point there isn’t going to be any more juice left in healthcare to squeeze; think of the housing bubble. We can wait until we are all in boiling water, or we work on finding solutions ahead of time. Here are some ideas about ways in which we can be proactive:

Single payer Medicare-for-all with a supplemental option: In this option, insurers would move to a catastrophic public plan with private supplemental options. Supplemental options could be subsidized. This strategy caps what one can expect from insurers, but it preserves the industry.

Straight up single payer: In this option, all insurance would be public. We remove one 20% profit margin, but also absorb the entire burden. If this doesn’t come with super charged bargaining power with healthcare manufacturers and innovators, the implications are a potentially frightening.

Reduce claims, billing, and litigation: The GOP wants to reduce bureaucracy in healthcare. All their repeal rhetoric aside, the GOP idea a strong one at it’s core. We can’t pay our bills. Finding reasons not to pay them is a poor solution… it just makes the private companies jack up their rates further to pad their profits. We’ve seen the need for this in our increasing oversight of Medicare.

Let Medicare negotiate drug prices: There is a strong argument for government regulation of the amount of profit that the drug companies make on pharmaceuticals. 70% of Americans take prescription drugs. How many take drugs they don’t actually need? Why do they take them? Are people taking highly advertised drugs when simple generics would work as well? How much do those drugs really cost? At some point the rain must come, even at the best of parities.

Focus on HMOs: HMOs can be really lackluster, but in general, by being focused on a certain area, an insurer can shave off some premium pricing by negotiating solid rates with a small group of providers for a small subsection of policy holders. The fewer middlemen between the patient and doctor the more room there is for reasonable profits.

Limit Premiums for everyone: “The group making over 400% of FPL but less than the rich” (I’m not sure there is a catchy name for this group that we tend to call “middle class”, but they are frustrated if our blog is any indication). These people, many with employer coverage, are getting the raw end of the deal. Some pay considerably more for healthcare than we should ask… and yet they also face the mandate if they aren’t covered. Solid though needs to be given to giving this group a fair deal.

Reform the employer mandate: The 9.5% for self-only coverage from employer rule is a nightmare. Who decided this was a good idea? It must be 9.5% for family coverage (maybe based on a family of 4 to be fair). Even better, let family members opt out and use the exchange. Or let the employer provide the subsidy the Government would have provided. It’s not rocket science. This part of the system obviously needs a review.

Limit Deductibles Even Further / Mandate HSA: Another GOP idea is the establishment of compulsory HSAs. Part of the healthcare tax system might be revised to include compulsory HSAs for those who can afford to set money aside for healthcare in order to ease the burden of high deductibles. Few people have $13,000 for a deductible. This means, without an HSA savings account, the current high deductible plans just don’t work. For many of us health coverage unworkable because having to meet a high deductible without the padding of an HSA essentially means that this group cannot afford to use health insurance, or uses it and faces bankruptcy. For some there is no point in having catastrophic coverage with a catastrophic deductible. That only works for those with money in income or savings to fund an HSA. We need to figure out the deductible issue a little better, and curb premiums (which will need to be higher the more they are expected to cover) with subsidization. Again, single payer may sound attractive when it comes to the catastrophic coverage, but only if we fix the issue of high deductibles.

Forget Insurance and Single Payer and Just Have HSAs with New Rules and Tighter Regulations on HealthCare: The whole reason we have insurance is because a single person can’t absorb the costs of a catastrophic accident, chronic condition, or illness. We need is to know that American families are covered in an emergency, and that they have access to affordable preventive care. That is the part that should be a right, and the part that the ACA has worked toward. There could be a plan in which everyone who can afford to pay taxes has a mandatory HSA that is funded in exchange for a tax break, and paired with a small healthcare tax that covers people in catastrophic accidents and offers basic preventive services for free. All other stuff could be paid out-of-pocket. If we focus our attention on regulating the rest of the healthcare system, the end result might be that people are protected in an emergency, get basic preventive care, and buy everything else out-of-pocket (with HSA as padding) if their wallet and the market allows it.

One Single Solution Given all of the Above

Above we have opinions for problems and possible solutions. This is (in this authors opinion) one overall solution:

- Public Single Payer catastrophic coverage with Private Supplemental options (which would be trying to do a better job than Medicare, and so is not Medicare-for-all).

- A general push toward limiting what is expected from profits. Catastrophic coverage and life saving drugs need to protect America as much as they need to have profits that incentivize innovation. If you can sell a drug for $1 in Canada, then you can sell it for $1 in the U.S., if you already made back your profit and you can afford to sell a drug for $30, don’t sell it for $3,000. Have some consideration for your fellow Americans.

- Giving the government more power in negotiating and regulating supplemental plans and private healthcare industries. It should be done out of the interest for fairness and affordability and not used as a tool to cripple the private industries.

- A focus on HMOs and coordinating healthcare locally.

- Even more focus on preventive care. Hidden costs of related procedures could be done away with as they scare people off from actually getting preventive care.

- Compulsory HSAs. Money that would have gone into premiums and deductibles of ObamaCare could be put into HSAs.

- Reduce litigation, billing, and claims by simplifying rule sets without sacrificing quality.

- Focus on curbing profits rather than ramping up taxes. We need a strong healthcare system, not an overly bloated and unsustainable one. We want to incentivize a cancer cure, not incentivize delaying a cancer cure or monopolizing one.

Lastly, we as America need to come together and fix the problem and leave a better world to our children. We should ideally do this without instituting radical change and without crippling an existing industry. But more importantly, we must improve our healthcare system without crippling the American people.

How many more price increases can the market, the people, or the nations bank ledger stand before we start having larger economic problems? We need to act to further the progress that began with the Patient Protection and Affordable Care Act and make the healthcare system sustainable.

Nick Jones

Really tough on the middle class. My rates as a 30 year old male have gone up AGAIN to $250 a month. That’d be reasonable if it was a decent policy. However, the doctors hardly speak English and graduated from out of country medical schools. My deductible is 7k… And this is after 4 years of 0 medical expenses but one yearly check up (ie. they were winning the ‘insurance bet’ in a big way).. Strongly considering going uninsured and just paying out of pocket next year. If it wasn’t for the darn catstrophe chance…

Moses Valdez

What we need is across the State lines to compete for customers. That will drive down prices, just like auto insurance.

Deb McCall

I think it stinks for the middle class. My insurance premiums went up a result of Obamacare, now I receive less care, pay higher premiums, higher deductibles and get nothing in retirement benefits anymore after working 40+ years already and 27 of them at the Mayo Clinic. This was not the case before the Obamacare law was pushed onto us. Employees are told Mayo cannot tell us how much more it will change going forward. Mayo has not been forced to join the marketplace but they have punished us in advance for it in costs. It takes 3-4mths to get an appt. I am also told that we will not be able to move around the marketplace and come back to Mayo another year, how does that work if open enrollment is every year? Government should look at standardizing the price of care across the board and make it illegal for insurers to charge more than what Medicare is willing or able to pay-that would be a really good start to fixing the problem of rising healthcare costs. Another thing that should change is that government elected officials and government employees are placed on the same medical care plans they are forcing everyday Americans to use, why should they have better plans than the rest of us?

ObamaCareFacts.comThe Author

Congress is essentially following the same rules as the average person. The thing is, all insurance (by the nature of having tiers of coverage) is discriminatory based on capital. Congress can get themselves Gold or Platinum plans, just like we can, and just like high paying employers always offer. The difference is the average person is likely going to go Silver or Bronze due to cost.

Just wanted to clarify that.

CK

Are you out of your flippin mind? Since Obamacare, only the poor are helped. The middle class is being screwed and you are doing nothing to stop it. YOU put that in motion. My deductibles are huge and not one ducking thing that was promised ( except helping the poor ) was true. It is fraud. The American people know, get a clue.

ObamaCareFacts.comThe Author

Keeping in mind this isn’t congress or healthcare.gov and rather is an independent website… You are right that in many cases the sick and poor were helped the most. Lots of lower-middle class healthy people got a good deal. Some in the middle class are dealing with the deductible issue and ALL democrats are bracing themselves to do something about it post-election. For that matter so are the GOP, although each candidate on both sides has a different gameplan for how to make the next right move. In other words, at this point I don’t think you’ll find a politician who doesn’t understand those deductibles are a problem. And certainly, us as an independent site trying to provide advice have gotten the message loud and clear.

Karen Steffens

I really like some of your ideas and I hate to be a pessimist but no one cares about anyone else but themselves. Greed will not allow a fair and reasonable solution to this problem. We need to start promoting healthcare as a basic human right not as something to be profited from. If we don’t “cripple an existing industry” we definitely won’t see any meaningful change.

Benefit Services Group, Inc.

(1) reduces provider, hospital and Rx reimbursements by 25%!!!!

(2) mandated HSA.you kidding people are not funding their 401k never mind HSA’s.

It’s not working the whole system is broken!

ObamaCareFacts.comThe Author

Agreed, however, I was suggesting the funding itself should be compulsory through taxation. Literally make funding it a tax (using the same reasoning as the mandate) and then subsidize that for under X of the FPL (and give tax break for those over X FPL). Like, you must put money in, but that money IS tax deductible. If you can’t deduct it’s give to you. This is different than the GOP mandated HSA which gives you $1,000 and a pat on the butt. Or at least, that was a suggestion spitballed at the internet here. Not sure how great that would work in practice or how people would take it.

Think the basic idea is that if we agree we all MUST have access to healthcare and that that healthcare must be so expensive we need high deductibles then an HSA could fit well into buffer the burden that puts on people, the Government, or the markets.

Ann Carmack

My daughters insurance went up 30%. ACA was the first affordable insurance for her. She is 52 years old. At this rate of increase, she will be unable to afford health insurance again in a couple of years. Something must be done to keep the plans affordable and coverage that will help her stay well.

Toni Halker

I think the entire health industry needs an overhaul. First of all, precription drugs. Why do Americans pay more than any other country? We developed most of these drugs. When you ask people in the med industry or insurance industry they tell you because patents are expensive and they have to pay for that. I don’t buy it. I happen to know that most of the drugs were paid for and developed with tax payor funds through grants from the government. Why do we pay to research and create the drug, then have to pay more than any other country to use the drug?

Secondly, copays ate bogus. Copays do not under most circumstances count toward the decutible. That’s not fair. What is a copay, a bonus to the doctors and drug companies? This is how it seems. Now doctors are putting themselves out as specialists so they can get the higher copay amount. Further, if you have an IV for a test that was ordered by your doctor, this is considered outpatient surgery, so again they can charge the higher rate on the copay. Or should I say bonus? The plans are all stacked against the consumer.

Thirdly, our insurance company this year, just decided not to fund the plan. They cancelled it arbitrarily. Now they are “offering” us (my husband and I) a plan that is double our old plan and it’s a catasrophic plan, so it basically covers nothing. We already pay nearly a quarter of our income toward the premium alone. We are self employed and operate a small non-profit with an income of less then $100K a year. So what are we supposed to do? We are both relatively healthy people and the only claim we had for 2015 was my husband’s cataract surgery. That’s it.

Fourth, I don’t like HMO’s and I think this is yet another scam. Why should I pay a GP for a referral and then have to pay the referral doctor at the higher specialist copay rate, then pay the GP a copay again to interpret the tests from the specialist and to order whatever tests the specialist advises? Not only is this time consuming for me, it is ridiculous that every time I see one of these doctors, I have to pay the copay, a copay that does not count toward my deductible. This is nothing but a shell game.

In closing, I think insurance companies and HMO’s are thieves. You need to fix this system. I believe this is a concerted effort by the insurance and drug companies to kill the AFA because they couldn’t get SCOTUS to do it for them. They re trying to ruin Obama’s legacy.