ObamaCare: Pros and Cons of ObamaCare

The Pros and Cons of ObamaCare

What are the pros and cons of ObamaCare? The ObamaCare pros and cons mirror the complex nature of the new health care law.

Pros: ObamaCare (the Affordable Care Act or ACA) contains many benefits, especially for low and middle-income families and small businesses. This includes tax credits for health insurance premiums and out-of-pocket cost assistance based on income, the expansion of Medicaid to low-income adults, letting children stay on their parents plan until 26, the mandate for large employers to cover employees, the expansion of consumer protections like guaranteed coverage for pre-existing conditions and the elimination of gender discrimination, and more.

Cons: ObamaCare contains some obstacles for high earners, those who had been healthy and paid low rates in the past, larger firms that didn’t insure their employees before the law, and certain sectors of the healthcare industry. After-all, ObamaCare contains some new taxes and regulations, and this means more costs for some demographics (especially for those who don’t directly benefit from assistance). Further, some would argue that the ACA didn’t go far enough to address the “US healthcare crisis” and others would argue that the additional government regulations are not an effective method of addressing healthcare inflation and costs related to taxpayers, individuals, and businesses.

In other words, the Affordable Care Act contains some negatives and some positives. And, while some of the pros and cons are subjective, we none-the-less need to ask ourselves this question: Do the costs outweigh the benefits?

Below we will also discuss the pros and cons of ObamaCare regarding its effects on individuals and families, businesses, the economy, and healthcare industry as a whole.

This video does a good job at explaining the ACA, ObamaCare, as a whole and what you need to know about the program. Watching this will make understanding the pros and cons of the Affordable Care a lot easier.FACT: Some parts of the law like the ACA’s cost curbing measures benefit almost everyone in the long run (aside from industries benefiting from rising costs). Meanwhile, the initial rising costs of expanding protections meant higher costs for many in the short term. There are lots of trade-offs in the ACA like that, for example the requirement to cover preexisting conditions is offset by the requirement to get coverage, get an exemption, or pay a fee (for 2014 – 2018; and in some states 2019 forward). Below we’ll cover more trade-offs via our pros and cons list to help illustrate the complex nature of the law and its effects.

ObamaCare Pros and Cons List

Here is a short list of the Pros and Cons of ObamaCare, the ACA. Remember you can get coverage with cost assistance based on income each year through your State’s Health Insurance Marketplace.

The ACA, ObamaCare, doesn’t create insurance; it regulates private insurance to ensure you get more rights and protections. In doing this, it helps tens of millions get access to high-quality affordable health insurance. Of course, health care reform has both financial and private costs. Below are just a few of ObamaCare’s pros and cons:

ObamaCare Pros |

ObamaCare Cons |

| Tens of millions of uninsured people have access to affordable, high-quality health insurance through Medicaid expansion, their employers, and the Health Insurance Marketplace. | To get the money to help insure all these people, there are new taxes (mostly on high-earners and the healthcare industry). The taxes that may affect you directly are the individual mandate and the employer mandate. |

| Over half of uninsured Americans can get free or low-cost health insurance, and some can get help on out-of-pocket costs using their state’s Health Insurance Marketplace. | The individual mandate says all Americans who can afford health insurance have to obtain health coverage, get an exemption, or pay a fee. That creates an extra complication with regards to filing taxes. Some folks who just barely miss the Federal Poverty Level limit of 400% are hit the hardest as they don’t qualify for assistance. Those who do get cost assistance will need to adjust tax credits on the 8962 – Premium Tax Credit form. NOTE: The fee for not having coverage is reduced to $0 2019 forward, although some states have their own mandate/fee. |

| Over 20 million people were exempt from the fee in 2016. Those with exemptions may still get cost assistance. Exemptions also qualify you for special enrollment. | To get many of the exemptions, you’ll need to submit a form to HealthCare.Gov or file the 8965 – Exemptions form. |

| There are now more private coverage options, and all major medical coverage options must provide minimum essential coverage. | More options mean more complicated shopping for coverage. Keeping a private health insurance system means that shopping for health insurance can be confusing, and consumers risk over-buying or under-buying. Coverage options also, by nature, create a tiered healthcare system where more money equates to a better quality of care. However, in that respect, nothing has changed. |

| ObamaCare’s many protections ensure that you can’t be dropped from coverage when you get sick or make an honest mistake on your application. You also can’t be denied coverage or treatment for being sick or get charged more for being sick. Additionally, you can’t be charged more for being a woman. Other protections ensure that you have the right to a rapid appeal, that health insurance companies can’t make unjustified rate hikes, and that these companies must spend the majority of premium dollars on care, not paying executives. | Insurance companies must cover sick people, and this increases the cost of everyone’s insurance. To ensure people don’t just buy coverage when they need it, most people must obtain coverage or pay a per-month fee. Also, you can only get coverage during annual open enrollment periods. You can owe the fee due to forgetting to pay a premium, and then not be able to get coverage until next open enrollment. Some people benefited from being in a low-risk group. Men in good health with no pre-existing conditions, who were not responsible for anyone but themselves, and who remained healthy had low insurance costs. They may have had cheap limited coverage before the premium hikes took place in 2014. |

| All major medical coverage must count as minimum essential coverage. This means that coverage must offer the ACA/ObamaCare’s protections, cover essential health benefits such as free preventative services, limit deductibles and out-of-pocket maximums, provide minimum actuarial value, and not have annual or lifetime dollar limits. | Minimum essential coverage can only be obtained during open enrollment unless you qualify for a special enrollment period. Those who don’t understand how to compare plans or didn’t have coverage before the ACA may be shocked by how cost sharing works on higher deductible plans. Also many may get non-minimum essential coverage like short term insurance because of their confusion. |

| ObamaCare, the ACA, includes some cost-curbing measures, which led to health care spending growing at the slowest rate on record (since 1960) in 2014. Meanwhile, health care price inflation is at its lowest rate in 50 years. Unfortunately, even though the costs are increasing more slowly than they might have, health care costs are steadily increasing. | The law also includes spending. Upfront spending and more regulation are required to realize long-term cost-curbing measures. |

| Medicaid has expanded to cover up to 15.9 million men, women, and children who fall below 138% of the poverty level. | Medicaid expanded using Federal and State funding. Not all States had to expand Medicaid. The states that have chosen not to expand Medicaid leave 5.7 million of our nations’ poorest people without coverage options. |

| CHIP has expanded to cover up to 9 million children. | CHIP also uses Federal and State funding. |

| The employer mandate says that starting 2015/2016, businesses with the equivalent of more than 50 full-time employees must provide health coverage. | In anticipation of the employer mandate, some businesses cut employee hours. This added extra operation costs to businesses that did not provide health insurance. Many lower wage employees find health insurance unaffordable and end up with no affordable options due to having been offered coverage through work (see below). |

| Small businesses with less than 25 full-time equivalent employees can get tax credits for up to 50% of their employees’ health insurance premium costs. | Employee health benefits can be expensive. Lower wage workers may end up getting better value through the marketplace, but having employer-sponsored coverage means that they can’t get cost assistance. Also, dependents of employees with coverage are unable to use the marketplace. |

| Young Adults can stay on their parents’ plan until 26 and 82% of uninsured adults will qualify for free or low-cost insurance. Insurance helps everyone get healthcare and protects them in an emergency. Young adult’s uninsured rates have dropped 46% (HHS). | Young people tend to be healthy and not to need coverage as often as older Americans. However, due to low premiums and the benefits of having a plan, young people have some of the best deals of anyone under the ACA when purchasing care. |

| Medicare has improved for Seniors by measures that eliminate the donut hole, keep rates down, cut wasteful spending and fraud, and expand free preventive services. | Some Medicare payments to doctors and hospitals have been limited. Medicare pays doctors according to a fee schedule. Its rates have led to very complex problems that are driving the costs of health care up for everyone. Also, retaining supplemental Medicare options involves confusing options for seniors. The unfounded death panel rumor led to cutting out an important provision in the law that would have provided end-of-life counseling. |

| The ACA, ObamaCare, retrains a free market semi-private healthcare system and thus still allows our $3 trillion dollar healthcare industry to thrive. | Retaining a for-profit healthcare system has economic benefits, but it also means that every aspect of the system requires making a profit. Americans have higher health care costs than other countries, which have more “universal” healthcare systems. |

A Breakdown of the Pros and Cons of ObamaCare

Above we offered a general overview of the pros and cons of ObamaCare (the Affordable Care Act), below we cover the pros and cons of specific aspects of the Affordable Care Act.

Pros and Cons of the Health Insurance Marketplace

The health insurance marketplace is your state’s website for health insurance. The marketplace allows you to apply for federally subsidized insurance and to find out if you qualify for Medicaid. The marketplace is your best choice for insurance if you qualify for cost assistance. To find out if you qualify for cost assistance, you can go to your state’s marketplace or a local broker or provider outside of the marketplace.

If you don’t qualify for cost assistance, you may find that using any major broker is the way to go as only certain plans from certain providers are offered in some states through the marketplace. A quality broker can offer you plans, both on and off the marketplace, from all providers in your state. Insurers have to deal with subsidies and an extra tax for plans they sell on the marketplace, and some insurers may not offer plans in your region at all.

Cost assistance makes the marketplaces attractive while having a wider choice makes shopping outside of the marketplaces attractive. The drawback to shopping outside the marketplace is that we have a very segmented private health insurance system, which can easily lead to people over-buying or under-buying health insurance policies. Also, insurers can still sell types of coverage that offer all of the ACA’s benefits and protections outside of open enrollment. Additionally, some shady, lead-generating sites have used websites that look like official sites to collect information, and then re-sell your consumer information. (We have done a lot of work to ensure those shady sites don’t advertise with us).

No matter what plan you get, you’ll pay the same premium (before subsidies) the insurance company pays broker fees, and your state controls insurance prices in your region. Regardless of what option you choose to obtain private insurance, make sure you inquire about cost assistance before choosing a plan. Learn more about ways to buy insurance.

You need to enroll in a plan during each year’s annual open enrollment period to avoid the fee and get cost assistance. Don’t wait until the last minute to get covered!

Marketplace Cost Assistance and Choices Outside the Marketplace

Healthcare.gov is the official Health Insurance Marketplace and is the only place where you can get cost assistance. Qualified brokers can help you shop for marketplace plans and you can shop around for quotes outside the marketplace too. Know your options and get the best coverage at the best prices.

The Pros and Cons of ObamaCare, the ACA, for Most Americans

Most Americans make under 400% FLP and have a lot to gain and little to lose under the new law. The average American family is likely to see a reduction in their insurance premiums, and 30 million of the 44 million who were without insurance before the law gained access to coverage due to expanding coverage via employer mandate, the health insurance marketplaces, Medicare, or Medicaid/CHIP. The uninsured numbers have fluctuated over time, but in general many benefited.

The ACA, ObamaCare, offers some protections and benefits to all Americans. Beyond the 10 essential health benefits mandated by ObamaCare, there are additional benefits that range from working toward eliminating the penalty for having a pre-existing condition to expanding health services. Overall, the quality of healthcare is increased, and the cost, in theory, will be reduced.

Lower-income Americans making below 138% of the Federal Poverty Level (FPL) may qualify for Medicaid under Medicaid expansion.

Middle-income Americans (those making between 133% – 400% of the federal poverty level) and employees will be able to use tax credits and out-of-pocket subsidies on the exchanges to save up to 60% of the current cost of premiums, thus making insurance affordable for up to 23 million Americans.

Affordable insurance is defined as costing less than roughly 8% of your annual income. Tax credits cap cost at roughly 9.5% for a silver plan for those making between 300 – 400% FPL. If insurance is unaffordable or you had another hardship, you may qualify for an exemption.

During open enrollment 2014, 85% of the 8 million enrollees got cost assistance to help reduce premium costs and out-of-pocket expenses. The enrollment numbers change each year, but every year millions get assistance.

One of the cons of ObamaCare is that, since many Americans work for larger employers, some employees may have the new costs involved with insuring their workforce passed onto them. Other workers may see a decrease in the quality of plans offered by employers, who are trying to avoid paying an excise tax on high-end health insurance plans. These negative outcomes will affect less than 1% of businesses; only a small fraction of these companies are expected to deal with the new challenges by cutting worker hours and benefits or by not hiring new workers. Get more information on the impact of the Affordable Care Act on jobs here.

The Pros and Cons of the ACA, ObamaCare, for Women

When it comes to women, ObamaCare, the ACA, offers many pros and few cons. 47 million women will gain access to women’s health services, including preventive and wellness services. Many of ObamaCare’s new benefits for women are required by law to have no out-of-pocket payments. Also, insurers can no longer charge women more than they charge men. Before the ACA, women’s insurance was more expensive than men’s insurance because pregnancy, childbirth, and other issues exclusive to women were passed along to consumers.

There aren’t many ACA cons that are unique to women; however, there is the issue of contraception and its availability. ObamaCare expanded contraception coverage, but this “mandate” is one of the most contested aspects of the new health care bill and, depending on your viewpoint, can easily be seen as a con.

ACA, ObamaCare, Pros and Cons for Low-Income Americans

Low-income Americans will enjoy more ObamaCare pros than cons. This is especially true in states that expanded Medicaid eligibility. Since ObamaCare works on a sliding scale, most low-income Americans, especially those without insurance, will see nothing but benefits. Medicaid expansion will cover over 15 million previously uninsured low-income individuals and families below the 138% FLP mark.

The cons of ObamaCare for low-income Americans are that some states, despite 100% federal funding for the first year and 90% after that, have decided to opt out of coverage for their poorest thereby leaving millions without coverage. In some cases, rejecting Medicaid Expansion isn’t just about saving money. In fact, the studies on whether or not states save at all by opting out have come up with inconclusive results. It’s often accused of being a politically driven move to “break” ObamaCare. The opt-out is projected to leave 2 to 3 million low-income Americans without coverage.

NOTE: The accusations that some state representatives are trying to “break” ObamaCare or”break” the ACA isn’t something that we are speculating or have made up. It’s readily available information on many of the more conservative blogs. It’s no secret that a portion of the GOP wants to repeal ObamaCare, the ACA. They have a strategic plan of non-cooperation that includes “breaking” the Exchanges and Medicaid Expansion. ObamaCare isn’t just going to go away since it is about 1,000 pages of legislation, but while the battle goes on, Americans continue to be caught in the crossfire. It’s also worth noting that the number of uninsured, Medicaid-eligible Americans differs from state to state. Some of the states opting out of expansion have a greater number of uninsured and, therefore, would both pay more and cover more of their constituents. Their cost would be great, as would the payment by this insurance to healthcare providers, who may otherwise have to provide services for free. The term “for free” refers to the Emergency Medical Treatment and Active Labor Act (EMTALA) of 1986. Participating Hospitals, those that accept Medicare, are required by law to provide emergency care to all patients regardless of their ability to pay. There is no funding attached to this law, so the cost of care is passed along to other consumers. Also, only life-threatening conditions are covered. Preventive care or early intervention that might prevent an acute condition from emerging is not covered under this law. It is an expensive form of medical care with a hidden cost.

ObamaCare ACA Pros and Cons for Seniors

ObamaCare’s pros and cons for seniors include unprecedented reforms to Medicare, such as closing the “donut hole,” and expanding both benefits and coverage options. Millions of seniors have already saved money or taken advantage of the ACA-created absence of out-of-pocket costs for wellness and preventive visits.

Some of the reforms to Medicare include reductions to Medicare Advantage, home health care payments, and Medicare hospital payments. Some Medicare reforms have had or may have negative impacts on some seniors and doctors who work with Medicare patients. An oversight provision was included in the law. An oversight committee is in charge of making sure that the potential pitfalls in Medicare reform don’t hurt seniors or the Medicare industry.

Under ObamaCare Part B, Medicare policyholders saw a reduction in Part B premiums, and the deductible went down for the first time in Medicare’s history. However, high-income seniors may pay more due to both the way the Part B formula works and the new taxes that affect some high earners.

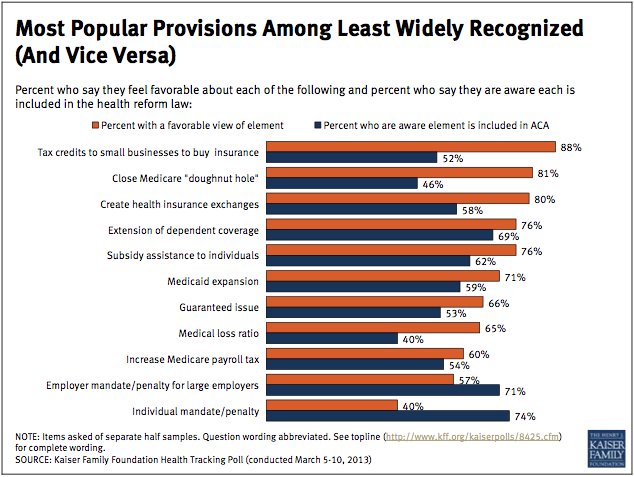

Pros and Cons of the ACA, ObamaCare, for Businesses

Small Businesses see the pros of ObamaCare while firms that don’t already provide their employees with health insurance have to deal with readjustment. However, only .2% of firms with over 50 employees currently fail to provide insurance to their full-time employees. A positive effect of ObamaCare on business is that it provides millions in tax credits to small businesses with fewer than 25 employees. These tax credits help offset the cost of buying health insurance for their employees. Small business has historically struggled to provide benefits to workers, and half of America’s uninsured are small business owners, workers, or dependents.

Unfortunately, one of the biggest negatives of the ACA is that many families are finding employer-sponsored plans to be affordable for the employee but unaffordable for dependents. This has led to a family affordability glitch (where families of workers have insurance that is in practice unaffordable, yet they can’t use the exchange and get cost assistance due to having access to employer-based coverage).

More ObamaCare Pros and Cons

Above we covered most of the main pros and cons related to ObamaCare. Here are some more specific topics to think about.

Some people oppose ObamaCare as a whole, but considering the 1000-plus pages of complex legislation contained within the Affordable Care Act, it’s hard to justify a total repeal of the law. Here are some more things ObamaCare does right and a few to which we might consider making changes.

Pros of ObamaCare in General

Most of ObamaCare’s 1000-plus pages are filled with impressive and long-overdue reforms to the 2.6 trillion dollar health care system. ObamaCare resulted in tens of millions of uninsured Americans getting covered. Not just the newly covered, but countless more have also benefited from ObamaCare’s improved health care services. For example, the free preventive care benefits everyone with private insurance.

Here are some of the benefits of the health care law:

ObamaCare Pros: Important New Healthcare Benefits

ObamaCare gives Americans access to hundreds of new health care benefits. Excluding those mentioned elsewhere on this page, benefits include these provisions. No annual or lifetime limits; children can stay on their parents plan to 26; the FDA can approve more generic drugs, thus driving prices down and breaking monopolies; and protections against discrimination for gender, the disabled, and victims of domestic abuse. Check out our ObamaCare Health Care Reform Timeline for a comprehensive list of reforms.

ObamaCare Pros: Preventive and Wellness Services

Americans now have access to preventive and wellness services at no out-of-pocket cost. Specific benefits can be found on our Benefits of ObamaCare page.

ObamaCare Pros: New Consumer Protections

In what’s commonly referred to as the “rate hike” review, ObamaCare, the ACA, regulates insurance providers with the “80/20” rule. This forces health insurance providers to either spend at least 80% of their income on health and marketing expenses or return the unspent remainder to their customers as rebates. Furthermore, Americans no longer have to worry about being dropped from their coverage for being sick or being denied new coverage due to a preexisting condition. ObamaCare has a long list of other protections that serve all Americans. For example, to promote wellness, it even includes a mandate that fast-food restaurants to display calories.

ObamaCare Pros: New Cost Assistance for the Middle Class and Small Business

Those earning under 400% of the federal poverty level (roughly 88k for a family of four) could save up to 60% on their premiums via tax credits and subsidies on the health insurance exchanges. Small businesses with less than 25 full-time employees have this advantage as well.

ObamaCare Pros: Medicaid Expansion

In states that have not opted out of Medicaid Expansion, those under 133% of the poverty level will be covered due to ObamaCare’s expansion of Medicaid to low-income Americans. In the past, many of these low-income Americans were left with too much income to qualify for Medicaid but without enough to afford insurance or medical care.

ObamaCare Pros: Improvements to Medicare

ObamaCare does a lot for Medicare. For the most part, these changes are a great improvement, and they have already benefited tens of millions of seniors. ObamaCare closes the Medicare drug “donut hole,” provides improved preventive and wellness services with no out-of-pocket cost and reforms aspects of Medicare to improve overall care for seniors.

ObamaCare Pros and Cons: The Debate of Quality Over Quantity

Doctors and hospitals are now in a system that rewards them for focusing on quality of care rather than quantity of care. Many of the provisions that enforce this do so by punishing medical providers for high turnover rates. However, this has some unintended consequences. Although the overall reform was designed to create a better healthcare system for all Americans, some doctors and health care institutions have been hit unfairly.

ObamaCare Pros: Oversight Committees

159 new boards, agencies, and programs are created by ObamaCare to oversee spending and to ensure that ObamaCare is working correctly. Though sometimes listed as a con, having oversight on a reform of this size is necessary to ensure that the program works. It’s important to note that ObamaCare, the ACA, doesn’t ration healthcare. It regulates the health insurance industry, which has been rationing our health care for years. Your healthcare is still between you and your doctor and is determined by your private insurance.

Cons of ObamaCare

Although ObamaCare does a lot right, it also has consequences that affect specific groups of Americans. ObamaCare has hurt a small number of small businesses, has negatively impacted insurance premiums, and has enacted reforms that hurt some medical industries and workers.

Here are some of the parts of ObamaCare, the ACA, that we need to rewrite:

ObamaCare Cons: Taxes on Small Business

.2% of firms in the US have over 50 full-time employees and have to either insure full-time workers or pay a fine. Some businesses cut employee hours or hire fewer new workers to avoid this. It’s worth noting that you don’t owe a fine for the first 30 workers in your business. Also, many businesses are coming up with solutions that theoretically don’t hurt the workforce, such as passing the extra costs onto consumers. Please be aware that, when politicians say “small business,” they are also referring to the top 3% of small businesses. You need to be aware that this 3% figure includes some very wealthy Hedge Funds, which use tax loopholes to pass as small businesses.

ObamaCare Cons: Religious Beliefs

There is some argument over ObamaCare funding women’s health services like contraception. There are exceptions built into the law allowing businesses to refuse to provide these services to women based on religious grounds; nonetheless, this issue has been causing problems in the political arena and the courts.

ObamaCare Cons: Rising Premiums

ObamaCare itself doesn’t raise premiums; in fact, many of its reforms to the insurance industry are intended to drive down costs, to make the quality of insurance better, and to prevent insurance company abuses. Unfortunately, many of the ACA’s, ObamaCare’s consumer-protecting provisions weren’t enacted until 2014. In the meantime, premiums rose at alarming rates. ObamaCare’s only guard against this is allowing states to enact provisions against price gouging. Many states are enforcing this, but others are not. For more information on this problem, see our ObamaCare Insurance Premium Rate Hikes page.

ObamaCare Cons: ObamaCare Insurance Exchanges

Another con of ObamaCare, ACA, is that 26 states have opted out of the State-Run Exchanges or plan to do so. These states want the federal government to run their exchanges for them. Many states claim that this is a cost-cutting measure, but the truth is much more complicated. The Medicaid-expanding provision was meant to be in the bill, but it is being used to avoid providing subsidies to low and middle-income Americans. Federal taxpayers are forced to take care of the constituents of states that did not create exchanges. This has also resulted in a 3.5% fee, paid by the insurance provider, on policies sold on the federal exchange. Learn more about the State Run Insurance Exchanges.

ObamaCare Cons: Tax for Not Buying Insurance

As of 2014, you must purchase insurance or pay a “penalty income tax.” The first year it was $95 or 1% of your income. Ideally, for the program to work optimally, everyone would have insurance. This would result in affordable, high-quality insurance for all. Since this is unrealistic, the tax is in place to help make up for the estimated 6 million people who will choose not to get health coverage.

ObamaCare Cons: Big Business Taxes

Medical device taxes and “drug innovator” taxes dig into the profits of some of the powerhouses in their respective industries. These taxes are a reaction to the large profit margins these companies benefit from and the often-monopolistic hold they have on their industries. These companies drive up the cost of health care, so they are taxed to help finance health care reform. However, taxes on large businesses may have unintended consequences on the job market and some aspects of the healthcare industry. At present, we’ve yet to see conclusive evidence on the effects of said taxes.

ObamaCare Cons: Taxes on the 2%

The top 2% of American businesses and individuals will pay some extra taxes. You could argue that it’s those earners falling just outside of the top 2% who will get hit the hardest. Despite having less disposable income, they still face a significant new tax burden. However, the most vocal opponents of the ACA (the ones who fund the anti-ObamaCare campaigns) are big businesses that oppose all regulations, entitlement programs, or any tax or program that affects their bottom line.

ObamaCare Cons: ObamaCare, the ACA, Hurts Medicare

Although ObamaCare has helped tens of millions of seniors save money on medications and get access to better healthcare, there are some caveats. The ACA, ObamaCare, cuts $716 billion from Medicare and reinvests the money back into the program. Since there is such a significant overhaul, ObamaCare set up a committee to oversee spending and effectiveness. Due to the sheer volume of the reforms, some of them, while well-intentioned, will inevitably have unintended consequences that warrant adjustment.

ObamaCare Cons: ObamaCare Cost

ObamaCare was projected to cost $1.36 trillion over its first ten years, and although a lot has changed, and although the ACA saves money in many ways, the bottom line is that the ACA costs money. For the program to work as intended, this is going to require funding from both the taxpayers and the States. However, the result of ObamaCare’s spending is a $200 billion reduction of the deficit over the next decade. Also, states receive between 90 – 100% of the necessary funding for most ObamaCare-related programs that they set up. A few states, including Nevada and Michigan, have done studies showing that states can save billions with ObamaCare. Despite a loss on per-plan profit, health insurance companies stand to make billions by insuring millions of newly-insured Americans.

How to Move Forward with The Pros and Cons of ObamaCare

Fixing the parts of ObamaCare that don’t work isn’t as simple as “repealing” ObamaCare. That would cost taxpayers billions. Dealing with the pros and cons is something that is already built into the law via oversight committees and other such forward-thinking provisions. With so many aspects of the Affordable Care Act still in the initial stages of growth, only time will tell how the ACA, ObamaCare, will impact America.

ObamaCare Pros and Cons

![]()