ObamaCare 2014 Midterms

How is ObamaCare Affected by the 2014 Midterms?

How do the 2014 midterm elections affect ObamaCare? Victories for Republicans in the House and Senate could mean trouble for ObamaCare’s key provisions. Republicans are pretty out-spoken about their dislike of some of ObamaCare’s major provisions like the medical device tax, medicaid expansion, the individual mandate, and the employer mandate. While many Republicans (especially in the house) want to see the whole law repealed, the most common next step will be dismantling key parts of the program. With 50 plus attempts at repeal under their belts, it’s only a matter of time before the Republicans in congress go after the ACA again.

Repeal or Dismantle ObamaCare?

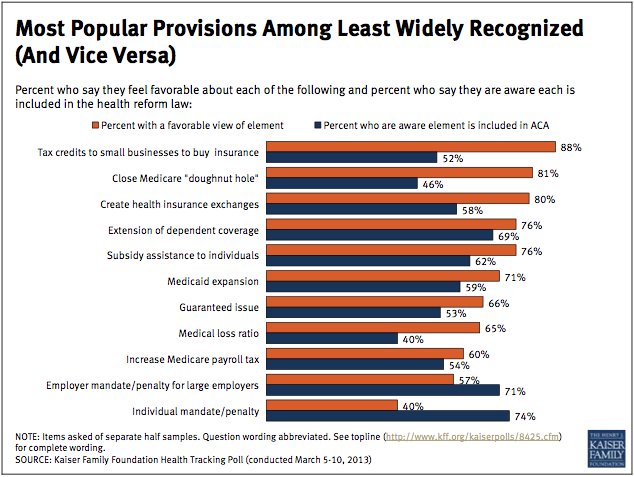

While a full repeal of ObamaCare makes a good talking point it’s pretty unrealistic given it’s success. The logistics of a bulk repeal of the hundreds of provisions, and the fact that a repeal would have to get by President Obama’s desk make repeal unlikely. So while a full repeal under this president is more talking point than reality, dismantling key parts of the program could have a nearly drastic effect while being much more practical. How hard are people going to fight to keep the mandate to get health coverage or the medical device tax? We already know these aspects of the law aren’t the popular ones, but what we need to take into consideration is that they are the ones that pay for the rest of our new benefits, rights, and protections.

Parts of ObamaCare that are in Jeopardy

Below is a quick list of the parts of the law that are in jeopardy due to the outcome of the 2014 midterm elections and what we know from what has happened so far. The following is our opinion from studying the Affordable Care Act over the past few years. Some of the most important provisions aren’t the most popular, and this is where the Achilles heel of the law lies.

Medicaid device tax: We predict this tax is the first provision to go. The Medical device industry claims it’s lobbyist were late to the table to advocate on behalf of the industry. The result is a tax that some claim to hinder research in development in smaller firms and to hamper employment. The other side says that with the new boom in business under the ACA the tax is more than fair. Regardless the medical device industry creates a lot of jobs and revenue in both red and blue states, meaning it’s about the only issue that members of both sides want to see go away. While repealing this tax would mean more profits for the heavy hitters of the medical device industry, it will also mean the ACA takes in less money to pay for it’s other provisions. It also sets a precedent for striking down healthcare taxes, next we may see the tax on generic drug manufacturers (who also benefit from the law) stricken down.

The individual mandate: Repealing the part of the law that requires Americans to have coverage or face a tax. Without the mandate we lose the major source of funding for subsidies. This either puts a giant burden on federal tax dollars or leads to the elimination/reduction of healthcare cost assistance. It also most certainly means premium increases, which compounds the aforementioned problems.

Medicaid expansion: Were you hoping that the 5.9 million adults who got left behind under expansion might get coverage. All that would have taken was the right leadership in states that rejected expansion. Unfortunately(?) in most cases the states that needed it the most retained the leaders who rejected expansion and thus we can expect the same states to reject expansion moving forward. This means millions of working poor adults without coverage and lower rates for Medicaid doctors.

The employer mandate: As a worker you may be thinking it would nice if your company offered you full-time benefits. The thing is, you should have already had them by now. The employer mandate is pushed back until 2016, it is very likely this provision will never actualize although many employers have already used the opportunity to cut back part-time hours. Obviously not getting offered insurance through employers means millions of hardworking adults are left to find coverage on their own, if subsidies are tightened up or eliminated this puts folks in a similar boat as they were in pre-ACA where they work full-time, but are priced out of insurance for them and their families.

Subsidies: One would think passing vote to take subsidies away form the tens of millions of people who qualify for them would be laughable, but don’t discount this. It may have slipped under your radar but there have already been some suspicious attempts to make subsidies illegal in the courts and of course the full repeal attempts include repealing subsidies. If we get a Republican President during the next election don’t be so sure that even the most popular aspects of the Affordable Care Act will be safe.

Want to know where the GOP will strike next or are interested in verifying some of our claims? Look at sources like Forbe’s Avik Roy and the Heritage Foundation here and here for insight.

ObamaCare isn’t the Main Issue

ObamaCare may have been an important issue in the midterms, but it wasn’t the main issue. The truth is a recent study shows an average of only 8% of voters found healthcare to be the most important issue in the elections. What this means in practical terms is that anyone who supports the program has a duty to educate themselves and the people around them as to how the law works and why it’s important.

The election wasn’t lost or won over the ACA, social initiatives like legalizing marijuana, marriage equality, minimum wage, and other issues Democrats support and most Republicans reject passed overwhelmingly across the country. Healthcare reform and other social issues are proving to be important to the people. The connection between voting in folks who support those things and who was actually voted in just may be another issue all together.

Ensuring We Move Forward With HealthCare Reform

If we were to lose the new benefits, rights, and protections of the Affordable Care Act it could be a long time before America tried another attempt at healthcare reform. When you hear about everyone rallying to get rid of the mandates or another key piece of the Affordable Care Act, speak up and help us educate people on why those aspects are so important to ensure America is covered.

Chris

It seems that beginning with 2015 self-employed individuals will not be able to pay their insurance premiums from company funds. Now the self-employed will get to pay Social Security taxes on their insurance premiums that they’re forced by law to pay. I’m still investigating whether this actually applies to me or not, but it’s nearly impossible to find any answers on the IRS site. I certainly have not discovered a publication that answers the question. For January 1, my individual policy premiums went up 33% and my coverage is not nearly as good. Now I discover that I’ll probably have to pay Social Security tax on what used to be a tax-free fringe benefit. Tell me again what part of this is “Affordable” or even “Protection.”

John Kerwood

The above is more very bad propaganda, more spin, re-crafted, after this law was crafted by a new, elite political class. It was formed on unsupportable assumptions, passed without the understanding of most lawmakers (and no one on main street). Then it was marketed with many buzz phases which proved false. Selective enforcement and delays were shrewd and calculated measures of executive overreach which kept most people “asleep”. As a middle class individual, if I get forced to the exchanges, I will be unable to afford coverage for our family…as I face rising penalties/taxes for not buying coverage. My family healthcare costs will greatly outpace the cost of housing + transportation. How political elite lawmakers passed themselves an “option out” for themselves was really woke me up. For those reasons, I know a 1,000+ page law is not for me….it needs to be dismantled.

If federal subsidies are found unconstitutional (and I am hopeful), the law collapses (or if the people really are blind) it will be allowed to bankrupt our country (by adding to the 18 trillion dollar debt).

Fortunately, more main street people are waking up.

Sam Yates

I think that this was completely unthought out and is an undue burden on people who already had sufficient coverage. It is certainly not affordable to a lot of people. My daughter had to retire on disability and tried to obtain coverage when the market opened in 2013. Nothing on your website or any number of personal calls worked. Finally, in February 2014, she finally was able to enroll at a cost of around $845/month for herself only. She could not afford this and when she asked to dis-enroll, she was told she couldn’t. In desperation she called Blue Cross who told her to do what hundreds of others were doing: don’t pay the bill and she would be dis-enrolled. In the meantime she found a policy with Blue Cross for around $300, with less coverage than she had on her old health insurance and a very significantly higher deductible ($6,000.00). The only person Obama Care is helping is Obama and the Democrats such as Nancy Pelosi who are all out to ruin this country as we have known it.