Getting Ready For Open Enrollment 2015

ObamaCare’s open enrollment period for 2015 starts on November 15th, 2014 and ends on February 15th, 2015. Let’s review the most important things to know about open enrollment in the health insurance marketplace for 2015.

• Open enrollment is the only time you can get cost assistance, enroll in a plan, or change plans. This is true whether you shop inside or outside of the marketplace as all insurers in the individual and families market have adopted the marketplace’s enrollment period for major medical health plans.

• Anyone who has a marketplace plan from last year must log in and verify their plan and information for 2015 during open enrollment. This will ensure that you get the right plan and cost assistance amount.

• If you had a plan last year and don’t verify your income and plan you may be automatically re-enrolled in the plan and cost assistance, or may be enrolled in a similar plan with similar cost assistance.

• There has been a 25% increase in marketplace plans and an average increase in premium growth of only 4% (that is actually impressively low considering historical premium growth).

• If your income goes up and you don’t verify your information you could end up owing money at the end of the year.

• Get covered or switch plans by December 15th, 2014 to ensure your plan starts on January 1st, 2015 without a hitch.

• Other insurance types like Medicare and employer based insurance have unique enrollment periods.

• Medicaid and CHIP can be enrolled in at anytime during the year, but if you want to use the marketplace to sign up you’ll have to do so during open enrollment.

• All insurance sold on the marketplace counts as minimum essential coverage and will protect you from the fee for not having coverage.

• The fee for not having coverage increases every year, so unless you qualify for an exemption, the chances that it is cheaper to pay the fee than to obtain coverage decreases every year.

• Cost assistance is based on income. If you income changes throughout the year report it to see if you qualify for further assistance and to prevent owing money at the end of the year .

• There are three ways to get cost assistance through the marketplace: Premium tax credits, cost sharing subsidies, and Medicaid and CHIP.

• Premium tax credits for reduced premiums are offered to most people making less than 400% of the federal poverty level.

• Tax credits can be paid in part or whole to your insurer to reduce your premium or applied to your federal income taxes.

• Cost sharing subsidies on out-of-pocket costs are offered to most people making less than 250% of the federal poverty level. To qualify for help on out-of-pocket costs you must enroll in a sliver level plan.

• Anyone can sign up for ObamaCare’s marketplace, but if you have access to insurance through your employer, qualify for Medicaid, CHIP or Medicare, or make over 400% of the Federal Poverty Level you won’t have access to cost assistance

• Find out if you qualify for cost assistance here: https://www.healthcare.gov/lower-costs/qualifying-for-lower-costs/.

• Most young adults will qualify for free or low cost coverage. Find out if you qualify by applying to the marketplace.

• Some young adults may qualify for catastrophic coverage which is very cheap, but has a high deductible and poor cost sharing.

• The cheapest plan isn’t always the best. When shopping for coverage remember that your goal is to make sure your medical needs are covered while saving as much on annual healthcare spending as possible. If you project needing a lot of medical services and drugs a higher premium plan could save you money in the long run.

• When it comes to comparing plans you’ll need to understand the difference between an HMO and PPO, how out-of-pocket costs weigh against premiums, and what the plans network and drug formulary covers. Know what your projected medical needs are and how to understand the jargon before shopping for plans.

• Applying for the marketplace isn’t the same as enrolling in a plan. Feel free to sign up, see if you qualify for cost assistance, and shop for plans in region before making your final choice.

• Don’t wait until the last minute to apply. The verification process can take a bit on a bad day, and you don’t want to be pushing things to the last minute.

• The initial rollout of the marketplaces didn’t go as smoothly as some had hoped, but all the marketplaces are secure and working well going into open enrollment 2015.

How to Sign Up For The Health Insurance Marketplace

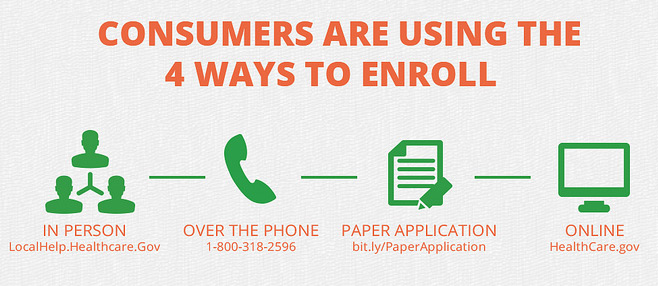

Obviously you can use your State’s health insurance marketplace to sign up for private insurance, get access to subsidies, or apply for Medicaid or CHIP, but there are actually four ways to apply including the website.

1) Find your State’s marketplace website.

2) Get in person help. You can find in person help by going toLocalHelp.Healthcare.gov.

3) Call the 24/7 marketplace helpline 1-800-318-2596.

4) Mail in a paper application. bit.ly/PaperApplication. (read these instructions first)

How to Enroll in a Health Insurance Marketplace Plan

Here are the official directions for enrolling in a marketplace plan through healthcare.gov. Remember signing up is only step one, you still need to choose a plan and make sure your first payment is made to officially have coverage. State based marketplaces have very similar sign up and enrollment processes, the direction below are specifically for State’s running a federal based marketplace (i.e. State’s using healthcare.gov as their marketplace).

- Set up an account. First you’ll provide some basic information. Then choose a user name, password, and security questions for added protection.

- Fill out the online application. You’ll provide information about you and your family, like income, household size, current health coverage information, and more. This will help the Marketplace find options that meet your needs. Important: If your household files more than one tax return, call the Marketplace Call Center at 1-800-318-2596 before you start an application.(TTY: 1-855-889-4325) This is a very important step. Please don’t skip it. Representatives can provide directions to make sure your application is processed correctly.

- Compare your options. You’ll be able to see all the options you qualify for, including private insurance plans and free and low-cost coverage through Medicaid and the Children’s Health Insurance Program (CHIP). The Marketplace will tell you if you qualify for lower costs on your monthly premiums and out-of-pocket costs on deductibles, copayments, and coinsurance. You’ll see details on costs and benefits to help you choose a plan that’s right for you.

- Enroll. After you choose a plan, you can enroll online and decide how you pay your premiums to your insurance company. If you or a member of your family qualify for Medicaid or CHIP, a representative will contact you to enroll. If you have any questions, there’s plenty of live and online help along the way.

For more details on signing up you can check out our health insurance marketplace guide or find your State’s health insurance marketplace now to get started.

We hope this quick list helps get you pointed in the right direction for open enrollment. We will be releasing a full fledged guide to open enrollment 2015 shortly, so keeping checking back for that and more ObamaCare Facts.

Amanda Y Hopkins

How can I change my health care provider Molina medical to Kaiser and medical