Premium Tax Credit Form 8962 and Instructions

The Forms Needed if You Got Marketplace Tax Credits Under the Affordable Care Act (ObamaCare)

Find out how to fill out Premium Tax Credit Form 8962, the form for reporting ObamaCare Tax Credits. We’ll review MAGI, FPL, and Adjusting credits.

NOTE: The forms for this year’s tax filing are featured below. New forms are posted up every year, and the links will generally update automatically. Still, always make sure to check the dates on the forms you are filing to avoid filing old forms. Please note, some of the images we used for informational purposes are from past years. Use them for reference, but make sure to refer to the official up-to-date forms from the IRS found in the links below.

Premium Tax Credit Form 8962 and Instructions

Here are the current Premium Tax Credit forms and official IRS instructions. See below for our simplified breakdown of form 8962.

8962 IRS forms:

- Form 8962, Premium Tax Credit (PTC)

- Form 8962, Premium Tax Credit (PTC) Instructions (HTML version)

- See Pub 947, for more information (especially for those who got married or divorced and need to use “alternative calculations”).

See our File Taxes for ObamaCare page for a breakdown of all healthcare-related tax forms.

Other IRS forms related to the PTC forms can be found here.

NOTE: You may also need to file additional 1040 forms, like a Schedule 2 (used for repaying excess tax credits), due to the way the 1040 was changed for the 2018 tax year forward.

TIP: The above forms are all you need for your taxes as they related to marketplace tax credits taken in advance. The information below is just about offering extra insight.

This is an example of what the 8962 form looks like. Some specifics change each year, but the general layout will be recognizable in any year.

Who Needs to Fill out the ObamaCare Tax Credit Form?

You only need to fill out form 8962 if both the following are true:

- You or a dependent had health insurance coverage in a qualified health plan purchased through a Health Insurance Marketplace (also known as an Exchange). This includes a qualified health plan purchased on healthcare.gov or through a state Marketplace.

- AND, You or a dependent got marketplace tax credits

What You Need to Know about Form 8962

Form 8962, Premium Tax Credit (PTC) is the form you will need to report your household Modified AGI (MAGI), your Federal Poverty Level amount, your family’s health insurance premium, exemptions, and the cost assistance you received.

Below we do a walkthrough of filling out the PTC form, and we simplify the terms found within.

Reporting your Premium Tax Credits on your 1040

Complete Form 8962 and attach it to your 1040. As noted above, you may also need to file additional 1040 forms, like a Schedule 2 (used for repaying excess tax credits), due to the way the 1040 was changed for the 2018 tax year forward.

Second Lowest Cost Silver Plan

To calculate your subsidy amount correctly, you’ll need to know the cost of the second-lowest-cost sliver plan in your state’s marketplace. You can find that info your 1095a form. If you didn’t get a 1095, or if you got the wrong one, you should wait until you get the right one and follow up with the Marketplace. If, however, you need to fill out the form on your own, you can use the Second Lowest Cost Silver Plan tax tool from HealthCare.Gov to help.

PTC Form 8962 and Instructions

IMPORTANT: This guide has been updated for the 2019 tax year. With that said, specifics are subject to change each year. On the off chance we missed something in our updates, we apologize in advance, and would ask you to simply refer to the official instructions. Feel free to use this guide for reference, but please refer to the official IRS instructions and forms when filing taxes.

Please open up Form 8962, Premium Tax Credit (PTC) and IRS Instructions for form 8962 and your 1040 form (since your Tax Credit is based on the results of your 1040). This will make following along easier and more helpful. You will also need forms 1095-A, 1095-B, or 1095-C, which show minimum essential coverage. These should have been sent by your insurer.

Part 1: Annual and Monthly Contribution Amount

Line 1. Family Size. The number of people you claim as dependent and yourself.

Line 2. Modified AGI (MAGI). This is your Gross Income (GI) Adjusted (A) and then Modified (M). Your 1040 will walk you through calculating AGI. Modified AGI (MAGI) includes Adjusted Gross Income on your federal income tax return plus any excluded foreign income, nontaxable Social Security benefits (including tier 1 railroad retirement benefits), Supplemental Security Income (SSI), and tax-exempt interest received or accrued during the taxable year.

Learn how to calculate MAGI (this link contains the MAGI worksheet from the 8962 instructions used to calculate MAGI).

See the instructions for more information.

Line 3. Total Household Income. You and your dependents’ MAGI combined.

Line 4. Federal Poverty Level. The Federal Poverty Level (FPL) guidelines let you compare your income to 100% of the FPL. Poverty level changes every year and is determined by family size. You can find your Federal Poverty Level amount by finding 100% of the FPL for your family size.

See Pages 2 and 6 of the instructions for more information.

Line 5. Household Income as a Percentage of the Federal Poverty Level. To find household income as a percentage of the Federal Poverty Line, divide MAGI by your family size’s Federal Poverty Level amount.

Household income will turn out to be a percentage of the baseline Federal Poverty Level based on your MAGI. For those receiving Tax Credits, this should be between 100%-400%. Learn more about Federal Poverty Guidelines.

Line 6. The Results. If you didn’t qualify for Premium Tax Credits (PTC) due to income and family size (the number is greater than 400% FPL) and you received advance payment of PTC, see the Form 8962, Premium Tax Credit (PTC) Instructions for more information on reporting your Excess Advance PTC Repayment amount. You can also see our guide to Advanced Premium Tax Credit repayment limits.

If the result was less than 100%, you can keep your tax credit so long as you meet the requirements. If the result is over 400%, you must repay the full amount. See table below for Advanced Tax Credit Repayment limits.

TIP: These figures are updated for plans held during 2019. They are subject to slight changes each year. See the 8962 instructions.

NOTE: The following Advanced Tax Credit Repayment limit table from form 8692 below is updated for 2020 coverage (accounted for on taxes filed in 2021).

| Income % of FPL | Filing Status: Single |

Filing Status: All Other |

|---|---|---|

| Less than 200% FPL | $325 | $650 |

| At least 200% FPL but less than 300% |

$800 | $1,600 |

| At least 300% FPL but less than 400% |

$1,325 | $2,700 |

| More than 400% FPL | Full Amount Received | Full Amount Received |

| If your year-end income exceeds 400% FPL, you will have to return the total amount of Advanced Premium Tax Credits you received. If you make too little to qualify for subsidies (less 100% FPL), then you should owe NOTHING (per the directions of form 8962 from which this table comes). That being said, if you know you are going to price out-of-cost assistance, make sure to update your Marketplace account. You might become eligible for a free or low-cost Medicaid plan if your state expanded Medicaid. | ||

TIP: See federal poverty level for more details. Make sure to refer to the current 8962 form for calculations each year at tax time (you can always use last year’s numbers for a general estimate).

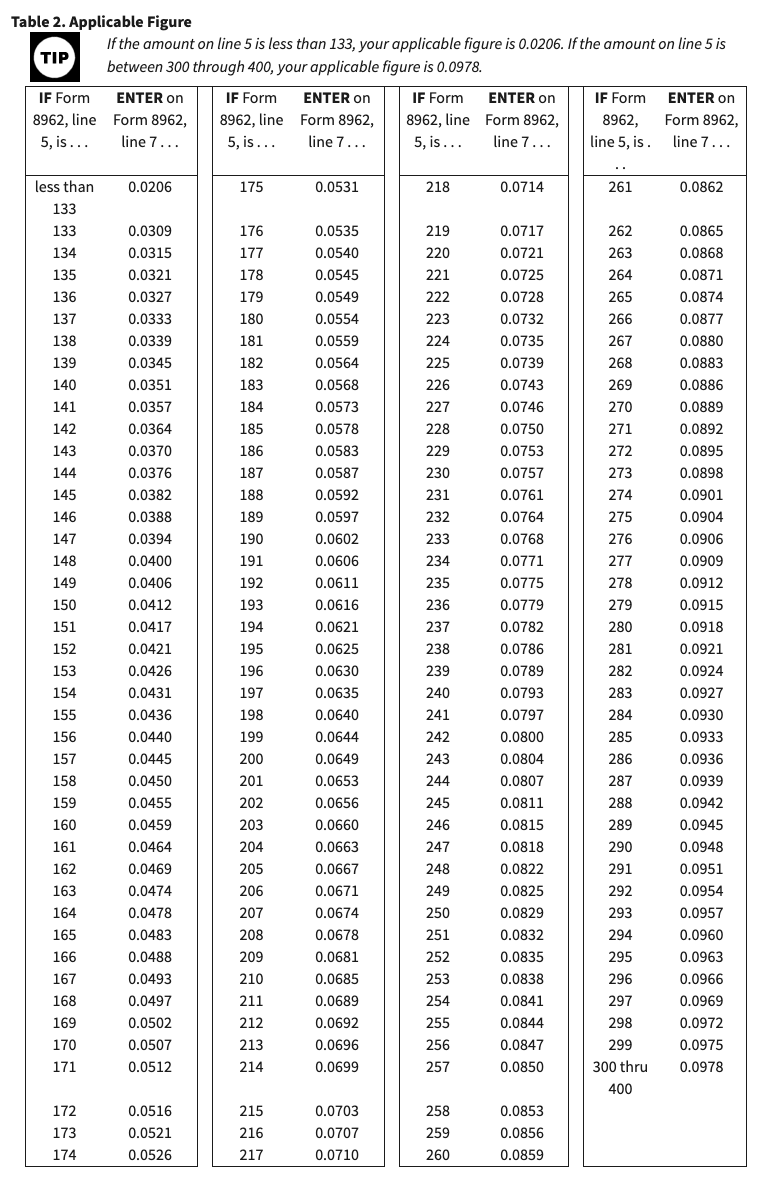

Line 7. Applicable Figure. See the chart found in PTC instructions below to fill out line 7 on the PTC. The numbers on the left side of the chart represent the federal poverty level, the numbers on the right side represent the percentage of your household income you can owe on a health plan (they thus affect how much of a tax credit you qualify for).

TIP: These figures are updated each year. The image below is offering you a visual example of what the table looks like. See the current 8962 instructions for the current figures.

Subsidy caps for ObamaCare’s advanced premium tax credits for 2020 plans (for taxes filed in 2021).

Line 8a. Your annual contribution to healthcare. Your household income capped by the applicable amount from line 7. (Somewhere between 2.08% and 9.86% of your Modified household income for the 2018 tax year for example. Written in the applicable figure table as a number between .0208 – .0986). TIP: Make sure to use current numbers as they are subject to change each year.

Line 8b. Your monthly contribution. Your annual contribution divided by 12.

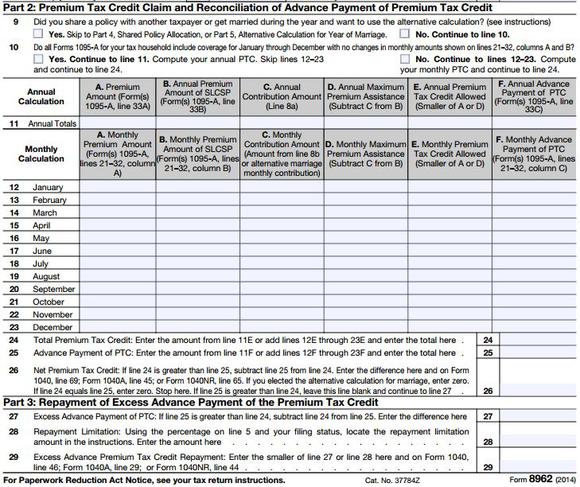

Part 2: Premium Tax Credit Claim and Reconciliation of Advance Payment of Premium Tax Credit

Tax Credit Amounts and Premium Amounts. To fill out a lot of the form, you’ll need forms 1095-A, 1095-B, or 1095-C, which show minimum essential coverage. These are sent by your insurer or employer. Not all insurers and employers are required to send forms, but if you got marketplace cost assistance, you should get this form. You’ll use this to calculate premium amounts and Tax Credit amounts. Open this form as well.

Line 9. Did you Meet Certain Requirements that would affect your calculation? If you share a policy, got married, or want to use an alternative calculation due to a life circumstance, you won’t use the standard calculation methods and will instead follow the alternative calculation instructions.

Line 10. Did you maintain minimum essential coverage? If you maintained coverage for each month of the year, then you’ll answer yes. If you are using multiple forms or had coverage gaps, you answer no. You can find this information on your 1095 forms. Many people will have short coverage gaps. Up to three months in a row is exempt. <—– starting in the 2019 tax year this won’t matter in most states, but it still matters for 2018 since the mandate to have coverage was still in effect.

Line 11-23. Calculating APTC Owed Amounts. You’ll fill out the chart of Premium amounts and assistance per month as seen below. All of this information can be found on form 1095 or will require calculations. See page 9 of the instructions for details.

Line 24. Total Premium Tax Credit. E is what your allowed Premium Tax Credit was. The total from E column of line 11 or combined totals of all E columns of lines 12 – 23.

Line 25. Total Advanced Payment of Premium Tax Credit. F is the amount you got in advance. The total from F column of line 11 or combined totals of all F columns of lines 12 -23.

Line 26. Net Tax Credit. The difference between the total Advanced Payment and Total Premium Tax Credit. You then report this on your 1040 (Line 69 of a standard 1040). If you got married and that messed up your tax credit, you enter 0 meaning you won’t have to pay back your tax credit amounts. See page 11 for details.

Part 3: Repayment of Excess Advance Payment of the Premium Tax Credit

The next section of the PTC form deals with repayment of excess Advanced Premium Tax Credits.

Line 27. Excess Advance Payment of PTC. If line 25 is greater than line 24, subtract line 24 from line 25.

Line 28. Repayment Limitation. The amount is limited. This ensures you won’t owe more than you can afford.

Remember, we posted these limits above, feel free to also see our guide to Advanced Premium Tax Credit repayment limits for further clarification.

29. Excess Advance Premium Tax Credit Repayment. Use a Schedule 2 to account for your excess credits. Enter the smaller of line 27 or line 28. If line 28 is blank, enter the amount from line 27 on line 29. Also enter the amount from Form 8962, line 29, on Schedule 2 (Form 1040), line 46, or Form 1040NR, line 44.

Part 4: Shared Policy Allocation

Line 30-34. Multiple payers for one plan. If you are allocating different tax credit amounts on the same plan to different people (in instances of marriage or divorce, for example), you report that in this section.

Part 5: Alternative Calculation for Year of Marriage

Complete Part 5 to elect the alternative calculation for your pre-marriage months. Electing the alternative calculation is optional, but doing so may reduce the amount of excess APTC that you must repay. To qualify, you must meet guidelines found in the instructions.

NOTE: The IRS instructions go into a lot of detail into the complex situations that can arise in terms of policy allocation and alternative calculations and provide examples. Make sure to reference them directly if you are for example dealing with tax credits in a year where you were married or divorced.

File your Premium Tax Credit Form

Once you complete the form, make sure to file it, and don’t forget to report your excess tax credits on your Schedule 2 and attach your 8962 form.

Instructions for Form 8962, Premium Tax Credit (PTC)

IRS Instructions for form 8962 can be found here. Above are instructions for form 8962 Premium Tax Credit (PTC). Please see the official IRS instructions for further clarification.

ObamaCare Taxes: Premium Tax Credit Form 8962![]()