What are ACA Rules for Employer Payment Plans?

Employer payment plans are valid under the ACA, count as group health plans, and are subject to market reforms (no pre-exiting conditions, no dollar limits, etc).

Employer payment plans are valid under the ACA, count as group health plans, and are subject to market reforms (no pre-exiting conditions, no dollar limits, etc).

It’s estimated there are between 20,000 and 45,000 deaths a year due to lack of health insurance. Get the facts on mortality and health insurance in the US by reading our breakdown of past studies and reports below. The Uninsured and Mortality Rates A 2012 familiesUSA study shows that more than 130,000 Americans died between 2005… Read More

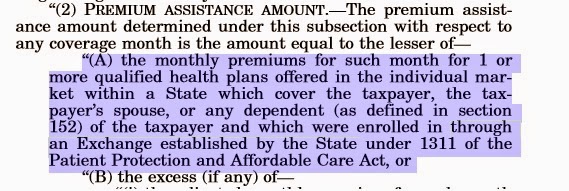

Section 1311 of the Affordable Care Act grants “an Exchange established by the state” authority (to issue subsidies), but doesn’t mention an Exchange established by the federal government. This is the key to understanding King V. Burwell.

Summary of the Health Care and Education Reconciliation Act of 2010 The HealthCare and Education Reconciliation Act of 2010 was signed into law along with the Patient Protection and Affordable Care Act, below is a summary. The health care related sections of both of these laws is what we usually think of as “ObamaCare”. The Student Aid and Fiscal… Read More

ObamaCare’s Cadillac Tax is a 40% excise tax on high end plans above $10,200 for individuals and $27,500 for family coverage that was set to start in 2018 but was been delayed. This tax is not deductible. The excise tax is one of the main revenue sources for the ACA, helps curb healthcare costs, and… Read More

Orrin Hatch’s replacement plan for ObamaCare, dubbed “the freedom option” in a WSJ op-ed, is an alternative to amending the law to clarify that Healthcare.Gov can issue subsidies, and is essentially a rehash of the old “repeal ObamaCare” plan.

The ObamaCare alternative, a plan by Burr, Hatch, and Upton called the Patient Choice, Affordability, Responsibility, and Empowerment (CARE) Act is here. Just wait until you see what is inside.

Get the facts on the ObamaCare replacement plan by Burr, Hatch, and Upton: the Patient Choice, Affordability, Responsibility, and Empowerment (CARE) Act. Below we present a summary, some quick facts, a pros and cons chart, a complete section-by-section breakdown, and finally we compare the CARE Act proposal to ObamaCare. Keep in mind this is an older replacement… Read More

Smaller firms get tax credits that mean better employee benefits at better prices. However, some larger firms who had great plans going into 2014 saw rate hikes.

They say the 60th time is a charm, or even if they don’t… The house voted for the 56th time to repeal ObamaCare, and the vote passed 239-186. Added together with provisional attempts this is the 60th GOP attempt to repeal the law.

The Individual Shared Responsibility Payment is the fee for not having Minimum Essential Coverage. Follow our guide to make calculating your payment easy. UPDATE 2019: For 2019 forward there is no fee for not having health insurance in most states. In this sense, the Individual Shared Responsibility Provision has been effectively repealed as the federal… Read More

Find out how to fill out Form 8965, Health Coverage Exemptions, the form for reporting ObamaCare Exemptions. We provide a simplified breakdown of form 8965. Due to changes in the tax structure under Trump there will be no federal fee for not having health coverage in most states for 2019 forward, thus exemptions won’t be… Read More

The 1095 forms are filed by the marketplace (1095-A), other insurers (1095-B), or by your employer (1095-C). We have simple instructions for the 1095 forms. Keep in mind the 1095 forms are filed by whoever provided you coverage, so individuals won’t have to fill them out themselves. TIP: This page has been updated for 2022 (although on-page… Read More

Let’s look at how ObamaCare affects immigrants and how immigration status affects Marketplace coverage, cost assistance, Medicaid, and coverage requirements. Most immigration statuses qualify people to use the Marketplace, but only lawfully present immigrants have access to cost assistance and are required to obtain coverage. Limitations apply to specific groups in regards to Marketplace coverage, Medicaid, and… Read More

My husband and I have not been helped but hurt and our details are below. But before I get into our details want to say that middle income people who do not qualify for subsidies, especially those who do not have health coverage via an employer (e.g. self employed or those who work for employers… Read More

Everything You Need to Know About Multi-State Health Plans If you travel out-of-state often, you may want a multi-state health plan through the Health Insurance Marketplace. Most plans are regional, so consider a multi-state plan even if you only plan to travel between two states. Ask this youtube video on “tricky plan issues” explains, you… Read More

Some say ObamaCare doesn’t do enough to control health care cost. Let’s look at how ObamaCare controls healthcare spending with cost controlling provisions. TIP: To find out what coverage under the Affordable Care Act will cost you, make sure to check out the healthcare.gov marketplace and find your cost after assistance is applied. Taxpayers are benefitting as… Read More

A 2015 report from the Commonwealth Fund shows a rise in health care coverage and affordability since ObamaCare was enacted.

ACA has helped me reduce my private health care premiums, no doubt. However, apparently ACA has established a standard Summary of Benefits document that all health care insurers must use to allow fair comparisons to potential enrollees. ACA does not, however require health care insurers to disclose plan documents prior to enrollment – according to… Read More

Here is a quick list of tips for getting the best health plan. No matter how you shop, this list will ensure you don’t over or under-buy health insurance. NOTE: Finding the best health plan for you and your family depends on your family size, income, needs, region, and more. The best plan for one… Read More

The Save American Workers Act changes the definition of full-time workers so fewer employers have to comply with ObamaCare’s employer mandate. Let’s take a look at the legislation, why it was passed in the House, why it won’t pass the Presidents desk, what effects it has, data on part-time hours and job loss, and some alternatives… Read More

What is Modified Adjusted Gross Income (MAGI), Adjusted Gross Income (AGI), Gross Income (GI), Family Income, Household Income, Etc? Modified Adjusted Gross Income (MAGI) is your Gross Income (GI) adjusted for deductions (AGI) and then modified by adding certain deductions back in to calculate MAGI. This page covers MAGI as it applies to Medicaid and… Read More

Having Health Insurance means you are covered in an emergency. Not getting coverage could result in big fees for those who wait until taxes are due. Obtaining and maintaining health insurance isn’t just about avoiding a fee, it’s about taking responsibility for your health, knowing you have coverage when you need it, and avoiding the devastating… Read More

Understanding Affordability Exemptions for Individual and Employer-Sponsored Health Coverage Under ObamaCare employer-sponsored coverage must cost no more than 8% (adjusted each year), after the employer’s contribution, to be considered affordable. If the amount exceeds 9.5% (adjusted each year), then the person can get an exemption to use the marketplace. This applies to employee-only coverage, family-member-only coverage, and… Read More

Here is our ObamaCare Thanksgiving list of the reasons we are grateful for the Affordable Care Act. Before you read our ObamaCare Thanksgiving list, take a moment to listen to a Thanksgiving message from our President. We are grateful to the Affordable Care Act because: • 8 million got affordable coverage through the marketplace and millions more got covered last… Read More