Short Term Health Insurance

Everything You Need To Know About Short Term Health Insurance Under the Affordable Care Act

Short term health insurance is meant to provide temporary health coverage. Short term plans don’t have to offer all of ObamaCare’s benefits and protections.

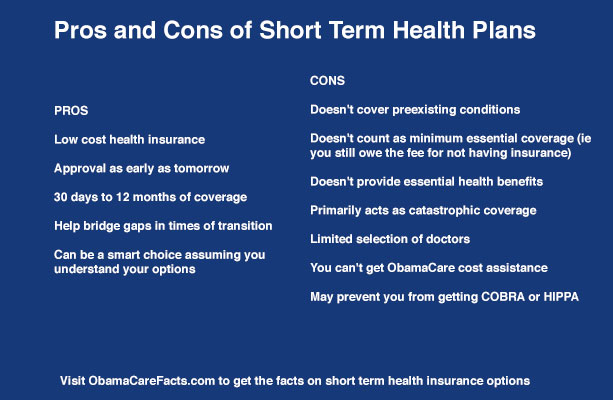

Pros and Cons of Short Term Health Insurance

The pros and cons of short term health insurance are straightforward.

Short term plans typically offer low cost / limited benefit coverage compared to comprehensive major medical coverage.

However, the trade-off is short term plans don’t have to follow the rules set forth by the Affordable Care Act (ObamaCare).

So for example short term plans don’t qualify for cost assistance and can discriminate based on preexisting conditions.

FACT: Despite the terminology, some “short term” plans can last up to a full year.

Here are some benefits of short term health insurance plans

- Low cost health insurance

- Approval as early as tomorrow

- 30 days to 12 months of coverage

- Help bridge gaps in times of transition

Here are some downsides of short term health insurance plans

- Can discriminate based on preexisting conditions

- Doesn’t count as minimum essential coverage (a type of major medical coverage that follows the rules of the Affordable Care Act)

- Doesn’t provide essential health benefits of ObamaCare

- Primarily acts as catastrophic coverage

- Limited selection of doctors

- You can’t get ObamaCare cost assistance with a short term health insurance plan

- Having this coverage may prevent you from getting COBRA or HIPPA

Short term as primary insurance. It used to be that short term wouldn’t work as primary insurance. However, since 2019 short term has been expanded and the fee for not having coverage has been taken away in most states. In general then, some may find short term to be a viable primary coverage option. It would basically be like having catastrophic coverage as your main coverage type. Learn more about short term as a primary insurance.

Should I get Short Term Coverage? If you are healthy and don’t qualify for cost assistance, are in between plans, or if you missed open enrollment, then a short term plan may be the right choice for you. Likewise, if you are healthy, you might even consider short term as an alternative to major medical. However, if you would qualify for cost assistance, live in a state with a mandate to have coverage, or have to cover a family with ongoing medical needs, then you’ll almost certainly want to look at major medical plans during open enrollment instead.

The fee for not having health insurance and short term coverage: From 2014 – 2018 you needed to obtain and maintain “minimum essential coverage” or pay a fee. For 2019 forward, there is no fee for not having health insurance in most states. That means for 2019 forward you can choose short term health insurance as an alternative to major medical in most states. Remember though, short term coverage doesn’t qualify for cost assistance and doesn’t have all the benefits, rights, and protections of the Affordable Care Act.

How Do I Get a Short Term Health Insurance?

Short term plans aren’t bought through the health insurance marketplace HealthCare.Gov, instead you’ll buy them from a private broker outside of the marketplace.

Finding a broker for short term coverage: If you want a short term plan, you have many options for finding a broker. However, if you choose a marketplace approved broker (a private broker who is also qualified to enroll you in a marketplace plan), they will be able to show you both short term and marketplace plans (thus they will be qualified to show you a fuller range of options than just marketplace brokers or just non-qualified brokers)! If you choose a broker who isn’t qualified to sell you marketplace plans, then your options may be limited to short term only. If you want help finding a marketplace qualified broker, feel free to call the number at the top of the page. If you don’t want to use that method, you can just search online for local brokers, contact them, and ask them what plan choices they offer! If you know what you are looking for in terms of plan types, finding the right broker for you is just a matter of looking for the right match for you.

Why Get Short Term Health Insurance?

Short term health insurance is a good choice for people who are in between coverage options, are exempt from the mandate to buy insurance, or want catastrophic health coverage outside of open enrollment. Although it doesn’t offer all the perks of comprehensive coverage, it does protect you from facing a medical catastrophe without insurance. Out of pocket medical costs can easily cost you more than the cost of a short term plan’s premium.

Here are some reasons to get short term health insurance

- Healthy and don’t want a more robust health plan

- Between jobs

- Waiting for employer group coverage to start

- Waiting for Marketplace coverage to start

- Traveling outside of network area

- A recent college graduate

- A temporary or seasonal employee

- A dependent no longer covered under parents plan

- On strike, laid-off, or a terminating employee.

Those are the basics of short term coverage under the Affordable Care Act, below we cover everything you need to know about short term coverage, what it does and doesn’t cover, and how it is related to the Affordable Care Act (ObamaCare).

Understanding Term Health Insurance and How it is Related to the Affordable Care Act

Short term health insurance (AKA “temporary health insurance” or just “term health insurance”) is not considered minimum essential coverage. That means it doesn’t qualify you for cost assistance under the Affordable Care Act, doesn’t have to offer the Affordable Care Act’s benefits, rights, and protections, and losing it won’t qualify you for special enrollment in ObamaCare’s Health Insurance Marketplace.

Despite those drawbacks, short term health insurance can be a smart and inexpensive solution for those in between coverage options, those traveling out-of-network, those wanting to fill gaps in their primary coverage, or those who simply want to maintain limited benefit coverage.

The reality is, the Trump administration expanded short term plans, so although these plans were originally meant to be temporary, those who qualify can now hold short term plans for a full year (meaning short term plans can now be used as a substitute for major medical coverage).

Below we further explain short term coverage, illustrate how it can act as a low cost / low benefit substitute for major medical, and discuss some drawbacks.

TIP: Losing a short term health plan does not qualify you for special enrollment in a marketplace plan.

What Is Short Term Health Insurance?

Short term health insurance was originally meant as a temporary health option that is meant to provide coverage in between other insurance options. Its benefits usually insure against catastrophe. It is coverage that protects against accidents or major illnesses. This is different from comprehensive major medical coverage, which typically includes preventive care, physicals, immunizations, and sometimes dental or vision care.

- Short term health plans are non-renewable, meaning your insurer doesn’t have to renew your plan (you have to qualify for renewal each time you go to renew your plan).

- Short term health plans don’t have to cover pre-existing conditions; you can be denied coverage for a pre-existing condition.

- Short term coverage doesn’t prevent you from being denied payment or dropped when you are sick if you didn’t disclose your preexisting medical condition at the time of application.

- Short term health plans aren’t guaranteed issue; you can be denied coverage for non-health reasons.

- Short term health plans also lack many other protections offered by the Affordable Care Act.

How Long Does Short Term Medical Insurance Last?

Short term plans typically last anywhere from 30 days to 12 months. If you get a plan that ends during open enrollment, some insurers can roll you over into a plan that counts as minimum essential coverage during open enrollment. Make sure that the end of short term coverage coincides with the start of a new plan. Plans purchased during open enrollment start as early as January 1st.

Are Short Term Health Plans Minimum Essential Coverage?

Short term health plans are not minimum essential coverage and will not help you avoid the fee for not carrying health insurance for 2014 – 2018. Luckily the fee is repealed for 2019 forward, so this won’t be an issue in 2019 and beyond.

Still, not being minimum essential coverage under the ACA means the ACA’s cost assistance and protections don’t apply!

Health Insurance Outside Open Enrollment

Before the Affordable Care Act, you could buy a health plan at any time in the private individual and family health insurance market. Today insurers have adopted enrollment periods that mirror those of the health insurance marketplace to ensure that people don’t wait until they are sick to get covered. While this is great for insurers and helps keep premium costs down, it creates a period of time each year when ObamaCare-compliant plans (typically called qualified health plans or minimum essential coverage) are unavailable in the individual and family market. Due to this gap, you may want to look at short term health coverage if you are without insurance in-between ObamaCare’s open enrollment periods and do not qualify for special enrollment.

Short Term Coverage and Special Enrollment

When you lose coverage during the year, it triggers a “special enrollment period” (so do other life events like having a baby, getting married, or moving). This is typically a 60-day window to enroll in a Marketplace plan starting on the day you lose coverage. Having short term coverage while you wait for the new coverage to start can be smart, but be aware that losing short term coverage will not trigger special enrollment. Thus, if you opt for short term coverage instead of using special enrollment, you won’t have an opportunity to get major medical again until next open enrollment.

TIP: You have the option of keeping your short term health plan after your new coverage starts, this may make sense if your short term plan is covering medical costs not covered by your new plan.

Examples of When to Get Short Term and When Not To Get Short Term

Below are a few examples of when to get short term and when not to get short term health insurance.

An example of when to go with special enrollment and not short term: If you lose coverage, and then get short term coverage for 2 1/2 months you will be past your 60-day window. This means that you will be unable to get Marketplace coverage. You cannot get Marketplace coverage after your 60-day window has ended. You will owe the fee for the 3rd month and each additional month you go without minimum essential coverage or an exemption. Short term insurance isn’t the same as minimum essential coverage, but you can remain uninsured for up to 3 months a year without paying a fee for being without minimum essential coverage.

An example of when to go with short term: You should consider short term insurance is if you are traveling out-of-state and your insurance is an HMO that only covers a small local region where you live. You may also want to go with short term if you simply have no other coverage options.

An example of when to go with both: For whatever reason, your employer plan may end before your Marketplace plan can start. During this “coverage gap,” you can buy a short term plan to make sure you are covered during the transition. This can also be done if you are transitioning from one employer plan to another, or if you get a lump-sum payment which disqualifies you from Medicaid or CHIP for a month.

Short Term Health Plans and Pre-existing Conditions

Short term health insurance doesn’t cover pre-existing conditions. The definition of a pre-existing condition varies by state, but, in general, short term health insurance policies exclude coverage for conditions that have been diagnosed or treated within the previous 2 to 5 years. Please be aware that you can be dropped from short term coverage or denied payment on claims if you try to get treated for a medical condition you didn’t disclose when you purchased your insurance. This is not true for ObamaCare-compliant major medical plans sold after 2014, only for short term health plans, grandfathered health plans, and other supplemental plans.

Are Short Term Plans “Junk” Insurance?

Short term health plans, or temporary health plans, have been called “junk” health insurance along with other non-ObamaCare-compliant plans like fixed benefit plans. The term “junk” health insurance is harsh. While it’s true that a short term plan’s coverage doesn’t compare to the benefits, rights, and protections offered by major medical, they could offer significant protection from catastrophic medical bills as well as savings to a shopper who understands the product.

Major Medical vs. Short Term

Major medical plans sold after 2014 must be ObamaCare-compliant (guarantee issue, cover preexisting conditions, offer minimum benefits, protect against the fee for not having insurance) and offer comprehensive coverage including ten essential benefits. Short term plans focus on catastrophic coverage and aren’t ObamaCare-compliant.

Short Term Coverage and COBRA

Enrolling in a short term coverage option will prevent you from qualifying for COBRA insurance coverage.

Short Term and HIPPA

If you are eligible for any guaranteed issue individual health plans, commonly referred to as HIPAA (Health Insurance Portability and Accountability Act) plans, purchasing a short term medical insurance plan will prevent you from qualifying for HIPPA plans.

Does Short Term Health Insurance Cover Me For ObamaCare?

No, most short term health insurance options will not count as minimum essential coverage.

Can I Buy Short Term Plans Through the Health Insurance Marketplace?

Although catastrophic coverage options exist in the marketplace, private companies sell short term plans to certain groups of young adults exclusively outside the marketplace.

Does Temporary Health Insurance Cost More?

In general short term plans will cost less than regular plans. However, you must take into account the fact that you may owe the per month fee for not having health insurance and will not be able to get cost assistance subsidies with the short term policy.

Can I Be Denied Short Term Health Insurance?

You and each family member can be denied short term health insurance. This may mean that only some of your family members may be able to get this kind of policy. It is also possible that the insurance company may decide they will not sell you a policy for anyone in your family. Please keep that in mind. Typically denials and increased premium costs are health related based on pre-existing conditions and are due to perceived risk by the insurer.

Can I get Cost Assistance on Temporary Health Insurance

You can only get ObamaCare’s cost assistance by enrolling in a qualifying plan on the health insurance marketplace during open enrollment. Temporary coverage is not available in the marketplace and isn’t a qualifying health plan.

Americans who don’t qualify for cost assistance or have missed open enrollment may consider temporary insurance as a viable option to ensure they have health coverage until they are eligible for other insurance options. If you are switching jobs, and can’t afford or don’t want to get COBRA, a temporary coverage option may make sense.

Should I Get Temporary Health Insurance

Whether or not temporary health insurance makes sense for you depends on your intentions and specific situation. If you have read and understood the information on this page, you should have a good idea as to whether short term coverage makes sense for you.

Understanding Short Term Health Insurance

![]()