Is ObamaCare a Handout?

ObamaCare is a law; the law contains subsidies based on household income. Whether this is a handout or not depends upon your definition of handout.

- Do you define handout as: something (such as food, clothing, or money) that is given to someone who is in need of it?

- Do you define handout as: a giveaway of taxpayer money to lazy people who refuse to work?

- Maybe you define a handout as: a giveaway of taxpayer money to corporations to ensure profits for shareholders and CEOs?

Perhaps you feel that the ObamaCare is only one of these things, some of these things, all of these things, or none of these things. Maybe you define “handout” in a different way altogether. Unfortunately the meaning of the word “handout” is a a broad one and open to many interpretations.

Instead of trying to argue semantics, let’s look at some facts that could help us better understand the subsidization part of the ObamaCare.

Facts on Cost Assistance and ObamaCare

Cost assistance is only a very small part of what ObamaCare does, the majority of the law is composed of regulations on the healthcare industry and consumer protections.

Cost assistance is one of the most contentious points of the law. Let’s look at some facts on how this assistance really works.

- To claim tax credits you must claim between 100% – 400% of the Federal Poverty Level in household income on your taxes ($11,770 -$47,080 for an individual or $24,250 – $97,000 for a family of 4 in 2015). You cannot be in this position unless you work, file taxes, and your employer doesn’t offer health insurance.

- In order to claim Medicaid, in a state that expanded Medicaid under ObamaCare, you must prove your income is 100% of the poverty level or less and file some fairly complicated forms. If your state didn’t expand Medicaid, and you don’t have children, then most adults will have no access to Medicaid. The reality is that a large portion of our nation is comprised of people who work hard but aren’t making enough money to buy health insurance, or will make less this year than they did in the past. Often single mothers or those temporary out-of-work use Medicaid as a safety-net, allowing them to break out of poverty.

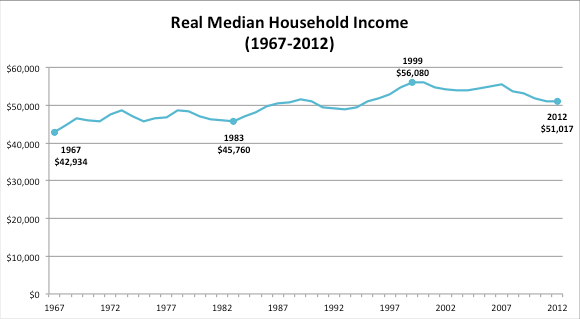

- The Median income in the US in 2012 was $51,017. Based on that fact, the above information on the federal poverty level, and the fact that ObamaCare expanded employer insurance, we can see that actually the majority of Americans qualify for some type of cost assistance under ObamaCare. I believe that few people would argue that most Americans are lazy, especially when half of us get some kind of help subsidy in paying for healthcare, and many of the rest have health insurance costs included in their wages. Remember cost assistance through the Marketplace, Medicaid / CHIP, and employer coverage all counts as cost assistance. If you are working and receive health insurance through your employer, remember that employer coverage is subsidized by tax breaks for insuring employees. Those tax breaks use tax payer money, just as direct subsidies do.

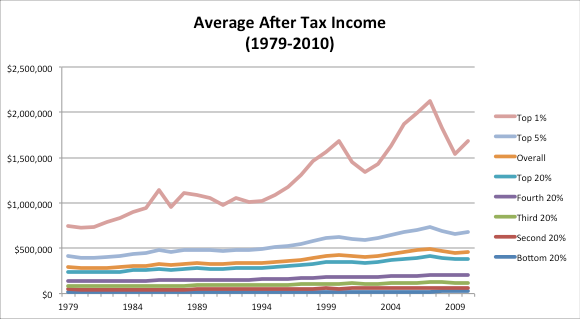

This chart shows how a large portion of our population is claiming some sort of income after taxes (which implies that they currently work or have worked in the past). Yet it also shows their after-tax income is so low their is no way they could afford to insure their families without assistance.

A Story About a Hardworking American Who Needs a “Handout”

Imagine this scenario of a hardworking person who suddenly needs a “handout”:

You’ve worked hard your whole life. You support your family of 4 working for your own contracting company. You are 55 and you plan to work until 65 at which point you’ll get on Medicare and consider retiring, maybe.

You’ve saved $100,000 cash, $50,000 in a 401k, and have a $300,000 house with only $50,000 left on your mortgage.

Surrounding your house is a white picket fence, your Golden retriever is running around outside and your 20 year old and 19 year old are back from College (which you are paying for in part).

The news is on, and you curse the poor people for taking all your tax money via ObamaCare, the big Government giveaway. You proudly have have forgone health insurance because you have money and will simply pay out of pocket if need be. You’ve done this for years and it’s saved you a good $50,000 from that alone. You are healthy, always have been, and don’t go to doctors often.

Now what if you have a heart attack. You ignore the first symptoms, but your body fails you, and you slip out of consciousness. While you were out you were airlifted to the hospital and the proper procedures were done to save your life.

While you recover, you can’t work and since you own and run your business, this is a problem. The bigger problem is that the hospital costs are going to run you about $50,000 this year (That is your savings over the past years gone in one instant).

You won’t be able to work during the peak season this year, that is going to cost you another $50,000. The airlift alone was $20,000 for some awful reason (if only you could have said no!). Well that is $120,000. There goes the bulk of your savings account, and now you can’t pay your mortgage. You could sell off the house, but that isn’t practical. If you don’t pay your mortgage the house isn’t yours to sell. You empty your 401K at a penalty to pay off everything. Your children switch to community college and boost their hours at McDonalds (at $7.25 an hour) because they can’t afford their tuition without your help.

Next year the costs of the heart attack are still adding up, you have fewer clients and workers because you can’t fullfill your contracts and provide employment due to last years heart attack.

Due to all of your loses, you were able to deduct those medical bills, and that left your taxable income at zero. Well that is a break because those 30% plus taxes were awful. Zero is much better.

Here is where your life can go from rough to ruined: You live in Texas and they are one of twenty states who are currently refusing to expand Medicaid to single adults (if you had children under 18 in Texas, there would be help, but you don’t).

Due to your annual income, you find yourself without affordable access to healthcare or health insurance. You make too much for Marketplace cost assistance, too little to afford coverage out-of-pocket, but are too well off to have access to Medicaid in Texas.

Then you feel chest pains again, this time the medical bills will be un-payable. The chances that you keep your house fall to near zero. After you are beat down hard enough and have nothing, some of the other safety nets may kick in, but that is too late. Getting back to contributing to society is going to be a long hard road for you and your family. Hopefully your children make it through community college, because Texas won’t be embracing a minimum wage increase anytime soon.

FACT: Every year, at least 1.5 million Americans suffer heart attacks.

The Conclusion

This isn’t the Oregon trail, this is real life. In real life accidents happen and insurance acts to protect us against unaffordable costs. With the rising cost of healthcare, most people can’t afford a heart attack or a car accident unless we have insurance. We all need health insurance even though many of us can’t afford to pay the full cost of it.

The Affordable Care Act was supposed to solve all of this by expanding Medicaid and offering cost assistance. Since so many states rejected aspects of the law, and the cost of coverage continues rising, many people are not getting the coverage that was envisioned by the original draft of the law. The story above may just be more common than we all want to admit.

Sometimes the 1% of most wealthy Americans get privileges that the rest of us feel we ought to have; sometimes tax payers give “handouts” to lazy people without wanting to. As much as we would like to believe our country is fair, “fairness” is a goal we strive for, not a right.

As times become harder for most of us, we need an insurance safety-net. We as a country need to keep as many of us as possible contributing to society rather than being ruined by the cost of living.