Obamacare Tax Refund

How Tax Refunds for Advanced Tax Credits Work under the Affordable Care Act

Millions may get a tax refund under ObamaCare. If your income was lower than projected, and you had a Marketplace plan, you may get an ObamaCare tax refund.

NOTE: This article was written in 2015, but has been updated for 2019 – 2020.

Why Millions May Get a Refund

Everyone who got a Tax Credit (any who enrolled in a marketplace plan and claimed tax credits due to making less than 400% of the Federal Poverty Level) needs to file Form 8962, Premium Tax Credit (PTC).

Most people will have a slightly higher or lower income than reported or will experience a life change.

Since Advanced Tax Credits are calculated up front, and then adjusted at tax time, most people who take credits will end up either owing back some credits or will qualify for even more tax credits when they file their taxes.

In short, that means millions who took at least part of the tax credit upfront may get a refund, while millions more may have to pay back excess Advanced Tax Credit Payments.

If you didn’t get the whole credit up-front, or your income was less than you projected when you filled out your marketplace application, there is a good chance you’ll get a refund.

Either way, you are going to have to fill out the form.

NOTE: There are limits to how much you can owe back to the IRS for excess Advanced Tax Credit Payments. To offer an example, the following Advanced Tax Credit Repayment limit table from form 8692 is updated for 2018 coverage (accounted for on taxes filed in 2019).

| Income % of FPL | Filing Status: Single |

Filing Status: All Other |

|---|---|---|

| Less than 200% FPL | $300 | $600 |

| At least 200% FPL but less than 300% |

$775 | $1,550 |

| At least 300% FPL but less than 400% |

$1,300 | $2,600 |

| More than 400% FPL | Full Amount Received | Full Amount Received |

| If your year-end income exceeds 400% FPL, you will have to return the total amount of Advanced Premium Tax Credits you received. If you make too little to qualify for subsidies (less 100% FPL), then you should owe NOTHING (per the directions of form 8962 from which this table comes). That being said, if you know you are going to price out of cost assistance, make sure to update your Marketplace account. You might become eligible for a free or low-cost Medicaid plan if your state expanded Medicaid. | ||

TIP: See federal poverty level for more details. Make sure to refer to the current 8962 form for calculations each year at tax time (you can always use last year’s numbers for a general estimate).

How to Get a Tax Refund Under ObamaCare?

Getting a tax refund under ObamaCare is simple. All you have to do is fill out Form 8962, Premium Tax Credit (PTC) and show that the amount that you were paid in advance is less than you were owed. Whatever amount you are owed based on your Modified Adjusted Gross Income and family sizes will be applied to your tax refund. So even if you had a marketplace plan and didn’t get any cost assistance up front, you could still be owed a refund.

If you don’t fill out the form, you won’t get to take advantage of refundable tax credits. And if you made more than projected, you could end up owing more. Even slight fluctuations in income can change Tax Credits. So do yourself a favor and file form 8962. You can use our ObamaCare Facts simplified instructions for Form 8962, Premium Tax Credit (PTC) to make the process easier.

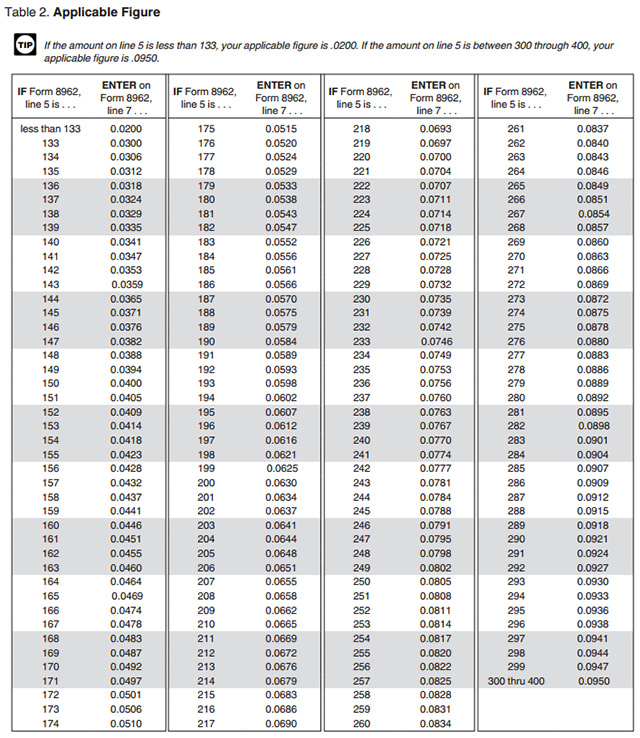

Table 2. Applicable Figure on the PTC form shows how each level of the Federal Poverty Line adjusts your Tax Credit amount. Thus slight variations in income can affect Tax Credit amounts.

NOTE: The form is only filled out once per household claiming taxes together.

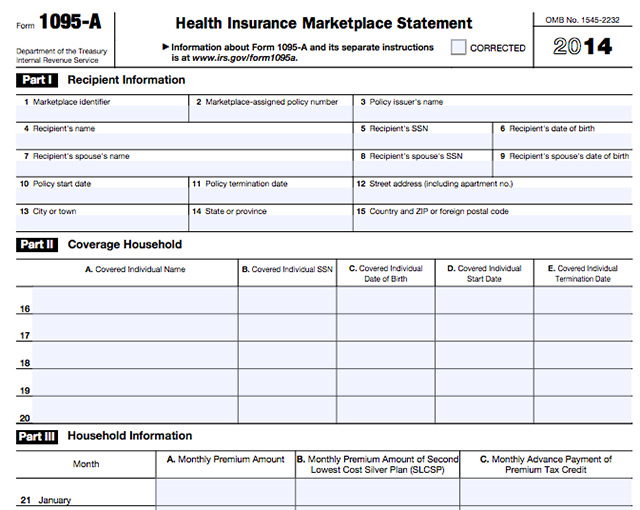

Form 1095-A is the Key

You’ll need to have form 1095-A on hand to fill out form 8962. The marketplace files those on January 31st, 2015. So look for yours shortly after. If you didn’t have Marketplace coverage, you might not see the form until next year. Don’t fret, you can report your coverage on your 1040 based on the honor system. See our ObamaCare Facts simplified guide to 1095 forms.

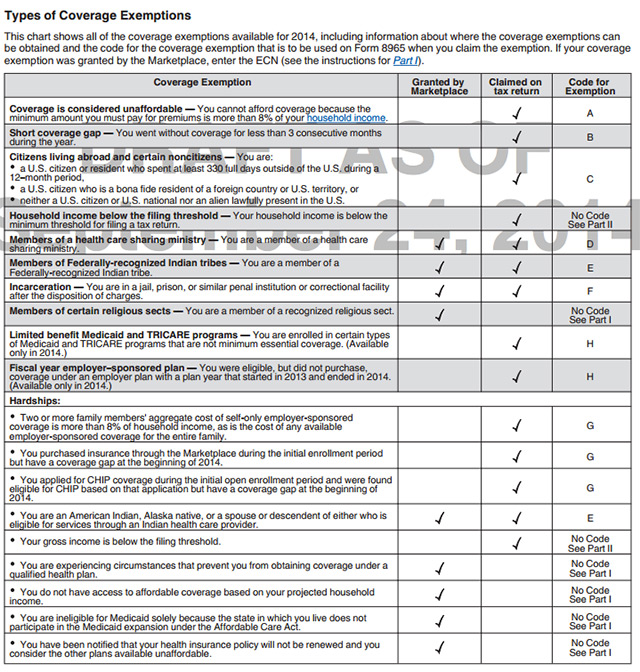

And May as Well Discuss the Exemptions Form

While an exemption won’t get you a refund, it will save you from owing the Shared Responsibility Payment on your 1040. That is important. You’ll fill out Form 8965 if you went even one month without coverage in 2014. So may as well get that form ready too. See our ObamaCare Facts simplified instructions for Form 8965, Health Coverage Exemptions.

Get more information on filing taxes under the Affordable Care Act.

charles baker

enrolled in Obama care no incometax threshold met do I get a refund of some of premiums I paid all premiums

leroy broadie

can you tell me about the obarma rebate that ends on the 15 of december?

Elaine Flynn

If I pay no income tax because I have no income, will I still get a refund if I qualify for a tax credit?

ObamaCareFacts.comThe Author

You can elect to file and adjust advanced tax credits, but you can’t claim a tax credit on the 8962 form if you made under 100% of the poverty level. You shouldn’t qualify for a tax credit if you made no income, but in some cases people will project incomes over 100% and then fall short. In this case they may find themselves owning no money back (but having to file form 8962 and income taxes).