The American Health Care Act Review

We review and explain each of the provisions in the House bill to repeal and replace ObamaCare, “The American Health Care Act”.

We review and explain each of the provisions in the House bill to repeal and replace ObamaCare, “The American Health Care Act”.

A Simple Version of Everything You Need To Know About the ObamaCare Repeal and Replace Plan We explain “the American Health Care Act” (The New ObamaCare Replacement Plan) in simple terms. You can see our full review here or see a simple pros and cons list here (the list below offers some opinion, like the opinion that taking away Medicaid from… Read More

We review “the American Health Care Act” (The New ObamaCare Replacement Plan) to help everyone understand the proposed changes.

We fact-check the full CNN ObamaCare debate between Bernie Sanders and Ted Cruz. We also provide a transcript and the full video.

An old lawsuit is rearing its ugly head again and it could lead to ObamaCare’s cost sharing assistance being defunded under Trump.

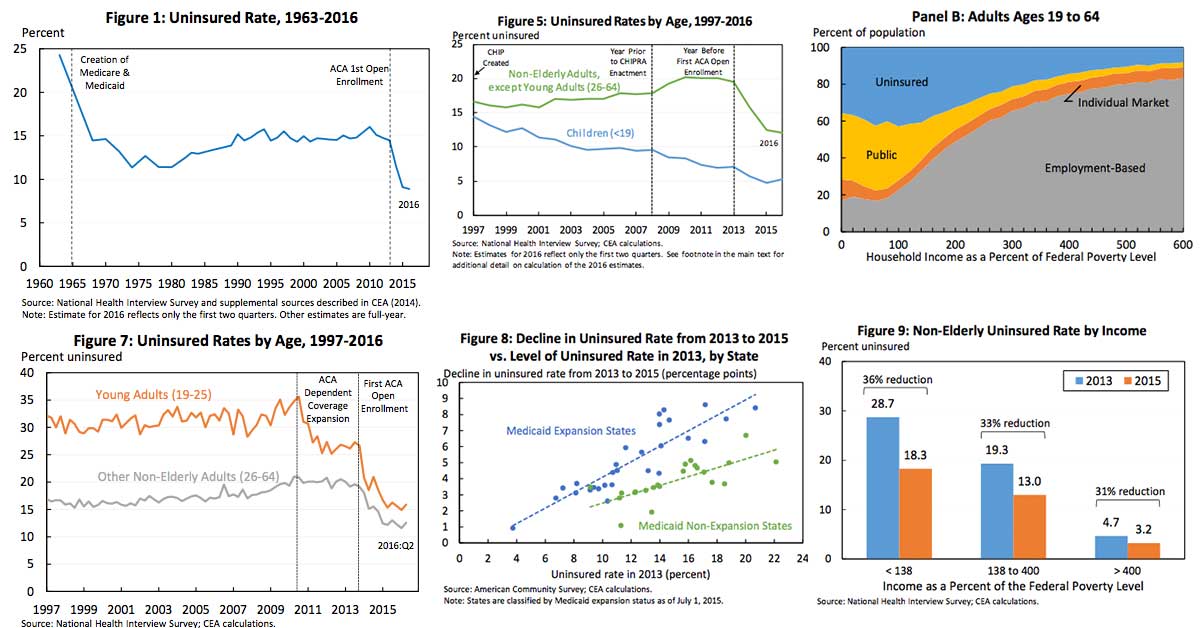

The White House just released a 100 page report on ObamaCare (the Affordable Care Act). Below are some key facts and the full report.

We explain how a HSA-eligible public option could work in a ObamaCare/Medicare repeal and replace plan.

We examine the GOP’s “fix” for preexisting conditions and the mandate, and offer alternative solutions that pair with Price and Ryan’s ACA replacement plans.

Trump’s been elected, and that means TrumpCare may replace ObamaCare. Here is what changes to expect for ObamaCare under President Trump.

Cuentas de Ahorro para la Salud y ObamaCare en el 2017 Cubrimos todo lo que necesite saber acerca de las Cuentas de Ahorro para la Salud (HSAs por sus siglas en inglés) para el 2017, incluyendo cómo funcionan con los planes ObamaCare. ¿Qué son las Cuentas de Ahorro para la Salud? Los ahorros de salud… Read More

Información Actualizada de Asistencia en Costos para el 2017 Para el 2017, los compradores pueden adquirir tres tipos de seguro médico bajo ACA: Créditos fiscales sobre primas, Subsidios de Reducción de Costos Compartidos, y Medicaid / CHIP. A continuación, se encuentra la información actualizada de asistencia en costos para los planes del 2017, incluyendo todos… Read More

The 2016 Federal Poverty Level Guidelines (Used in 2016 and 2017) Understanding the Federal Poverty Guidelines for Determining Cost Assistance For 2016 Medicaid and CHIP and Assistance on Plans Active in 2017 Below are the 2016 Federal Poverty Guidelines used for cost assistance on 2017 health plans, 2016 Medicaid / CHIP, and taxes filed April 15, 2018…. Read More

A major medical health insurance plan generally describes any private individual or family plan sold after 2014 that follows the ACA’s new guidelines. This means it is a plan that counts as minimum essential coverage, offers the ten essential health benefits, follows guidelines for deductible and out-of-pocket maximum limits, and covers “major expenses” associated with serious illness… Read More

Updated Cost Assistance Information for 2017 For 2017, shoppers can get three types of health insurance cost assistance under the ACA: Premium Tax Credits, Cost Sharing Reduction Subsides, and Medicaid/CHIP. Below is updated cost assistance information for 2017 plans, including all plans purchased during 2017 open enrollment Nov 1. 2016 – Jan. 31. 2017. TIP: Seniors… Read More

Health Saving Accounts and ObamaCare for 2017 We cover everything you need to know about Health Savings Accounts (HSAs) for 2017, including how HSAs work with ObamaCare plans. What Are Health Savings Accounts? Health savings accounts are tax-advantaged medical savings accounts that you can draw money from for certain medical expenses. They work a bit… Read More

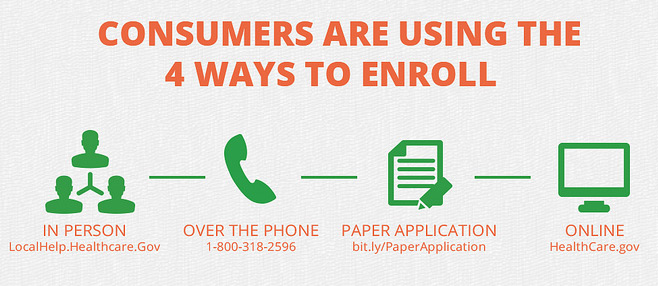

Understanding ObamaCare’s 2017 Open Enrollment Period Open Enrollment 2017 started November 1, 2016 and ended January 31, 2017. Open enrollment is the only time you can enroll in a health plan on the individual market without qualifying for special enrollment. That means if you wanted to get cost assistance and avoid the monthly fee for 2017,… Read More

HillaryCare Explained – The History of Hillary Clinton’s Healthcare Reform Efforts HillaryCare describes healthcare reform efforts by Hillary Clinton. This includes her healthcare reform efforts in 1993 that paved the way for CHIP and the ACA, and all efforts since. If Hillary gets elected HillaryCare will describe healthcare reform under her Presidency. Below we discus: Hillary’s… Read More

ObamaCare News Archives Below you will find our archive of news articles on the Affordable Care Act from 2012 – 2014, see our current ObamaCare news section for recent news related to the ACA. ObamaCare News November 2014 Should I Shop Inside or Outside of the Marketplace? Published November 20th, 2014 by ObamaCare Facts Most of… Read More

A Quick and Simple Guide to Health Insurance Costs and Assistance Types of health insurance costs include: monthly premiums and out-of-pocket costs / cost sharing (copays, coinsurance, deductible, out-of-pocket maximum). Here the premium is what one pays for the policy, and then cost sharing is a reference to the part of the costs the plan covers… Read More

When it comes to Advanced Premium Tax Credits, it is always tempting to take the maximum amount you qualify for. However, repayment limits can mean owing back credits.

Explaining ObamaCare to the average person who is upset with costs is really hard, but an honest approach sends the right message.

We explain some ideas for how to fix ObamaCare (the Affordable Care Act). The goal is to seek universal coverage and fix the ACA’s sticking points.

What is TrumpCare? “TrumpCare” describes health care reform under Donald Trump. We explain TrumpCare and how it is different than ObamaCare. An Introduction to the Many HealthCare Bills, Regulations, and Ideas We Call “TrumpCare.” Below we explain different aspects of TrumpCare. When people say “TrumpCare” they are essentially referring to healthcare changes made, attempted to be… Read More

Here is a quick guide for enrolling in Healthcare.Gov coverage at the last moment.

Out-of-pocket costs, the GOP’s rejection of Medicaid, the family glitch, and premium increases. These are ObamaCare’s sticking points.