The Ongoing Republican Strategy to Break ObamaCare

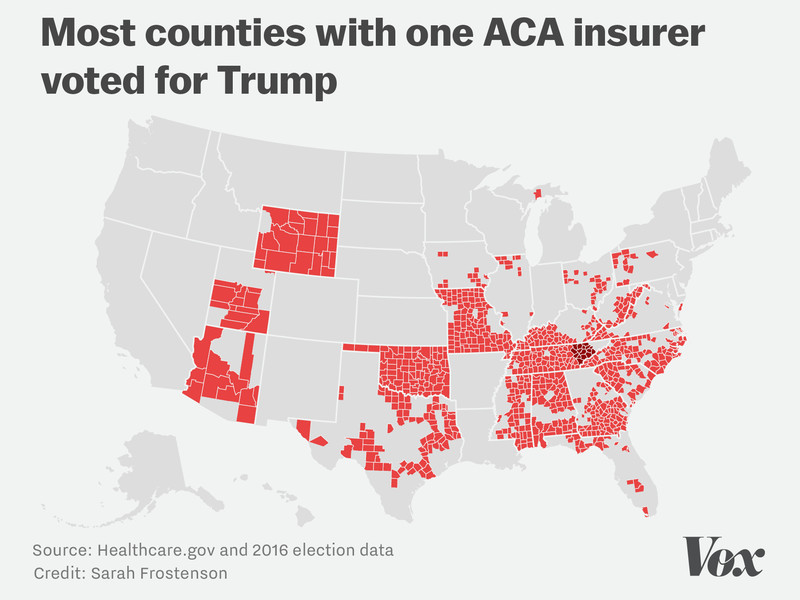

Recent premium hikes and the lack of coverage under the ACA is partly a result of an ongoing Republican Strategy to “Break ObamaCare.” We explain.

Recent premium hikes and the lack of coverage under the ACA is partly a result of an ongoing Republican Strategy to “Break ObamaCare.” We explain.

Below is an explanation of what is wrong with ObamaCare along with a large collection of centered suggestions for how to fix it.

House Republicans are considering high-risk pools (sick pools) as part of their ObamaCare replacement revival, we explain what “high-risk pools” mean.

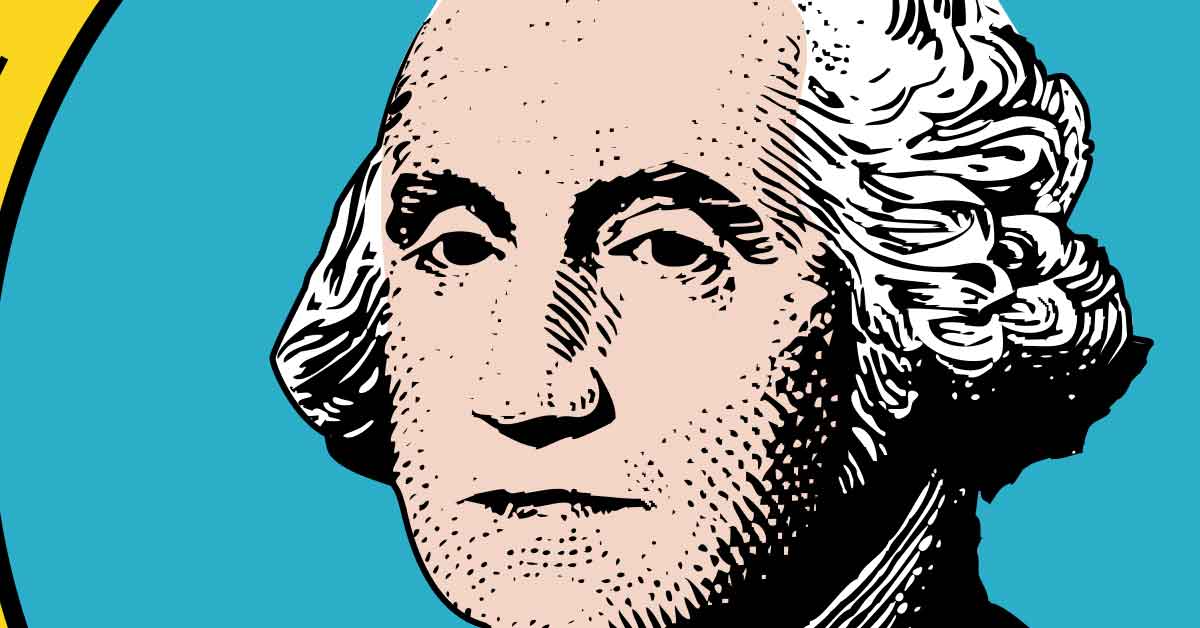

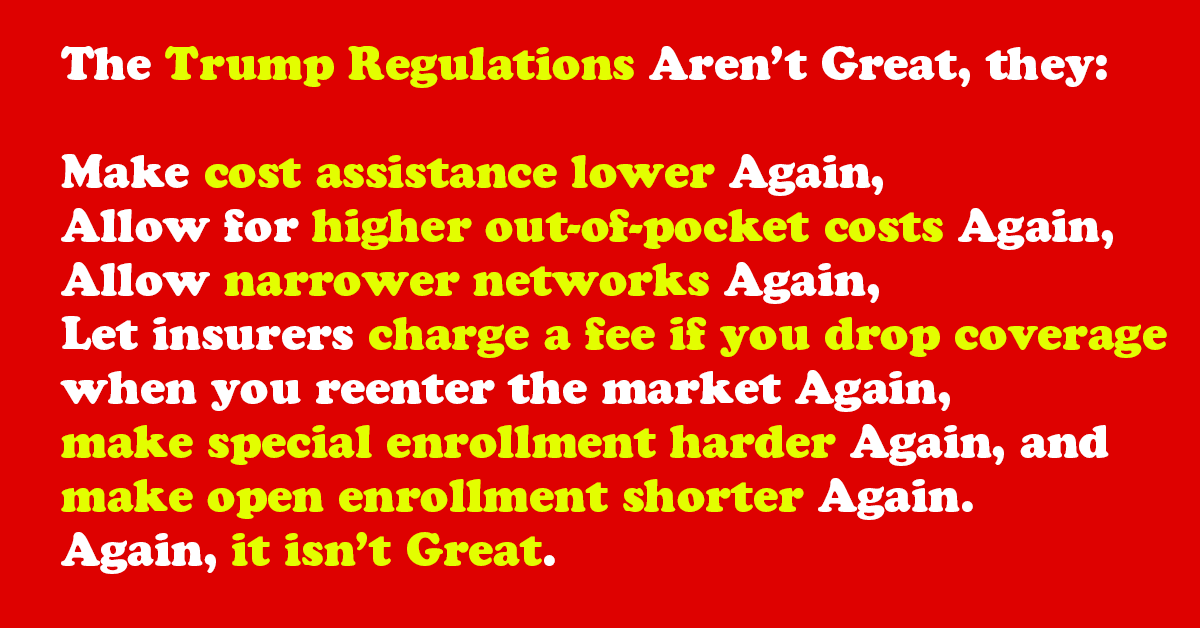

The Trump Administration regulation published by CMS on Thursday April 13th was a handout to insurers, a blow to many consumers, and may curb premium costs.

Here is advice for conservatives in the White House and Freedom Caucus trying to hash out an ObamaCare replacement.

The idea of an ObamaCare Death spiral is essentially a myth, so is the idea that Democrats forced the ACA through without Republican input.

We fact-check the full CNN ObamaCare debate between Bernie Sanders and Ted Cruz. We also provide a transcript and the full video.

Open Enrollment for Marketplace insurance ends January 31st. Even though the future of the ACA is less than certain, there are no changes to Marketplace insurance or Cost Assistance yet. If you are still in need of health insurance for 2017, please sign up at Healthcare.gov or your state’s Marketplace while you still can. Support Marketplaces and Cost Assistance… Read More

Trump signed an Executive Order on the Affordable Care Act (ObamaCare) on his “first day” as President to “prepare” for the law’s repeal.

Washington State House Bill 1026 Several House representatives in Washington have sponsored HB 1026 which would establish a single-payer health care system in Washington state using the Affordable Care Act’s State Innovation Waiver 1332. The 1332 waivers first became available to state legislators this year, and these waivers allow states to utilize 95% of the… Read More

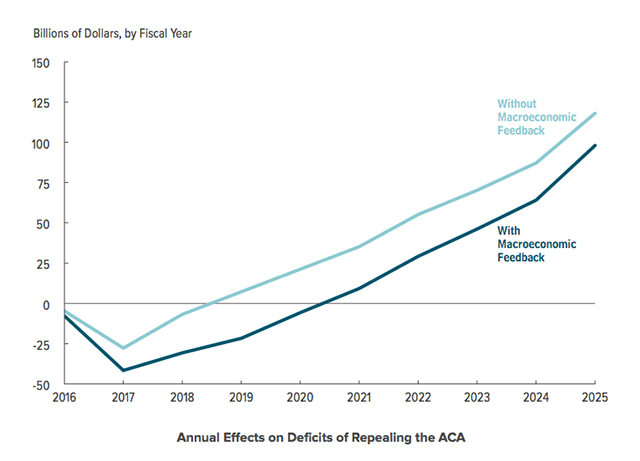

What Repealing and Replacing ObamaCare Could Look Like Under the Trump Administration Republicans in Congress plan to repeal the Affordable Care Act (ObamaCare). Get the facts on a repeal and replace plan under the Trump administration and what it means for America. UPDATE 2019: The repeal and replace plan never passed, and thus some specifics here… Read More

We explain how a HSA-eligible public option could work in a ObamaCare/Medicare repeal and replace plan.

We examine the GOP’s “fix” for preexisting conditions and the mandate, and offer alternative solutions that pair with Price and Ryan’s ACA replacement plans.

Understanding the GOP Pre-Existing Condition “Continuous Coverage Exclusion” Provision The Affordable Care Act eliminated preexisting conditions, but almost all GOP plans (including Tom Price’s plan) bring them back via a “Continuous Coverage Exclusion” for pre-existing conditions. TrumpCare (the American Health Care Act) and the Continuous Coverage Provision As predicted in the article below, the newest House… Read More

Trump’s been elected, and that means TrumpCare may replace ObamaCare. Here is what changes to expect for ObamaCare under President Trump.

Cuentas de Ahorro para la Salud y ObamaCare en el 2017 Cubrimos todo lo que necesite saber acerca de las Cuentas de Ahorro para la Salud (HSAs por sus siglas en inglés) para el 2017, incluyendo cómo funcionan con los planes ObamaCare. ¿Qué son las Cuentas de Ahorro para la Salud? Los ahorros de salud… Read More

Información Actualizada de Asistencia en Costos para el 2017 Para el 2017, los compradores pueden adquirir tres tipos de seguro médico bajo ACA: Créditos fiscales sobre primas, Subsidios de Reducción de Costos Compartidos, y Medicaid / CHIP. A continuación, se encuentra la información actualizada de asistencia en costos para los planes del 2017, incluyendo todos… Read More

Although health insurance premiums are up 22% on average for 2017, but many can get a plan for a $100 or less through healthcare.gov.

Updated Cost Assistance Information for 2017 For 2017, shoppers can get three types of health insurance cost assistance under the ACA: Premium Tax Credits, Cost Sharing Reduction Subsides, and Medicaid/CHIP. Below is updated cost assistance information for 2017 plans, including all plans purchased during 2017 open enrollment Nov 1. 2016 – Jan. 31. 2017. TIP: Seniors… Read More

Health Saving Accounts and ObamaCare for 2017 We cover everything you need to know about Health Savings Accounts (HSAs) for 2017, including how HSAs work with ObamaCare plans. What Are Health Savings Accounts? Health savings accounts are tax-advantaged medical savings accounts that you can draw money from for certain medical expenses. They work a bit… Read More

Citing losses, but on the back of the Department of Justice (DOJ) attempting to block a merger with Humana, Aetna has stated it will pull out of 11 ObamaCare exchanges.

ObamaCare Public Option Explained ObamaCare allows for a public option, a public health insurance plan that can compete with private companies and works with the ACA. This “ObamaCare public option” can work a few ways. President Obama previously expressed support for a national public option and suggested that states create state-based public options via sec. 1332 waivers, especially in regions with low competition. Initially… Read More

When people get sick they typically lose their income source. Unless they have savings, this results in a plan drop. Thus, private health insurance loses value in a catastrophic long-term event.

The drug Pembrolizumab, which is thought to have help Jimmy Carter beat cancer, has been approved by the FDA through an accelerated fast-track process.

Bernie Sanders proposed a single payer Medicare for all solution for American health care (BernieCare). What does that mean?