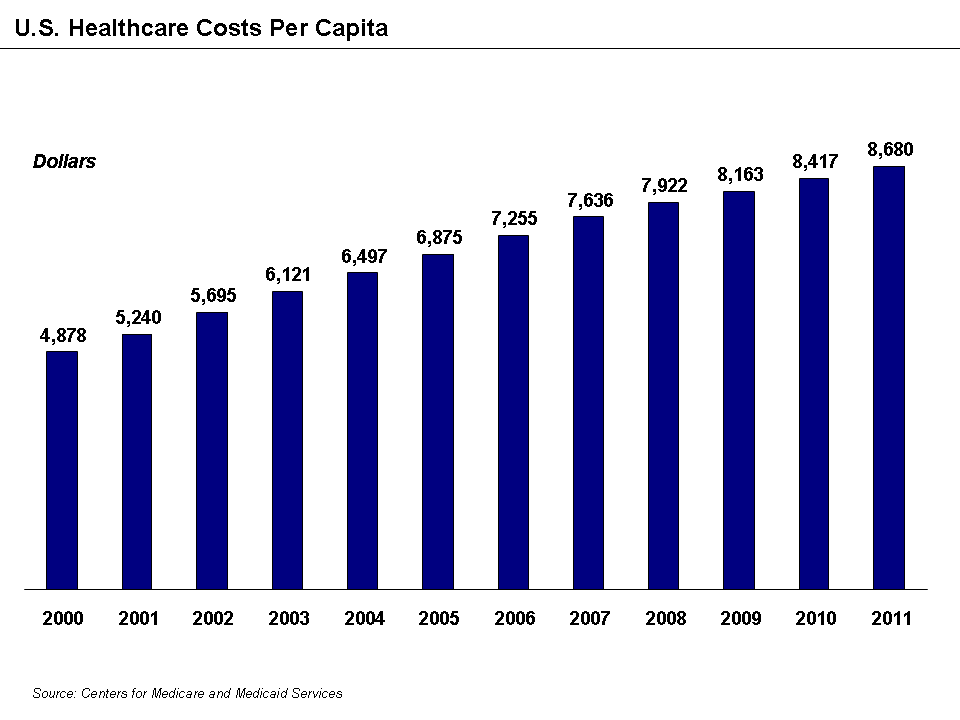

High Premiums and High Deductibles Going into 2016

People of all income levels, news sources, insurers, and providers have expressed frustration over rising health premiums and deductibles going into 2016.

People of all income levels, news sources, insurers, and providers have expressed frustration over rising health premiums and deductibles going into 2016.

A woman put a public facebook post up about a BCBS plan in Alabama. Is this an ObamaCare problem or an Alabama problem?

Even if all states expand Medicaid, we need Planned Parenthood. ObamaCare’s expansion of coverage options provides free sexual and reproductive health services, but millions fall in the Medicaid gap in state’s that didn’t expand.

Out-of-network emergency care is covered under all insurance plans sold after March 23rd, 2010 as part of Ten Essential Benefits under the Affordable Care Act.

If the cheapest employer plan available to you is 9.56% of MAGI for self only coverage you can get ObamaCare’s cost assistance.

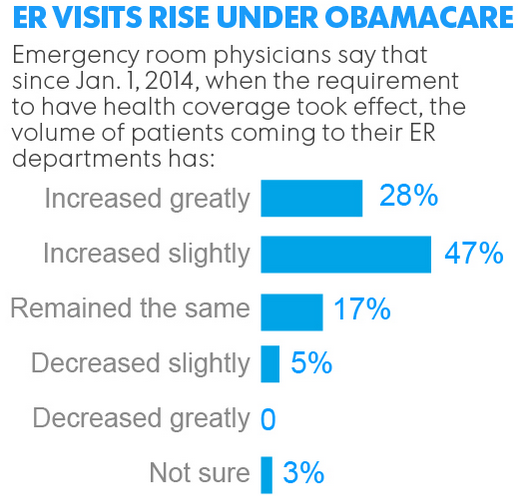

A study shows that ER visits have increased as more people have gotten coverage under the Affordable Care Act. This expected short term outcome isn’t ideal, but speaks to habits of the previously uninsured, the fact that ER visits are covered under the ACA, and an increased doc shortage as demand outpaces supply in the short term.

ObamaCare covers one type of birth control per person from each of 18 FDA-approved categories at no out-of-pocket cost, although some plans have exemptions. This page will tell you what kinds of birth control are covered, which health plans have exemptions, how to get free birth control under the Affordable Care Act, and how to get help… Read More

Under the ACA you can take tax deductions for medical and dental expenses that exceed 10%* of your annual Adjusted Gross Income using a Form 1040, Schedule A. This includes deductions for most medical and dental costs for you, your spouse, and your dependents. Most people won’t take this deduction, but if you’ve had a… Read More

Yes. Since cancer screenings are a preventive service (one of ObamaCare’s Minimum Essential Benefits), all ObamaCare health insurance plans have to cover lung cancer screenings. In most cases, this service must be offered at no out-of-pocket costs.

ObamaCare’s Cadillac Tax is a 40% excise tax on high end plans above $10,200 for individuals and $27,500 for family coverage that was set to start in 2018 but was been delayed. This tax is not deductible. The excise tax is one of the main revenue sources for the ACA, helps curb healthcare costs, and… Read More

Come 2017 Arkansas plans to create a “private option” alternative to Medicaid that uses a single pool for nearly 190,000 under the 138% Poverty Level.

Veterans coverage (Veteran’s health care program) counts as Minimum Essential Coverage under ObamaCare so you don’t need to get other coverage.

Affordable Care Act Vision Coverage Vision insurance generally isn’t covered under the Affordable Care Act (ObamaCare). However, pediatric eye care is a required benefit included on all plans that qualify as minimum essential coverage under the ACA. Even though adult vision coverage isn’t a required benefit of ObamaCare, “vision health” is still an important aspect… Read More

Get the facts on the ObamaCare replacement plan by Burr, Hatch, and Upton: the Patient Choice, Affordability, Responsibility, and Empowerment (CARE) Act. Below we present a summary, some quick facts, a pros and cons chart, a complete section-by-section breakdown, and finally we compare the CARE Act proposal to ObamaCare. Keep in mind this is an older replacement… Read More

ObamaCare sign up numbers reach 10 million after a surge in Federal Marketplace enrollments. A February 2015 HHS report shows ObamaCare is working. Enrollment numbers have surpassed 10 million between the state and federal marketplaces. It also points out some other really cool and groundbreaking facts about the uninsured rate (updated with citations on March 18 2015)…. Read More

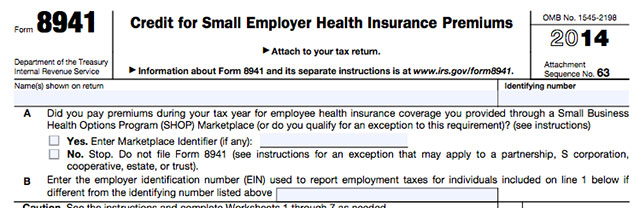

Employers can get a Tax Credit for up to 50% of their contribution to employee premiums by filing Form 8941, Credit for Small Employer Health Insurance Premiums. Get detailed HTML based instructions on Form 8941 from the IRS, simplified instructions ObamaCare’s employer tax credit form can be found below. What is Form 8941, Credit for Small Employer Health Insurance Premiums?… Read More

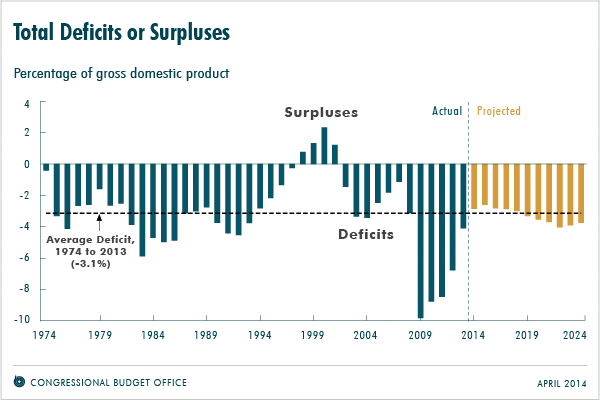

ObamaCare decreases the deficit and debt with cost controlling provisions and taxes, but subsidies, protections, and healthcare spending may result in more debt over the long term if no further changes are made. UPDATE 2019: This page was created in 2015, numbers have been revised since this was written. So the logic remains the same, but the specific numbers need to… Read More

Get the Facts on the 60 minutes report on ObamaCare “Dissecting ObamaCare” featuring Steven Brill author of “America’s Bitter Pill.” We fact-check the video. Watch the full of the 60 Minutes ObamaCare video. First fact-check, it’s only 13:19 minutes long, not 60:00. CBS intended each of its segments to run for approximately 15 minutes and… Read More

The Forms Needed if You Got Marketplace Tax Credits Under the Affordable Care Act (ObamaCare) Find out how to fill out Premium Tax Credit Form 8962, the form for reporting ObamaCare Tax Credits. We’ll review MAGI, FPL, and Adjusting credits. The form can seem daunting at first, but by understanding what all the fields mean,… Read More

The Save American Workers Act changes the definition of full-time workers so fewer employers have to comply with ObamaCare’s employer mandate. Let’s take a look at the legislation, why it was passed in the House, why it won’t pass the Presidents desk, what effects it has, data on part-time hours and job loss, and some alternatives… Read More

What is Modified Adjusted Gross Income (MAGI), Adjusted Gross Income (AGI), Gross Income (GI), Family Income, Household Income, Etc? Modified Adjusted Gross Income (MAGI) is your Gross Income (GI) adjusted for deductions (AGI) and then modified by adding certain deductions back in to calculate MAGI. This page covers MAGI as it applies to Medicaid and… Read More

ObamaCare’s open enrollment period for 2015 starts on November 15th, 2014 and ends on February 15th, 2015. Let’s review the most important things to know about open enrollment in the health insurance marketplace for 2015. • Open enrollment is the only time you can get cost assistance, enroll in a plan, or change plans. This is true whether you… Read More

ObamaCare affects premium rates, that much is for sure, but whether or not they are rising or falling seems to depend upon your news source. Sure, that was meant as a back-handed dig on those super useful biased news outlets, but there is actually some good truth in the idea that rate fluctuations are a… Read More

Insurance Companies Can’t Cancel Coverage For Any Reason Other Than Fraud or Non-Payment ObamaCare bans rescission (rescinding health coverage), in other words, insurers can’t cancel coverage from any reason aside from non-payment or fraud. Before the ACA an insurance company could find a small detail like a mistake on your application, or the omission of… Read More

How Medicare Works Medicare, or Original Medicare, is a federal program offered to seniors when they reach 65, people with certain disabilities, and those with ESRD. Original Medicare includes Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance). Supplemental Medicare options are also offered to “fill the gaps” in Medicare coverage. Supplemental Medicare… Read More