Bernie Sanders Introduces Medicare for All Act of 2017

We explain the basics of the Bernie Sanders Medicare-for-all bill, a bill to expand universal coverage to all Americans by expanding Medicare.

We explain the basics of the Bernie Sanders Medicare-for-all bill, a bill to expand universal coverage to all Americans by expanding Medicare.

Deferred Action for Childhood Arrivals (DACA) recipients are not eligible for ObamaCare, don’t have to comply with the mandates, can’t use the marketplace, and can’t get cost assistance.

There is a talking point that says “Trump is adding a 19% surcharge” to plans. This isn’t fully true. Instead Trump has threatened not to fund cost-sharing reduction subsidies.

TrumpCare weakens (not eliminates) key protections for those with pre-existing conditions, which could result in some being excluded from the market due to cost.

Does TrumpCare Cover Pre-Existing Conditions? We explain how TrumpCare affects those with pre-existing conditions to help clear up the confusion regarding TrumpCare and Pre-existing conditions. UPDATE 2019: This plan never passed, and thus the specifics here are of historical interest only. The Basics of TrumpCare and Pre-Existing Conditions Generally speaking, Under ObamaCare (the Affordable Care Act) no one with pre-existing conditions… Read More

The 2017 Federal Poverty Level Guidelines (Used in 2017 and 2018) Understanding the Federal Poverty Guidelines for Determining Cost Assistance For 2017 Medicaid and CHIP and Cost Assistance on Health Plans Held in 2018 Below are the 2017 Federal Poverty Guidelines used for Medicaid/CHIP in 2017 – 2018 and cost assistance on 2018 health plans under the… Read More

House Republicans are considering high-risk pools (sick pools) as part of their ObamaCare replacement revival, we explain what “high-risk pools” mean.

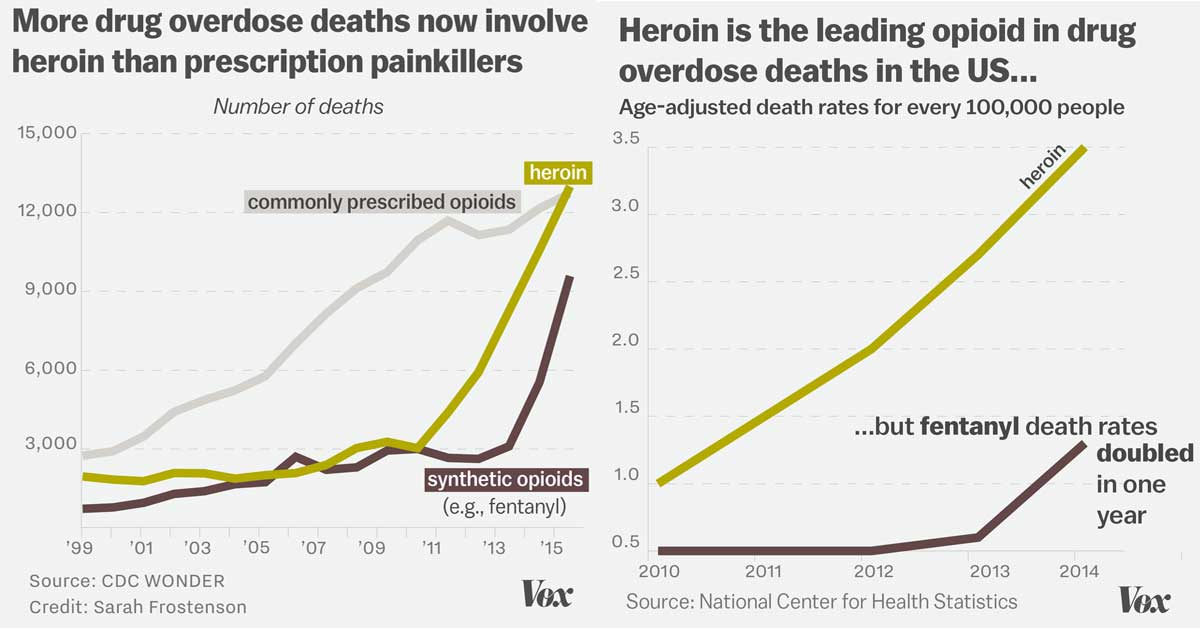

Heroin and fentanyl deaths are now more common than deaths from prescription drugs like oxycodone. Here is an educated opinion as to why.

We fact-check the full CNN ObamaCare debate between Bernie Sanders and Ted Cruz. We also provide a transcript and the full video.

Trump signed an Executive Order on the Affordable Care Act (ObamaCare) on his “first day” as President to “prepare” for the law’s repeal.

The GOP has promised to repeal and replace ObamaCare, but step one might be a repeal of ObamaCare through the budget reconciliation process.

We explain the House GOP Better Way Plan (the House Republicans’ ObamaCare replacement plan) and how it could change ObamaCare.

Cuentas de Ahorro para la Salud y ObamaCare en el 2017 Cubrimos todo lo que necesite saber acerca de las Cuentas de Ahorro para la Salud (HSAs por sus siglas en inglés) para el 2017, incluyendo cómo funcionan con los planes ObamaCare. ¿Qué son las Cuentas de Ahorro para la Salud? Los ahorros de salud… Read More

The 2016 Federal Poverty Level Guidelines (Used in 2016 and 2017) Understanding the Federal Poverty Guidelines for Determining Cost Assistance For 2016 Medicaid and CHIP and Assistance on Plans Active in 2017 Below are the 2016 Federal Poverty Guidelines used for cost assistance on 2017 health plans, 2016 Medicaid / CHIP, and taxes filed April 15, 2018…. Read More

2017 Open Enrollment for ObamaCare starts November 1st and 7 in 10 marketplace shoppers can still get prices as low $75, and 8 out of 10 less than $100!

Subsidios de ObamaCare en el Mercado de Seguros Médicos de su Estado Los subsidios de ObamaCare pueden ahorrarle dinero en sus primas y pagos adicionales. Los subsidios de ObamaCare solo están disponibles a través del Mercado de seguros, veamos que son los subsidios, cómo funcionan y cómo los puede aplicar para lograr un seguro médico… Read More

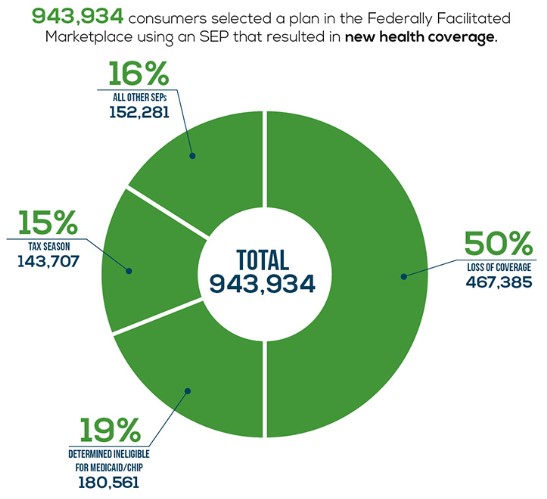

According to CMS nearly 950,000 Americans selected a plan through the HealthCare.gov via Special Enrollment between February 23 and June 30, 2015. What Is Special Enrollment? A Special Enrollment Period (SEP) is a time outside of open enrollment where people can get a Marketplace plan that is eligible for cost assistance and protects them from the fee. There are a number… Read More

How to Understand Household Income, Family Size, Tax Family, and Coverage Family for ObamaCare Cost Assistance For ObamaCare, your “household” is your “tax family” (head of household, spouse, and tax dependents). Cost assistance is based on household income and size, the people who share a plan are called a “coverage family.” With this in mind, Household… Read More

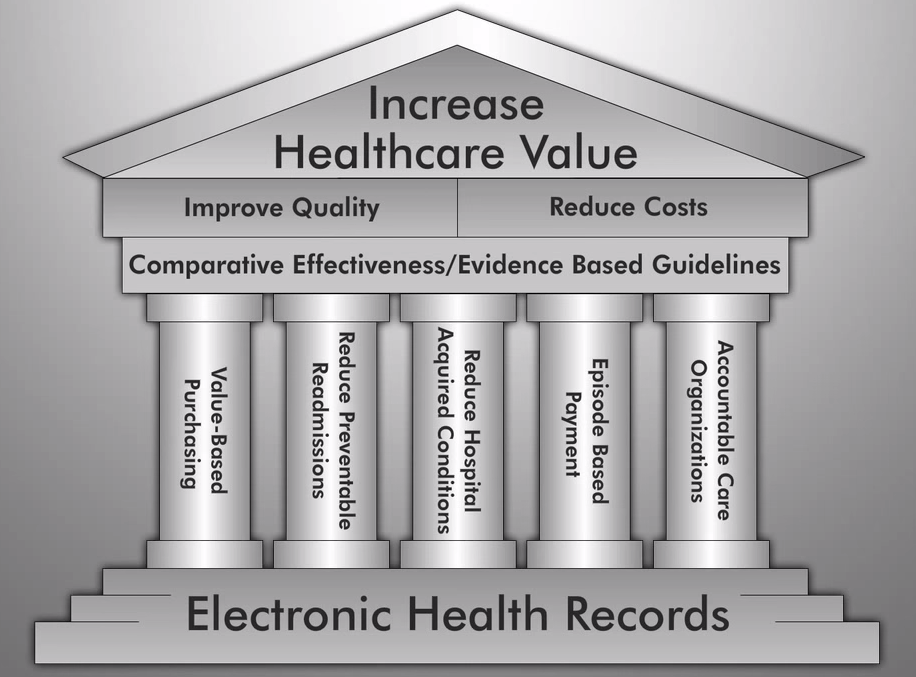

Account Care Organizations (ACOs) are groups of medical providers that accept payments based on quality under the Medicare Shared Savings Program (MSSP). This model is meant to be an alternative to the traditional fee-for-service (FSS) aimed at reigning in unnecessary treatments, coordinating care, promoting quality over quantity, and curbing Medicare spending. The bottom line: According… Read More

ObamaCare covers one type of birth control per person from each of 18 FDA-approved categories at no out-of-pocket cost, although some plans have exemptions. This page will tell you what kinds of birth control are covered, which health plans have exemptions, how to get free birth control under the Affordable Care Act, and how to get help… Read More

If you are 55 or older and receive Medicaid, the state can use estate recovery and liens to recover any and all Medicaid costs, but the practice is rare. Let’s look at the facts and myths behind Medicaid estate recovery, who it applies to, and the involvement (or non-involvement of the ACA). The gist (in… Read More

Health insurance premiums aren’t regulated, they are just subsidized based on income, but cost sharing and benefits are regulated by the ACA.

Come 2017 Arkansas plans to create a “private option” alternative to Medicaid that uses a single pool for nearly 190,000 under the 138% Poverty Level.

A list of ObamaCare’s Exemptions, including Hardship Exemptions, you can apply for in order to qualify for Special Enrollment or be exempt from the fee can be found below. This page just covers the basics, see our page on ObamaCare Exemptions for further details on exemptions and the fee (active on plans held in 2014 –… Read More

Get the Facts on the 60 minutes report on ObamaCare “Dissecting ObamaCare” featuring Steven Brill author of “America’s Bitter Pill.” We fact-check the video. Watch the full of the 60 Minutes ObamaCare video. First fact-check, it’s only 13:19 minutes long, not 60:00. CBS intended each of its segments to run for approximately 15 minutes and… Read More