State Health Insurance Exchange: State Run Exchanges

Learn About Your State’s Health Insurance Exchange Marketplace

ObamaCare’s state Health Insurance Exchanges are now open for business. You can find your state’s Health Insurance Marketplace and apply for health coverage today.

Use the list of state-based marketplaces (also referred to as exchanges) to locate your state’s marketplace or check if your state uses the federal marketplace, HealthCare.Gov.

Getting covered is easy—just find your state’s marketplace, sign up, and enroll in a plan. Before you do, it’s a good idea to learn more about health insurance to make sure you choose the best plan for your needs.What are Health Insurance Marketplaces (Exchanges)?

The Affordable Care Act (ObamaCare) created state-specific Health Insurance Marketplaces (also known as Exchanges). These are online platforms where consumers can compare prices, purchase health insurance that meets the minimum essential coverage requirements, access federal subsidies, and apply for exemptions.

Signing Up For the Health Insurance Marketplace

State marketplaces provide 24/7 assistance to help you sign up, enroll, or switch plans. Scroll down to find your state’s marketplace and get started. While some states have set up their own marketplaces, many have not, and the list can change each year. If your state doesn’t have its own marketplace, you’ll use HealthCare.Gov to access your options.

Getting Cost Assistance on the Marketplace

Americans making under 400% of the Federal Poverty Level (FPL) may qualify for cost assistance through the marketplace. Cost assistance includes reduced premiums via tax credits for those making between 100% – 400% FPL, out-of-pocket cost assistance (available on Silver plans only) for those making between 100% – 250% FPL, and Medicaid for those making under 138% FPL (if their State has implemented Medicaid expansion).

Marketplace Open Enrollment

Open enrollment for health insurance begins annually on November 1st and ends on December 15th. However, states with their own exchanges often have unique deadlines, and some states may start enrollment early or extend deadlines for various reasons.

Be sure to check state-specific deadlines each year for enrollment dates in your state and make sure to check HealthCare.Gov for official extensions.

If you missed the deadline for ObamaCare’s open enrollment, you won’t be able to sign up until the next open enrollment period unless you qualify for a special enrollment period.

When in doubt, visit www.healthcare.gov, the official Health Insurance Marketplace for states without their own marketplaces. Keep reading for more specific information about your state’s Health Insurance Marketplace and a list of all marketplaces.A Primer to State Exchanges: State Health Insurance Marketplace Facts

States have either implemented a state-run health insurance exchange or opted to let the federal government manage it for them. Some states have taken a hybrid approach by partnering with another state or the federal government. Regardless of the approach your state has taken, the process for shopping for insurance remains the same. Simply find your state’s marketplace below and apply to get ready for cost assistance, enroll in a plan, or change plans during open enrollment.

• Insurance must be obtained during open enrollment.

• The only way to qualify for and use cost assistance is through the marketplaces.

• Over half of uninsured Americans will get cost assistance on their state’s health insurance exchange marketplace resulting in free or low-cost health insurance.

• Marketplace plans are known as metal plans. The more precious the metal, the better the plan. All metal plans qualify for tax credits, but only Silver plans qualify for out-of-pocket assistance through Cost Sharing Reduction subsidies.

• All marketplace plans must offer ten essential benefits with no lifetime or annual dollar limits, include free preventive services and an annual wellness visit, have at least a 60% actuarial value, and cap deductibles and out-of-pocket maximums.

• You can’t be charged more based on health status or gender.

• Sometimes health insurance exchanges are called health insurance marketplaces.

• The official health insurance marketplace for states not running their own exchange is www.healthcare.gov.

• State-specific health insurance marketplaces each have their own unique name. Check out the list below for the official name of your state’s marketplace.

• Most Americans will have to obtain health insurance and maintain it throughout the year, get an exemption, or pay a per-month fee on their taxes for every month they went without insurance. UPDATE: The national fee is repealed 2019 forward, but some states have their own mandates.

• When you apply for your state’s marketplace you’ll find out if you or a family member is eligible for Medicaid, CHIP, or Medicare.

• If you have Medicare or access to affordable, quality job-based insurance keep it.

• If you don’t have access to affordable job-based insurance, you can use your state’s marketplace t obtain coverage during open enrollment.

• If you miss open enrollment, you won’t be able to get coverage again until the next open enrollment period without qualifying for a special enrollment period.

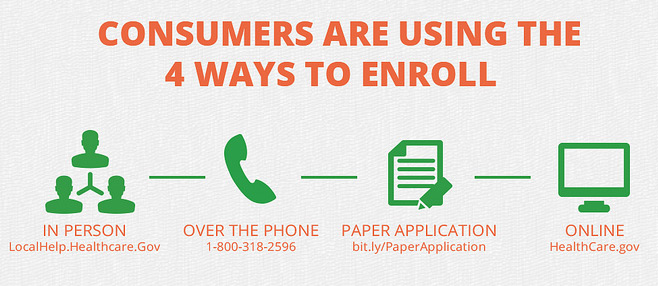

How to Sign Up For The Health Insurance Marketplace

There are four ways to sign up for your State’s Health Insurance Marketplace.

1) Find your State’s marketplace website listed below.

2) Get in-person help. You can find in-person help by going to LocalHelp.Healthcare.gov.

3) Call the 24/7 marketplace helpline 1-800-318-2596.

4) Mail-in a paper application. bit.ly/PaperApplication (read these instructions first).

See our sign up page for a complete list of what you’ll need to sign up.

My State’s Health Insurance Exchange? What is My State’s Health Insurance Marketplace?

The health insurance marketplace in your state allows you to shop for federally regulated and subsidized health insurance. Depending on your state, you will either use healthcare.gov or your state’s health insurance marketplace.

The health insurance marketplace in your state allows you to shop for federally regulated and subsidized health insurance. Depending on your state, you will either use healthcare.gov or your state’s health insurance marketplace.

Below is a list of states and their official marketplaces. While each has a unique name, they all serve the same purpose: to provide an online platform for affordable, high-quality health insurance shopping.

Find your state’s Health Insurance Marketplace using the chart below:

Please Note: Health insurance must be obtained during open enrollment. Nevada, Oregon, and Idaho have changed what their marketplaces will offer. Other marketplaces may also adjust services each year. Any marketplace listed below may be replaced by the federal marketplace for some or all services, so please refer to the official marketplace websites for details. Some states that don’t offer a marketplace for individuals and families will still offer Medicaid and CHIP sign-up through a state site or a state-based marketplace for employers. If you are an employer looking for your state’s SHOP marketplace, please refer to our ObamaCare Small Business Health Options marketplace facts page. Regardless of what your state offers, the list below will point you in the right direction.

| State Name | Official Site to Buy Health Insurance: The Name of Your State’s Health Insurance Exchange Marketplace |

| Alabama Alaska Arizona Delaware Florida Georgia Illinois Indiana Iowa Kansas Louisiana Maine Michigan Mississippi Missouri Montana Nebraska New Hampshire New Jersey North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania South Carolina South Dakota Tennessee Texas Virginia West Virginia Wisconsin Wyoming |

You’ll use the official website HealthCare.gov to apply for coverage, switch plans, get cost assistance, compare plans, and enroll. |

| Arkansas | If you live in Arkansas, you’ll use HealthCare.gov to apply for coverage, switch plans, get cost assistance, compare plans, and enroll. You can get more information from Arkansas’ official health care website Arkansas Health Connector. |

| California | If you live in California, Covered California is the Health Insurance Marketplace to serve you. Instead of HealthCare.gov, you’ll use the Covered California website to apply for coverage, switch plans, get cost assistance, compare plans, and enroll. Visit Covered California now to apply. |

| Colorado | If you live in Colorado, Connect for Health Colorado is the Health Insurance Marketplace to serve you. Instead of HealthCare.gov, you’ll use the Connect for Health Colorado website to apply for coverage, switch plans, get cost assistance, compare plans, and enroll. Visit Connect for Health Colorado now to apply. |

| Connecticut | If you live in Connecticut, Access Health CT is the Health Insurance Marketplace to serve you. Instead of HealthCare.gov, you’ll use the Access Health CT website to apply for coverage, switch plans, get cost assistance, compare plans, and enroll. Visit Access Health CT now to apply. |

| District of Columbia | If you live in the District of Columbia, DC Health Link is the Health Insurance Marketplace to serve you. Instead of HealthCare.gov, you’ll use the DC Health Link website to apply for coverage, switch plans, get cost assistance, compare plans, and enroll. Visit DC Health Link now to apply. |

| Hawaii | If you live in Hawaii, the Hawaii Health Connector is the Health Insurance Marketplace to serve you. Instead of HealthCare.gov, you’ll use the Hawaii Health Connector website to apply for coverage, switch plans, get cost assistance, compare plans, and enroll. Visit Hawaii Health Connector now to apply. |

| Idaho | If you live in Idaho, Your Health Idaho is the Health Insurance Marketplace to serve you. Instead of HealthCare.gov, you’ll use the Your Health Idaho website to apply for coverage, switch plans, get cost assistance, compare plans, and enroll. Visit Your Health Idaho now to apply. |

| Kentucky | If you live in Kentucky, kynect: Kentucky’s Healthcare Connection is the Health Insurance Marketplace to serve you. Instead of HealthCare.gov, you’ll use the kynect: Kentucky’s Healthcare Connection website to apply for coverage, switch plans, get cost assistance, compare plans, and enroll Visit kynect: Kentucky’s Healthcare Connection now to apply. |

| Maryland | If you live in Maryland, the Maryland Health Connection is the Health Insurance Marketplace to serve you. Instead of HealthCare.gov, you’ll use the Maryland Health Connection website to apply for coverage, switch plans, get cost assistance, compare plans, and enroll. Visit the Maryland Health Connection now to apply. |

| Massachusetts | If you live in Massachusetts, the Health Connector is the Health Insurance Marketplace to serve you. Instead of HealthCare.gov, you’ll use the Health Connector website to apply for coverage, switch plans, get cost assistance, compare plans, and enroll. Visit the Health Connector now to apply. |

| Minnesota | If you live in Minnesota, MNsure is the Health Insurance Marketplace to serve you. Instead of HealthCare.gov, you’ll use the MNsure website to apply for coverage, switch plans, get cost assistance, compare plans, and enroll. Visit MNsure now to apply. |

| Nevada* | *Nevada will use HealthCare.gov to apply for coverage, switch plans, get cost assistance, compare plans, and enroll. Employer can still use the Nevada Health Link to shop for employee health plans. Visit the Nevada Health Link now to apply. |

| New Mexico | If you live in New Mexico, BeWellNM is the Health Insurance Marketplace to serve you. Instead of HealthCare.gov, you’ll use the BeWellNM website to apply for coverage, switch plans, get cost assistance, compare plans, and enroll. Visit BeWellNM now to apply. |

| New York | If you live in New York, New York State of Health is the Health Insurance Marketplace to serve you. Instead of HealthCare.gov, you’ll use the New York State of Health website to apply for coverage, switch plans, get cost assistance, compare plans, and enroll. Visit New York State of Health now to apply. |

| Oregon* | *Oregon will use HealthCare.gov to apply for coverage, switch plans, get cost assistance, compare plans, and enroll. Cover Oregon will still be used to apply for Medicaid and CHIP. Visit Cover Oregon now to apply for Medicaid and CHIP. |

| Rhode Island | If you live in Rhode Island, HealthSource RI is the Health Insurance Marketplace to serve you. Instead of HealthCare.gov, you’ll use HealthSource RI website to apply for coverage, switch plans, get cost assistance, compare plans, and enroll. Visit HealthSource RI now to apply. |

| Utah | You’ll use the official website HealthCare.gov to apply for coverage, compare plans, and enroll. Open enrollment goes until March 31st, 2014. Coverage can start as soon as January 1, 2014.For small businesses and their employees: In Utah, your Small Business Health Options Program (SHOP) is Avenue H. Instead of HealthCare.gov, you’ll use the Avenue H website to apply for coverage, switch plans, get cost assistance, compare plans, and enroll. Visit Avenue H now to apply. |

| Vermont | If you live in Vermont, Vermont Health Connect is the Health Insurance Marketplace to serve you. Instead of HealthCare.gov, you’ll use the Vermont Health Connect website to apply for coverage, switch plans, get cost assistance, compare plans, and enroll. Visit Vermont Health Connect now to apply. |

| Washington | If you live in Washington, the Washington Healthplanfinder is the Health Insurance Marketplace to serve you. Instead of HealthCare.gov, you’ll use the Washington Healthplanfinder website to apply for coverage, switch plans, get cost assistance, compare plans, and enroll. Visit the Washington Healthplanfinder now to apply. |

| American Samoa Guam Northern Mariana Islands Puerto Rico Virgin Islands |

You’re not eligible to use the Marketplace to apply for health insurance. Check with your territory’s government offices to learn about health coverage options. |

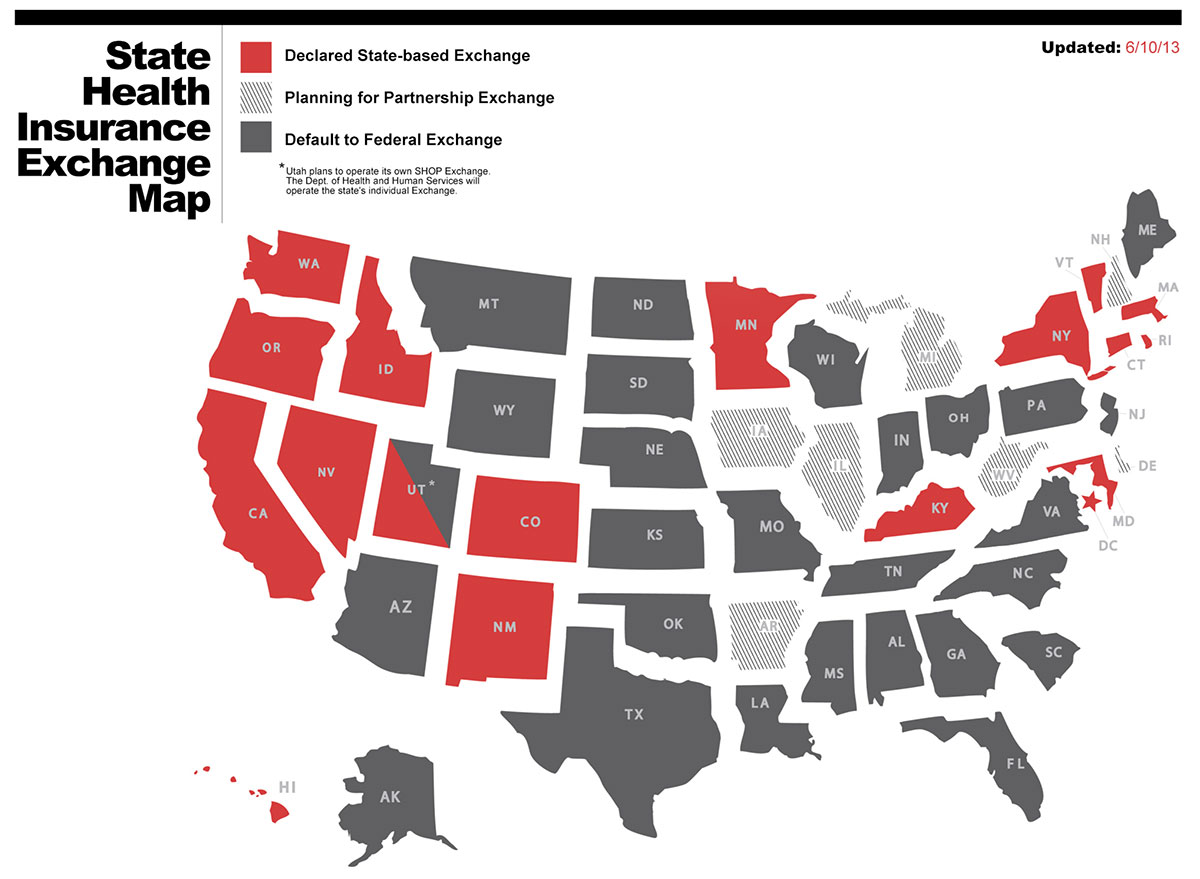

Will My State Run Their Own Health Insurance Exchange?

States had the option to either run their own health insurance marketplace or defer to HealthCare.Gov. Below is a list of states and their chosen approach, indicating whether they operate their own exchange, have a partnership with the federal government, or rely entirely on HealthCare.Gov.

The Insurance Exchanges: A Health Care Choice Left Up to the State

State-run exchanges differ across the country, as the Affordable Care Act allows states flexibility in how they implement their marketplaces. States can either:

1. Run their own exchange (offering maximum state control),

2. Create a joint Federal-State partnership exchange, or

3. Defer to a completely federally run exchange.

Regardless of the exchange model, all must receive federal approval before being implemented (all states have now declared the type of exchange they operate).

While the full impact of the exchanges is still being observed, trends suggest that many Red states have deferred to federally run exchanges, while Blue states are more likely to have opted for state-run exchanges.

Which States Will Run a State Health Insurance Exchange?

While every state will have a health insurance exchange (marketplace), less than half of the states run their own exchange. States can choose between running a state-run exchange, relying on a federally-run exchange, or operating a partnership exchange with the federal government.

The table below provides detailed information on the type of exchange each state operates. Use the table above to find out the official website for purchasing health insurance in your state.

IMPORTANT: The states that run their own marketplace may change each year. This list is from 2015 and should be used as an example. Be sure to check with the current year’s information for the most up-to-date status.

| Location | Marketplace Decision | Structure of Marketplace | Type of Marketplace |

|---|---|---|---|

| United States | 17 State-based Marketplace; 7 Partnership Marketplace; 27 Federally-facilitated Marketplace | NA | NA |

| Alabama | Federally-facilitated Marketplace | NA | NA |

| Alaska | Federally-facilitated Marketplace | NA | NA |

| Arizona | Federally-facilitated Marketplace | NA | NA |

| Arkansas | Partnership Marketplace | NA | NA |

| California | State-based Marketplace | Quasi-governmental | Active purchaser |

| Colorado | State-based Marketplace | Quasi-governmental | Clearinghouse |

| Connecticut | State-based Marketplace | Quasi-governmental | Clearinghouse |

| Delaware | Partnership Marketplace | NA | NA |

| District of Columbia | State-based Marketplace | Quasi-governmental | Clearinghouse |

| Florida | Federally-facilitated Marketplace | NA | NA |

| Georgia | Federally-facilitated Marketplace | NA | NA |

| Hawaii | State-based Marketplace | Non-profit | Clearinghouse |

| Idaho | State-based Marketplace | Quasi-governmental | Clearinghouse |

| Illinois | Partnership Marketplace | NA | NA |

| Indiana | Federally-facilitated Marketplace | NA | NA |

| Iowa | Partnership Marketplace | NA | NA |

| Kansas | Federally-facilitated Marketplace | NA | NA |

| Kentucky | State-based Marketplace | Operated by State | Not yet addressed |

| Louisiana | Federally-facilitated Marketplace | NA | NA |

| Maine | Federally-facilitated Marketplace | NA | NA |

| Maryland | State-based Marketplace | Quasi-governmental | Clearinghouse |

| Massachusetts | State-based Marketplace | Quasi-governmental | Active purchaser |

| Michigan | Partnership Marketplace | NA | NA |

| Minnesota | State-based Marketplace | Quasi-governmental | Clearinghouse |

| Mississippi | Federally-facilitated Marketplace | NA | NA |

| Missouri | Federally-facilitated Marketplace | NA | NA |

| Montana | Federally-facilitated Marketplace | NA | NA |

| Nebraska | Federally-facilitated Marketplace | NA | NA |

| Nevada | State-based Marketplace | Quasi-governmental | Clearinghouse |

| New Hampshire | Partnership Marketplace | NA | NA |

| New Jersey | Federally-facilitated Marketplace | NA | NA |

| New Mexico | State-based Marketplace4 | Quasi-governmental | Not yet addressed |

| New York | State-based Marketplace | Operated by State | Active purchaser |

| North Carolina | Federally-facilitated Marketplace | NA | NA |

| North Dakota | Federally-facilitated Marketplace | NA | NA |

| Ohio | Federally-facilitated Marketplace | NA | NA |

| Oklahoma | Federally-facilitated Marketplace | NA | NA |

| Oregon | State-based Marketplace | Quasi-governmental | Active purchaser |

| Pennsylvania | Federally-facilitated Marketplace | NA | NA |

| Rhode Island | State-based Marketplace | Operated by State | Active purchaser |

| South Carolina | Federally-facilitated Marketplace | NA | NA |

| South Dakota | Federally-facilitated Marketplace | NA | NA |

| Tennessee | Federally-facilitated Marketplace | NA | NA |

| Texas | Federally-facilitated Marketplace | NA | NA |

| Utah | Federally-facilitated Marketplace | NA | NA |

| Vermont | State-based Marketplace | Operated by State | Active purchaser |

| Virginia | Federally-facilitated Marketplace | NA | NA |

| Washington | State-based Marketplace | Quasi-governmental | Clearinghouse |

| West Virginia | Partnership Marketplace | NA | NA |

| Wisconsin | Federally-facilitated Marketplace | NA | NA |

| Wyoming | Federally-facilitated Marketplace | NA | NA |

Structure of Exchange: States can choose how they establish their health insurance exchange. The exchange can be part of an existing state agency or office (Operated by State), set up as an independent public agency (Quasi-governmental), or run as a non-profit entity (Non-profit). This flexibility allows states to structure their exchanges in a way that best aligns with their goals and administrative capabilities.

Type of Exchange: In addition to how the exchange is structured, states also have options in how they manage the health plans available on the exchange. While all exchanges must contract only with health plans that meet federal standards for qualified health plans, states have two main options for contracting with these plans. They can either:

• Operate as a clearinghouse, where the exchange contracts with all qualified health plans that meet the minimum requirements.

• Serve as an active purchaser, meaning the exchange contracts with selected health plans and/or negotiates premium prices with the health plans to offer consumers better deals.

This flexibility allows states to tailor the role of their exchange based on their market and regulatory priorities.

Source: kff.org

Are Subsidies Legal on State Health Insurance Marketplaces

Yes, subsidies are legal on both state-run and federally-run health insurance marketplaces. Despite any confusion or legal challenges you may have heard about, the law supports subsidies for all eligible Americans, regardless of which type of marketplace they use. For more information on the related lawsuits, you can check out our ObamaCare lawsuits page.

The Danger in States Opting Out of Creating a State-Run Health Insurance Exchange

With only 17 States Creating Health Insurance Exchanges Federal Taxpayers are Responsible for Millions of other State’s Constituents.

This situation has led to millions of residents in states without their own exchanges relying on federal subsidies. These same states are often the ones opting out of Medicaid expansion, further shifting their financial responsibility onto the federal government.

States that opt out of running their own health insurance exchanges and Medicaid expansion increase the federal financial burden. Many of their low- and middle-income residents still need coverage, meaning the federal taxpayer has to subsidize their health insurance. This approach passes the costs onto all American taxpayers while leaving the poorest residents of these states without Medicaid coverage, ultimately placing more strain on the exchanges and increasing the financial burden nationwide.

A New Fee Set in Motion By States Opting out of the State-Run Insurance Exchanges

Under ObamaCare, a provision allows the federal government to charge insurers a 3.5% fee for selling insurance on the Federal Health Insurance Exchange. This fee was implemented in response to states opting out of running their own exchanges, a move that many GOP-led states made as part of a broader strategy to “break” ObamaCare, often discussed in conservative circles.

About ObamaCare’s Optional 3.5% Fee for Selling Insurance

The 3.5% fee is charged to insurance companies selling plans on the federal exchange, rather than state-run exchanges. States that chose not to establish their own exchanges do not receive the same federal grants and assistance, though their residents are still eligible for subsidies. However, without state assistance, the 3.5% fee could potentially be passed down to constituents in the form of higher premiums.

Despite the added cost, insurance companies are incentivized to sell on the exchanges because it provides access to millions of Americans who can only apply their tax credits, subsidies, and other forms of cost assistance through the exchange.

The exact impact of the 3.5% fee on states that opted out of creating their own exchanges and on the price of insurance premiums is still unfolding. There are numerous factors influencing which plans are offered, where, and by which insurers. On our site, we will continue to provide updates and insights into how these choices affect state residents and their insurance costs moving forward.

Updates On State-Run and Federal Run Insurance Exchanges

The state insurance exchanges are a crucial component of ObamaCare, and their success serves as a key indicator of the overall program’s effectiveness. Whether your state operates its own marketplace or relies on the federal exchange, it is essential to visit the official website and apply for coverage during the open enrollment period. Each year, your state’s health insurance marketplace opens during this time to provide access to affordable health insurance options. Make sure to act during the open enrollment period to secure your health insurance coverage for the upcoming year.

Find Your State’s Health Insurance Exchange Marketplace

![]()