ObamaCare Insurance Premiums

How ObamaCare Affects Health Insurance Premium Rates

Insurance premiums are a sore subject with many readers. However, insurance premium increases related to Obamacare are largely a response to the protections contained within the law, such as the mandate for insurers to cover people with pre-existing conditions. Meanwhile, parts of the law like the rate review provision and the creation of the health insurance marketplace help to reduce premium costs.

While some might complain about a lack of cost controls, or the effect of subsidization on rate hikes, the reality is the rate hikes we saw in the early years were mostly a result of added minimum benefits. Another important factor to consider in terms of rate hikes is uncertainty due to the two political parties fighting over healthcare (the many repeal attempts and court cases and changes in congress have caused uncertainty).

Further, it is important to note that now that the added benefits and uncertainty is mostly priced in, in recent years we have seen rate hikes subside (for example rate hikes in 2019 were tame compared to past years).

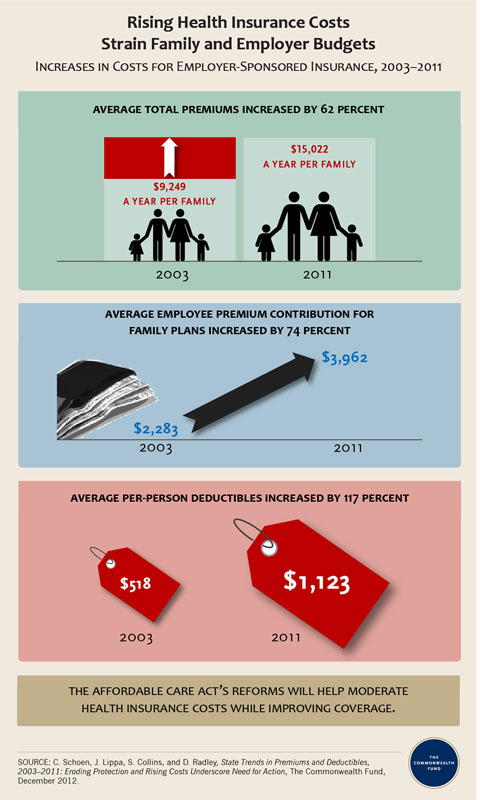

Before we discuss more how the Affordable Care Act’s provisions both increase and decrease premiums, it’s important to keep in mind that health insurance premium rates have been rising at alarming rates over the past decade due to the rising cost of health care in the U.S. In fact premium rates are rising faster than income which is part of the cause of Americans lacking access to affordable health insurance.

Let’s take a in-depth look at ObamaCare insurance premiums, how the law both increases and decreases premium rates, what new protections you have against rate hikes, why your provider may be raising your rates, and how to acquire Affordable health insurance that is protected under the Affordable Care Act (ObamaCare).

Why Are Health Insurance Premiums Rising Under ObamaCare?

The primary cause of the insurance premium rate hikes under ObamaCare is the requirement for insurers to cover high-risk consumers. Insurance companies can no longer deny Americans with pre-existing conditions and can’t charge higher rates based on health status or gender. These factors, along with a few other required benefits, rights, and protections (like the elimination of lifetime and annual dollar limits) led to rate increases between 2010 and 2014.

By 2015 a lot of the premium growth has slowed, and health care spending is curbed for the first time in the decade in many instances. On top of that, many Americans can now get reduced premium rates and lower out-of-pocket costs by enrolling in a plan on their State’s health insurance marketplace.

The need for healthcare reform is obvious, the real question is, “does the ObamaCare (The Affordable Care Act) do enough to make insurance more affordable through its mandates, marketplace, and it’s new provisions, like the medical loss ratio and rate review provision, to protect consumers against insurance premium rate hikes moving forward.”

FACT: Some regions saw bigger premium hikes than others under the ACA. Also, lower-income adults (under the 400% Federal Poverty Level) are the most likely to see a reduction in what they pay. Those with high-end plans, who had been in exclusive groups due to being healthy, saw the biggest premium increase. Post-2015 fluctuations, common as the law was transitioning to its new protections, are projected to curb and remain curbed over time.

ObamaCare Premiums in 2015

Reports are showing that premiums seeing average increase in premium growth of only 4% in 2015. In some major cities rates are even going down before subsidies. The cost of insurance premiums varies wildly by region, so not everyone is expected to see rates go down or stay about the same. Regardless of rate increases specific to your insurer and your region you’ll want to sign into your state’s marketplace and check out the new plans being offered in 2015 and make sure all of your information is up to date before December 15th, 2014.

How to Buy ObamaCare Insurance: The ObamaCare Healthcare Guide

Before you buy insurance, read our Guide to the Health Insurance Exchange Marketplaces to get the inside scoop on your State’s marketplace. Find out how to navigate the marketplace, get the best deals on health insurance premiums, and find the best quality healthcare for you, your family, and your business.

Everything you need to know about buying health insurance on Obamacare’s Health Insurance Marketplace: Get the ObamaCareFacts.com Health Insurance Exchange Marketplace Guide Now!

Or see our page on Buying and Comparing Health Insurance Plans on comparing plans sold both on and off your State’s marketplace.

You can get an estimate of what your health insurance will cost on the marketplace by going to the health insurance premium estimate tool from healthcare.gov.

How ObamaCare’s Subsidies and Taxes Affect Premium Rates

While the average premium continues to rise faster than inflation and has since 1999, the amount of the premium many Americans will pay will go down significantly starting in 2014. Those making under 400% of the federal poverty level are eligible for premium tax credits which reduce monthly premium rates. Small employers can also get tax breaks of up to 50% off the cost of their employee’s premiums.

Those who receive tax credits and tax breaks can expect to pay much lower premium costs (although the rest of the cost is made up through subsidies). Some Americans will even get assistance on out-of-pocket costs like copays, coinsurance, out-of-pocket maximums, and deductibles and over 15 million will get free insurance through Medicaid.

On the other side of the coin, higher earners may see their rates go up due to the inherent “cost-sharing” associated with ObamaCare being a tax. Those who make more pay more, those who make less, pay less. Also note, high-end insurance plans are subject to a 40% excise tax starting in 2018. The excise tax will greatly increase the cost of high-end insurance plans.

• Healthcare costs have been rising faster than inflation making insurance more and more unaffordable for the Average American. While ObamaCare helps many, some higher-earners may pay more under the program.

• ObamaCare helps offset the unaffordable of out-of-pocket costs like deductibles, copays, and coinsurance for those making under 250% of the Federal Poverty Level.

• The Affordable Care Act has curbed premium rate growth before subsidies on average so far, 2015’s rates are proof of that. For folks who get subsidies premiums are more affordable than any time in recent memory.

• All insurance plans that start after 2014 have new benefits, rights, and protections. The rate of growth of premiums is still rising, but the quality of your insurance increased as well. The result is you are now getting more bang for your buck including many essential services like maternity care and check-ups with no out of pocket cost on every plan.

• Not only do we all have new rights and protections but the marketplace and the expansion of Medicaid and CHIP mean up to 50 million Americans without insurance could be covered in the next decade.

Health Insurance Premium Caps and Tax Credits

As mentioned above subsidies available on the marketplace can cap the amount of your premium you are responsible for each month. If you make less than 400% of the Federal Poverty Level and currently have insurance through a private provider you should apply for your State’s health insurance marketplace and see if you qualify for lower rates. You may be eligible for tax credits that cap the amount of your premium you are responsible for.

Rising Cost of Employer-Based Premiums and the SHOP Marketplace

Since 2003, premiums have increased 80 percent, nearly three times as fast as wages (31 percent) and inflation (27 percent). This has led to many employees not being able to afford work-based insurance and many small employers not being able to provide it. 2013 premium costs rose 4% and workers’ wages and general inflation were up 1.8 percent and 1.1 percent respectively. While inflation is still out-pacing pay and the growth of premium costs, it seems ObamaCare has already helped to curb the growth of premiums. 2014 should mean more affordable insurance as small businesses can now get tax breaks on group coverage through their State’s health insurance marketplace SHOP.

Health Insurance Plans Bought Before 2010

If you have an older plan, you may be grandfathered into a plan that is not eligible for certain protections required under the Affordable Care Act until 2015 including the rate review provision. Read more about health plans with Grandfathered Status.

Will buying a plan now protect me from higher rates in 2014 and Beyond?

If you don’t like your current plan or have a plan that is Grandfathered Status you can purchase a new plan through the health insurance marketplace. New plans tend to have higher premium rates, but better coverage. If you make less than 400% of the Federal Poverty Level you are eligible for cost assistance. Cost assistance often means that you’ll not only find a better plan on the marketplace, but a cheaper one as well.

New Rules for Insurance Companies: Rate Review Provision and Medical Loss Ratio

The Affordable Care Act contains two major provisions that regulate health insurance providers increasing rates they are:

Rate Review Provision – Insurance companies have to justify rate hikes of over 10% to the State.

Medical Loss Ratio / 80/20 Rule – Insurance companies have to spend at least 80 percent of premium dollars on claims and activities to improve health care quality. 85% in large group markets.

ObamaCare regulates health insurance companies, not your health care. In other words, the Government offers protections but is not in control of your health care… You are!

Watch the following video to understand how ObamaCare affects premium rate increases in 2014 and beyond:

The Facts on ObamaCare Insurance Premiums and the Medical Loss Ratio (80/20 Rule)

The medical loss ratio, or 80/20 rule, helps to decrease the growth in premium rates. Since insurance companies have stricter regulations on what they can spend your premiums on there is less incentive for them to inflate rates.

The 80/20 Rule generally requires insurance companies to spend at least 80% of the money they take in on premiums on your health care and quality improvement activities instead of administrative, overhead, and marketing costs.

The 80/20 rule is sometimes known as Medical Loss Ratio, or MLR. If an insurance company uses 80 cents out of every premium dollar to pay for your medical claims and activities that improve the quality of care, the company has a Medical Loss Ratio of 80%.

Insurance companies selling to large groups (usually more than 50 employees) must spend at least 85% of premiums on care and quality improvement.

If your insurance company doesn’t meet these requirements, you’ll get a rebate from your premiums.

ObamaCare Rebates

If your insurance company spends more than 20% (15% in large markets) of premium dollars on expenses other than health care costs they will have to send out rebates for the difference. You may see the rebate in a number of ways:

- A rebate check in the mail

- A lump-sum deposit into the same account that was used to pay the premium, if you paid by credit card or debit card

- A direct reduction in your future premium

- Your employer may also use one of the above rebate methods, or apply the rebate in a way that benefits employees

An estimated 8.5 million Americans will receive rebates from their health insurers this summer thanks to the Affordable Care Act, which says companies that fail to spend at least 80 percent of premiums on health care must refund the difference to consumers.

ObamaCare Insurance Reform: The Rate Review Provision

ObamaCare does not increase insurance premiums directly. In fact, ObamaCare’s rate review provision states that as of 2011, insurance companies are no longer be able to raise insurance premiums solely for the sake of profit. If health insurance companies do raise premiums, they will have to justify rate hikes of over 10% to the State they operate in and then disclose this information immediately on both their website and healthcare.gov.

If the State does not have an effective rate review program, the Federal Government will step in. This has already prevented many unjustified rate hikes.

The Rate Review Provision Protects Against “Price Gouging”

What is “Price gouging”? When a seller prices goods or commodities much higher than is considered reasonable or fair, due to a demand or supply shock it is called “price gouging”.

Since tens of millions of Americans will now have to be covered and can’t be charged more based on health status or gender many insurance companies wanted to raise their rates. ObamaCare’s rate review provision makes sure these rate increases are fair and not for the purposes of “price gouging”.

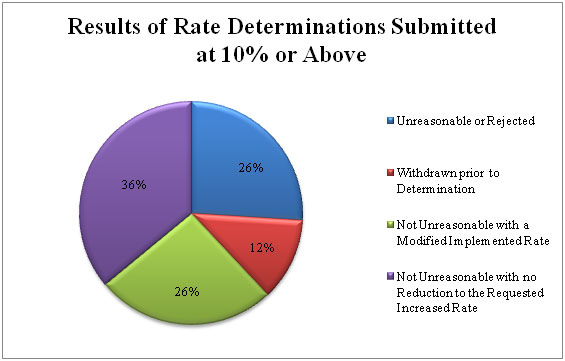

How the Rate Review Process Works

When a health insurance company proposes a rate increase of 10% or more it must be gone over a group of independent experts.

If the reviewers feel insurance price increases are unreasonable, they can try to decrease the proposed increases or deny them outright. For instance, Connecticut reduced a proposed Anthem Blue Cross Blue Shield increase from 12.9 percent to 3.9 percent.

When a rate increase does occur, the health insurance provider must post the insurance rate hikes and a justification on their website and on healthcare.gov.

The disclosure process associated with the “rate review” is intended to help consumers to “shop” for private insurance particularly on the health insurance exchanges.

As of Sept. 2012, the rate review provision has saved Americans $1 billion, in States that are enforcing the law.

Total Savings in the Individual and Small Group Markets from Modified, Rejected or Withdrawn Rate Increase Requests of 10% or above, by State From HHS Annual Rate Review Report 2012

| Individual Market | Small-Group Market | Total | ||||

|---|---|---|---|---|---|---|

| State | Number of Affected Enrollees | Estimated Savings | Number of Affected Enrollees | Estimated Savings | Number of Affected Enrollees | Estimated Savings |

| Alabama | — | — | * | * | * | * |

| Alaska | * | * | * | * | * | * |

| Arizona | 2,204 | $396,000 | * | * | 2,204 | $396,000 |

| Arkansas | 266 | $23,000 | — | — | 266 | $23,000 |

| California | 166,652 | $34,295,000 | 377 | $255,000 | 167,029 | $34,550,000 |

| Colorado | 30,466 | $11,304,000 | — | — | 30,466 | $11,304,000 |

| Connecticut | — | — | 32,223 | $2,369,000 | 32,223 | $2,369,000 |

| Delaware | — | — | 27 | $6,000 | 27 | $6,000 |

| District of Columbia | — | — | — | — | — | — |

| Florida | 55 | $7,000 | * | * | 55 | $22,000 |

| Georgia | — | — | * | * | * | * |

| Hawaii | — | — | — | — | — | — |

| Idaho | * | * | * | * | * | * |

| Illinois | * | * | * | * | * | * |

| Indiana | 3,304 | $1,569,000 | 2,633 | $460,000 | 5,937 | $2,028,000 |

| Iowa | — | — | 6,929 | $1,125,000 | 6,929 | $1,125,000 |

| Kansas | — | — | * | * | * | * |

| Kentucky | * | * | — | — | * | * |

| Louisiana | * | * | * | * | * | * |

| Maine | 1,105 | $399,000 | * | * | 1,105 | $399,000 |

| Maryland | — | — | — | — | — | — |

| Massachusetts | — | — | — | — | — | — |

| Michigan | 20,503 | $3,741,000 | 72,533 | $11,770,000 | 93,036 | $15,511,000 |

| Minnesota | — | — | — | — | — | — |

| Mississippi | — | — | 207 | $0 | 207 | $0 |

| Missouri | * | * | 120 | $4,000 | 120 | $4,000 |

| Montana | * | * | * | * | * | * |

| Nebraska | 1,302 | $0 | 1,909 | $0 | 3,211 | $0 |

| Nevada | 4,372 | $0 | — | — | 4,372 | $0 |

| New Hampshire | — | — | — | — | — | — |

| New Jersey | — | — | * | * | * | * |

| New Mexico | — | — | — | — | — | — |

| New York | — | — | 87,037 | $20,242,000 | 87,037 | $20,242,000 |

| North Carolina | — | — | 2,174 | $69,000 | 2,174 | $69,000 |

| North Dakota | — | — | 1,416 | $484,000 | 1,416 | $484,000 |

| Ohio | * | * | * | * | * | * |

| Oklahoma | — | — | * | * | * | * |

| Oregon | 15,554 | $1,352,000 | — | — | 15,554 | $1,352,000 |

| Pennsylvania | — | — | * | * | * | * |

| Puerto Rico | — | — | 5,300 | $2,623,000 | 5,300 | $2,623,000 |

| Rhode Island | — | — | — | — | — | — |

| South Carolina | 6,942 | $1,461,000 | 1,421 | $339,000 | 8,363 | $1,800,000 |

| South Dakota | * | * | 499 | $232,000 | 499 | $232,000 |

| Tennessee | — | — | — | — | — | — |

| Texas | — | — | 2 | $2,000 | 2 | $2,000 |

| Utah | — | — | * | * | * | * |

| Vermont | 600 | $362,000 | — | — | 600 | $362,000 |

| Virginia | — | — | * | * | * | * |

| Washington | 293,053 | $49,035,000 | 21,360 | $85,000 | 314,413 | $49,121,000 |

| West Virginia | — | — | 221 | $201,000 | 221 | $201,000 |

| Wisconsin | 286 | $104,000 | 5,886 | $4,078,000 | 6,172 | $4,182,000 |

| Wyoming | * | * | * | * | * | * |

| Overall | 546,664 | $104,050,000 | 242,274 | $44,342,000 | 788,938 | $148,407,000 |

ObamaCare Insurance Premium Rate Hikes Facts

• Many people are finding their Premiums rising at alarming rates. People with high-end plans may continue to see higher prices on their plans moving forward, while low to middle-income Americans and employees will see an Average savings of 60% of their premiums due to subsidies, tax credits, and up-front assistance. Customers in States utilizing rate review provisions who purchase marketplace insurance using premium tax credits will see the highest reduction in rates.

• Holding insurance companies accountable, the rate review provision and the 80/20 rule yielded an estimated $2.1 billion in savings in 2012 alone. However, this is very disproportionately from one State to the next, with many saving nothing and others saving tens of millions.

• The rate review provision has led to less requests for premium increases over 10% since the provision went into effect.

• In 2012 States like Washington and California have saved their constituents tens of millions of dollars by blocking or lowering rate increases, while others like Texas have saved only $2k via the Rate Review provision.

• 44 States and Washington D.C. have effective Rate Review programs. Montana, Wyoming, Arizona, Missouri, Arizona, Louisiana, and Alabama do not. Virginia has a partially effective program.

• Some rate increases have made insurance unaffordable for Americans. Many of ObamaCare’s provisions associated with premium costs don’t start until 2014.

• Insurance companies have to disclose how funds are being spent. They must spend a minimum of 80% on healthcare or give consumers a rebate for the difference. This is known of the 80/20 rule and has saved Americans $1.1 Billion as of Sept. 2012.

• The rapid appeals provision lets you repeal any claim from insurance companies within days, giving customers legal standing to fight the appeal and helping to curb insurance premium costs.

• The Rate Review rules apply to new plans in the individual and small group markets. (If you are in a health plan that existed on March 23, 2010, your plan may be a grandfathered plan, which is exempt from the Rate Review rules.)

• Each state may have its own minimum premium increase that requires a review, based on the state’s unique premium trends, health care cost trends, and other factors.

• If your state doesn’t have a Rate Review program, or has a Rate Review program that is ineffective, the federal government will conduct Rate Reviews in your state.

• An estimated 13 million Americans have received rebates due to the 80/20 rule.

Purchasing Affordable Health Insurance Through the Insurance Exchange

As mentioned above Americans can use ObamaCare’s online health insurance exchange to buy affordable quality health insurance. Those under the 400% FLP and employers will be able to use subsidies to purchase plans at an average of 60% less than they pay now.

All Americans (including Congress) will be able to buy their insurance through the exchange or find out if they qualify for Medicaid, CHIP, or Medicare. Anyone (except congress) can keep their current health insurance, pay a tax, purchase private insurance or stay on their private insurance. Those with work-based insurance or their dependents cannot receive subsidies through the marketplace.

The ObamaCare Insurance Exchanges Online Market Place is open now, but insurance doesn’t kick in until 2014. Health insurance premiums are projected to drop dramatically for many Americans due to the competition on the marketplace which is projected to help further drive down the rates for all Americans.

ObamaCare Insurance Premiums Moving Forward

We will continue to keep you updated on ObamaCare Insurance premium increases and on how ObamaCare is affecting health insurance premiums and protecting you against unjustified rate hikes.

ObamaCare Insurance Premium Hikes Aren’t What You Think

![]()