Advanced Tax Credit Repayment Limits

How Repaying ObamaCare’s Premium Tax Credits Works

If your income changes, you may have to pay back Advanced Premium Tax Credit Payments up to the Advanced Tax Credit Repayment Limit based on your income. If you don’t claim enough money to qualify for tax credits, you won’t owe back anything.

IMPORTANT: The 400% Federal Poverty Level (FPL) Subsidy Cliff was temporarily removed by the American Rescue Plan and extended through 2025 by the Inflation Reduction Act. Through 2025, if you make over 400% FPL tax credits gradually decrease as your taxable income raises. This impacts repayment limits, but please note if you take more credits in advance than you end up qualifying for, you will still need to repay them.

This page is updated for 2023 – 2024.

What Are the Advanced Premium Tax Credit Repayment Limits?

Advanced Premium Tax Credit repayment limits are the maximum you have to repay if your income is higher than you estimated when you received Premium Tax Credits for health insurance.

ObamaCare Tax Credit Repayment Thresholds

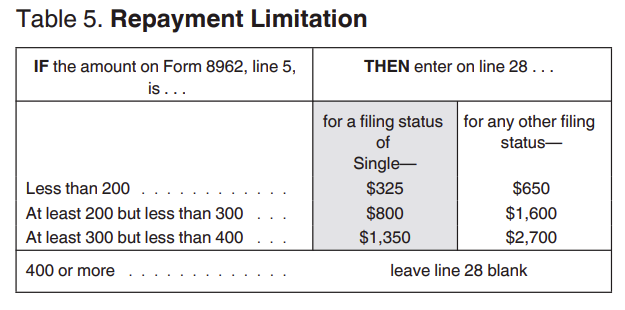

The following Advanced Tax Credit Repayment limit table is from form 8692 below (updated for 2022 tax filing). This table shows the maximum amount of tax credits you have to repay based on income as a percent of the Federal Poverty Level (FPL).

Form 8962: Line 28. Repayment Limitation. The amount is limited to certain amounts helping to ensure you won’t owe more than you can afford if you received an excess of Advanced Premium Tax Credits. Please note that you’ll owe back all tax credits if you make over 400% and could owe back nothing if you make less than 100% of the poverty level.

Table 5. Repayment Limitation (ObamaCare Repayment Limits)

| Income % of Federal Poverty Level (FPL) | Filing Status: Single |

Filing Status: All Other |

|---|---|---|

| Less than 200% FPL | $325 | $650 |

| At least 200% FPL but less than 300% |

$800 | $1,600 |

| At least 300% FPL but less than 400% |

$1,350 | $2,700 |

| More than 400% FPL | Full Amount Received | Full Amount Received |

| If your year-end income exceeds 400% FPL, you will have to return the total amount of Advanced Premium Tax Credits you received. If you make too little to qualify for subsidies (less 100% FPL), then you should owe NOTHING (per the directions of form 8962 from which this table comes). That being said, if you know you are going to price out-of-cost assistance, make sure to update your Marketplace account. You might become eligible for a free or low-cost Medicaid plan if your state expanded Medicaid. | ||

TIP: “Income” is household income calculated as MAGI. Once you know your household income, you can compare it to the Federal Poverty Level guidelines for the year you had coverage.

TIP: The numbers above are the maximum amount you will have to repay, not the exact amount. In other words, repayment limits mean you can’t pay higher than the amount listed for your family size and % of the Federal Poverty Level, but may pay less. Ex. if you made 201% as a family of two you can’t owe back more than $1,650 f0r 2021 plans filed for in 2022 (your repayment is capped at $1,650). Amounts are subject to change each year, so always double-check this year’s repayment limits.

TIP: The American Rescue plan Act expanded cost assistance under the Affordable Care Act and made some changes that impact tax credit repayment limits. The Act granted a repayment holiday for 2020, which could lower what you have to repay in tax credits for the 2020 plan year. It also offers subsidies over the 400% poverty level for 2021 – 2022. For 2021 – 2022, those making over 400% FPL can’t pay more than 8.5% of household income, thus in most cases going over 400% won’t result in owing back the full amount received in tax credits.

TIP: This page covers Advanced Premium Tax Credit Repayment limits for the current year. It is updated yearly to reflect any changes (although please note some years there are no changes. For verification of repayment limits, please see the official IRS 8962 form instructions. Make sure to refer to the current 8962 form for calculations each year at tax time (you can always use last year’s numbers for a general estimate).

What Cost Assistance Must be Paid Back?

You don’t have to pay back Cost Sharing Reduction Subsidies or Medicaid, but you could end up owing Advanced Premium Tax Credits back up to the limit for your income level. If you want to avoid this, make sure to double-check your application and report changes to income throughout the year so your credits can be adjusted. For those who are unsure what their income will be, consider taking only part of the Credit upfront.

How Do you Calculate Repayment of Tax Credits?

You’ll calculate your repayment when you file the Premium Tax Credit Form 8962.