ObamaCare’s Sticking Points

Out-of-pocket costs, the GOP’s rejection of Medicaid, the family glitch, and premium increases. These are ObamaCare’s sticking points.

Out-of-pocket costs, the GOP’s rejection of Medicaid, the family glitch, and premium increases. These are ObamaCare’s sticking points.

Cómo Registrarse para tener Seguro Médico bajo la Ley de Cuidados de la Salud Asequibles (Affordable Care Act) Para registrarse a ObamaCare encuentre el mercado de seguros de su estado, regístrese e inscríbase. Realice su registro para ObamaCare durante el registro abierto. Las instrucciones para registrarse, los detalles sobre cuotas, excepciones, periodos de registro e inscripción, e… Read More

Subsidios de ObamaCare en el Mercado de Seguros Médicos de su Estado Los subsidios de ObamaCare pueden ahorrarle dinero en sus primas y pagos adicionales. Los subsidios de ObamaCare solo están disponibles a través del Mercado de seguros, veamos que son los subsidios, cómo funcionan y cómo los puede aplicar para lograr un seguro médico… Read More

A quick overview of everything you need to know about getting coverage, switching plans, and cost assistance during ObamaCare’s 2016 open enrollment period.

According to CMS 9.9 million are enrolled and paid for Marketplace coverage. This is on track with the HHS estimate of 9.1 million for the end of 2015 and the CBO’s previous estimate of an average of 12 million for the year.

We explain Scott Walker’s plan to repeal and replace ObamaCare. We compare it to the ACA and examine what it gets right and wrong.

A new 2015 CDC study shows the uninsured rate below 10% at 9.2% for the first 3 months of 2015.

If an employer has to offer coverage under the employer mandate they must offer coverage to 95% of full-time equivalents, there is no exception.

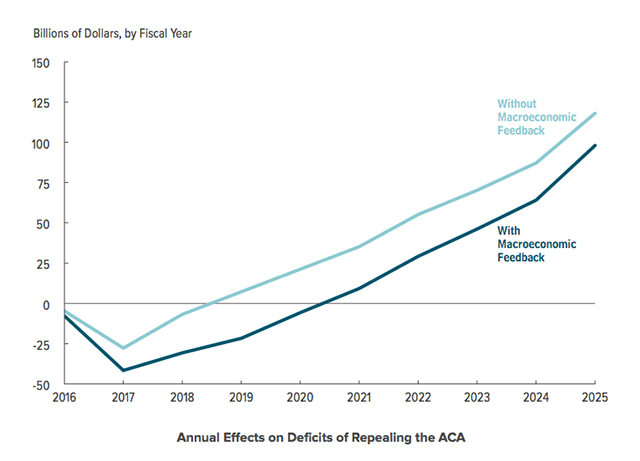

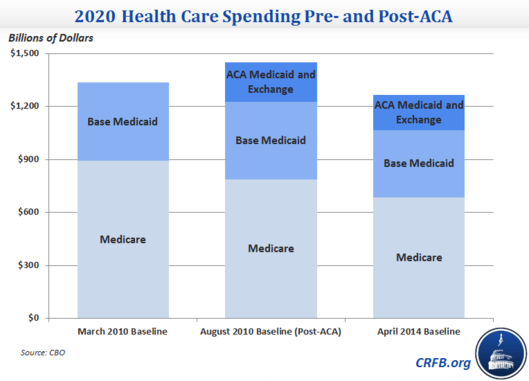

Repealing ObamaCare would increase the federal deficit by at least $137 billion over ten years and increase the number of uninsured by 19 million by 2016.

Insurers can charge a group health plan as a whole more based on health status, but not individuals or families. The law doesn’t actually protect groups of people for being charged more

A 2015 RAND corporation study shows gross enrollment numbers under the ACA of 22.8 million, while Medicaid sees 12 million according to CMS.

ObamaCare covers one type of birth control per person from each of 18 FDA-approved categories at no out-of-pocket cost, although some plans have exemptions. This page will tell you what kinds of birth control are covered, which health plans have exemptions, how to get free birth control under the Affordable Care Act, and how to get help… Read More

If you are 55 or older and receive Medicaid, the state can use estate recovery and liens to recover any and all Medicaid costs, but the practice is rare. Let’s look at the facts and myths behind Medicaid estate recovery, who it applies to, and the involvement (or non-involvement of the ACA). The gist (in… Read More

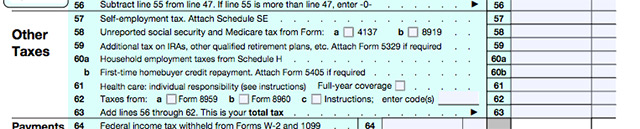

Here are some last minute tax tips for ObamaCare about claiming tax credits, claiming exemptions, using your 1095-A form, and filing for extensions.

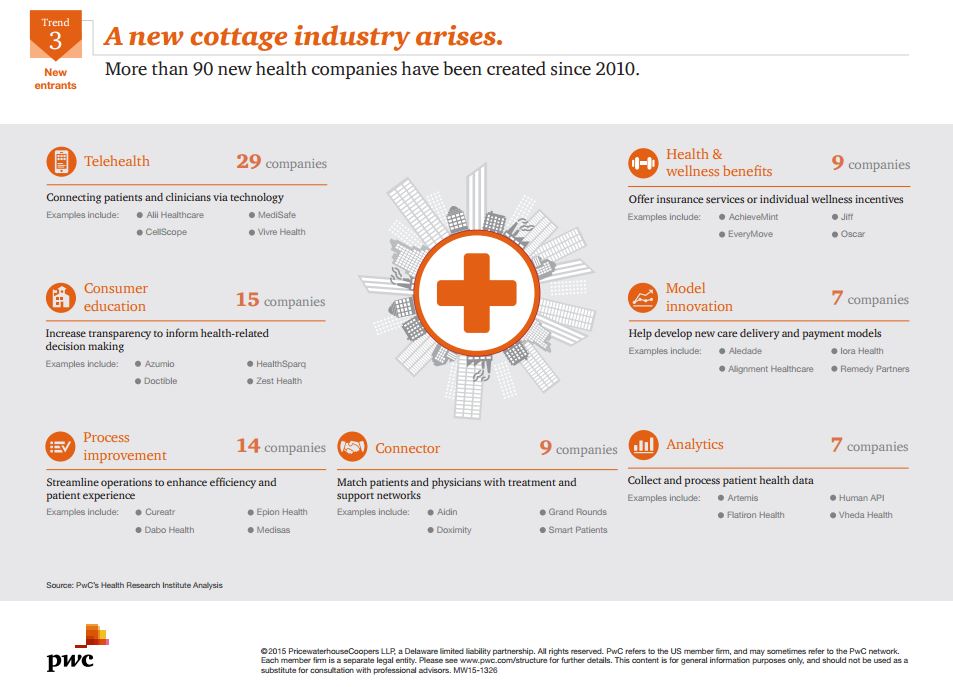

According to PwC more than 90 new companies related to healthcare have been created since the ACA was signed into law. As more people get access to healthcare new companies are entering the nearly $3 trillion health care market.

The Affordable Care Act (ObamaCare) was signed into law 5 years ago on March 23rd, 2010. We look at the successes, sticking points, and politics of the law.

Employers can use Health Reimbursement Arrangements (HRAs), Employer Payment Plans, and Flexible Spending Accounts (FSAs) to save money on healthcare. We take a look at healthcare arrangements to find out how they can benefits employers and employees alike. We will also look at how they affect employer and employee taxes and penalties. It’s important to understand… Read More

Under the Affordable Care Act (ObamaCare) if you didn’t have health insurance for the whole year you may owe the fee, but if you had coverage for some of the year you may qualify for an exemption.

ObamaCare and Health Insurance for the Self-Employed The Affordable Care Act (ObamaCare) has some important implications for how the self-employed go about obtaining, maintaining, and paying for health coverage. If you’re self-employed, most of the healthcare provisions in the ACA apply to you. Let’s take a look at how you’re affected by ObamaCare, how you can reduce the cost of coverage, and how… Read More

The reason people with incomes below the Federal Poverty Level don’t qualify for tax credits is Medicaid expansion was supposed to cover those with incomes below the 100% FPL mark, but anti-ObamaCare opposition repealed the part of the law that made expanding Medicaid mandatory.

Affordable Care Act Vision Coverage Vision insurance generally isn’t covered under the Affordable Care Act (ObamaCare). However, pediatric eye care is a required benefit included on all plans that qualify as minimum essential coverage under the ACA. Even though adult vision coverage isn’t a required benefit of ObamaCare, “vision health” is still an important aspect… Read More

Get the facts on vaccines. Should we vaccinate our children, should I get the flu shot, what are the risks, pros, cons, and myths? We uncover the truth. FACT: The flu vaccination and other vaccinations are covered at no out-of-pocket cost on all major medical plans under the Affordable Care Act (ObamaCare). That means if you… Read More

My daughter has worked 30 hours a week for a large company since Jan. 2014. She was not given health care coverage by the company so she has been buying insurance as an individual. I was told that beginning in Jan. 2015, a company is responsible for providing health care coverage for those working 30… Read More

A list of ObamaCare’s Exemptions, including Hardship Exemptions, you can apply for in order to qualify for Special Enrollment or be exempt from the fee can be found below. This page just covers the basics, see our page on ObamaCare Exemptions for further details on exemptions and the fee (active on plans held in 2014 –… Read More

Starting in 2015, employers who don’t offer qualifying coverage, will make a Employer Shared Responsibility Payment. Get simplified instructions on the fee below. This page covers employer responsibility under the ACA and the payment. For more details see Employer Mandate. What is Shared Responsibility? Shared Responsibility is part of the ACA’s Title I. Subtitle F—Shared Responsibility for… Read More