ObamaCare Small Business Facts

How Will ObamaCare Affect Your Small Business?

Get the facts on how ObamaCare impacts small businesses. ObamaCare’s small business tax credits and expansion of health insurance help small businesses and employees, while some higher earners and larger firms face new requirements.

The Affordable Care Act (ACA) offers incentives, such as tax breaks and tax credits via the Small Business Health Options Program (SHOP), to small businesses with the equivalent or less than 25 full-time workers, making less than $50,000 in average annual wages, to help them provide health benefits to employees. This helps both small businesses and their employees.

Meanwhile, while the majority of employers and employees won’t pay any additional taxes under the ACA, there is an increase to the current Medicare part A tax for businesses and employees making over $200,000. Further, there is also a requirement for employers with 50 full-time equivalent employees or more to offer health insurance to full-time workers or pay a penalty (this started in 2016 after being pushed back).

In short, the ACA offers perks for small businesses, offers perks to many employees (especially those who didn’t have employer health benefits before the ACA), but also includes some requirements for larger firms and high earning employees.

Does ObamaCare Hurt Small Business?

Does ObamaCare Hurt Small Business?

The first thing that we need to address is one of the most common Media talking points: the claim that “ObamaCare hurts small business.”

The truth on ObamaCare and Small Business: Like with most things, the truth isn’t black and white. However, generally speaking, ObamaCare helps most small businesses. The fact is, small business owners have historically had a much harder time providing themselves and their employees with insurance due to rising health insurance costs; meanwhile bigger businesses have remained largely unaffected due to the leverage buying large group health plans gives them. This problem has become increasingly severe in the past decade.

A report by the common wealth fund in 2006 showed that the nation’s smallest firms pay an average of 18 percent more in health insurance premiums for the same benefits than the largest firms. Meanwhile, the cost of providing health insurance to small business employees had been rising higher than inflation rates prior to the Affordable Care Act.

Prior to the ACA, almost half of America’s uninsured were small business owners, employees or their dependents (check the small business facts section below for some other mind-blowing facts small business and healthcare, what the NFIB call their members number one concern!)

While the Affordable Care Act mandates the responsibility for the cost of insuring full-time employees to businesses with 50 or more full-time equivalent employees, it also provides generous tax credits to smaller businesses with 25 or less full-time equivalent employees. In other words workers and small business owners tend to benefit under the new law, while larger employers (who don’t provide health insurance) have to deal with new costs.

The mandate has had both positive and negative effects on jobs. Learn more about ObamaCare and jobs.

NOTE: Some of the facts below were written before the SHOP and Employer Mandate were fully implemented. In general all the business related provisions of the law are in effect including the SHOP and Employer Mandate.

Summary of ObamaCare and Small Business

A quick summary of what ObamaCare means for small businesses. This section includes the latest updates on the employer mandate and tax credits:

• ObamaCare creates the Small Business Health Options Program or SHOP, a part of each States Health Insurance Marketplace, where small businesses with 50 full-time equivalent employees or fewer can shop for group health plans. Starting on November 15th, 2015 those with 100 full-timers or less can use the SHOP.

• The online portion of the SHOP opened on November 15th, 2014. Small businesses can also apply for SHOP plans and tax credits using a paper application.

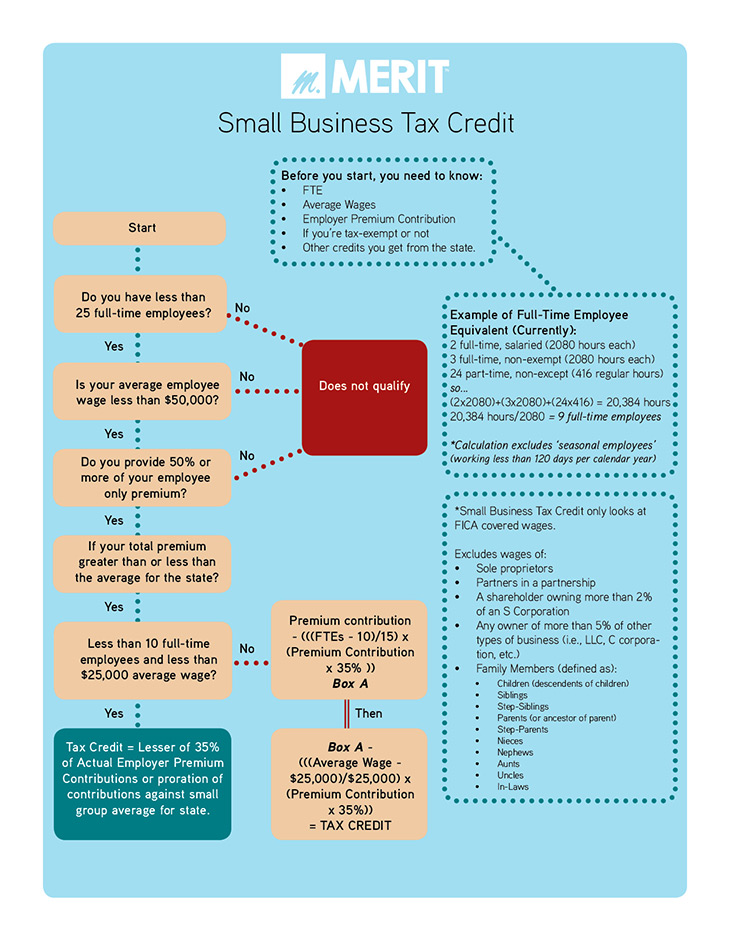

• Taxes and tax credits are based on the number of full-time equivalent employees (FTE) and their average annual wages, not solely on the number of full-time employees.

• Small businesses with fewer than 25 full-time equivalent employees, with average annual wages below $50,000, can get tax credits (as adjusted for inflation beginning in 2014) to help pay for employee premiums.

• Tax credits are retroactive since 2010, so you can still claim your health insurance tax credit for any year since 2010.

• You’ll need to file Form 8941 to claim your Tax Credit. See our ObamaCare Facts simplified instructions for Form 8941, Credit for Small Employer Health Insurance Premiums for details.

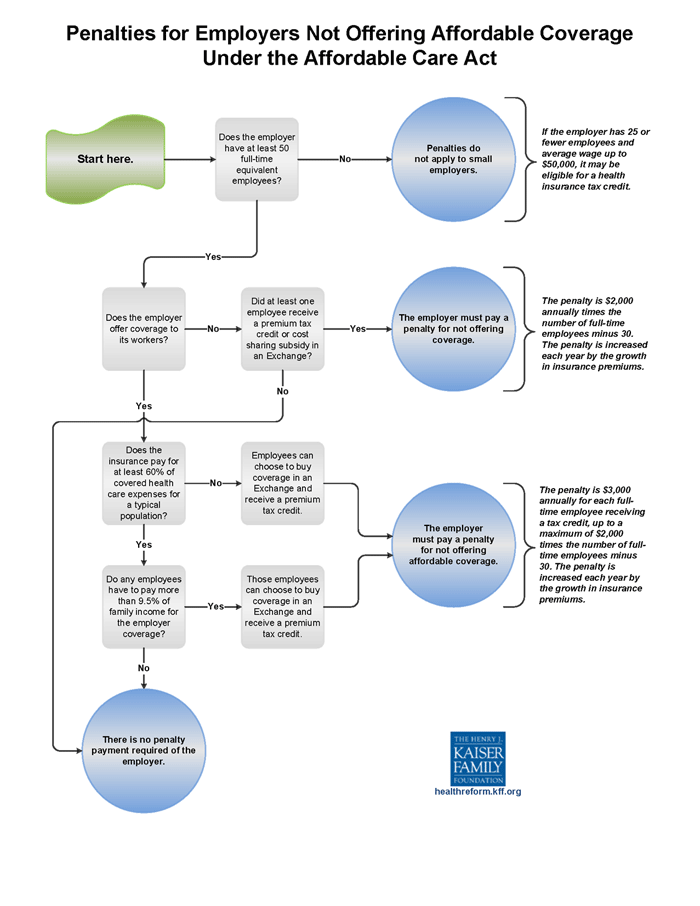

• The requirement for businesses with over 50 full-time equivalent employees to provide health coverage to full-time employees is often referred to as the “employer mandate” and is officially part of the Affordable Care Act’s Employer Shared Responsibility Provision. The fee for not covering employees is called a Shared Responsibility Payment.

• Small businesses with more than 100 full-time equivalent employees are required to provide health coverage to at least 70% of full-time employees starting in 2015, and 95% of full-time employees starting in 2016.

• Starting 2016 employers with 50-99 full-time equivalent employees will have to insure their full-time workforce as well.

• For employers with 50 more FTE, who don’t provide coverage, a fee is $2,000 per full-time employee (minus the first 30 full-time employees) is assessed.

•For employers with 50 more FTE, who provide coverage that doesn’t provide minimum value or isn’t affordable, the fee is the lesser of: $3,000 per full-time employee receiving subsidy, or $2,000 per full-time employee (minus the first 30). See employer mandate for further details on how the fee works.

• Transition relief is available to small businesses and large businesses transitioning into compliance with the new mandate. Please see the official IRS rules regarding transition relief here.

• Businesses making over $250,000 in profit must pay a .9% increase on the current Medicare part A tax. The tax is split (.45% each) between the employer and employees making over $200,000 individual ($250,000 family).

• All businesses with over 50 full-time equivalent employees have to let their employees know about their State’s Health Insurance Marketplace / exchange. What Do I Need to Tell My Employees about ObamaCare?

ObamaCare Small Business Delays

Both the SHOP (the part of the marketplace employers can use to shop for subsidized employee health plans) and the employer mandate were delayed. Below are the details.

The SHOP Delayed Until 2014 / 2015

The opening of the SHOP “Small Business Health Options Program” (the part of the marketplace small businesses use to buy employee health plans) was pushed back to November 15th, 2014 (open enrollment 2015) for firms with more than 50 full-time equivalent employees. Those with 100 or more FTE will be able to use the SHOP on November 15th, 2015 (open enrollment 2016).

Until the web portal for the shop is accessible, employers can use a paper application to apply for shop plans and tax credits. Small businesses can buy a SHOP plan through an agent now and claim tax breaks up to 50% of their share of employee premiums starting January 1st, 2014. Small business health care tax credit may be carried back and applied retroactively to previous tax years, or carried forward to future tax years. Learn more about the ObamaCare SHOP Small Business Health Options Program.

Employer Mandate Was Delayed Until 2015 / 2016

ObamaCare’s employer mandate was delayed until 2015 / 2016. In 2015 employers with more than 100 FTEs needed to provide coverage to at least 70% of full-time employees. Starting in 2016 employers with 50 or more FTEs will need to provide coverage to “substantially all” (95%) of their full-time workforce. Learn more about the employer mandate.

NOTE: The requirement for 2015 means that businesses should have had employee health plans in place for 2015. This means employers needed to SHOP for plans starting on November 15th, 2014 (open enrollment 2015).

ObamaCare Small Business Video: Overview of Key Provisions Related to Small Business

This ObamaCare small business video from fitsmallbusiness does a great job at breaking down some of the key small business-related provisions in the Affordable Care Act.

Here is a timeline sections contained in the ObamaCare small business video in case you want to skip ahead:

1:09 -The 4 Company Size Categories of ObamaCare

1:33 – What FTE’s are and how to calculate them for your business.

2:41 – Small Business Health Options Program (SHOP Exchanges)

4:05 – ObamaCare Small Business Healthcare Tax Credit

5:34 – The Employer Mandate

6:30 – New costs for small businesses

7:07 – How Obamacare differs based on the number of FTE’s you employ

Positive Effects of ObamaCare on Small Business

ObamaCare provides small businesses with affordable insurance options, cost assistance, and increased buying power via the Small Business Health Options Program (SHOP). Since small businesses with fewer than 50 full-time equivalent employees can use the SHOP to get better deals on employee insurance, but aren’t mandated to do so, it’s safe to say small businesses will not be hurt by ObamaCare, but will in fact benefit.

• The smaller the businesses the better the tax breaks.

• Businesses with over 50 full-time equivalent employees are exempt from the fee on their first 30 full-time workers greatly reducing the negative effect the law could have on businesses that just barely qualify as a large firm.

• The Employer mandate isn’t meant to hurt small businesses. It ensures that companies like Walmart take a Shared Responsibility in providing healthcare access to more Americans.

• Small employers can see up to a 50% reduction in their share of the cost of employee premiums. The amount employers do pay is tax-deductible and can be carried forward or backward.

• Small employers can offer better quality benefits due to the increased benefits, rights, and protections offered by ObamaCare.

• Due to small businesses being able to shop for group health plans on their State’s Health Insurance Marketplace via the SHOP, AKA the Small Business Health Options Program, small businesses now have the same buying power as larger firms. Along with tax credits, increased buying power helps small businesses afford to provide benefits to their employees.

• All new “ObamaCare taxes” larger businesses and higher-income employees pay help to make all the benefits, rights and protections of the law possible, including subsidized insurance for low-to-middle income Americans, small businesses, Medicaid, CHIP, and Medicare.

Negative Effects of ObamaCare on Small Business

Negative effects of ObamaCare on small businesses have included employees’ hours being cut, costs passed onto the consumers or shareholders, a reduction in hiring, and more out-of-pocket costs for larger businesses. Almost all of the negative effects are due to some employers responding to the looming “employer mandate” and thus cutting hours. Although the negative side effects of ObamaCare are very real for some small businesses; some of the more radical claims, the Papa Johns claim for instance, was over-dramatized and used as a talking point.

• Some of the larger firms (those with over 50 full-time equivalent employees) and their employees may be affected by some of the new taxes as well as the 2015 employer mandate to buy insurance for full-timers.

• Worker hours are cut back to part-time by larger firms to avoid providing coverage to full-timers.

• It’s important to point out that the majority of firms, 96%, are exempt from the mandate and don’t make enough to be faced with the new Medicare tax. Of those that do have to comply, only truly large businesses, who currently don’t offer benefits, and employee many low wage full-time workers, face truly hard decisions. Those firms offering higher wages typically already provide benefits, while smaller businesses (with between 100 and 50 FTE) will benefit greatly from not owing the fee on the first 30 employees. So a firm with 100 FTE and 60 full-time workers will only owe the fee for 30 employees, and this assumes that they currently insure no full-time employees. Learn more about loopholes for smaller businesses and more about the ACA and jobs.

For more information on the ACA and your small business please see an effective visual breakdown of ObamaCare and Small Business by signs.com.

What is a Small Business?

Although we tend to think “mom and pop” when we hear small business, the actual definition isn’t that cut and dry. A small business is a business that is privately owned and operated, with a small number of employees and relatively low volume of sales. However, depending on the industry and loopholes, small businesses can be classified to include companies with anywhere between 1 and 250 employees.

It’s important to understand that when someone says “small business” they could mean a wide range of different types and sizes of firms that are all technically classified as small businesses. For example, a hedge fund can pass millions of dollars through to investors using loopholes to qualify as a small business. Additionally, in some states, small businesses in certain industries can an employee up to 99 full-timers and make less than $7 million in profit and still be categorized as a “small business”.

Be wary of politicians who try to lump in hedge funds and other exceptions to the rule with “Mom and Pop Shops” who struggle to provide their workers with the same quality insurance that larger firms are able to provide.

For the purposes of tax credits, which are the biggest benefit to small businesses under the ACA, 90% of all firms qualify. 50% of employees are employees by firms with 10 or less employees. Over 50% of Americans depend upon their employer for coverage.

ObamaCare, Small Business, Buying Power and Cost Assistance on the SHOP

When we say ObamaCare helps small business, we mean that it helps smaller businesses provide their employees with better quality coverage that includes the new rights and protections offered by ObamaCare and gives them increased buying power (and in some cases cost-assistance) via the Small Business Health Options Program (SHOP) accessible through your State’s health insurance marketplace.

ObamaCare helps to provide small businesses having fewer than 25 full-time equivalent employees, and average annual wages below $50,000, with better access to quality healthcare via tax credits for up to 50% of employee premium costs via the SHOP exchange, part of the Health Insurance Marketplace.

The SHOP exchanges are state-specific online marketplaces where employers can purchase employee insurance in a controlled market giving them the same buying power as larger firms.

The SHOP offers the same insurance choices and prices to small firms as they will to larger firms (although small firms may be able to use premium tax credits to “afford” cheaper insurance). The SHOP exchanges provide all employers with equal access to quality healthcare.

Below, we explain the different taxes and benefits of ObamaCare for small business as well as some small business facts to help you understand ObamaCare, Small Business and Small Business Insurance in America.

ObamaCare Small Business Costs: Do I Have to Purchase Insurance for My Employees?

Understanding the ObamaCare Small Business Mandate: Beginning in 2016, Small Businesses with over 50 full-time employees that choose not to provide insurance, provide insurance that doesn’t meet the minimum standards set forth by ObamaCare ( that must provide the minimum benefits of a “bronze” plan bought on the ObamaCare health insurance exchange), or provide insurance that exceeds 9.5% of family income (for employee only insurance) will have to pay a shared responsibility fee. (For those with 100 or more FTE this started in 2015).

Please note that the Affordable Care Act counts full-time equivalent employees, not the number of full-time employees an employer has. Full-time equivalent employees include part-time hours, plus the number of full-time employees a firm has. In other words, cutting workers to part-time won’t save a company from being responsible for offering health insurance to full-time workers alone.

ObamaCare Small Business Shared Responsibility Fee (Employer Mandate Fee)

The “mandate’s penalty fee” is officially called an employer shared responsibility fee. The penalty for small businesses not covering their full-time workers is $2000 per employee. If however, at least one full-time employee receives a premium tax credit because coverage is either unaffordable or does not cover 60 percent of total costs, the employer must pay the lesser of $3,000 for each of those employees receiving a credit or $2000 for each of their full-time employee. The first 30 workers are excluded from being counted toward the fee. The fee offsets the cost of the employees who will use the exchange or emergency room services in lieu of employer-based insurance. See employer mandate for more details.

The Internal Revenue Service has more information about the Employer Shared Responsibility Payment.

What is a Full-time Employee / What is a Part-Time Employee

What is a full-time employee? What is a part-time employee?: The term ‘full-time employee’ means an employee who is employed on average at least 30 hours of service per week over a given month. In general an employee is full-time if they work 30 hours, or 130 hours over a month, for more than 120 days. Employers can choose a “look-back” period of between 3 and 12 months to measure if an employee has worked an average of 30 hours per week. If the worker has worked less than 30 hours a week, or less than 130 hours over a month, for more than 120 days, they are defined as a part-time employee. See the official IRS page on what defines a full-time or part-time employee.

What Does Full Time Equivalent (FTE) Mean? What does Part-Time Equivalent (PTE) Mean?

What does “the equivalent” of a full-time / part-time employee mean?: The Affordable Care Act’s Rules for Employers often refer to businesses with 25 or 50 “full-time equivalent employees” (abbreviated FTE).

In simple terms FTE or “full-time equivalent” equals (the total number of full-time employees) plus (the combined number of part-time employee hours divided by 30). (seasonal employees, contractors, and business owners don’t count toward the total. Other specific types of workers, like a traveling salesperson, should use Reasonable Methods for Crediting Hours.)

For example, a firm has 35 full-time employees (workers who work 30+ hours) and 20 part time employees who all work 24 hours per week (96 hours per month). These part-time employees’ hours would be treated as equivalent to 16 full-time employees, based on the following calculation:

20 employees x 96 hours / 120 = 1920 / 120 = 16

In this example, the firm would be considered a “large employer,” based on a total full-time equivalent count of 51—that is, 35 full-time employees plus 16 full-time equivalents based on part-time hours.

Business Taxes and Credits are Based on Average Annual Wages Too

Please be aware average annual wages of employees are used alongside of FTE when determining if a firm has to pay a fee or will receive tax credits.

Average annual wages are determined by dividing the total wages paid by the employer by the number of FTEs (and rounding down to the nearest $1,000).

Employers Read this Official IRS article on Determining FTEs and Average Annual Wages

Cutting back worker hours won’t change how the ACA affects a business alone.

ObamaCare Small Business Insurance Requirements

All insurance provided to your employees must meet the minimum requirements of ObamaCare. Learn more about the essential health benefits your insurance plan must provide (all plans sold on the SHOP exchange will meet the requirements, however, if you want to keep the current plan you offer it must meet guidelines.. Please note that high-end insurance plans will be subject to a 40% excise tax in 2017.)

Will I Get Tax Breaks for Insuring My Employees?

Small Businesses can apply for tax breaks of up to 35% (25% for non-profits) of their contribution to employees’ premiums if they have fewer than 25 full-time employees. To qualify, businesses must pay for at least 50% of their employees’ premiums and their worker’s average annual wages can’t be more than $50,000 a year (adjusted for inflation starting in 2014). By 2014, the tax credit amount was increased to 50% (35% for non-profit).

Here is an example for an employer who qualified for the maximum credit worth 50% of their premium contribution in 2014:

Number of employees: 10

Wages: $250,000 total or $25,000 per employee

Employer contribution to employee premiums: $70,000

Tax credit amount: $35,000 (50% of employer’s contribution)

Tax Credits are only available on the SHOP exchange. Check out some more small business healthcare tax credit scenarios to get a better understanding of how the tax credit works.

To qualify for tax credits, insurance must be purchased on the Affordable Insurance Exchange for at least two years. Credits can be claimed on your income tax return with an attached Form 8941 showing calculations for the credit.

Businesses with 10 or fewer employees and average annual wages of $20k or less were eligible for the full 35% credit between 2010 and 2013, and then a 50% tax credit beginning in 2014.

Small business employers with over 25 full-time employees will not have access to the same tax breaks as those small businesses with fewer than 25 employees. Tax credits are available for small businesses on a sliding scale depending on the number of employees and average annual wages.

In other words, ObamaCare offers small businesses with less than 25 full-time employees big tax breaks to provide quality health benefits to employees.

Employer-based plans that provide health insurance to retirees ages 55-64 can get financial help via the Early Retiree Reinsurance Program. This program is designed to lower the cost of premiums for all employees and reduce employer health costs.

The Affordable Care Act Exact Wording on Small Business Tax Credit

Here is the exact wording from Part II – Small Business Tax Credit of Subtitle E—Affordable Coverage Choices for All Americans of TITLE I—QUALITY, AFFORDABLE HEALTH CARE FOR ALL AMERICANS. Check out our summary of provisions in the Affordable Care Act for summaries of every provision in the law related to small business

Part II – Small Business Tax Credit

Sec. 1421. Credit for employee health insurance expenses of small businesses. Amends the Internal Revenue Code to provide tax credits to small employers.

Sec. 45R. Employee health insurance expenses of small employers. Provides a sliding scale tax credit to small employers with fewer than 25 employees and average annual wages of less than $40,000 that purchase health insurance for their employees. The full credit will be available to employers with 10 or fewer employees and average annual wages of less than $20,000. To be eligible for a tax credit, the employer must contribute at least 50 percent of the total premium cost or 50 percent of a benchmark premium. In 2011 through 2013, eligible employers can receive a small business tax credit for up to 35 percent of their contribution toward the employee’s health insurance premium. Tax-exempt small businesses meeting the above requirements are eligible for tax credits of up to 25 percent of their contribution. In 2014 and beyond, eligible employers who purchase coverage through the State Exchange can receive a tax credit for two years of up to 50 percent of their contribution. Tax-exempt small businesses meeting the above requirements are eligible for tax credits of up to 35 percent of their contribution.

As the law is written, annual wages may not exceed a $40,000 threshold, the official IRS website says $50,000. It is our understanding that the $50,000 figure (adjusted for inflation starting 2014) is correct and reflects the most recent update to the law. Please consult an agent when making choices about providing coverage to your workforce.

How Do You Claim the ObamaCare Small Business Tax Credit?

In order to claim the tax credit for Small Business health insurance premiums, you’ll need to use a Form 8941 to calculate the credit. For detailed information on filling out this form, see the Instructions for Form 8941. If you are a tax-exempt organization, include the amount on line 44f of the Form 990-T. You must file Form 990-T in order to claim the credit, even if you don’t ordinarily do so.

Starting 2014 you were able to claim your tax credit through the SHOP (Small Business Health Options Marketplace, explained below). For 2013 you needed to use the forms mentioned above.

If you are a small business, include the tax credit amount as part of the general business credit on your income tax return.

You can find out if you qualify for the small business health care tax credit by visiting IRS.gov. You can also consult with your tax advisor or accountant to learn if you qualify, and if so, how much your credit will be.

How the ObamaCare Small Business Tax Credit Works

Businesses with 25 or less FTE, with average annual wages of less than $25,000, are eligible for a tax credit. Those with 10 or less FTE, with average annual wages of less than $10,000, can claim the full 50%.

Small business employers who did not owe taxes during the year can carry the credit back or forward to other tax years. Also, since the amount of health insurance premium payments is more than the total credit, eligible small businesses can still claim a business expense deduction for the premiums in excess of the credit. That’s both a credit and a deduction for employee premium payments.

There is good news for small tax-exempt employers too. The credit is refundable, so even if you have no taxable income, you may be eligible to receive the credit as a refund so long as it does not exceed your income tax withholding and Medicare tax liability.

Use this infographic to understand if your small business will qualify for tax credits through the SHOP marketplace. Please note that the tax break was 50% and not 35% starting in 2014.

Moving Forward With ObamaCare for Small Business in 2015

Open enrollment for individual and small business health insurance exchanges began on November 15th, 2014 small businesses with less than 50 FTE can use the SHOP to apply for tax credits and get qualifying employee health plans. Next year those with up to 100 FTE can use the shop too. Employers can use a paper application with the help of an agent in the meantime.

The marketplaces are probably the most important provision of health-care reform for small businesses because they will help lower costs and improve choice of plans. Businesses will use a specific part of the exchange called SHOPs.

SHOP Exchange: Small Business Health Options Programs and Purchasing Qualified Health Plans (QHPs)

Small businesses with less than 50 employees can use the SHOP. This is the small business section of the “ObamaCare” health insurance exchange. The SHOP exchange, or Small Business Health Options Programs, offers small businesses a large variety of Qualified Health Plans (QHPs) that allows employers and employees to choose insurance that meets their budgets.

SHOP Choices. The SHOP exchanges provide side-by-side comparisons of Qualified Health Plans, benefits, costs, and quality.

SHOP Employee Options. SHOPs allow small business employers to offer workers Qualified Health Plans from several insurers, just like larger employers.

SHOP Employer Control. Small Business employers control when they participate as well as their own level of contribution towards coverage. SHOPs allow you to make a single monthly payment via SHOP rather than to multiple plans.

SHOP Affordability. SHOP can save your business money by spreading insurers’ administrative costs across more employers. Small Businesses may be eligible for tax credits and subsidies on the SHOP exchange as well.

Small businesses can apply for tax credits to cover up to 50% of premium costs of low to moderate wage employees through the SHOP.

Learn more about the SHOP marketplace.

Can I Purchase Insurance On the Exchange if I Have Employe-Based Insurance?

You can purchase insurance on the exchange, but you (and your family) will not qualify for tax breaks, credits or help on upfront costs unless your employer offers substandard insurance (it must offer the same benefits as the basic Bronze plan sold through ObamaCare’s exchanges/marketplaces) or if your insurance costs more than 9.5% of your income.

If your employer-based insurance doesn’t meet the above criteria you should be eligible for subsidies. However, you’ll need your employer to fill out an employer coverage tool form before you can get covered.

Since the 9.5% cap is for the employee-only income, the total cost of a plan offered by an employer can be more than 9.5% of family income. There is no rule that says your spouse, dependents or you have to take the insurance your employer offers. The rule only states that you cannot receive cost assistance subsidies. Watch the following video on employee health insurance:

ObamaCare and COBRA

Can I still go on COBRA if I lose my job? Yes, ObamaCare doesn’t affect COBRA and having COBRA will exempt you from the Individual Mandate (the tax for not having insurance).

What is the ObamaCare Small Business Medicare Tax Hike?

The Medicare part A tax is paid by both employees and employers who earn over a certain amount. ObamaCare’s Medicare tax hike is a .9% increase (from 2.9% to 3.8%) on the current total Medicare part A tax. This tax is split between the employer and employee meaning that they will both see a .45% raise. Small businesses making under $250,000 are exempt from the tax. Employees making less than $200,000 as an individual or ($250,000) as a family are also exempt. Employers must withhold and report an additional 0.9 percent total on employee wages or compensation that exceed $200,000.

- Small businesses making under $250,000 in taxable profit don’t have to pay this ObamaCare small business tax increase. Neither do employees making less than $200,000.

- Taxable income is defined as profit above and beyond expenses, tax credits provided by ObamaCare for insuring employees, tax breaks and money reinvested into the company.

- This group of small businesses making over $250,000 in taxable income accounts for 3% of small businesses in the US.

Under ObamaCare you can be 96% certain the ObamaCare tax increases don’t negatively affect your small business, but improved health care does.

Additional Costs for Small Business: $63 Pre-existing Conditions Fee

There will be an annual fee of $63 dollars paid by small business employers purchasing insurance. The ObamaCare small business fee is decreased by a small amount each year until 2017 when pre-existing conditions are phased out. These costs may get passed onto employees. Due to tax credits, small businesses will still see a net savings, while larger firms will have more up-front costs, which may get passed onto employees.

Employers With Over 200 Employees

Under the Affordable Care Act, if an employer has over 200 employees, the employer must automatically enroll new employees regardless of other coverage. New hires can then opt-out of the coverage and employers can remove them as of the effective date. If the employer has less than 200 employees, the employer does not have to automatically enroll new employees. However, the employees must be offered coverage if they meet eligibility guidelines.

New Rules for Employee Waiting Periods For Enrollment

The Affordable Care Act imposes a new limit on waiting periods for health insurance enrollment. Employers must not have waiting periods of longer than 90 days. Starting 2015 fines began being imposed for waiting periods longer than 30 days, and increased fees for waiting periods of longer than 60 days, assuming the employer is “mandated” to offer full-time employees health insurance.

Summary Of Benefits and 60-day Notification

Employers must provide a summary of benefits during open enrollment (or on the first day a plan starts) and a notification to employees about any material changes to the plan 60 days in advance of any changes.

Employer Plans and Reference Pricing: What You Need to Know

In a May 2 document, labeled Frequently Asked Questions about Affordable Care Act Implementation, the administration essentially gave the go-ahead to large or self-insured employers to use reference pricing in designing health plan benefits.

The concept of reference pricing is that your employer gives you a cap for a treatment to encourage you to shop around for the best price for that treatment. This is meant to give you an incentive to get the $10,000 surgery as opposed to the $50,000 one (this applies to drug treatments as well, favoring generics over name brands). The concept assumes both treatments are adequate and says that if you choose the more expensive one you must pay fees above the cap.

This is meant to reduce overall healthcare spending by giving folks a reason to shop around for a great price on something that would otherwise be paid by the insurer, thus giving the consumer little incentive to price shop. This is also meant to be an incentive to hospitals, doctors, and drug companies to price more fairly and competitively as discrepancy in price for the same treatment.

Learn more about reference pricing from Kaiser.

ObamaCare Small Business Facts Every Employer and Employee Should Know

• About one half of the uninsured across the country are small business owners, employees or their dependents.

• Since 1986, the National Federation of Independent Business’ members have said that healthcare costs are their No.1 concern.

• More than half (56%) of people in the U.S. under age 65 receive health insurance coverage as an employer benefit.

• Defining Small Business: A small business can range from 1 to 500 employees and do millions upon millions in business. In some industries, a small businesses can have up to 1,500k employees.

• Small businesses can also include hedge funds using pass-throughs and other loopholes.

• The United States has almost 6 million small employers, 90 percent of which employ fewer than 20 people.

• Small businesses with under 25 employees benefit the most from ObamaCare.

• 25% of business owners are uninsured, another 50% rely on family. 60% of those who do have private insurance have incomes up to four hundred percent above the poverty level.

• Small Business employees make up over half of the workforce and are the main driving force in job creation.

• Over the past decade, average annual family premiums for workers at small firms increased by 123 percent, from $5,700 in 1999, to $12,700 in 2009, while the percentage of small firms offering coverage fell from 65 to 59 percent.

• ObamaCare will provide subsidized healthcare to 83% of the small business owners who are currently uninsured.

• On average, a small businesses will pay about 18% more than a larger business for the same health coverage.

• Our biggest job creators (small businesses) will still go on creating jobs with high retention rates just like they do now, except they will be able to provide incentives to their employees with higher quality and more affordable health insurance. The head of the CBO Douglas Elmendorf said, “We don’t think that the healthcare law is having a significant impact on the economy today… It would reduce the amount of labor used in the economy by about a half a percent at the end of the decade… but, most of that is people choosing not to work because they can obtain health insurance at an affordable price outside of the workforce.”

• There has been no evidence that ObamaCare will change the hiring practices of big business. ObamaCare actually creates jobs, including a grant to create an estimated 5 million jobs in the healthcare industry.

• The way U.S. income tax brackets work is that taxes are levied on marginal income. In other words, the rate applied to income earned over the $250,000 threshold is irrelevant to the first $250,000 worth of taxable income. If you have $250,010 of taxable earnings then only that last $10 is taxed at the higher rate.

• As Reported By Fox News “The Affordable Care Act tackles small business owners’ top priorities when it comes to health-care reform: cost and accessibility. The law will significantly rein in costs while providing more health coverage options for entrepreneurs,” John Arensmeyer, founder and CEO of the Small Business Majority, said in a statement.

So let’s be clear, all of your friends, your mom and most of the people you meet on the street who work for small businesses will benefit from the new healthcare reform law. We expect to see their healthcare costs either stay the same or decrease (taking into account the rate at which health care costs were rising independent of ObamaCare), while the quality of their healthcare and what they can offer to their employees greatly increases.

Download more ObamaCare Small Business Facts from the White House. Or check out the NFIB report on small business and the health care crisis.

…Hedge Funds Are Considered a Small Business

A significant number of the ObamaCare “small businesses” who would have to pay more are hedge funds.

Hedge funds use “pass-throughs” to qualify as small businesses by “passing” expenses “through” to investors. In other words, a hedge fund can have millions of dollars “pass-through” without it counting towards their small business status. A republican-run government would ensure that hedge funds continue to receive tax breaks and keep loopholes open for these types of organizations.

Hedge Funds count as small businesses (due to the “pass-through” loophole), so when someone tells you they want tax cuts for small business, it doesn’t always mean what you think.

• Hedge funds, including Mitt Romney’s Bain Capital, made billions of dollars from the Auto Bailout. In fact, his wife, Ann, personally gained at least $15.3 million from the bailout—and a few of Romney’s most important Wall Street donors made more than $4 billion.

• Although small business accounts for about 50% of private-sector jobs and GDP, (Gross Domestic Product) these numbers don’t start with the top 3% and trickle down. In fact, the biggest job creators and the highest job retention comes from small businesses with less than 10 employees.

• Of the 5,930,132 employer firms in 2008, 79 percent had fewer than 10 employees, and 99.7 percent had fewer than 500 employees. (Medium business, are sometimes defined as small business because of technicalities.)

The Reality of the Mom and Pop Small Business and ObamaCare

The Reality of the Mom and Pop Small Business and ObamaCare

Most Mom and Pop Small Business will not be hurt by ObamaCare. In fact, the Affordable Care Act will help them to insure themselves, their families and their employees (in the current system, it’s hard for Mom and Pops to provide quality benefits and many don’t have health insurance at all).

What Does ObamaCare Do With Your Small Business Taxes?

ObamaCare uses taxes in combination with cuts from wasteful spending in the health care industry to help provide cost assistance in order for employers and employees to afford quality healthcare. Healthcare that can’t be taken away when you are sick, and coverage that can’t deny you for having pre-existing conditions are great benefits under the ACA. It provides preventive services and a number of benefits that were not available to most people before.

Of course, for a small business, this means being able to offer your employees more attractive packages and receiving better tax breaks for doing so. A larger small businesses will have to provide insurance for their employees or pay a penalty. Either way, small business is vital in providing affordable quality health care to Americans.

If you are a small business owner or if you know or love someone who has ever been sick, you need consider, not what other people think of ObamaCare, but what the program does for your business and your family. Thank you for learning the ObamaCare small business facts, please let the small business owners in your life know what ObamaCare means for them.

The Truth about ObamaCare and Small Business

![]()