What is the Health Insurance Marketplace?

How to Use Your State’s Health Insurance Marketplace to Buy “Affordable” Health Insurance

ObamaCare’s Health Insurance Marketplace, or ObamaCare Marketplace, is your State’s price comparison website for subsidized health insurance under the ACA. The following guide will explain the marketplace and how you, your family, and your business can compare health plans and qualify for reduced premiums and out-of-pocket costs on marketplace based coverage.

TIP: Sometimes people call the Affordable Care Act by its nickname “ObamaCare,” likewise sometimes people will refer to the marketplaces for insurance created under the ACA as “ObamaCare Marketplaces.” On our site our goal is to help you find what you are looking for and to help you understand how everything works. For this reason we use both the official names and nicknames of the ACA, Marketplace, etc.

Open Enrollment in the Health Insurance Marketplace

ObamaCare’s Health Insurance Marketplace is open during each year’s annual open enrollment period. Open enrollment is the only time you can apply for cost assistance, enroll in a plan, or switch plans without qualifying for a special enrollment period. Enroll in a plan offered on HealthCare.Gov during open enrollment to get coverage with cost assistance that offers all of the ACA’s benefits, rights, and protections.

Open enrollment in the Health Insurance Marketplace starts November 1st and ends December 15th. Log in to your marketplace account and verify your plan before Open Enrollment ends.

FACT: From 2014 to 2018, to avoid the penalty you needed to obtain and maintain minimum essential coverage throughout the year. UPDATE: The fee was reduced to $0 in most states in 2019. With that said, marketplace plans are still the only plans that have to follow all of the ACA’s rules and the only plans that can offer cost assistance.

Health Insurance Marketplace Facts

• Most Americans who are non-exempt will be required to have health coverage. Uninsured Americans can shop for coverage options in their State’s marketplace.

• No one can be denied coverage on the marketplace for health-related reasons.

• Premium costs are no longer based pre-existing conditions, health status, claims history, duration of coverage, gender, occupation, and small employer size and industry.

• The only factors that can affect premiums of new insurance plans starting in 2014 are your income, age, tobacco use, family size, geography and the type of plan you buy. This applies to all plans sold through your State’s health insurance marketplace.

• The marketplace is open to all Americans, but no one is required to use it.

• You can compare competitively priced health plans through the marketplace to find the best deal for you, your family or your employees.

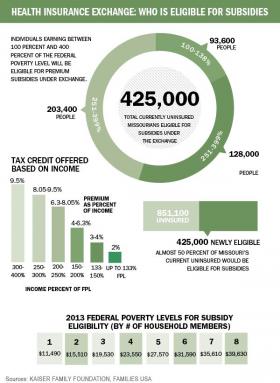

• Individuals and families earning less than 400% of the Federal Poverty Level can get cost assistance through the marketplace.

• Small businesses with under 50 full-time equivalent employees can use a part of the marketplace called “the SHOP” (Small Business Health Options Program).

• Small businesses with fewer than 25 full-time or full-time-equivalent employees with average annual wages below $50,000 can get tax credits to help pay for employee premiums through the SHOP.

• ObamaCare’s (ACA’s) first open enrollment ran from October 1st, 2013 to March 31st, 2014. There is an open enrollment period every year. For example, open enrollment for 2020 health plans is from Nov 1 – Dec 15 2019.

• Medicare, health insurance marketplaces, and employer-based insurance have open enrollment periods. Medicaid, CHIP, and non-subsidized private insurance outside of the marketplace are not subject to mandatory enrollment periods, although most ObamaCare-compliant plans “known as Minimum Essential Coverage” can only be purchased during open enrollment inside and outside of the marketplace.

• Insurance purchased by the 15th of each month starts on the 1st of the following month after you paid your premium. Insurance purchased after the 15th starts on the 1st of the month after that.

• You can get an estimate of what your health insurance will cost on the marketplace by going to the healthcare.gov. Applying and enrolling in a plan is not the same thing, you are free to shop around for plans during open enrollment.

• Remember many states have their own marketplace, but healthcare.gov official health insurance marketplace.

Your State’s marketplace (AKA Exchange) is the official website for buying health insurance! The Marketplace opened October 1st, 2013. All Americans had to obtain health insurance by January 1st, 2014 or pay a per-month fee. However coverage gap exemptions technically gave people until May 1st, 2014 to be covered without owing the fee that first year. Then in 2019 the fee for not having coverage was reduced to $0 in most states.

Listen to President Obama discuss ways to enroll in the Health Insurance Marketplace, give an update on the website, and discuss what the Affordable Care Act has done to benefit Americans so far. This video was made during open enrollment 2014; the first open enrollment period for the health insurance marketplace.

Why Use the Health Insurance Marketplace?

The main draw of the marketplace is that it is the only way for Americans to purchase quality subsidized insurance without the help of a broker. The marketplaces take the guesswork out of buying health insurance and makes coverage cheaper due to access to cost-assistance. The only way for Americans to apply for premium health care tax credits is through the marketplace.

You can also use the marketplace to apply for Medicaid and CHIP. If you get insurance through work, you can use the marketplace, but may not be eligible for tax credits. If you are eligible for Medicare, please go to our page on Medicare enrollment, Medicare isn’t part of the marketplace.

Health Insurance Marketplace Technical Issues

The official ObamaCare website launched with some technical issues. However, by the time the marketplaces closed in the first year, 8 million had enrolled in individual and family plans and millions more had enrolled in Medicaid and CHIP through the marketplace.

Many of the issues with the Health Insurance Marketplace were addressed after it opened. However, Trump has spent little money on updating its software, and you may have problems. You can get the latest update on the status of the ObamaCare Website here.

Who Uses the Health Insurance Marketplace?

The health insurance marketplace is for uninsured Americans looking for private individual and family plans and those eligible for cost assistance. The roughly 80% percent of Americans who already have health insurance either through an employer, privately or through a government program like Medicare or Medicaid not much will change under the Affordable Care Act.

• If you don’t have insurance and don’t have access to affordable, quality employer-based insurance you can use the marketplace.

• If you make less than 400% of the Federal Poverty Level, and don’t have access to employer-based insurance, you may get cost assistance through the marketplace.

• If you make less than 133% of the Federal Poverty Level, you will qualify for Medicaid if your state expanded Medicaid.

• Each year millions of Americans of all income levels enroll in plans sold on the marketplace or expanded under the ACA. In 2019 over 20 million who didn’t have coverage before the law were covered.

FACT: Uninsured rates dropped to record lows under the ACA, and part of that is from the marketplace. 2019 data shows that about 8.4 million were enrolled in the marketplace during open enrollment 2018, that is down from 11.8 million during open enrollment 2017. Meanwhile, those who are were eligible for Medicaid coverage due to Medicaid expansion and are covered is estimated at 12.6 million as of 2017 (up from 11.9 million as of 2016). NOTE: See updated enrollment sign up info.

Do I Have to Use the Marketplace if I Don’t Have Health Insurance?

NOTE: Remember the fee is reduced to $0 in most states, so the information on the fee below is mostly for historical purposes.

The ACA’s (ObamaCare’s) “individual mandate,” says that most legal residents in the U.S. must obtain health coverage, an exemption or pay a fee after 2014. Trump’s rollbacks have made it uncertain whether this provision will continue to be enforced.

If you don’t get health insurance will theoretically have to pay 95 dollars or 1 percent of their annual income, whichever is higher. That amount will rise each year until it hits $695 or 2.5 percent by 2016. (it’s a little more complicated than that, so please see our individual mandate page for more information).

If you have health insurance already, then you are most likely in the clear. If you make less than 400% of the Federal Poverty Level, you will most likely qualify for free or low-cost health insurance through the marketplace, so it is advised that you at least fill out an application. The marketplace is an option and not a requirement. You may buy private insurance through a broker or directly from a provider or obtain any other type of minimum essential coverage which includes most common health insurance types. See our Guide to Health Care Plans here.

About the Marketplace: What is Affordable Insurance?

Affordable health insurance is health insurance that costs less than 8% of your family’s income. Please note that if insurance is obtained through an employer, it can cost up to 9.5% of your income and still be considered affordable. If you can’t get affordable coverage, you will most likely be exempt from having to purchased health insurance.

How Does the Health Insurance Marketplace Work?

The Health Insurance Marketplace works a lot other price comparison websites do. You go on your State’s marketplace and fill out some basic tax and medical history on your family. Then you can use a price calculator to get side by side comparisons of rates and benefits to compare health insurance plans and pick the best ones for you and your family.

There are three ways to apply for coverage from the health insurance marketplace: online, by mail, or in-person with the help of a Navigator or other qualified helper. Telephone help and online chat will be available 24/7 to help you complete your application. This line is already open for those who have questions. Questions? Call 1-800-318-2596, 24 hours a day, 7 days a week. (TTY: 1-855-889-4325)

Before you use the marketplace check out our complete guide to the insurance exchanges to find out how to save big and get the most bang for your buck!

Online Health Insurance Marketplace Enrollment:

When Does the Health Insurance Marketplace Open?

The Health Insurance Marketplace opened on October 1st, 2013. Open enrollment lasted until March 31st, 2014. There are open enrollments each year from Nov 1 to Dec 15 (although deadlines may be expanded in some states).

Please note that you may qualify for special enrollment periods outside of open enrollment if you meet certain “qualifying life events.” These events are things like moving to a new state, changing your income, and changing your family size. For example, if you marry, divorce, have a baby or become pregnant, you may get up to an extra 60 days to enroll.

Although insurance purchased through the marketplace can only be purchased during open enrollment to avoid the penalty for not having insurance, you can apply for health coverage outside of the Marketplace, or apply for Medicaid or CHIP, at any time.

Ways to Sign Up For The Health Insurance Marketplace

There are four ways to sign up for your State’s Health Insurance Marketplace.

1) Find your State’s marketplace website.

2) Get in-person help. You can find in-person help by going to LocalHelp.Healthcare.gov.

3) Call the 24/7 marketplace helpline 1-800-318-2596.

4) Mail-in a paper application. bit.ly/PaperApplication. (read these instructions first)

How to Sign Up For the Health Insurance Marketplace Website

Here are the official directions for signing up for health insurance through healthcare.gov.

- Set up an account. First, you’ll provide some basic information. Then choose a username, password, and security questions for added protection.

- Fill out the online application. You’ll provide information about you and your family, like income, household size, current health coverage information, and more. This will help the Marketplace find options that meet your needs. Important: If your household files more than one tax return, call the Marketplace Call Center at 1-800-318-2596 before you start an application.(TTY: 1-855-889-4325) This is a very important step. Please don’t skip it. Representatives can provide directions to make sure your application is processed correctly.

- Compare your options. You’ll be able to see all the options you qualify for, including private insurance plans and free and low-cost coverage through Medicaid and the Children’s Health Insurance Program (CHIP). The Marketplace will tell you if you qualify for lower costs on your monthly premiums and out-of-pocket costs on deductibles, copayments, and coinsurance. You’ll see details on costs and benefits to help you choose a plan that’s right for you.

- Enroll. After you choose a plan, you can enroll online and decide how you pay your premiums to your insurance company. If you or a member of your family qualify for Medicaid or CHIP, a representative will contact you to enroll. If you have any questions, there’s plenty of live and online help along the way.

Marketplace Qualified Health Plans = Minimum Essential Coverage

All health plans purchased through the marketplace (sometimes called an exchange) will qualify as minimum essential coverage (meaning you won’t have to pay the fee for not having insurance). You can also find out if you qualify for Medicaid, CHIP, or Medicare through your State’s marketplace. We also provide more detailed guides to the exchanges and links to official and state resources for your State’s online health insurance marketplace.

After You Do Your Health Insurance Marketplace Research: Make sure to visit the Health Insurance Marketplace to find out how to apply for your State’s Health Insurance Marketplace.

Qualified Health Plan: What Type of Coverage Can I Buy on the Health Insurance Market Place

There are four tiers of Qualified Health Plans (plans that meet the minimum standards of the ACA or ObamaCare including offering the 10 Essential Benefits) available on the exchange. Each tier of plan offers better benefits and less cost-sharing. The plans are Bronze (with a 40% out of pocket cost on non-covered items), Silver (30%), Gold (20%) and Platinum (10%). Please be aware that high-end plans carry a 40% excise tax. Affordable insurance assumes that you will buy a silver plan.

We cover the different types of qualified health plans in detail on our Complete Health Insurance Exchange Guide. Use our guide to find out which plan is right for you and your family.

Choosing the Right Qualifying Health on the Health Insurance Marketplace

Although it may be tempting to get a low-end plan, you should consider you and your family’s medical history. While many things are covered without any out of pocket cost on all plans, higher premium plans have a smaller percentage of out of pocket costs. One trip to the hospital could more than make up the cost difference between a Bronze and Platinum plan for your family. Not all plans are created equal, so make sure you shop around and look at every aspect of the plan and it’s network before deciding which one is right for you.

Avoiding Premium Increases on Qualifying Health Plans

While you’ll never be charged more due to health status, there are a few factors to consider to try to get the lowest premium possible. Be aware that when you sign up for the health insurance marketplace, a fluctuation in income or the smoking status of a family member can increase costs drastically. The ACA (ObamaCare) focuses on wellness, and you should too.

Do I Have to Shop for a Health Plan Before I Apply for Subsidies?

To see if you qualify for subsidies the only thing you have to do is apply for the marketplace. When you compare plans, the rates displayed will reflect your subsidies.

You can get an estimate of what your health insurance will cost on the marketplace by going to the health insurance premium estimate tool from healthcare.gov.

Getting and Using Subsidies on the Online Insurance Marketplace

Cost assistance is offered in the form of premium tax credits or out-of-pocket subsidies through ObamaCare’s online health insurance marketplace for those who don’t have access to employer-based coverage. If you make between 133% – 400% of the Federal Poverty Level (FPL) will automatically apply for cost assistance when they sign up for the exchange. These deductions will be taken out of your monthly premium costs. If you lose or gain income throughout the year, it could cause you may be responsible for the difference on next year’s tax returns.

Please note that due to Medicaid Expansion in some States those below the 139% FPL may be eligible to receive Medicaid. If you or a family member qualifies for Medicare, Medicaid or CHIP, they will not be able to receive cost assistance through the marketplace.

The three types of cost assistance are:

Medicaid / CHIP for those making less than 138% of the Federal poverty level (FPL) may get free or low-cost insurance through Medicaid or CHIP.

Help with out-of-pocket costs for those making up to 250% of the FPL

Premium tax credits for those making up to 400% of the FPL. You may qualify for both premium and cost-sharing subsidies as they are not mutually exclusive. Cost assistance is only available through your State’s health insurance marketplace.

NOTE: Exact figures below are from 2020 and act as an example. Figures are adjusted upward each year.

| Types of Cost Assistance: Health Insurance Financing | Individual Annual Income | Family of Four Annual Income |

| Medicaid health coverage, if your state decides to offer it |

Up to $17,609 | Up to $36,156 |

| Help to pay your premium, if you buy into your state’s online marketplace | Between $12,760-$51,040 | Between $26,200-$104,800 |

| Subsidies for out-of-pocket costs, if you buy in your state’s online marketplace |

Up to $31,900 | Up to $65,500 |

Qualifying for Medicare, Medicaid or CHIP on the ObamaCare Marketplace

When you fill out your information, you will also be made aware if you or any members of your household qualify Medicare, Medicaid or CHIP (children’s health insurance program). If you qualify for any of these programs, you will not be able to purchase insurance through the exchange. Please use the resources found on this site to ensure that you understand the parameters that you or your family member will need to meet to qualify for Medicare, Medicaid or CHIP. Understanding some of the variables could be the difference between getting in the program and not.

Purchasing Health Insurance Through the Online Marketplace

To sign up for health insurance either use our guide to finding your states insurance marketplace or simply use the healthcare.gov application page. Before you do, we strongly suggest you research the marketplace using our site as we provide unbiased reviews, tricks, and tips ensuring you get your best option at the best price.

Small Business Health Insurance Marketplace or “SHOP”

The Small Business Health Insurance Marketplace, otherwise known as the “SHOP” (Small Business Health Options Program), allows employers to shop for employee health insurance. Eligible employers can save up to 50% of their employee’s insurance costs using premium tax credits! Find out more about the SHOP Exchanges.

Purchasing Small Business Health Insurance Through the Online Marketplace

If you are looking to purchase employee health insurance through the online marketplace, you will be using the SHOP online marketplace. SHOP stands for small business health options program; you can find out more information at our SHOP marketplace page or use the official healthcare.gov SHOP exchange resource to sign up now.

Regulated Insurance In the Marketplace

All insurance purchased through the online marketplace is heavily regulated. All plans must meet all the criteria of the law.

Healthy Competition In the Marketplace

Since health insurance companies must compete for your business, they will have to offer better prices and plans to compete with other companies selling insurance on your State’s marketplace.

The Benefits of Health Insurance Purchased Through the Marketplace

All plans must include the 10 essential health benefits mandated by ObamaCare. From emergency services to newborn care ObamaCare ensures that some of your most essential benefits are covered under every plan. Find out more about the essential health benefits here.

Here is a quick and easy to read brochure to help you get ready for the health insurance marketplace.

Are People Enrolling in the Health Insurance Marketplace?

As of December 11th Health and Human Services (HHS), the department in charge of implementing and overseeing the Affordable Care Act reported that:

- November’s federal enrollment number outpaced the October number by more than four times.

- Nearly 1.2 million Americans, based only on the first two months of open enrollment, have selected a plan or had a Medicaid or CHIP eligibility determination;

- Of those, 364,682 Americans selected plans from the state and federal Marketplaces; and

- 803,077 Americans were determined or assessed eligible for Medicaid or CHIP by the Health Insurance Marketplace.

- 39.1 million visitors have visited the state and federal sites to date.

- There were an estimated 5.2 million calls to the state and federal call centers.

Update: Over 8 million Americans enrolled in a marketplace plan during open enrollment the first year.

ObamaCare Website Glitches with the Health Insurance Marketplace

The ObamaCare website launched with some glitches. Work was done to correct the problems. The official ObamaCare website for the health insurance marketplaces, healthcare.gov, has been having technical issues. Most of the feedback from the states that created their own marketplaces have shown that they are working as intended if not better. The website glitches have been increasingly problematic since Trump cut the tech support budget. The following video discusses what was going on with the health insurance marketplace glitches. Check out this article to get an idea of what is going on with the website.

Ready to Use the Health Insurance Marketplace?

If you think you know enough about the marketplace to use it now, go and use our list of State Health Insurance Marketplaces to find your State’s marketplace. Alternatively, you can keep reading our Complete Health Insurance Exchange Guide and our other resources on the online marketplaces to get a better understanding on how you and your family can find the best plan at the best price.

Using the Online Health Insurance Marketplace

![]()