ObamaCare Exemptions List

A list of ObamaCare’s Exemptions, including Hardship Exemptions, you can apply for in order to qualify for Special Enrollment or be exempt from the fee can be found below.

This page just covers the basics, see our page on ObamaCare Exemptions for further details on exemptions and the fee (active on plans held in 2014 – 2018 in all states).

UPDATE: The exemption information on this page generally applies to each year, however 1. you should always check the most recent 8965 form for information (exemptions may change slightly each year), and 2. starting in 2019 the fee for not having coverage is reduced to zero in most states (and thus an exemption is not otherwise needed in most states for the 2019 tax year forward).

What Are Exemptions?

Exemptions are qualifying life events that do one of three things:

- Exempt you from the requirement to have coverage (and thus the requirement to make the Individual Shared Responsibility Payment for not having coverage).

- Qualify you for a Special Enrollment Period to get Marketplace coverage.

- Qualify you for Catastrophic Coverage outside of the Marketplace.

NOTE: Almost everyone who got coverage qualifies for one of the coverage gap exemptions.

What Are the Exemption Types?

There are two types of exemptions regular exemptions and hardship exemptions.

Regular exemptions are offered to every tax paying citizen who would have to comply with the requirement to get coverage, hardship exemptions are exemptions you have to qualify for based on life circumstances.

Hardship Exemptions and Catastrophic Coverage

If you are over 30, only a Hardship Exemption will qualify you to shop for Catastrophic coverage and not paying the fee.

Other exemptions will simply exempt you from paying the fee, but won’t qualify you to purchase a low premium Catastrophic health plan.

Regular Exemptions: How Do I Claim an Exemption?

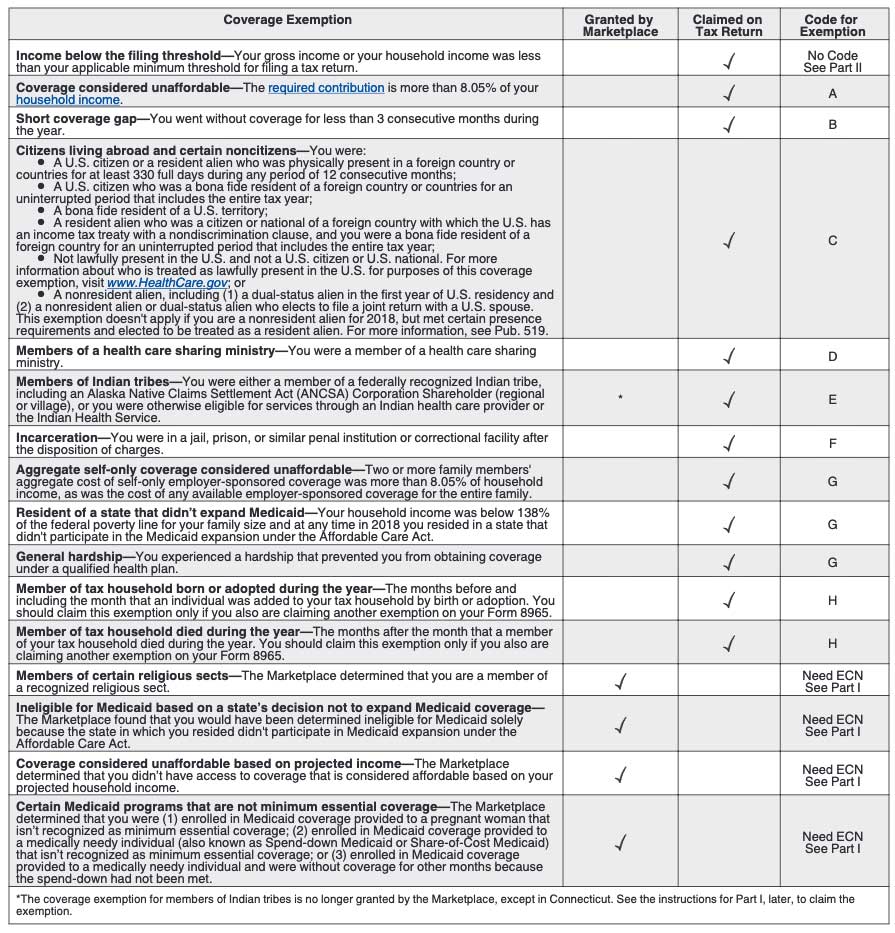

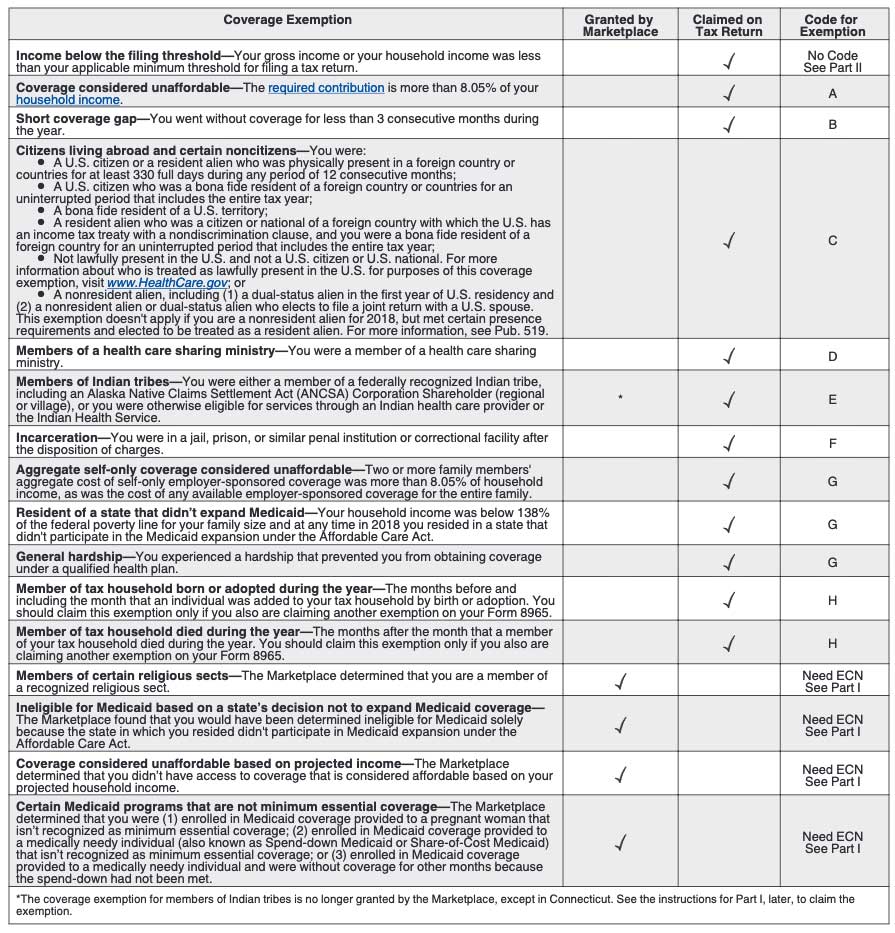

Some exemptions are applied for at the Marketplace, others are claimed on your tax return, some require both. Of the marketplace exemptions, some will require you to get a Exemption Certificate Number (ECN) from the marketplace.

When you file your taxes, you may need to use Form 8965 to claim exemptions. See our ObamaCare Facts simplified instructions for Form 8965, Health Coverage Exemptions.

| Coverage Exemption | Granted by Marketplace | Claimed on Tax Return | Code for Exemption |

|---|---|---|---|

| Income below the filing threshold—Your gross income or your household income was less than your applicable minimum threshold for filing a tax return. | ✓ | No Code See Part II |

|

| Coverage considered unaffordable—The required contribution is more than 8.05% of your household income. | ✓ | A | |

| Short coverage gap—You went without coverage for less than 3 consecutive months during the year. | ✓ | B | |

Citizens living abroad and certain noncitizens—You were:

|

✓ | C | |

| Members of a health care sharing ministry—You were a member of a health care sharing ministry. | ✓ | D | |

| Members of Indian tribes—You were either a member of a federally recognized Indian tribe, including an Alaska Native Claims Settlement Act (ANCSA) Corporation Shareholder (regional or village), or you were otherwise eligible for services through an Indian health care provider or the Indian Health Service. | * | ✓ | E |

| Incarceration—You were in a jail, prison, or similar penal institution or correctional facility after the disposition of charges. | ✓ | F | |

| Aggregate self-only coverage considered unaffordable—Two or more family members’ aggregate cost of self-only employer-sponsored coverage was more than 8.05% of household income, as was the cost of any available employer-sponsored coverage for the entire family. | ✓ | G | |

| Resident of a state that didn’t expand Medicaid—Your household income was below 138% of the federal poverty line for your family size and at any time in 2018 you resided in a state that didn’t participate in the Medicaid expansion under the Affordable Care Act. | ✓ | G | |

| General hardship—You experienced a hardship that prevented you from obtaining coverage under a qualified health plan. | ✓ | G | |

| Member of tax household born or adopted during the year—The months before and including the month that an individual was added to your tax household by birth or adoption. You should claim this exemption only if you also are claiming another exemption on your Form 8965. | ✓ | H | |

| Member of tax household died during the year—The months after the month that a member of your tax household died during the year. You should claim this exemption only if you also are claiming another exemption on your Form 8965. | ✓ | H | |

| Members of certain religious sects—The Marketplace determined that you are a member of a recognized religious sect. | ✓ | Need ECN See Part I |

|

| Ineligible for Medicaid based on a state’s decision not to expand Medicaid coverage—The Marketplace found that you would have been determined ineligible for Medicaid solely because the state in which you resided didn’t participate in Medicaid expansion under the Affordable Care Act. | ✓ | Need ECN See Part I |

|

| Coverage considered unaffordable based on projected income—The Marketplace determined that you didn’t have access to coverage that is considered affordable based on your projected household income. | ✓ | Need ECN See Part I |

|

| Certain Medicaid programs that are not minimum essential coverage—The Marketplace determined that you were (1) enrolled in Medicaid coverage provided to a pregnant woman that isn’t recognized as minimum essential coverage; (2) enrolled in Medicaid coverage provided to a medically needy individual (also known as Spend-down Medicaid or Share-of-Cost Medicaid) that isn’t recognized as minimum essential coverage; or (3) enrolled in Medicaid coverage provided to a medically needy individual and were without coverage for other months because the spend-down had not been met. | ✓ | Need ECN See Part I |

|

| *The coverage exemption for members of Indian tribes is no longer granted by the Marketplace, except in Connecticut. See the instructions for Part I, later, to claim the exemption. | |||

Full List of Hardship Exemptions

ObamaCare’s hardship exemptions apply to those who have had certain life circumstances that qualify as “hardships.” There are many things that will qualify you for a hardship, but in simple terms: If you wanted to buy health insurance and you were unable to because of a life circumstance or situation outside your control then you most likely qualify for a hardship exemption.

If any of the following circumstances apply to you, you may qualify for a hardship exemption from paying the fee, and qualify for a catastrophic plan, or qualify for a special enrollment period. Not all exemptions last for a full calendar year. You’ll need to submit documentation to be granted an exemption in most cases.

Information below obtained from HealthCare.Gov.

NOTE: Below is a list of exemptions for the 2018 plan year (for taxes filed by April 2019). These were taken directly from the official IRS instructions. See the official list at IRS.Gov’s 8965 Instructions.

General hardship (code “G”).

You can claim a coverage exemption for yourself or another member of your tax household for 2018 if you experienced a hardship that prevented you from obtaining minimum essential coverage. Hardship exemptions usually cover the month before the hardship, the months of the hardship, and the month after the hardship. General hardships can include:

- You were homeless;

- You were evicted or facing eviction or foreclosure;

- You received a shut-off notice from a utility company;

- You experienced domestic violence;

- You experienced the death of a close family member;

- You experienced a fire, flood, or other natural or human-caused disaster that caused substantial damage to your property;

- You filed for bankruptcy;

- You had medical expenses you could not pay;

- You experienced unexpected increases in necessary expenses due to caring for an ill, disabled, or aging family member;

- Your child was denied Medicaid and CHIP, and another person is required by court order to provide coverage to the child;

- You were without coverage while awaiting an appeals decision from the Marketplace;

- You were determined ineligible for Medicaid in a state that did not expand Medicaid coverage;

- You lived in a country where there is no qualified health plan offered, there is only one issuer offering coverage, or all affordable plans provide abortion coverage contrary to your beliefs;

- You experienced personal circumstances that create a hardship, such as when no affordable plans provide access to needed specialty care; or

- You experienced a hardship not included in this list that prevented you from getting health insurance.

For more information, see www.healthcare.gov/health-coverage-exemptions/hardship-exemptions.

NOTE: Below is a list from 2016, almost all the details on exemptions are the same, I am leaving this list up because it explains teh proof you need to claim the hardship exemption!

ObamaCare Hardship Categories and DocumentationYou may qualify for a hardship exemption if you experienced one of the following: |

||

| Hardship number | Category | Submit this documentation with your application |

| 1. | You were homeless. | None |

| 2. | You were evicted in the past 6 months or were facing eviction or foreclosure. | Copy of eviction or foreclosure notice |

| 3. | You received a shut-off notice from a utility company. | Copy of shut-off notice from a utility company |

| 4. | You recently experienced domestic violence. | None |

| 5. | You recently experienced the death of a close family member. | Copy of death certificate, copy of death notice from newspaper, or copy of other official notice of death |

| 6. | You experienced a fire, flood, or other natural human-caused disaster that caused substantial damage to your property. | Copy of police or fire report, insurance claim, or another document from government agency, private entity, or news source documenting event |

| 7. | You filed for bankruptcy in the last 6 months | Copy of bankruptcy filing |

| 8. | You had medical expenses you couldn’t pay in the last 24 months. | Copies of medical bills |

| 9. | You experienced unexpected increases in necessary expenses due to caring for an ill, disabled, or aging family member. | Copies of receipts related to care |

| 10. | You expect to claim a child as a tax dependent who’s been denied coverage in Medicaid and the Children’s Health Insurance Program (CHIP), and another person is required by court order to give medical support to the child. | Copy of medical support order AND copies of eligibility notices for Medicaid and CHIP showing that the child has been denied coverage |

| 11. | As a result of an eligibility appeals decision, you’re eligible either for 1) enrollment in a qualified health plan (QHP) through the Marketplace, 2) lower costs on your monthly premiums, or 3) cost-sharing reductions for a time period when you weren’t enrolled in a QHP through the Marketplace. | Copy of notice of appeals decision |

| 12. | You were determined ineligible for Medicaid because your state didn’t expand eligibility for Medicaid under the Affordable Care Act. | Copy of notice of denial of eligibility for Medicaid |

| 13. | You received a notice saying that your current health insurance plan is being canceled, and you consider the other plans available unaffordable. | Copy of notice of cancellation |

| 14. | You experienced another hardship in obtaining health insurance. | Please submit documentation if possible |

| NEED HELP WITH YOUR APPLICATION? Visit HealthCare.gov or them at 1-800-318-2596. Para obtener una copia de este formulario en Español, llame 1-800-318-2596. If you need help in a language other than English, call 1-800-318-2596 and tell the customer service representative the language you need. We’ll get you help at no cost to you. TTY users should call 1-855-889-4325. | ||

The Medicaid Exemption and Special Enrollment Period

Applying for Medicaid or CHIP and being rejected can grant you not only an exemption but also a special enrollment period. You’ll need to have your rejection letter as proof to qualify for either.

Exemptions for Citizens Living Abroad

You are exempt if you were:

- A U.S. citizen or resident who spent at least 330 full days outside of the U.S. during a 12– month period; A U.S. citizen who was a bona fide resident of a foreign country or U.S. territory;

- A resident alien who was a citizen of a foreign country with which the U.S. has an income tax treaty with a nondiscrimination clause, and you were a bona fide resident of a foreign country for the tax year;

- or Not a U.S. citizen, not a U.S. national, and not an individual lawfully present in the U.S. For more information about who is treated as lawfully present for purposes of this coverage exemption, visit healthcare.gov.

NOTE: The 12 month period can be any 12 month period. You’ll be exempt for any months of that 12 month period that fall within the tax year. Learn more about the 330-day rule here.

Remember you’ll need to apply for exemptions, and file the exemptions form to officially claim your exemption. Don’t wait until the last minute.

Do Exemptions Require Proof?

Some, but not all exemptions, require proof. (list of proofs required for exemptions is found above; generally exemptions granted by the marketplace, especially those that need an ECN, require proof).

How Do I Apply for an Exemption?

Apply for exemptions at HealthCare.Gov. You’ll need to fill out an application and send proof if required. It takes time to process your application, so don’t wait until the last minute.

Electronic Confirmation Number (ECN)

Marketplace exemptions, when confirmed, result in the Marketplace issuing you an Electronic Confirmation Number (ECN) which you’ll use to claim the exemption on your taxes.

How Long Do Health Insurance Exemptions Last?

The following exemptions are regular exemptions that exempt you from the fee. Short coverage gaps, and some hardship exemptions, only last a limited amount of time (typically 60 days.)

Full List of Regular Exemptions (Descriptions)

Below is a full list of exemptions and some descriptions of how each exemption works. This information simply offers detail on what is already covered above.

IMPORTANT: Specifics figures are subject to change each year, for example, the 9.5% and 8% numbers from 2014 are adjusted each year. for 2018 coverage they are 8.05% and 9.56% respectively for example. Further, some exemptions may be added and/or removed each year. Most of the information applies to any year, but make sure to check the official 8965 form instructions (and in some cases 8962 instructions) for specifics.

• Unaffordable Coverage Options- People who would have to pay more than 8% (adjusted each year) of their household income (MAGI) for the lowest priced Marketplace Health Insurance after subsidies qualify for this exemption. If employer insurance is unaffordable, costing more than 9.5% (adjusted each year) after employer contributions for self-only coverage, you will likely qualify for this exemption. You also qualify if average costs of premiums on an employer plan is more than ~8% MAGI. You must apply for this exemption. Remember that your MAGI is not your taxable income; it includes the amounts you invested into non-taxable savings accounts, income from Social Security, and educational expenses.

NOTE: There is an exemption if two or more family members’ aggregate cost of self-only employer-sponsored coverage is more than ~8% of household income, as is the cost of any available employer-sponsored coverage for the entire family.

NOTE: If your employer’s coverage is considered affordable (less than ~9.5% of your household income), you will not qualify for an exemption from the fee yourself, but your uninsured dependents may still qualify. The fee is 1/12 the fee per month for each family member without coverage.

• Low Income/No Filing Requirement- People with incomes below the IRS threshold required for filing taxes (in 2018, $12,000 for a single person under 65 and $24,000 for a married couple under 65) are exempt. This exemption is automatic. Please note people in this income bracket may also qualify for Medicaid.

• Hardship Exemption- The Health Insurance Marketplace, also known as the Affordable Insurance Exchange, has certified that you have suffered a hardship that makes you unable to obtain coverage either for financial or other reasons. There are many situations which will qualify you for a hardship exemption, so please see below for the full list. Essentially, if you wanted to buy health insurance, but were unable because of a hardship, you qualify. All you need to do is apply and provide documentation of your hardship.

• Short Coverage Gap Exemption- If you go without coverage for less than three consecutive months during the year you will not be responsible for the fee for those months. This allows people who don’t have a plan to sign up by the end of open enrollment (typically Feb 15th each year) and still be exempt from the fee. It also allows folks who have had coverage throughout the year downtime between insurance options for when they may experience a life change like moving or switching jobs. The coverage gap doesn’t apply if you don’t get covered; if you have more than one gap, it only applies to the first gap of fewer than three months. It can be paired with other exemptions.

• Religious Conscience- People can qualify for religious exemptions. The Social Security Administration administers the process for recognizing these sects according to the criteria in the law.

• Health Care Sharing Ministry- If you are a member of a recognized health care sharing ministry you qualify for an exemption.

• Not lawfully present- If you are an undocumented immigrant; you are not legally a U.S. citizen, a U.S. national, or an alien lawfully present in the U.S.

• Incarceration- People who are incarcerated are exempt.

• Indian tribes- Members of a federally recognized Indian tribe are exempt.

Other Hardship Exemptions And Some Historic Information

Here are some additional exemptions, these are generally all exemptions from past years, but they may be useful for reference.

- There was another coverage gap exemption for coverage purchased at any time during open enrollment 2014. This exemption applied to those who purchased marketplace insurance between March 15th and March 31st, 2014 (that coverage didn’t start until May 1st, 2014).

- You purchased insurance through the Marketplace during the initial enrollment period but have a coverage gap at the beginning of 2014.

- If your plan was canceled or became unaffordable in 2014 because of the Affordable Care Act, you qualify for a hardship exemption in 2014 only and were not required to obtain coverage for 2014.

- You applied for CHIP coverage during the initial open enrollment period and were found eligible for CHIP based on that application but have a coverage gap at the beginning of 2014.

- You were engaged in service in AmeriCorps State and National, VISTA, or NCCC programs and were covered by short-term duration coverage or self-funded coverage provided by these programs.

- You were eligible but did not purchase, coverage under an employer plan with a plan year that started in 2013 and ended in 2014. (Available only in 2014.)

- You were enrolled in certain types of Medicaid and TRICARE programs that are not minimum essential coverage. (Available only in 2014.)

- You had some specific types of limited benefit coverage. These are mostly limited benefit Medicaid or TRICARE plans. See IRS Notice 2014-10. Further details can be found on the 8965 Form. (Available only in 2014.)