How Does ObamaCare Control Costs?

Some say ObamaCare doesn’t do enough to control health care cost. Let’s look at how ObamaCare controls healthcare spending with cost controlling provisions.

TIP: To find out what coverage under the Affordable Care Act will cost you, make sure to check out the healthcare.gov marketplace and find your cost after assistance is applied.

How ObamaCare Controls Costs

The Affordable Care Act controls both consumer and industry costs. This includes cost controlling measures that affect low-income and high-income consumers, hospitals, drug makers, medical device makers, public health insurance, private health insurance, and more. The ACA leaves no healthcare stone unturned, but some argue despite this, it doesn’t address some of healthcare’s biggest problems well enough.

The United States spent an estimated $2.5 trillion on health care in 2009, which translated to per capita costs of $8,086—the highest in the world. Reining in health care costs is a major priority for policymakers. Yet during the debate over health reform, no clear consensus emerged about how best to do it. For that reason, the ACA contains a broad variety of different provisions targeting costs. – 2011 Report from rwjf.org (also used for additional information on this page in regards to cost controlling provisions)

FACT: Today in 2015 the healthcare system cost nearly $3 trillion and per capita spending about $9,000 (total population’s per capita share of that expense. This may point to the ACA’s provisions just creating a larger spending problem, but the truth is the provisions were expected to cost more at first but curb premium growth, health care consumer spending, and industry spending over time.

This video points out the cost of repeal (as estimated in 2013 by the CBO) and then discusses one of the ACA’s many cost curbing provisions in regard to hospital billing.

Cost Controlling Provisions

Let’s look at the cost curbing measures the Affordable Care Act contains, who they help, and how they are working. Remember anytime personal costs are curbed it is likely to raise healthcare spending, and new rules (even if they may curb costs in the long term) tend to increase costs in the short term (like dollar limits and minimum benefits).

Health Insurance Marketplaces

The marketplaces create large group markets where competition drives costs down over time and consumers can get more affordable coverage. As of early January 2015 6.8 are covered through the marketplace, many with cost assistance allowing them to afford coverage and care. Ideally over time plans that don’t offer value or are too expensive are phased out due to competition, and insurer overhead is lessened as it is easier for insurers to feature their product to the public.

Minimum Benefits

ObamaCare mandates minimum benefits and minimum value for plans. That means less Americans struggle with health insurance costs, and taxpayers and hospitals struggle less with medical debt and unpaid bills. Free preventive care and covered benefits means less healthcare spending over time as America focuses on wellness and prevention.

Dollar Limits

Insurers can no longer impose dollar limits on essential care. This helps ensure health care costs are more affordable and helps hospitals avoid get stuck with unpaid bills.

Medicaid Expansion

The expansion of public health insurance to the 138% Federal Poverty Line means tens of millions more Americans get access to care. This also ensures less unpaid emergency care brought on by lack of coverage.

Mandates

The mandates mean more people have coverage. That means a healthier population. It also help pays for reform by the fees for not being covered, or for employers not covering full-time employees.

Insurer Rules = High Deductible Plans

High deductible plans are more common under the ACA, this is due to new rules on cost sharing for insurers. This allows insurers to keep premiums affordable. While HSA’s help folks pay for out-of-pocket costs and cost assistance lowers the max out-of-pocket costs a person can pay, high deductible plans can cause some to put off care. In practice access to care and affordability has increased under the law.

Despite the potential problems with high deductible plans causing people to put off care, they do something really good for healthcare costs, they incentivize people to shop around for care. When someone else, be it an insurer or public healthcare provider, is footing the bill people are less likely to shop around for care and are more likely to have unnecessary treatments. High out-of-pocket costs create an incentive to shop smart for care, and thus this incentivizes healthcare providers to offer competitive prices. Like with many of the ACA’s provisions, it’s the indirect effects that perhaps help to curb costs the most over the long term.

Cost Assistance

Cost assistance ensures access to care and affordable coverage for tens of millions. It costs the tax payer more than any other provision in the ACA. So it both increases annual tax payer costs and decreases health care spending on emergency care. 75% of healthcare spending is on chronic disease, much could be prevented by having a healthier society.

Rate Review & 80/20 Rule

New rules on insurer profits and rate hikes help to keep premium growth down and force insurers to be honest about rate increases.

Taxes

Generally the ACA’s 21 new taxes help to fund the reforms and are focused on those industries that benefit most under the law like hospitals, drug makers, and device manufacturers.

Independent Payment Advisory Board (IPAB)

From 2014–2017, any year in which the Medicare per capita growth rate exceeds the average growth in the consumer price index (CPI) and medical care CPI, the IPAB will be required to recommend Medicare spending reductions. For determination years 2018 and after, the target is pegged to per capita GDP growth plus one percentage point. The IPAB recommendations will become law unless Congress passes an alternative proposal with the same budgetary savings. The board’s mandate also includes recommendations on private health spending. While not binding, these recommendations could reduce increases in private health spending.

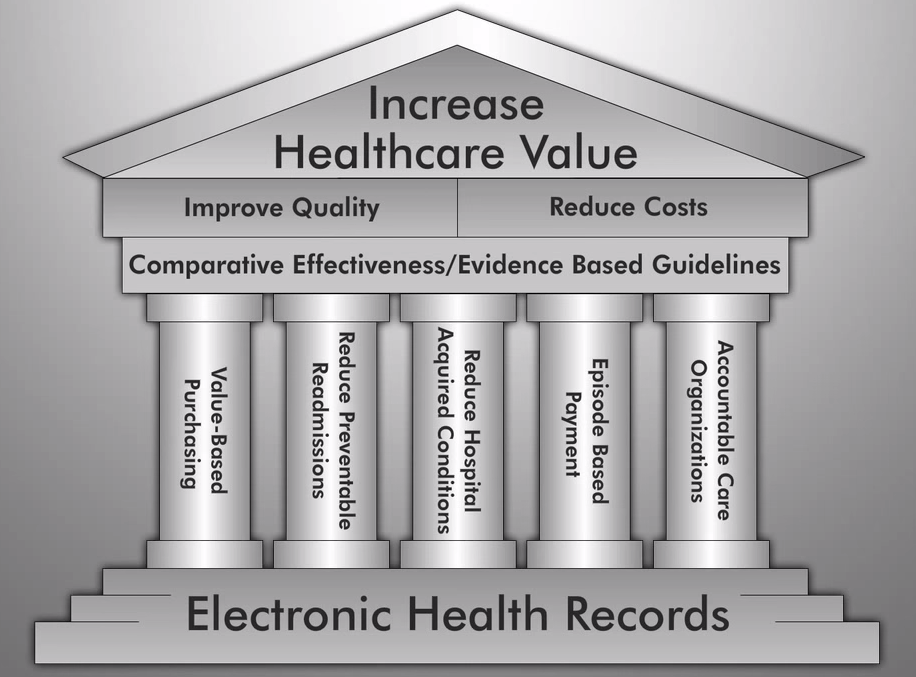

Accountable Care Organizations (ACOs)

The ACA contains measures to encourage health care providers to band together in accountable care organizations (ACOs) to better coordinate services for a group of patients, resulting in higher-quality care at lower costs. An ACO, which can include primary care physicians, specialists, hospitals or other providers, bears responsibility jointly for the cost and quality of care delivered to a subset of traditional Medicare beneficiaries. If they hit the quality targets, any savings that result are then shared among the providers. Although many details still need to be worked out, the Congressional Budget Office (CBO) has projected that this provision could save Medicare $4.9 billion through 2019.

The idea of quantity over quality is one of the main driving forces in the rising cost of health care in the US. The ACA seeks to incentivize quality over quantity.

The idea of quantity over quality is one of the main driving forces in the rising cost of health care in the US. The ACA seeks to incentivize quality over quantity.

Quality Over Quantity

The ACA aims to incentivize hospitals to promote high-quality care and avoid unnecessary readmissions. Specifically, Medicare payments will be reduced for hospitals with high rates of potentially preventable readmissions. A hospital’s readmission rate for certain conditions—starting in 2013, heart attack/failure and pneumonia are the first conditions addressed—will be compared to its expected readmission rate, and the hospital will be subject to a reduction in Medicare payments for its “excess readmissions.” The CBO estimates that this payment adjustment could save $7.1 billion over 10 years.

Wellness and Prevention

Essential wellness and prevention are free under all plans from private to Medicare. Also incentive programs for employers and some private health plans are expanded. Again the cost of the provision is weighted against the prevention of more serious illness, which costs more to treat, down the road.

Since Medicare and Medicaid are public programs, increasing benefits means more tax payer dollars. Medicare benefit expansion is estimated to cost $3.6 billion over 10 years. However the highest spending in healthcare in the US is on chronic treatment for Medicare. So the cost could easily be offset.

Wasteful Spending, Fraud, and Abuse Reform

The ACA significantly increases the government’s ability to monitor and punish those who abuse the Medicare and Medicaid programs. According to the CBO, every $1 invested in uncovering fraud amounts to $1.75 in budget savings. The CBO projects that when all ACA provisions to fight waste, fraud and abuse are implemented, Medicare and Medicaid spending will fall by $2.9 billion and revenues will increase by $900 million over 10 years.

And Much More

Aside from the major provisions and provision related cost curbing measures above the ACA contains a thousand pages of reforms. Many of these help in small ways. Do yourself a favor and read our complete summary of Provisions in the PPACA.