ObamaCare Subsidies

ObamaCare Subsidies – Premium and Out-of-Pocket Cost Assistance on Marketplace Plans Explained

ObamaCare subsidies help reduce the cost of your premiums and out-of-pocket expenses based on your income. These subsidies are only available on plans sold through the Health Insurance Marketplace.

Let’s break down what subsidies are, how they function, and how you can apply for free or low-cost health insurance.

The types of assistance available under the Affordable Care Act (ObamaCare) include:

- Premium Tax Credits: These lower your monthly premiums and are available for those with incomes between 100% – 400% of the Federal Poverty Level (FPL). The subsidy cliff has been eliminated through 2025, meaning more people may qualify.

- Cost Sharing Reduction (CSR) Subsidies: Available on Silver Plans only, these subsidies lower out-of-pocket costs for those with incomes between 100% – 250% FPL.

- Medicaid Expansion and CHIP: These programs provide free to low-cost comprehensive insurance for individuals and families. Medicaid is available for those with incomes between 0% – 138% FPL, although eligibility can be lower in some states. See details below:

Before we dive into further details, the chart below provides a quick overview of ObamaCare’s cost assistance options based on your “MAGI” (modified adjusted gross income) for 2023.

| Types of Cost Assistance For 2023 | Individual Annual Income | Family of Four Annual Income |

| Medicaid health coverage (if your state decides to offer it) | Up to $18,754* | Up to $38,295* |

| Help to pay your premium (if you buy in your state’s online marketplace) | Between $13,590-$54,360 | Between $27,750- $111,000 |

| Subsidies for out-of-pocket costs (if you buy a Silver plan in your state’s online marketplace) | Between $13,590- $33,975 | Between $27,750- $69,375 |

NOTE: Medicaid/CHIP eligibility will be updated when the new Federal Poverty Level data is published in early 2023.

TIP: Want to find out what you can save quickly, check out our Subsidy Calculator. You can also explore HSAs (Health Savings Accounts) and Medical Deductions for other ways to save.

TIP: Below is general information on cost assistance. For the most recent cost assistance levels, see our page on cost assistance in 2021.

ObamaCare Cost Assistance Subsidy Facts

There are three types of cost assistance: Premium Tax Credits to lower your premiums, Cost Sharing Reduction subsidies to reduce out-of-pocket costs, and Medicaid and CHIP. Let’s take a quick look at some cost assistance subsidy facts before going into the details.

• Cost assistance subsidies are only available through your state’s health insurance marketplace and are only available during open enrollment , unless you qualify for a special enrollment period. The exceptions are Medicaid and CHIP, which can be obtained year round, and Medicare, which has its own enrollment period.

• Although subsidies are only offered on marketplace plans, many health insurance brokers outside the marketplace can help you enroll in a marketplace plan.

• Subsidies are based on income. In most states, anyone making less than 400% of the Federal Poverty Level (FPL) is eligible for a subsidy in Marketplace plans.

• The Federal Poverty Level adjusts for inflation each year, enabling an increasing number of Americans to qualify for more cost assistance.

• Those making under 400% of the FPL have access to tax credits, those making under 250% FPL are eligible for cost-sharing reduction subsidies on silver plans, and those making under 138% (in states that expanded Medicaid) are eligible for Medicaid.

• The type of income used to determine subsidies is household Modified Adjusted Gross Income, or MAGI, which is a figure based on income after most deductions have been taken.

• If you qualify for cost assistance, a marketplace plan can’t cost you more than 9.5% of your income after tax credits are applied (the exact amount is adjusted each year, so it may be a little higher or lower than 9.5%). The less you make, the lower the cap on what you’ll pay.

• The amount of cost assistance you can get is based on the second-lowest-cost Silver plan available in your state’s Marketplace.

• In states that didn’t expand Medicaid, many adults making under 100% of the Federal Poverty Level (FPL) fall into the Medicaid gap, meaning they won’t qualify for Medicaid or subsidies.

• CHIP eligibility can differ by state and varies by the age of the children, but it is generally set at levels much higher than Medicaid eligibility.

• Cost-sharing reduction subsidies are only available on Silver plans.

• Tax credits can be applied in advance (partially or in full) to lower your premiums, or they can be adjusted on your federal income taxes.

• If your income changes, report it so that the marketplace can adjust your subsidies. You may qualify for bigger subsidies if your income decreases, and you will save yourself from having to repay advanced tax credits if your income increases.

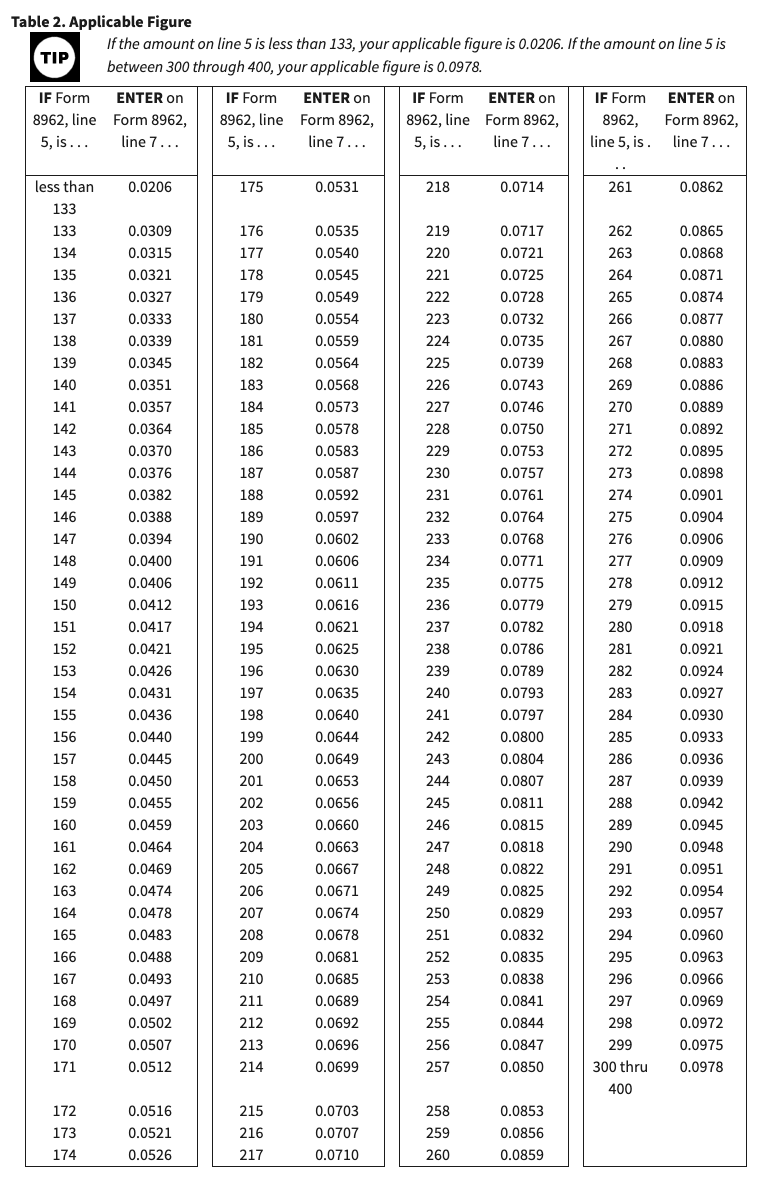

• In order to adjust tax credits at the end of the year, you’ll need to file a Premium Tax Credit Form 8962 along with your 1040 Income Tax Returns. Your assistance amounts can change with even a slight change in income. This means that many will qualify for greater refunds due to Tax Credits, while some will repay a portion of their Advanced Tax Credit Payments.

• Aside from taking cost assistance immediately, you can also use a Health Savings Account (HSA) or other medical savings accounts to lower your Modified Adjusted Gross Income (MAGI) and spend tax-free dollars on healthcare expenses.

• If you spend more than 10% of your Adjusted Gross Income on medical, dental, and vision expenses, consider using a Schedule A to take medical deductions on your taxes.

• If you don’t qualify for subsidies, you may want to explore options outside of the marketplace as well; in some states, certain plans aren’t available through the marketplace.

• You may qualify for both cost assistance and an exemption from the tax if, after subsidies, the cheapest marketplace plan cost more than 8% of your income.

• Cost assistance is also available for small businesses with fewer than 25 full-time equivalent employees. Learn more about ObamaCare and Small Business.

ObamaCare Rebates and Refunds: While not a subsidy, the ACA includes provisions that help lower your premiums. If your insurer spends too much on overhead and not enough on care, they owe a rebate. In 2011-2013 alone, $1.9 million in rebates were returned to customers. Rebates can be issued as a check or applied to reduce future premiums. Learn more about the 80/20 rule and rate review provisions, which are saving people money on their premiums, often without them even knowing it.

ObamaCare Subsidy Tips and Tricks

When projecting your income, keep these tips and tricks in mind.

- When reporting income to the Marketplace, you are reporting projected Modified Adjusted Gross Income (MAGI), which is your expected income after most tax deductions.

- Your Modified Adjusted Gross Income (MAGI) determines where your household income falls on the Federal Poverty Level (FPL) Guidelines. This placement helps determine your assistance amounts. Consider finding extra deductions or adjusting income projections as needed.

- In states that didn’t expand Medicaid, you’ll get maximum assistance at 100% of the Federal Poverty Level. In states that did expand, you’ll need to report over 139% of the Federal Poverty Level. If you want a private plan with assistance and not Medicaid, don’t report under these amounts.

- For Medicaid, know your state’s expansion status. In expanded states, under 138% FPL qualifies for Medicaid. In non-expanded states, eligibility can vary, and limits can be below 50% FPL.

- CHIP covers low-income children, providing options even in non-Medicaid-expansion states.

- If you report less than 100% of the Federal Poverty Levelin a state that didn’t expand Medicaid, you might not qualify for coverage. Consider reporting slightly higher income to qualify for assistance.

- Cost Sharing Reduction Subsidies require income between 100% – 250% of the Federal Poverty Level.

- Reporting income over 400% FPL disqualifies you from receiving cost assistance.

- Cost assistance levels off between 300% – 400% FPL, so wherever you report in that range, your cost assistance will not change.

- Cost assistance levels off between 100% – 133% FPL as well.

- You don’t have to pay back Cost-Sharing Reduction subsidies or Medicaid.

- You do have to pay back tax credits, but only up to the repayment limits (see below).

- If your income varies (due to self-employment or seasonal work), consider taking only part of the tax credit upfront to avoid potential repayments.

- For the best value, report lower income, understand MAGI deductions, choose a “Silver plan,” and be prepared to repay any excess tax credits with your tax return using form 8962.

- Adjust your income information throughout the year to get the right cost assistance, but you may prefer to pay back excess credits if it helps retain assistance.

- Using an HSA or deducting 100% of health insurance premiums (if self-employed) can help lower your MAGI.

What is a Subsidy?

A health care subsidy (cost assistance) helps lower the amount you pay for your monthly premium (through advanced premium tax credits) or reduces your out-of-pocket costs for expenses like copays, coinsurance, deductibles, and out-of-pocket maximums (cost-sharing reduction). These subsidies are funded by the federal government and paid for through taxes.

Who is Eligible For Subsidies Under ObamaCare?

Subsidy eligibility is based on income for all legal U.S. residents. However, individuals who have access to affordable employer-based health insurance, are eligible for Medicare, or are incarcerated cannot receive subsidies. Other restrictions may apply.

During open enrollment, Americans making under 400% of the federal poverty level (FPL) can receive advanced premium tax credits to lower premium costs. Those with incomes below 250% FPL can access cost-sharing reduction subsidies to reduce out-of-pocket expenses. Additionally, individuals earning less than 138% FPL (in states that expanded Medicaid) may qualify for Medicaid, which helps subsidize both premiums and cost-sharing. Subsidies are only available through your state’s health insurance marketplace.

Do I Qualify For ObamaCare’s Cost Assistance Subsidies?

Any legal resident under 65 making between 100%-400% of the Federal Poverty Level qualifies for cost assistance, as long as they don’t have access to affordable employer coverage. Subsidies are only available for Health Insurance Marketplace plans.

The best way to see if you qualify for subsidies is to visit your state’s marketplace or the Federal Marketplace–HealthCare.Gov–and fill out an application. Applying does not obligate you to purchase health insurance, but it will give you an idea of your options.

You can also use our Subsidy Calculator to learn more.

REMEMBER: While qualified health insurance agents, brokers, and providers can help determine if you qualify for cost assistance subsidies and assist you in signing up for a Marketplace plan, subsidies are only available for plans offered on your state’s marketplace. Keep reading to learn more about how cost assistance works with the Affordable Care Act.

Marketplace Subsidies and Open Enrollment

Marketplace subsidies must be obtained during Open Enrollment or, in the case of a qualifying life event, during a Special Enrollment Period.

You can apply for cost assistance before open enrollment, but you won’t be able to enroll in a plan with those subsidies until the annual open enrollment period begins. If you’d like to apply now, find your state using the link below or keep reading to better understand how subsidies work.

Click here to find your state health insurance marketplace (also known as an exchange).

The ObamaCare “Subsidy Cliff.”

If your income is close to 400% of the Federal Poverty Level, it’s important to keep deductions and income in mind. Those who exceed the “subsidy cliff” will be responsible for paying back tax credits. Learn more about paying back advanced tax credits (this does not apply to cost-sharing reductions, subsidies, or Medicaid) below.

On that note, other important cutoffs are:

- Less than 100% FPL — If your income is below this, you can’t get Marketplace cost assistance and could fall in the “Medicaid gap” if your state didn’t expand coverage to at least 100% FPL.

- Less than 138% FPL — If your state expanded Medicaid, you are covered under Medicaid. In states that didn’t expand, subsidy amounts level off between 100% – 133% FPL.

- 100% – 150% FPL — This amount qualifies you for maximum out-of-pocket assistance if your state didn’t expand Medicaid.

- 138% – 150% — You qualify for maximum assistance if your state did expand Medicaid.

- 250% FPL — This is the cut-off for out-of-pocket assistance. If you adjust your income over this mid-year, you lose your cost-sharing reduction subsidies moving forward (but won’t owe them back).

- 300% FPL — At this amount, subsidies level off. You’ll get the same amount of tax credits anywhere between 300% – 400% FPL.

- 400% FPL or more — You can’t get cost assistance; watch out for the “Subsidy Cliff.“

Keep reading to get in-depth information on everything ACA subsidy related.

What if I Don’t Qualify For Subsidies?

If you don’t qualify for subsidies through the marketplace due to your income, then you’ll want to shop around outside the marketplace in addition to looking at Marketplace plans.

Not all of the plans offered in your region are available on the marketplace, and not all insurers participate in the marketplace. Some may find their best option on the marketplace (even without subsidies), while others might find a better option outside the marketplace. We strongly recommend finding a trusted broker or agent to help you with the process of shopping outside the marketplace.

There is no need to make a decision until you’re ready, but keep in mind that regardless of how you shop, you’ll need to obtain coverage during open enrollment in the individual market.

Get tips for shopping for health plans.

Can I get Subsidies If I Qualify For Medicaid?

If you qualify for Medicaid, or if your state didn’t expand Medicaid and you make less than 100% of the Federal Poverty Level, you will not qualify for subsidies on the health insurance marketplace. This affordability gap is sometimes called the “Medicaid Gap.”

ObamaCare Subsidies Fix For Insurance Purchased Outside of the Marketplace

Due to technical issues with their state’s website, some people in certain states who bought insurance outside of the marketplace, despite qualifying for subsidies, could have retroactively signed up for a marketplace plan and received federal subsidies. The marketplace closed on March 31st, 2014, and the change had to be made before that deadline. Contact your insurance company for further details.

What if I Can’t Afford Health Insurance?

If you can’t “afford” health insurance, you may be exempt from the individual mandate (the requirement to buy insurance or pay a fee) and may be eligible for free or low-cost insurance through ObamaCare’s subsidies. Many Americans will be exempt from the requirement to buy health insurance but will still be able to get a free or very low-cost plan on the marketplace.

FACT: During open enrollment for 2014, the top reason why some people did not even look for coverage was the perception that they could not afford insurance. Applying for a marketplace account is the easiest way to find out if you qualify for assistance.

Can I Get Subsidies If I Qualify For Employer Coverage?

If you have access to affordable employer coverage that meets the minimum requirements, you can’t get cost assistance subsidies.

Can I Purchase Insurance On the Exchange if I Have Insurance Through Work?

You can purchase insurance on the exchange, but you (and your family) will not qualify for tax breaks, credits, or help on up-front costs unless your employer offers substandard insurance. The insurance must provide the same benefits as the basic Bronze plan sold through ObamaCare’s exchanges/marketplaces or your insurance must cost more than 9.5% of your income.

If your employer-based insurance doesn’t meet the above criteria, you should be eligible for subsidies. However, you’ll need your employer to fill out an employer coverage tool form before you can get covered.

The 9.5% cap applies only to the employee-only portion of the income, meaning the total cost of a plan offered by an employer to the employee can be more than 9.5% of family income. There is no rule that says your spouse, dependents, or you have to take the insurance your employer offers. The rule only states that they cannot receive cost assistance subsidies. If an employer-based plan is unaffordable, you may qualify for an exemption from the fee. Watch the following video on employee health insurance:

How Will Subsidies Affect My Cost?

As a general rule, the lower your income, the more you benefit from advanced premium tax credits, reducing your monthly premium, and cost-sharing reduction subsidies, which lower your out-of-pocket costs. The total cost of your plan is determined by factors like the plan you select, your family size, location, age, and whether you smoke. Subsidies are then applied to reduce this cost. When you use the marketplace, these subsidies are automatically calculated, allowing you to compare plans and view the final price you’ll be paying.

As you can see from the image below, ObamaCare’s subsidies can significantly reduce the portion of the premium you are responsible for, but keep in mind that if your income changes during the year, you may need to reconcile the difference on your year-end tax returns.

A chart showing how premiums are capped by the second lowest cost silver plan

Premium tax credits are based on the second lowest silver plan (SLCSP) in a state’s Marketplace. The chart below shows the minimum and maximum percentage of household income that a person will pay for that plan. The percentage you’ll pay is based on your household income (compared to the federal poverty level) and it adjusts according to the price of the plan chosen.

Here are the Premium Tax Credit Subsidy Caps for 2023 from Rev. Proc. 2022-34:

| Income | 2023 |

|---|---|

| Less Than 150% FPL | 1.92% – 1.92% |

| At least 133% but less than 150% | 1.92% – 1.92% |

| At least 150% but less than 200% | 2.88% – 3.84% |

| At least 200% but less than 250% | 3.84% – 6.05% |

| At least 250% but less than 300% | 6.05% – 7.73% |

| At least 300% but not more than 400% | 7.73% – 9.12% |

| At least 400% and higher | 9.12% – 9.12% |

NOTE: To qualify for tax credits, you must earn between 100% and 400% of the Federal Poverty Level (FPL). If your state expanded Medicaid, you will be eligible for Medicaid instead of tax credits below 133% (or 138% adjusted) FPL. However, under the American Rescue Act, individuals receiving unemployment benefits may still qualify for marketplace assistance, even if not eligible for Medicaid expansion.

The chart that shows adjustments for each poverty level

Above is the basic rule for cost assistance; below is a chart that illustrates how the adjustments are applied to calculate your premium tax credits. The numbers on the left represent a percentage of the Federal Poverty Level, while the numbers on the right indicate the maximum percentage of household income that your premium can cost after applying tax credits.

TIP: The chart below offers an example, and exact amounts may vary each year.

Subsidy caps for ObamaCare’s advanced premium tax credits for 2020 plans (for taxes filed in 2021).

Subsidies and Types of Marketplace Plans

Under the ACA, there are four types of marketplace plans, often called “metal plans” due to their quality being associated with a specific metal. Here’s a breakdown:

• Bronze: Lowest premiums but highest out-of-pocket costs. Covers about 60% of your healthcare costs.

• Silver: Moderate premiums and out-of-pocket costs. Covers about 70% of your healthcare costs. Note: Cost-sharing reduction subsidies are only available with Silver plans, making them a better option for many people who qualify for subsidies.

• Gold: Higher premiums but lower out-of-pocket costs. Covers about 80% of your healthcare costs.

• Platinum: Highest premiums but the lowest out-of-pocket costs. Covers about 90% of your healthcare costs.

When you purchase a marketplace plan with cost assistance subsidies, you will choose one of these metal-tiered plans. It’s important to understand that while higher-tier plans, like Gold and Platinum, cost more upfront, they offer lower out-of-pocket costs and a wider network of doctors and hospitals.

TIP: Don’t make the mistake of purchasing a low-cost Bronze plan when a Silver plan may offer much better coverage and save you money on out-of-pocket expenses in the long run. Ideally, you want a plan with a high actuarial value (lower out-of-pocket costs) and a premium you can afford. Check out some of our tips on buying health insurance.

The Federal Poverty Guidelines Help to Determine Subsidies

Subsidy calculations are based on the federal poverty guidelines, which allow individuals and families earning up to 400% of the federal poverty level (FPL) to qualify for financial assistance. These guidelines are updated annually and play a key role in determining eligibility for various forms of cost assistance, such as premium tax credits and Medicaid.

TIP: For mobile and smaller screen sizes, you may need to drag the table below to scroll through and view different poverty levels.

It’s important to note that these guidelines not only determine eligibility for subsidies but also affect the amount of assistance an individual or family can receive.

| Persons in family/household | Poverty guideline |

|---|---|

| 1 | $13,590 |

| 2 | 18,310 |

| 3 | 23,030 |

| 4 | 27,750 |

| 5 | 32,470 |

| 6 | 37,190 |

| 7 | 41,910 |

| 8 | 46,630 |

For families/households with more than 8 persons, add $4,720 for each additional person.

FACT: The Federal Register notice for the 2023 Poverty Guidelines was published on January 21st, 2022.

If your income is less than the amount in the above table, you may qualify for coverage under Medicaid. However, your state must participate in Medicaid expansion in 2014. If it is not participating and you do not qualify for Medicaid under your state’s Medicaid rules, you must pay the entire cost of a plan bought through the marketplace.

ObamaCare provides three different kinds of subsidies. Medicaid / CHIP for those making less than 138% of the Federal poverty level (FPL), help with out-of-pocket costs for those making up to 250% of the FPL, and advanced premium tax credits for those making up to 400% of the FPL.

ObamaCare and Advanced Premium Tax Credits

If you qualify for Advanced Premium Tax Credits, you can apply them immediately to reduce your monthly premium costs. You have the option to choose how much of the credit will be applied each month toward your premium, up to the maximum amount.

If you decide to use less than your full Advanced Premium Tax Credit, the remaining amount will be refunded to you when you file your income taxes. However, if you use more than your eligible credit amount, you will need to repay the excess when you file your taxes.

Eligibility for Tax Credits

You may qualify for tax credits if you meet the following criteria:

• You purchase health insurance through the Marketplace.

• You are ineligible for coverage through an employer or government plan.

• Your income falls within certain limits.

• You file a joint tax return if you are married.

• You are not claimed as a dependent by someone else.

If eligible for tax credits, you have two options:

1. Get It Now: Have some or all of the estimated credit paid in advance to your insurance company, which reduces your monthly premiums.

2. Get It Later: Receive the full credit when you file your tax return.

Adjustments to tax credits are made when you file your taxes, and there is a limit on how much of the credit you may need to repay, based on your income.

Learn more from the IRS on Tax Credits.

ObamaCare and Out-of-Pocket Subsidies (Cost Sharing Reduction)

To receive out-of-pocket assistance (also known as cost-sharing reduction subsidies), you must purchase a Silver plan from your state’s exchange and have an individual or family income at or below 250% of the Federal Poverty Level (FPL).

• Families in the lowest income bracket may pay as little as 6% of their out-of-pocket expenses, while those closer to 250% FPL could pay up to 27%.

By combining Advance Premium Tax Credits with Out-of-Pocket subsidies, the average subsidy for individuals and families is around $5,000. Families with lower incomes or multiple children may qualify for even larger subsidies.

How Cost Sharing Reduction Subsidies Cap Out-of-Pocket Costs

Cost-sharing reduction (CSR) subsidies help cap out-of-pocket costs based on your income level and are expressed as an actuarial value percentage. The actuarial value indicates the portion of covered health expenses your Silver plan will pay due to CSR subsidies, with the remaining percentage being your responsibility.

Here’s how the CSR levels break down by income level:

100-150% FPL = 94% Actuarial Value

150-200% FPL = 87% Actuarial Value

200-250% FPL = 73% Actuarial Value

More than 250% FPL = 70% Actuarial Value (standard Silver plan without CSR subsidies)

When reviewing the summary of benefits and coverage, look for CSR levels 73, 87, or 94 to understand how much of your healthcare costs the plan will cover based on your income.

ObamaCare and Medicaid

For the least wealthy Americans, ObamaCare has made accessing Medicaid easier. However, a Supreme Court ruling allowed states to choose whether to expand Medicaid, leading to a voluntary adoption of Medicaid expansion. This means that in states opposing Medicaid expansion, many residents may not afford health insurance from the state exchanges.

In states that have expanded Medicaid, coverage may differ from Silver plan coverage, but it still provides most essential benefits, including free preventive care. Learn more about Medicaid Expansion for details on the differences.

It’s important to note that subsidies are only available when purchasing a policy through your state’s health insurance exchange. For any questions regarding subsidies, coverage, or deductibles, contact your state exchange and speak with a navigator—specially trained personnel equipped to assist with these inquiries.

For a simple explanation of what ObamaCare subsidies are and how they work, watch the following video:

Verify Cost Assistance Each Year

If you received cost assistance last year, it’s important to verify your income on your state’s marketplace and shop around for new plans to ensure you’re still getting the best value. Income and plan options can change, so reviewing them annually is crucial.

What Subsidies Do I Have to Pay Back?

You don’t have to repay Cost Sharing Reduction Subsidies or Medicaid, but you may need to repay Advanced Premium Tax Credits up to a certain limit based on your income level. This repayment is handled through the Tax Credit form, which adjusts for any excess Advanced Premium Tax Credits received.

Line 28. Repayment Limitation for the current tax year ensures you won’t owe more than you can afford if you received too much in Advanced Premium Tax Credits. This amount is subject to change annually.

TIP: The chart below provides an example, but note that exact amounts may change each year.

NOTE: The following Advanced Tax Credit Repayment limit table from form 8692 below is updated for the 2022 – 2023 tax year.

| Income % of FPL | Filing Status: Single |

Filing Status: All Other |

|---|---|---|

| Less than 200% FPL | $325 | $650 |

| At least 200% FPL but less than 300% |

$800 | $1,600 |

| At least 300% FPL but less than 400% |

$1,350 | $2,700 |

| More than 400% FPL | Full Amount Received | Full Amount Received |

| If your year-end income exceeds 400% FPL, you will have to return the total amount of Advanced Premium Tax Credits you received. If you make too little to qualify for subsidies (less 100% FPL), then you should owe NOTHING (per the directions of form 8962 from which this table comes). That being said, if you know you are going to price out-of-cost assistance, make sure to update your Marketplace account. You might become eligible for a free or low-cost Medicaid plan if your state expanded Medicaid. | ||

TIP: See federal poverty level for more details. Always refer to the current 8962 form for exact calculations at tax time (you can use last year’s numbers as a general estimate).

Apply For ObamaCare Subsidies Now

Subsidies are only available through ObamaCare’s health insurance marketplace. Check out your State’s Health Insurance Marketplace today. You can apply at any time to see if you qualify for cost assistance, but you have to enroll in a plan during each year’s annual open enrollment.

Do I Qualify For Subsidies From ObamaCare?

To find out if you qualify for subsidies, you can visit the marketplace, where you’ll be able to see if you meet the income requirements for premium tax credits, cost-sharing reductions, or Medicaid based on your household income and family size. Make sure to apply during the open enrollment period to take advantage of these options.

![]()