Premium Tax Credits

ObamaCare’s Premium Tax Credits can be paid to your insurer in advance to lower your monthly premium on a Marketplace plan or adjusted on your tax returns.

Tax Credits are based on household income and are available to folks making between 100% and 500% of the Federal Poverty Level (FPL).

Expanded Premium Tax Credit Cap: The premium tax credit cap was 400%, but the cap is currently expanded to 500%.

TIP: All numbers are subject to change each year. Make sure you are using the figures for the year in question, whether you are getting Premium Tax Credits for the year or doing your taxes for a past year. Also, keep in mind when you sign up at HealthCare.Gov they will calculate your Advanced Premium Tax Credits for you. If you want to see what sort of tax credits you might get this year, check out our tax credit calculator page.

FACT: ACA Premium Tax Credits (PTC) have replaced HCTC (HealthCare Tax Credits) since 2013.

NOTE: You can also choose to take only part of the tax credit in advance or none of the tax credit in advance and deduct the tax credit on your tax returns. If you’re unsure of your income, you should do your best to project the amount you need based on factors like last year’s taxes and your current employment, but keep in mind you may need to deal with refunds and repayments at tax time if you earned more or less than projected. Learn about tax credit repayment limits.

FACT: Advanced Premium Tax Credits can lower what you pay to your insurer each month, while Cost Sharing Reduction subsidies can lower the out-of-pocket costs of Silver plans.

How ObamaCare’s Tax Credits Work

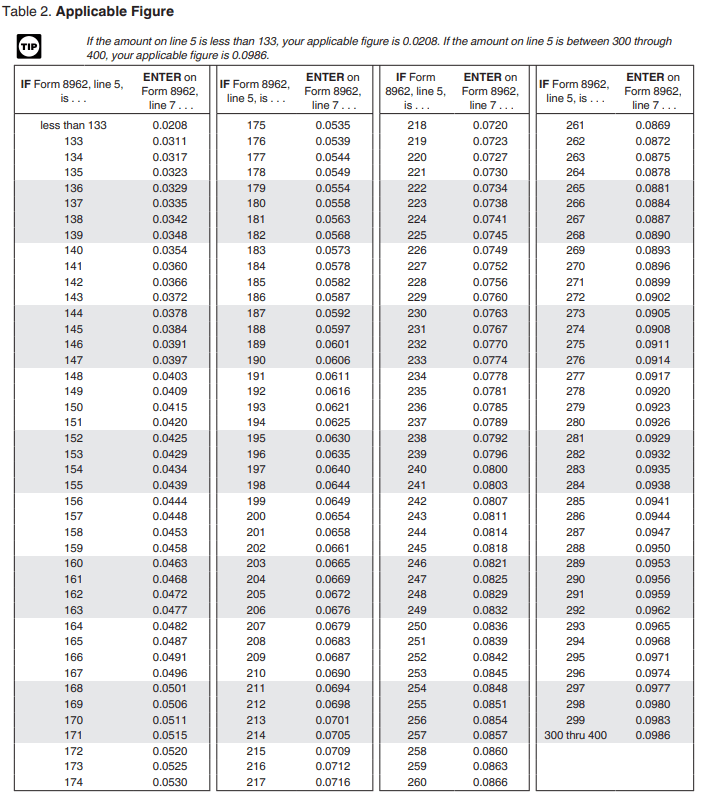

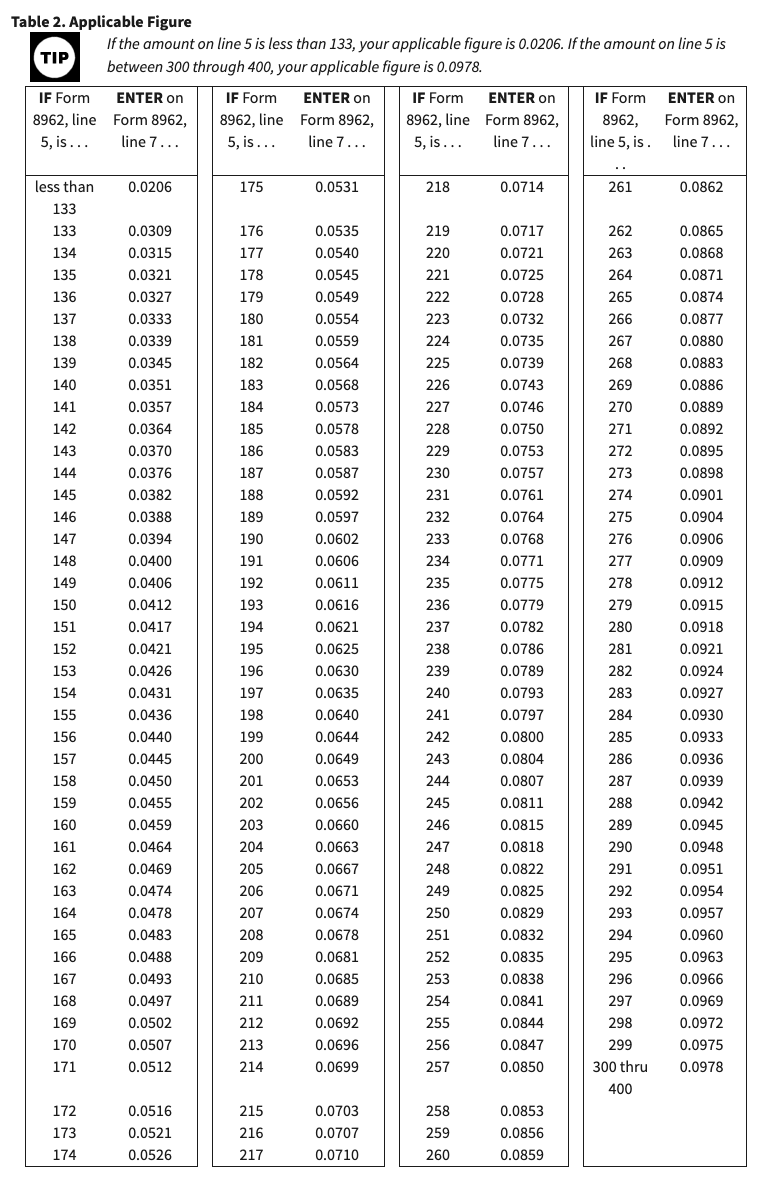

Tax credits are based on income and cap your monthly premium between roughly 2% and 9.5% (adjusts each year, see the form 8962 instructions for the numbers for more information) of your total household Modified Adjusted Gross Income (MAGI) per household member AKA household income.

Caps are based on the second-lowest cost Silver plan (SLCSP). The less income you have, the lower the percentage of your income you will pay within that range. Subsidy amounts are also determined by a plan’s premium before cost assistance compared to the SLCSP.

If your income changes slightly, then the exact amount of assistance you get will too. Each level of the Federal poverty line between 133%-300% equals a different Tax Credit amount (100 – 133 is about .2%, 300 – 400 is about 9.5%), and it’s up to you to decide what percentage of that Tax Credit you want to be paid to your insurer in advance.

TIP: It is important to note that if you take more tax credits than you end up qualifying for, you may have to pay some or all of them back at tax time. See repayment limits.

Learn more about the Federal Poverty Level here

Learn more about calculating MAGI and calculating tax credits.

TIP: If you think you might go over 400% of the poverty level, consider not taking credits in advance, if you think you’ll go under, consider that you won’t be able to take credits in retrospect if you do! Simply be mindful of the subsidy cliffs.

Premium Tax Credit Subsidy Caps By Percentage of Household Income for SLCSP

TIP: The numbers below are an example. Specific figures are updated each year.

Premium tax credits are based on the second lowest silver plan (SLCSP) in a state’s Marketplace. The chart below shows the minimum and maximum percentage of the household income that a person will pay for that plan. The amount you’ll pay is based on your household income (compared to the federal poverty level) and is adjusted based on the price of the plan chosen.

Keeping in mind that the exact numbers are subject to change each year, here are the Premium Tax Credit Subsidy Caps for 2021 from Rev. Proc. 2020-36:

| Income | 2021 |

|---|---|

| Less Than 133% FPL | 2.07% |

| At least 133% but less than 150% | 3.10% – 4.14% |

| At least 150% but less than 200% | 4.14% – 6.52% |

| At least 200% but less than 250% | 6.52% – 8.33% |

| At least 250% but less than 300% | 8.33% – 9.83% |

| At least 300% but not more than 400% | 9.83% |

NOTE: To qualify for tax credits you must make between 100% – 400% of the poverty level (FPL). If your state expanded Medicaid you will be eligible for Medicaid instead of tax credits below 133% (or 138% adjusted) FPL.

Advanced Premium Tax Credits And Other Options

A tax credit can be paid in advance to your insurer through the Marketplace. This is called an Advanced Premium Tax Credit. The amount paid to the insurer is the difference between your premium cap and the cost of the plan. You’ll see that number reflected when you compare marketplace plans.

As noted above, credits can also be taken at tax time. In fact, if you made more or less than you projected, you may either owe more money or get a refund depending on how much you took in tax credits upfront (explained below). You can also split tax credits between taking them upfront as Advanced Tax Credits and at tax time as tax credits.

Reporting Life Changes for Cost Assistance

Be aware that you should report your income if it changes, or if you have another life change that could affect what premiums you get. If you report life changes the marketplace can adjust your tax credit for you, if not you may end up owing money or being owed money on your tax returns.

NOTE: Tax credits can be paid in advance to lower your premium upfront or can be deducted from your Federal income taxes at the end of the year. If you didn’t take the full Tax Credit in advance, or you made less than you projected in 2014 and didn’t adjust your info in the marketplace, you can deduct the remaining amount on your Federal Income Taxes using Form 8962, Premium Tax Credit (PTC).

See our ObamaCare Facts simplified instructions for Form 8962, Premium Tax Credit (PTC).

Who is Eligible For Tax Credits

You are eligible for a Tax Credit if:

- You shop through the Health insurance Marketplace

- Your income is between 100%-400% FPL

- You’re not eligible for other coverage like employer-based coverage (this is true even if you are a dependent and a family member offered coverage through another member’s plan)

- You aren’t using Married Filing Separately Status

Sign up for your state’s Marketplace today and find out if you qualify for lower-cost premiums with Premium Tax Credits.

Paying Back Advanced Tax Credit Payments or Getting a Refund

If you got Tax Credits you’ll have to adjust them on your Tax Returns to find your Net Credit. Chances are that you will be owed a bigger Tax Refund, or you will owe a portion of those Tax Credits back up to the limitation amount based on income. You’ll need to fill out Form 8962, Premium Tax Credit (PTC) to adjust tax credits, click that link for a simplified guide to filing the 8962 form.

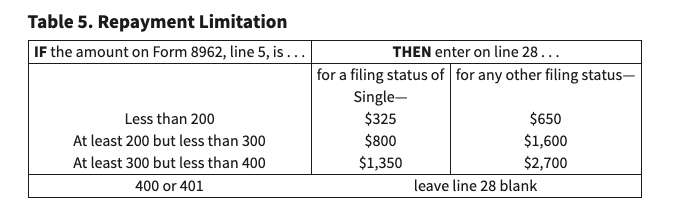

Line 28. Repayment Limitation for 2020 (may adjust each year). The amount you would have to repay due to excess Advanced Tax Credit Payments is limited according to income ensuring you can’t owe more than you can afford.

ObamaCare Tax Credit Repayment Thresholds For 2020 Plans (2021 Tax Season)

NOTE: The following Advanced Tax Credit Repayment limit table from form 8692 below is updated for 2020 coverage (accounted for on taxes filed in 2021).

NOTE: The American Rescue Plan Act expanded cost assistance under the Affordable Care Act and made some changes that impact tax credit repayment limits. Please see our page on repayment limits to learn more.

| Income % of FPL | Filing Status: Single | Filing Status: All Other |

|---|---|---|

| Less than 200% FPL | $325 | $650 |

| At least 200% FPL but less than 300% | $800 | $1,600 |

| At least 300% FPL but less than 400% | $1,325 | $2,700 |

| More than 400% FPL | Full Amount Received | Full Amount Received |

| If your year-end income exceeds 400% FPL, you will have to return the total amount of Advanced Premium Tax Credits you received. If you make too little to qualify for subsidies (less than 100% FPL), then you should owe NOTHING (per the directions of form 8962 from which this table comes). That being said, if you know you are going to price out-of-cost assistance, make sure to update your Marketplace account. You might become eligible for a free or low-cost Medicaid plan if your state expanded Medicaid. | ||

TIP: See federal poverty level for more details. Make sure to refer to the current 8962 form for calculations each year at tax time (you can always use last year’s numbers for a general estimate).

See the following two images from form 8962 for a better understanding of where the above numbers are coming from.

NOTE: The screenshots below are just examples, they are from the 2020 8962 instructions and are subject to change each year.

ObamaCare repayment limits for 2020 plans / 2021 tax season.

Subsidy caps for ObamaCare’s advanced premium tax credits for 2019 plans (for taxes filed in 2020).

Subsidy caps for ObamaCare’s advanced premium tax credits for 2020 plans (for taxes filed in 2021).