Household Size and Income, Coverage and Tax Family

How to Understand Household Income, Family Size, Tax Family, and Coverage Family for ObamaCare Cost Assistance

For ObamaCare, your “household” is your “tax family” (head of household, spouse, and tax dependents). Cost assistance is based on household income and size, the people who share a plan are called a “coverage family.”

With this in mind,

- Household income is MAGI of the head of household (and spouse if filing jointly) plus the AGI plus the AGI of anyone claimed as a dependent.

- Family size is the number of people in your “tax family.”

- Tax Family is everyone who files taxes together (not just everyone who lives together).

- Coverage Family is everyone sharing a plan.

- You’ll need to know all of this to claim cost assistance or exemptions for the Affordable Care Act in any year.

What Does Household Size Mean?

For determining cost assistance under the Affordable Care Act, “household size” is the number of people filing taxes together. This doesn’t have to be the same as the number of people sharing a plan together.

TIP: Don’t include anyone you won’t file taxes with when applying for cost assistance, but DO include anyone you will file with even if they don’t need coverage. Cost assistance is a form of tax credit.

What is Household Income / Family Income? (What Income is Counted For ObamaCare?)

Household income (sometimes called family income) is the income counted for ObamaCare. Household or family income for the ACA is MAGI of the head of household (and spouse if filing jointly) plus the AGI plus the AGI of anyone claimed as a dependent. Once you know your household income you can compare it to the corresponding Federal Poverty Level to understand what cost assistance you are eligible for.

What is AGI? / What is MAGI?

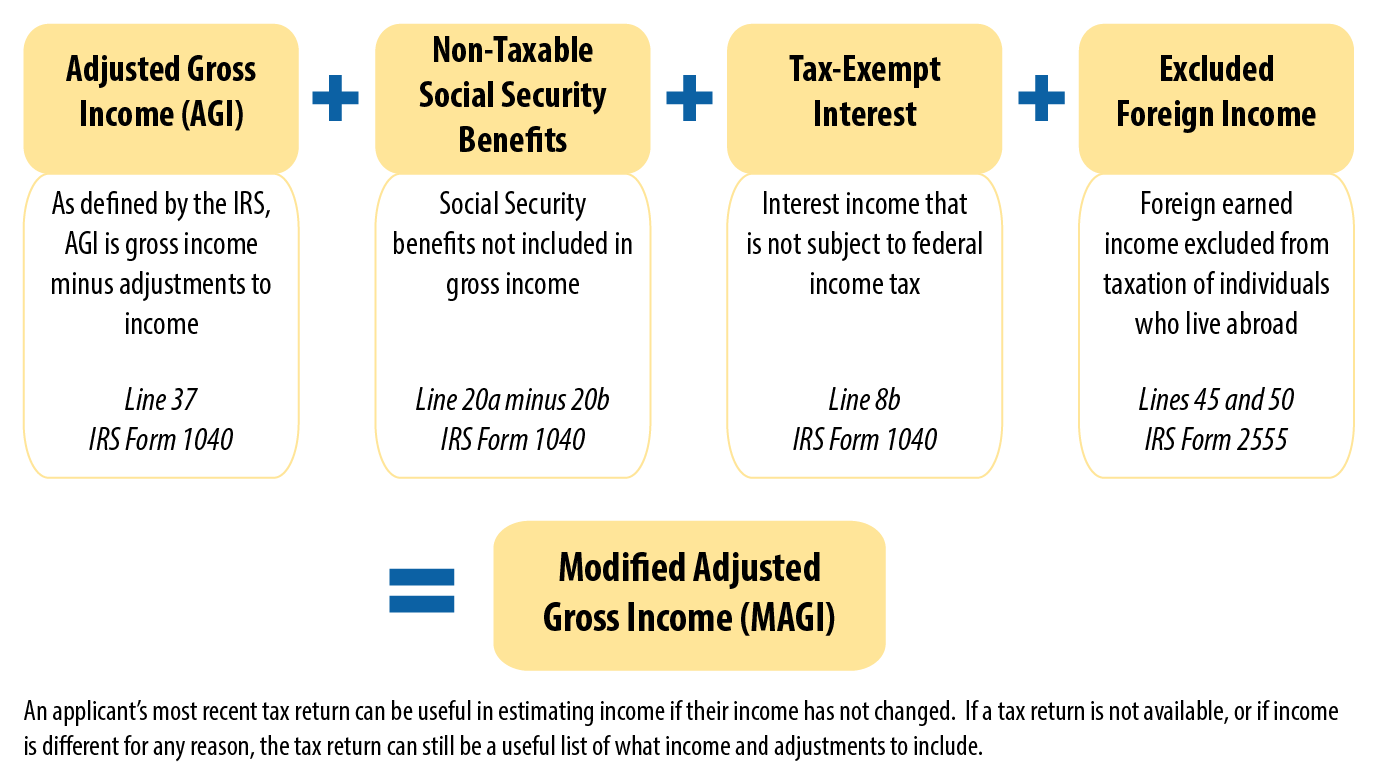

- AGI is Gross Income (income before taxes) adjusted for deductions.

- MAGI is Income adjusted for deductions, with certain income added back in.

You can learn more about MAGI and AGI here.

What Are Coverage Family and Tax Family?

Anyone who has filled out form 8962 for the Premium Tax Credit has heard the terms “coverage family” and “tax family,” let’s clarify what that means.

Everyone who shares a plan together is called a “coverage family” and everyone who files taxes together is called a “tax family.” Your “coverage family” and “tax family” don’t have to be the same, for instance, the head of household may have an employer plan while the rest of the family (who doesn’t have access to the plan) gets a plan on the Health Insurance Marketplace or through Medicaid or CHIP.

Tax Credits are Based on Household Size and MAGI, But be Aware That Coverage Family and Tax Family Can Be Different

Household size and household income are counted for the “tax family” filing together, but the “coverage family” (for tax purposes) is only the people on the plan.

Who To Include on a Marketplace Application

Now that you understand the terms and reasoning behind household size, household income, tax family, and coverage family, use the information below for further clarification.

HeatlhCare.Gov states this simply by saying, “follow these basic rules when reporting members of your household.”

- If you plan to claim someone as a tax dependent for the year you want coverage, do include them on your application.

- If you won’t claim them as a tax dependent, don’t include them.

- Include all of these people even if they don’t need health coverage.

Learn more about who you can claim as a tax dependent from the IRS.

| Relationship | Include in household? | Notes |

|---|---|---|

| Dependent children, including adopted and foster children | Yes | Include any child you’ll claim as a tax dependent, regardless of age. |

| Children, shared custody | Sometimes | Include children whose custody you share only during years you claim them as tax dependents. |

| Non-dependent child under 26 | Sometimes | Include them only if you want to cover them on your Marketplace plan. |

| Children under 21 you take care of | Yes | Include any child under 21 you take care of and who lives with you, even if not your tax dependent. |

| Unborn children | No | Don’t include a baby until it’s born. You have up to 60 days after the birth to enroll your baby. |

| Dependent parents | Yes | Include parents only if you’ll claim them as tax dependents. |

| Dependent siblings and other relatives | Yes | Include them only if you’ll claim them as tax dependents. |

| Spouse | Yes | Include your legally married spouse, whether opposite sex or same sex. Married couples must file taxes jointly to qualify for savings. |

| Legally separated spouse | No | Don’t include a legally separated spouse, even if you live together. |

| Divorced spouse | No | Don’t include a former spouse, even if you live together. |

| Spouse, living apart | Yes | Include your spouse unless you’re legally separated or divorced. (See next row for an important exception.) |

| Spouse, if you’re a victim of domestic abuse, domestic violence, or spousal abandonment | Not required | In these cases, you don’t have to include your spouse.See rules for victims of domestic abuse, domestic violence, or spousal abandonment. |

| Unmarried domestic partner | Sometimes | Include an unmarried domestic partner only if you have a child together or you’ll claim your partner as a tax dependent. |

| Roommate | No | Don’t include people you just live with — unless they’re a spouse, tax dependent, or covered by another exception in this chart. |

See “Who’s included in your household” from HealthCare.Gov for more information