How Does ObamaCare Affect Me?

What ObamaCare Means for You, Your Family, and Your Business

When hearing about the Affordable Care Act (ObamaCare), the first question that comes to mind is, “how will ObamaCare affect me, my family, and my business?” The answer, of course, depends on a number of factors including income and whether or not you currently have health insurance. Below we break down different segments of the population and discuss how each demographic will be affected.

TIP: This was written prior to the Affordable Care Act’s marketplace being implemented. However, it still generally applies today and will apply in years moving forward as long as the Affordable Care Act and its major provisions remain intact. For what has changed, please see ObamaCare changes.

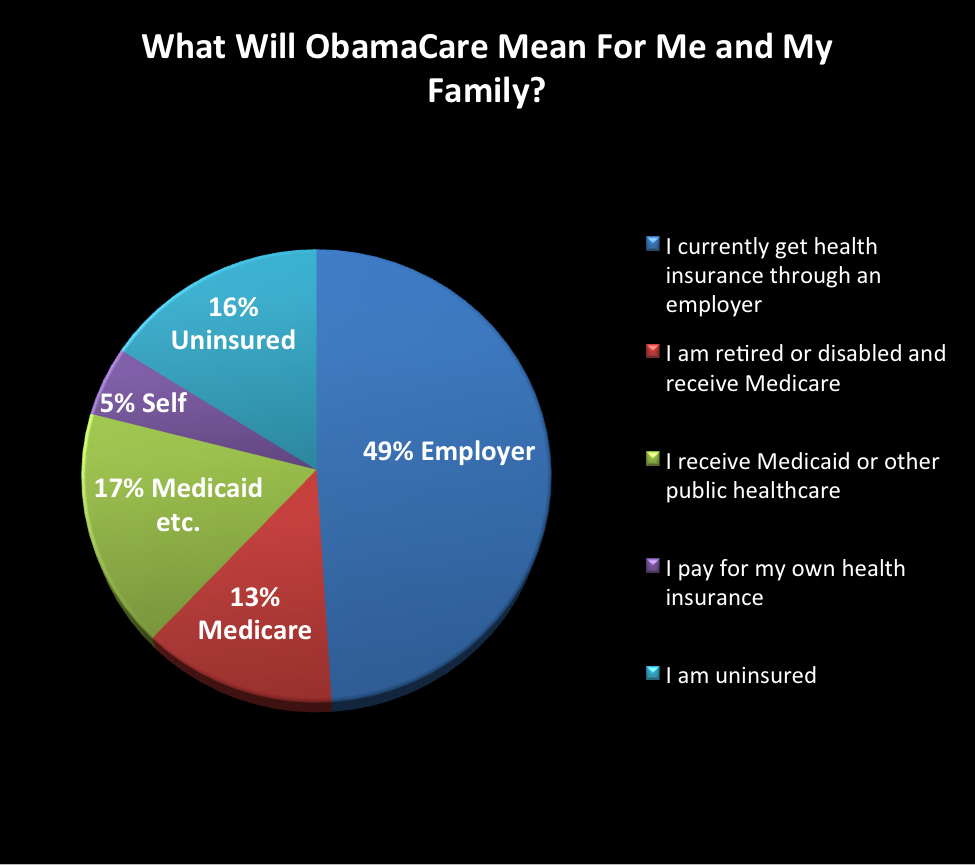

The percentage of US population in each category of the image above is from the Kaiser Family Foundation compilation of data for 2011. It is based on analysis by the Kaiser Commission on Medicaid and the Uninsured and the Urban Institute of the US Census Bureau’s Annual Social and Economic Supplement to the Current Population Survey (CPS ASEC). The CPS supplement is the primary source of annual health insurance coverage information in the United States.

The percentage of US population in each category of the image above is from the Kaiser Family Foundation compilation of data for 2011. It is based on analysis by the Kaiser Commission on Medicaid and the Uninsured and the Urban Institute of the US Census Bureau’s Annual Social and Economic Supplement to the Current Population Survey (CPS ASEC). The CPS supplement is the primary source of annual health insurance coverage information in the United States.

Where more than one kind of insurance was reported, individuals were sorted into only one category of insurance coverage using the following hierarchy:

- Medicaid: Includes the Children’s Health Insurance Program (CHIP), and those who have both Medicaid and another type of coverage, such as dual-eligible who are also covered by Medicare.

- Medicare: Includes those covered by Medicare only, as well as those covered by Medicare and a private or other sources of coverage.

- Employer: Includes those covered by employer-sponsored coverage either through their own job or as a dependent.

- Other Public: Includes those covered under the military or Veterans Administration.

- Individual: Includes those covered by private insurance other than employer-sponsored coverage.

- Uninsured: Includes those without health insurance and those who have coverage under the Indian Health Service only.

The Affordable Care Act Benefits Everyone

While some groups of people may pay more (specifically those with higher incomes) and some may have access to free or low-cost health insurance (those with low-to-middle incomes) everyone will have access to better quality health insurance that includes 10 Essential Health Benefits and some other benefits, rights, and protections. Let’s discuss some of the benefits that apply to all non-grandfathered health plans.

TIP: Benefits listed below are not all guaranteed on short-term plans and some limited benefit plans.

10 Essential Health Benefits

All qualified health insurance plans must include services from the following ten categories of “essential benefits“:

- Outpatient services, such as doctor visits or tests done outside a hospital

- Emergency services

- Hospital stays

- Pregnancy and baby care

- Mental health and substance abuse services, including behavioral health treatment

- Prescription drugs, including generic and certain brand-name drugs

- Rehab and rehabilitative services, those that help people recover from an accident or injury and those that help people with developmental issues.

- Lab tests

- Preventive and wellness services, along with those that help people manage chronic conditions. This includes chiropractic care.

- For children only, dental and vision services

Other Benefits for Everyone

- Easier to understand explanations of insurance coverage

- No limits on total annual or lifetime benefits. If you get seriously ill and need expensive treatment, you won’t have to worry about running out of insurance cover

- Guaranteed acceptance with no exclusions for pre-existing conditions

- Premiums will not vary with health or gender

- Free Preventative Care

- Many more benefits, rights, and protections will apply to you and your health insurance plan. Certain exclusions apply to health plans with grandfathered status.

Find Out How ObamaCare Affects You

Find the group you are a part of below to find out how the Affordable Care will mean to you. You can also use the AARP’s healthlawfinder tool for further information on how the Affordable Care Act affects you.

I currently get health insurance through an employer (49%)

- For the 170.9 million people covered by employers, not much will change. In most cases, you and your family will continue to enjoy the same or better healthcare under Obamacare. You’ll get all the new rights and protections offered by the program including not being able to be dropped when you are sick, free preventative care and essential benefits, better coverage for mental health problems, and the option to include dependents until they are 27 to name a few.

- Both the employer and employee premiums are taken out of income before taxes, so your health care is already subsidized by tax breaks

- Some existing employer plans offer limited benefits, exclude essential benefits (such as maternity care or mental health care) or have low limits on annual or lifetime benefits. Employers can still offer these plans for the present, but you may be better off buying a plan through the Health Insurance Marketplaces.

- By January 2015 large employers (those with more than 50 full-time employees) will have to offer plans that provide full-time employees with the new minimum health care coverage at the cost of no more than 9.5% of employee’s income. This provision is sometimes called the employer mandate.

- You will have the option to look for better coverage for yourself or your dependents through the new Health Insurance Marketplaces. However, you will not be eligible for premium tax credit assistance or cost-sharing assistance unless either

- The employer plan does not provide the 10 Essential Benefits or covers less than 60% of health costs (the standards required of a new “Bronze” level plan);

- The employee-only premium would be more than 9.5% of income.

- Small Employers (fewer than 50 employees) can look for better health plans through “S.H.O.P.” (Small Business Health Options Program), part of the new Health Insurance Marketplaces.” New tax credits for those with less than 25 full-time equivalent employees may encourage them to offer more generous plans.

- If you lose your job or decide to start your own business, the Health Insurance Marketplace will likely be a much better deal than the “COBRA” plan that allows you to continue your present coverage provided you pay the full premium.

I’m covered but can’t afford the premiums my employer asks for dependent coverage

- Unfortunately while the “Affordable Health Care Act” guarantees somewhat “affordable” premiums for employees, many employers require their employees to pay the full premium for dependent coverage if they choose it. This can be so expensive that many families cannot afford dependent coverage.

- You can buy coverage for dependents through the Health Insurance Marketplaces, but an unforeseen effect is that most dependents won’t be eligible for premium tax credit (subsidies) or cost-sharing assistance for low-income households.

- Hopefully, employers will stop offering unaffordable coverage for spouses who will then become eligible for cost assistance through the Health Insurance Marketplace

I work Part-Time

- The law will require large employers (more than 50 employees) to offer health care to full-time employees but has left it up to each employer to decide if it wants to offer coverage to part-time workers (working less than 30 hours a week).

- Some employers reduced hours for some jobs to below 30 hours a week to avoid the cost of providing healthcare.

- Others, who used to provide limited coverage to part-time workers, have realized that those workers could be better off if they buy insurance through the new Health Insurance Marketplaces. Some employers may choose to give you money to buy an individual health care policy instead of providing a company health plan.

- If your employer does not provide you with health coverage for any reason, you can use the Health Insurance Marketplaces to buy subsidized quality health insurance.

I am retired or disabled and receive Medicare (13%)

(AARP) The health care law means you’ll get more from your Medicare

New protections and benefits in the health care law strengthen Medicare, protecting the benefits you’ve earned, and providing more care from your coverage.

Your guaranteed benefits are protected

You’ve earned your Medicare over a lifetime of work. The health care law protects the benefits you were promised to ensure you can always get the care you need when you need it. The law also adds resources to fight fraud, scams, and waste and helps the Medicare program save money.

More preventive care is covered

Medicare now covers a yearly wellness visit and preventive care at no cost to you. This includes cancer, cholesterol and diabetes screenings, immunizations, diet counseling, and more.

Lower prescription drug costs

If you have Medicare Part D, and you reach the coverage gap or “doughnut hole” in 2013, you will get a 52.5 percent discount on brand-name prescription drugs and a 21 percent discount on generic drugs while in the coverage gap.

The discounts will continue until 2020 when the gap will be a thing of the past.

Check out the AARP’s Doughnut Hole Calculator to see how much you’ll save.

- Your Medicare benefits will continue with some improvements such as free preventative care and lower costs on prescriptions. You won’t have to replace your Medicare coverage with Marketplace coverage. No matter how you get Medicare, whether through Original Medicare or a Medicare Advantage Plan, you’ll still have the same benefits and security you have now.

- You should not use the new Health Insurance Marketplaces, as these do not cover Medicare. You still enroll for or make changes to your Medicare plan through http://www.medicare.gov/ or call 1-800-MEDICARE

- Medicare now provides free certain preventive services, like mammograms or colonoscopies, with no coinsurance or deductible payments. You also can get a free yearly “Wellness” visit.

- You can always see any doctor or healthcare provider that takes Medicare. If your doctor participates in these programs, you won’t be forced to change doctors. You can see still see any doctor or healthcare provider who accepts Medicare.

- Medigap Policies and Medicare Advantage Plans continue unchanged.

- Medicare beneficiaries who earn more than $85,000 ($170,000 for a couple) will have to pay more for prescription drug coverage in Medicare Part D

- Those who are enrolled in Medicare Part A, which covers hospital care, or the Advantage plans will meet the health law’s mandate for individuals to have insurance.

- Medicare will continue to provide the same care to those with serious potentially fatal illnesses. Rumors that Medicare will stop treating Cancer patients or that Obamacare creates “Death Panels” are completely false. The fact-checkers at PolitiFacts.com rate this a “Pants-on-Fire” lie. See politifact.com

| Year | You’ll pay this percentage for brand-name drugs in the coverage gap | You’ll pay this percentage for generic drugs in the coverage gap |

| 2013 |

47.5% |

79% |

| 2014 |

47.5% |

72% |

| 2015 |

45% |

65% |

| 2016 |

45% |

58% |

| 2017 |

40% |

51% |

| 2018 |

35% |

44% |

| 2019 |

30% |

37% |

| 2020 |

25% |

25% |

- Prescription benefits improve: You can save money on brand-name drugs if you’re in the “donut hole,” you’ll also get a 50% discount when buying Part D-covered brand-name prescription drugs. The discount is applied automatically at the counter of your pharmacy—you don’t have to do anything to get it. By 2020, you’ll pay only 25% for covered brand-name and generic drugs during the gap—the same percentage you pay from the time you meet the deductible (if your plan has one) until you reach the out-of-pocket spending limit (up to $4,750 in 2013).

Read more about the Medicare Part D Coverage Gap (Donut Hole).

For more information get a free copy of Medicare & You 2015

This official government booklet tells you: Summary of Medicare benefits, coverage decisions, rights and protections, and answers to the most frequently asked questions about Medicare. Medicare.gov

I receive Medicaid or other public healthcare (16% Medicaid, 1% other)

- Medicaid is a joint Federal-State program where each State can adopt its own rules. Eligibility will be determined by your State.

- As of 2015 30 States (and DC) have adopted a new expanded Medicaid program that covers all Americans in families below 138% of the Federal Poverty Level. This will include single adults who previously were unable to qualify for Medicaid. Not every State expanded Medicaid as the Supreme Court ruled that each State could opt-out. Arkansas has an interesting variant – those qualifying will be able to buy coverage in the Health Insurance Marketplace and Medicaid will pay their premiums! Pennsylvania plans a similar system. State’s can still opt-in to expanding Medicaid under alternative programs, so if your state hasn’t expanded it doesn’t mean it won’t in the long run.

- States expanding Medicaid as of 2014 – AZ, AR, CA, CO, DE, DC, HI, IL, IA, KY, MD, MA, MN, MA, NV, NJ, NM, NY, ND, OR, PA, RI, VT, WA, WV,

- States not expanding Medicaid as of 2014 (new states have opted-in to expanding Medicaid, see the most recent list here) – AL, AK, FL, GA, ID, IN, KS, KY,LA, ME, MS, MO, MT, NE, NC, OK, SC, SD, TX, UT, VA, WI, WY

- States that have not yet decided NH, OH, TE

- C.H.I.P. the children’s health insurance program for those just above Medicaid income limits will continue but for many families, it will make more sense to buy a new policy for the whole family in the Health Insurance Marketplace

- Apply to your State’s Health Insurance Marketplace to see if you qualify for Medicaid.

- Veterans can still receive care through the VA system

- Indian Tribes can receive care through the Indian Health Service

- Other Government employee and retiree programs like FEHBP or TRICARE are considered as employer-provided insurance. They will continue to function much in the same way they do now and will remain unchanged aside from the new rights and protections offered by ObamaCare.

- The only people forced to switch to coverage obtained through the Health Insurance Marketplaces will be Members of Congress and their staff.

I pay for my own health insurance (5%)

In the past, individual health care policies were more expensive and offered fewer benefits than most employer group policies. Often pre-existing conditions were not covered and premiums increased sharply with age or because of prior health history. More than half of these plans had high deductibles and limited annual or lifetime benefits. Insurance companies would frequently dump anyone who became seriously sick. They were happy to collect premiums from those who did not need health care but hated to have to pay anything out.

- If you currently have a cheaper policy with very high deductibles and low coverage, this may no longer be available. Upgrading to a policy that offers better benefits may cost more than you want to pay (though after considering the better benefits and tax credits available you may find yourself better off). However in most cases, you have a choice – you can switch on January 1st to a new policy, or keep your present “grandfathered” policy until it expires without having to pay the penalty.

- However, many of these policies paid out very little of the premiums collected for healthcare. The new law requires insurance companies to spend at least 80% of premium income on health benefits, or else refund the difference to policyholders. This rule, together with competition from policies offered through the new health exchanges, means that many companies are leaving the individual insurance market and telling policyholders they had to find new care by January 1st, 2014.

- In most states, new plans can be purchased either through the Health Insurance Marketplace or an insurance broker. You must purchase a qualifying plan through the Marketplace to get a premium tax credit.

- New plans are required to cover all “10 essential health benefits.” At present, many individual policies exclude maternity, mental health, and drug coverage.

- All plans will have to offer free preventative care

- New plans cannot exclude preexisting conditions and cannot raise premiums because of health issues.

- New plans must provide similar levels of coverage to the plans sold on the Health Insurance Marketplace: Catastrophic, Bronze, Silver, Gold or Platinum and must follow new rules that will make it easier to compare plans and see what is covered.

- Because of these big differences in coverage, you cannot compare premiums for many individual plans offered in the past with new plans

- Premiums will depend only on age and if you are a smoker. Women cannot be charged more, and the premiums for older members may not exceed three times the premium for a 21-year-old. In some states, such as New York, premiums must be the same for all ages as they are in most employer group plans. Most State’s present plans allowed premiums to increase to five times the premium for a 21-year-old. So women, older adults and those with health problems will find their rates under ACA are much cheaper but healthy young men are likely to have to pay more. However, in many cases, cost-assistance will offset this increase.

- Anyone over 30 (unless they are low-income, undocumented aliens, or incarcerated) must purchase at least a bronze plan or pay the penalty that will help offset care for the uninsured

Pre-existing Condition Insurance Plan (PCIP), which is a Federal program introduced under the Affordable Care Act as an interim measure, and the 35 similar state-run “Last resort” policies for people with pre-existing conditions who had been denied coverage elsewhere, will no longer be needed. Even the sickest people can purchase health coverage without higher premiums. The costs of care for the sickest are shared across the whole population, just as they are in employer group policies.

If you currently have such a PCIP or a State high-risk pool policy, you will find similar coverage at much lower cost through the Health Insurance Marketplace.

Beware of Scam Artists!

To avoid scams buy insurance only through the Health Insurance Marketplace or from an accredited and licensed agent. Professional insurance agents who have passed exams are one of the following qualifications:

- Registered Health Underwriter (RHU)

- Health Insurance Associate (HIA),

- Registered Employee Benefits Consultant (REBC),

- Certified Employee Benefits Specialist (CEBS), or

- Chartered Life Underwriter (CLU).

You can find a professional insurance agent through the National Association of Health Underwriters Agent Finder Tool: nahu.org

(Hint: enter your zip code, set search radius, check Individual Health Plans in the Practice Areas Section, and leave the rest blank)

I am uninsured (16%)

About 50 million nonelderly individuals were uninsured for at least part of 2012. Going without coverage can have serious health consequences because the uninsured receive less preventive care, reducing the chance that disease will be detected early. Delayed care often results in more serious illness requiring expensive treatment and in many cases leading to permanent disability or death.

For health insurance purposes a “family” is considered to be a taxpayer, spouse, and anyone claimed as a “dependent” on the family’s tax return.

The tax rules for who is a dependent are complicated (you can read about them in IRS Publication 501) but in general a dependent is a relative (including those related by marriage) whose own income covers less than half of their expenses. So sons and daughters away at college will be dependents if their earnings cover less than half their expenses, but an adult child who works but still lives at home is considered a separate family for health insurance purposes.

- I work full-time but my employer does not offer health insurance

- Businesses with more than 50 employees were required to offer insurance to all full-time workers (working 30 or more hours a week) after 2015

- Small employers (less than 50 employees) can arrange coverage through the “S.H.O.P.” Marketplace, which should have better rates than previously available to small businesses. You should check with your employer to see if they intend to offer insurance

- New tax credits are available to help small employers (with less than 25 employees) provide coverage

- If your employer does not offer health coverage in 2014 you can buy your own coverage through the Marketplace, and most people will receive tax credits that pay for part of the premium.

- Low-income workers, or those with many dependents, may qualify for the expanded Medicaid (if your State participates).

Your employer should tell you what health coverage they will offer in 2014. Almost anyone can look for coverage through the Health Insurance Marketplaces (formerly called Exchanges), but subsidies are only available if your employer did not offer health insurance.

- My employer offers insurance but I can’t afford the premiums

- This will remain a big problem for low-income workers. Health care is expensive and in 2013 KFF estimate that the average employer-provided insurance costs $16,351 per family, and employees on average paid 29% of this amount (almost $400 a month). Obviously, the premium paid by individual families varies a lot depending on family size and the generosity of the employer. Employers may ask workers to pay up to 50% of the cost of employee coverage, and 100% of the cost of dependents coverage.

- If the premium for employee-only coverage would be more than 9.5% of your earnings, you are considered uncovered, and so eligible to buy a subsidized policy through the Health Insurance Marketplaces.

- If the premium for employee-only cover is less than 9.5% of your income but is still more than you can afford, you can look for more affordable coverage for yourself and your dependents through the Health Insurance Marketplace, but you will not be eligible for premium assistance.

- I get insurance through my job but my spouse and children do not

- You are considered uncovered and can apply for better coverage through the Health Insurance Marketplace with premium assistance for the whole family if you meet these two conditions. First, if the employer-offered coverage does not offer adequate coverage by covering 60% of expected average medical expenses and all “Ten Essential Benefits.” Second, the premium for employee-only coverage cannot be more than 9.5% of your earnings.

- If your employer does not offer dependent coverage, you can apply for insurance for your dependents through the Health Insurance Marketplace, and the cost of covering uninsured dependents may be reduced by premium tax credits

- If your employer offers dependent coverage but at premiums that you cannot afford to pay you can buy insurance through the marketplace (either for the whole family or just dependents) but you will not qualify for premium assistance

- When comparing the costs of employer-provided and individual health insurance remember that your premiums for employer group health insurance (including premiums for dependents) come out of your paycheck before social security and taxes are calculated. Premiums for individual health coverage come out of after-tax income.

- I have health problems and was refused health insurance, or asked to pay premiums that I could not afford

- The Affordable Health Care Act stops insurance companies from denying coverage to those who are sick, excluding benefits for pre-existing conditions or asking them to pay higher premiums.

- It also limits age-related higher premiums to no more than three times the premium charged to a 21-year-old, this will save money for those over 50 but may also raise rates for younger people.

- You will be able to apply for insurance through the Health Insurance Marketplace, and they will not deny you coverage or ask you to pay extra.

- If you have high health expenses, you may want to consider a “Gold or “Platinum” policy, which will pay a higher percentage of your expected medical expenses. Each policy will vary, but Gold and Platinum policies may have low or no annual deductible, lower co-payments, and lower maximum annual out-of-pocket costs.

- I lost my job and with it my employer health insurance

-

- Job loss accounts for a large proportion of the uninsured. Although anyone leaving a job is guaranteed the right to keep their health insurance for a year by COBRA, they would have to pay the full premiums themselves, which few unemployed people can afford to do.

- Job loss is one of the changes that allow you to apply for health insurance outside the open enrollment period

- Predicting your 2014 income would be difficult because you do not know how long it will be before you find a job, or what that job will pay. Use your present income level from the month in which you lost your job. Then when you find a new job or get alternative insurance, whether it is employer-provided, Medicaid or Medicare, inform the Health Insurance Marketplace of the change. The IRS will calculate premium tax credits on a month-by-month basis, taking into account only those months you were without employer-provided or other insurance.

- You may qualify for Medicaid, though eligibility rules vary considerably from state to state. In about half the states childless adults are not eligible to claim Medicaid (unless pregnant or disabled)

- Insurance is available through the Health Insurance Marketplace but may still not be affordable. The Marketplace will also tell you if you qualify for Medicaid.

- I am a student and have little money

Your situation depends on whether someone claims you as a dependent on their tax return. If your own income covers less than 50% of the cost of your support you probably qualify as a dependent on someone’s tax return. In this case, you are considered part of their family even if you live separately and your income is included with theirs in assessing premium subsidies.

-

- If you are under 27, a parent can now add you to their employer-provided policy.

- If someone claims you as a dependent on their tax return and is buying their insurance on the Marketplace, they can include you on their family policy. In many cases, tax credits mean that adding a dependent won’t increase the premium they pay.

- If you are not claimed as a dependent, and you expect your 2014 income will be less than $15,856 you probably qualify for the expanded Medicaid program, provided your State did not opt-out.

- If you are not a dependent, are a US citizen, or Legal Permanent Resident, and earn between $15,856 and $45,960 (more if you have dependents of your own) you can get a tax credit to assist you in buying a policy.

- Non-citizens, here on Student visas do not qualify for tax assistance.

- I am self-employed

- In the past individual health insurance for the self-employed was either expensive or for many individuals unobtainable due to preexisting health conditions.

- You can buy a policy for yourself and family in the Marketplace at guaranteed rates that will not be affected by preexisting health conditions

- Premiums will be much lower, or benefits higher, than previously available insurance,

- If you have employees you can purchase a small business policy that covers you and your employees

- New Premium Tax Credits may cover part of the cost

- I work one or more part-time jobs, have dependents to take care of, and can’t afford insurance.

-

- 16% of uninsured are in your situation. Employers are not required to offer you health insurance but if they do (at a cost less than 9.5% of your income) you are not eligible for premium tax credit assistance

- Because most part-time workers cannot afford even the employer-subsidized premiums, and offering benefits may prevent the workers getting subsidized insurance through the Health Insurance Marketplace, some employers who used to offer health care to part-time workers decided not to do so after 2014.

- Since many part-time jobs are at low-wage, part-time workers are unlikely to be able to afford premiums for dependent coverage. In many states may not qualify for Medicaid either, although their children will usually qualify for Medicaid or C.H.I.P.

- Otherwise, the rules are the same as for those with full-time jobs. You can look for coverage through the Health Insurance Marketplace, which will also tell you if you qualify for Medicaid.

- I am an undocumented immigrant

- Sorry but ObamaCare cannot help you. Congress prohibited the government from assisting with your healthcare.

- If your children are US Citizens, and so here legally, they may qualify for assistance through other programs like Medicaid but you still cannot claim a premium tax credit and cannot obtain health insurance through the Health Insurance Marketplace.

- I don’t need health insurance, so why should I have to pay for it?

-

- Everyone needs health insurance sometime in their lives. You may be perfectly healthy and fit today but who knows what tomorrow will bring? You may get run down by a car, fall and break a leg, or get hurt in an incident. Even fit high school and college football players suddenly have heart attacks. A sudden pain may turn out to be cancer, requiring very expensive treatment. We all underestimate the chances of this happening to us until it does.

- The whole point of insurance (whether it is fire insurance on your home, auto insurance, or health insurance) is the sharing of risks. Consider home insurance: in most years you pay far more in premiums than you receive back but then comes a year when a fire, hurricane or tornado demolishes your home, and you will be glad to have insurance. Similarly, your state requires you to have car insurance, even though you hope won’t have an accident this year. When we get very sick, medical bills sky-rocket and the only way we can afford to treat those seriously ill is if the healthy share the cost. So employer-based insurance shares the burden of caring for the sick across all employees and each employee knows that if he gets sick he will be taken care of.

- If only the sick bought health insurance, premiums would be unaffordable. The Affordable Care Act brings new benefits like the prohibition on pre-existing condition exclusions and the guarantee that no one will be denied coverage when they need it. These protections are only possible if healthy individuals purchase insurance and do not wait until they fall sick.

- Emergency Rooms have to treat everyone, whether they can pay or not. So currently people who don’t have insurance rely on emergency rooms, which is a very expensive way to provide treatment. The cost of caring for the uninsured is pushed on to other patients and ultimately to the taxpayer. Even if you are healthy, all the new health insurance policies offer free preventative care, designed to detect conditions such as diabetes, heart disease or cancer that if untreated could lead to serious illness, disability or death. Early treatment might save your life!

- If you are under 30, you can just opt for “catastrophic” health insurance, designed to cover unforeseen emergencies.

- You still have a choice whether to get insurance or not: if you choose not to get insurance even though you could afford it, you simply have to pay a “Shared responsibility payment,” which will be 1% of your income (or $95 if that would be less).

- You are exempt from paying this penalty if are not required to file a tax return, earn less than 138% of the Federal Poverty Level, or if the lowest “Bronze” insurance available in your area would cost more than 8% of your income. You are also exempt if you are here illegally, incarcerated, a member of an Indian tribe, a member of certain religious groups that provide health care, or live outside the USA. See irs.gov

- If you can’t afford insurance on your own and your taxable income is less than 400% of the Federal Poverty Level you will be eligible for lower premiums and out-of-pocket costs through your State’s health insurance marketplace.

- Consider a lower-cost “Bronze” plan. After tax credits, these policies may cost as little as $20 a month and may cost you nothing if the tax credit covers the entire premium.

To find the options available to you visit www.healthcare.gov

How Will ObamaCare Affect Me?

![]()