Why ObamaCare is Not Socialism

ObamaCare isn’t “socialism”. Under ObamaCare we have a regulated private health care industry that uses a mix of public and private funding..

ObamaCare isn’t “socialism”. Under ObamaCare we have a regulated private health care industry that uses a mix of public and private funding..

Ted Cruz may “get ObamaCare” or as we like to call it “buying health insurance”. Ted Cruz is a showman and we expect he’ll use this experince as a stunt, if he does decide to go through with it.

Employers can use Health Reimbursement Arrangements (HRAs), Employer Payment Plans, and Flexible Spending Accounts (FSAs) to save money on healthcare. We take a look at healthcare arrangements to find out how they can benefits employers and employees alike. We will also look at how they affect employer and employee taxes and penalties. It’s important to understand… Read More

The best health insurance plan for an individual or family is going to depend on the income and needs of that family. With that said, many will find a marketplace plan that qualifies for cost assistance to be the best value for them. Very generally speaking the best health plan when it comes to benefits… Read More

ObamaCare and Health Insurance for the Self-Employed The Affordable Care Act (ObamaCare) has some important implications for how the self-employed go about obtaining, maintaining, and paying for health coverage. If you’re self-employed, most of the healthcare provisions in the ACA apply to you. Let’s take a look at how you’re affected by ObamaCare, how you can reduce the cost of coverage, and how… Read More

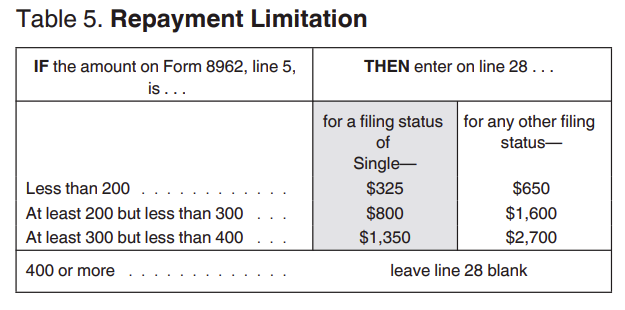

How Repaying ObamaCare’s Premium Tax Credits Works If your income changes, you may have to pay back Advanced Premium Tax Credit Payments up to the Advanced Tax Credit Repayment Limit based on your income. If you don’t claim enough money to qualify for tax credits, you won’t owe back anything. IMPORTANT: The 400% Federal Poverty Level… Read More

Affordable Care Act Vision Coverage Vision insurance generally isn’t covered under the Affordable Care Act (ObamaCare). However, pediatric eye care is a required benefit included on all plans that qualify as minimum essential coverage under the ACA. Even though adult vision coverage isn’t a required benefit of ObamaCare, “vision health” is still an important aspect… Read More

Get the facts on the ObamaCare replacement plan by Burr, Hatch, and Upton: the Patient Choice, Affordability, Responsibility, and Empowerment (CARE) Act. Below we present a summary, some quick facts, a pros and cons chart, a complete section-by-section breakdown, and finally we compare the CARE Act proposal to ObamaCare. Keep in mind this is an older replacement… Read More

Starting in 2015, employers who don’t offer qualifying coverage, will make a Employer Shared Responsibility Payment. Get simplified instructions on the fee below. This page covers employer responsibility under the ACA and the payment. For more details see Employer Mandate. What is Shared Responsibility? Shared Responsibility is part of the ACA’s Title I. Subtitle F—Shared Responsibility for… Read More

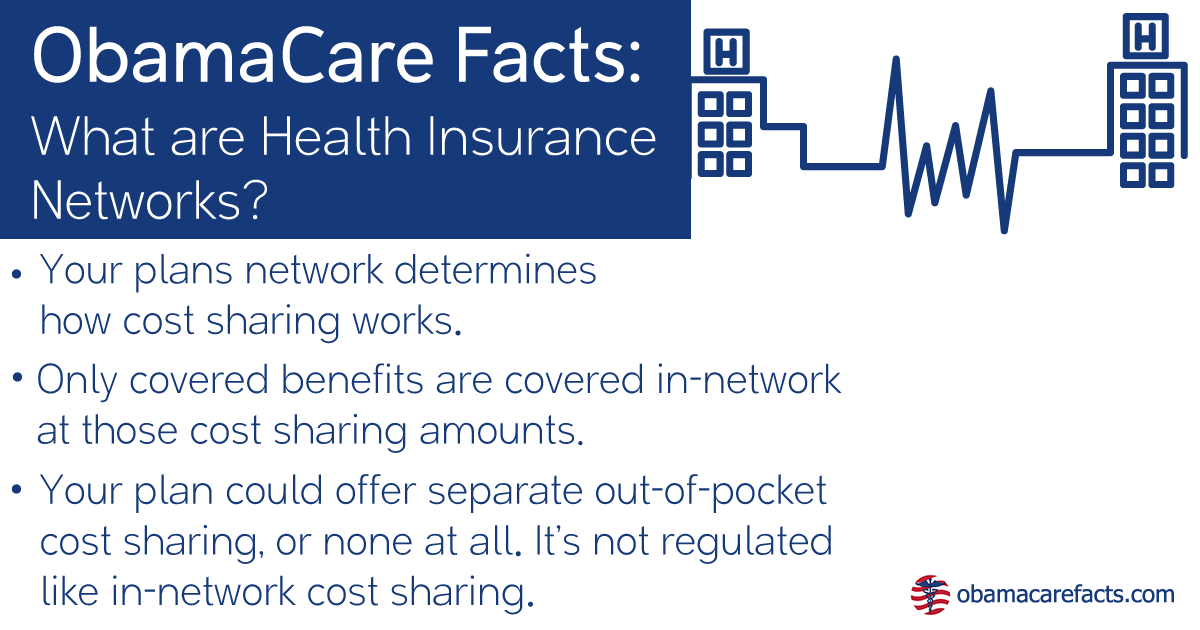

How Health Insurance Networks Work With Health Insurance The general types of networks are HMOs and PPOs. A given provider will then either be “in-network” or “out-of-network” for a given plan. You and your insurer save money by using “in-network providers.” You’ll almost always have different cost-sharing when you use a provider “out-of-network,” so you’ll… Read More

Covered benefits are the items your plan covers with cost sharing in it’s network. Uncovered benefits, or covered benefits out-of-network cost more. ObamaCare’s Essential Benefits vs. Covered Benefits Under the ACA all major medical plans must offer at least one covered service from ten categories of essential health benefits. That makes all essential benefits covered… Read More

Everything You Need to Know About Multi-State Health Plans If you travel out-of-state often, you may want a multi-state health plan through the Health Insurance Marketplace. Most plans are regional, so consider a multi-state plan even if you only plan to travel between two states. Ask this youtube video on “tricky plan issues” explains, you… Read More

A 2015 report from the Commonwealth Fund shows a rise in health care coverage and affordability since ObamaCare was enacted.

ObamaCare’s Platinum Plan is a type of Metal Plan on the Health Insurance Marketplace. Platinum Plans qualify for Tax Credits and have the highest premiums. Other Metal Plans include Bronze, Silver, and Gold. Also, a Catastrophic Plan is available to young adults and to some people with hardship exemptions. Platinum plans have the highest premiums and the lowest cost-sharing. They only make… Read More

ObamaCare’s Gold Plan is a type of Metal Plan on the Health Insurance Marketplace. Gold Plans qualify for Tax Credits, have high premiums, and generous cost-sharing. Other Metal Plans include Bronze, Silver, and Platinum. Also, a Catastrophic Plan is available to young adults and to some people with hardship exemptions. Gold plans mean higher premiums, less Tax Credits, but much… Read More

ObamaCare’s Bronze Plan is a type of Metal Plan on the Health Insurance Marketplace. Bronze Plans qualify for Tax Credits and have low premiums. Other Metal Plans include Silver, Gold, and Platinum. Also a Catastrophic Plan is available to young adults and to some people with hardship exemptions. All plans offer basic benefits and minimum cost-sharing, Bronze Plans tend… Read More

ObamaCare’s Silver Plan is a type of Metal Plan on the Health Insurance Marketplace. Silver Plans qualify for both Tax Credits and Cost-Sharing subsidies. Other Metal Plans include Bronze, Gold, and Platinum. Also, a Catastrophic Plan is available to young adults and to some people with hardship exemptions. HealthCare.Gov, or your state’s Marketplace in states that don’t… Read More

Understanding the difference between HMO Health Maintenance Organization and PPO Preferred Provider Organization health plan types helps you compare plans to get the right coverage for you and your family. You can learn about the less common EPO Exclusive Provider Organization plans here. Under ObamaCare most plans are either HMOs or PPOs. Knowing which one is… Read More

If your state didn’t offer auto-renew, or you don’t have confirmation your plan auto-renewed. You have until the end of open enrollment each year to get covered.

Your health plan’s Summary of Benefits and Coverage (SBC) is a summary of what your plan covers in terms of benefits and cost sharing, and explanations of how everything works. We suggest opening up a Summary of Benefits and Coverage sheet as you follow along. The Summary of Benefits and Coverage PDF can be found… Read More

Get health insurance quotes and find out if you qualify for cost assistance from CMS approved brokers and on HealthCare.Gov. Below we will discuss the best ways to get health insurance quotes (HINT: Start at ObamaCare’s Health Insurance Marketplace sometimes called “the Marketplace” AKA HealthCare.Gov). We’ll also give you lots of helpful advice to help ensure you get… Read More

Here is a quick list of tips for getting the best health plan. No matter how you shop, this list will ensure you don’t over or under-buy health insurance. NOTE: Finding the best health plan for you and your family depends on your family size, income, needs, region, and more. The best plan for one… Read More

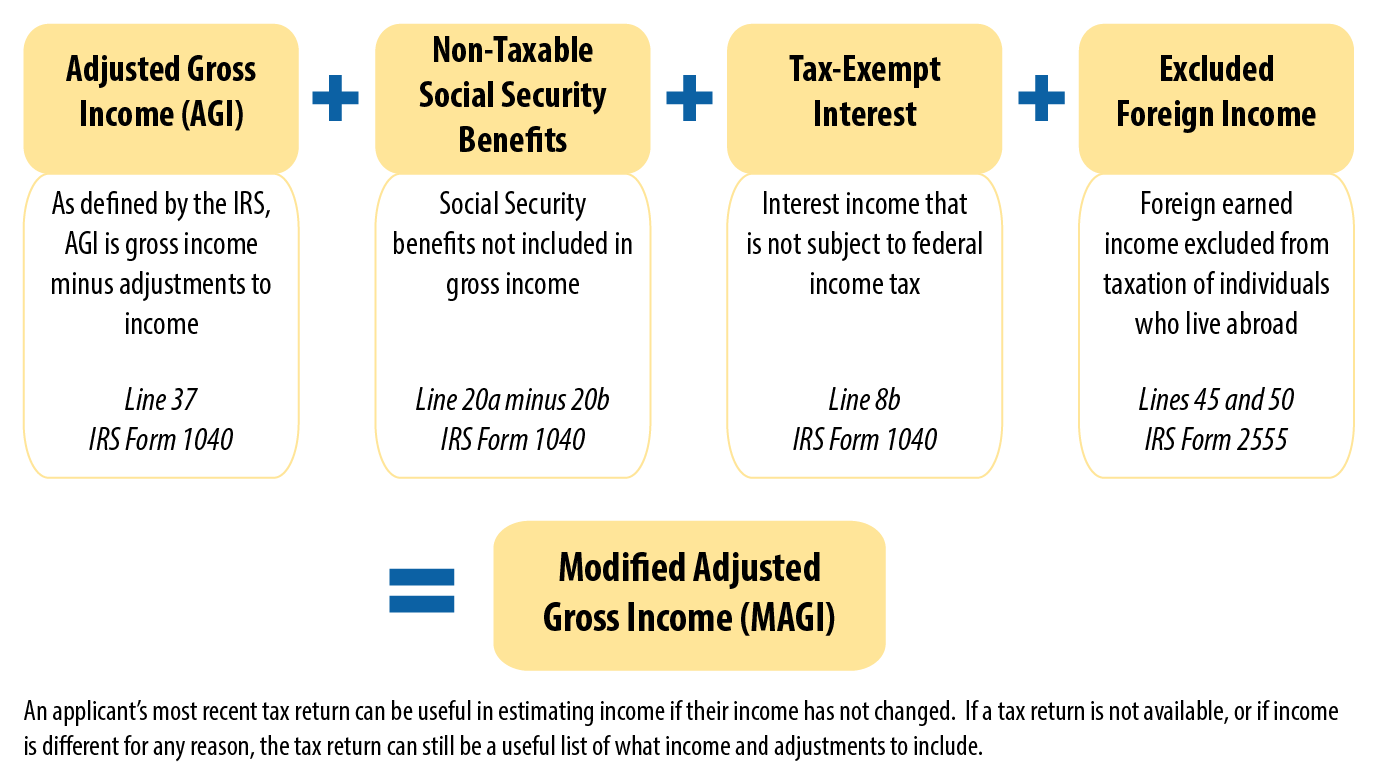

What is Modified Adjusted Gross Income (MAGI), Adjusted Gross Income (AGI), Gross Income (GI), Family Income, Household Income, Etc? Modified Adjusted Gross Income (MAGI) is Gross Income (GI) Adjusted for deductions (AGI) and then Modified by adding some deductions back in (MAGI). On this page, we cover MAGI as it applies to Medicaid and the Marketplace…. Read More

Having Health Insurance means you are covered in an emergency. Not getting coverage could result in big fees for those who wait until taxes are due. Obtaining and maintaining health insurance isn’t just about avoiding a fee, it’s about taking responsibility for your health, knowing you have coverage when you need it, and avoiding the devastating… Read More

What is Health Insurance Coinsurance? In health insurance, coinsurance is your share of costs of the allowed amount for a covered service after you reach your deductible. Coinsurance is different from a copay which is a fixed dollar amount for services and is not typically dependent on meeting your deductible. How does Coinsurance Work? Each service or drug that is subject… Read More