ObamaCare Medicare: ObamaCare and Medicare

Get the Facts on the Impact of ObamaCare on Medicare

This page contains a summary of everything you need to know about the Affordable Care Act (ObamaCare) and Medicare.

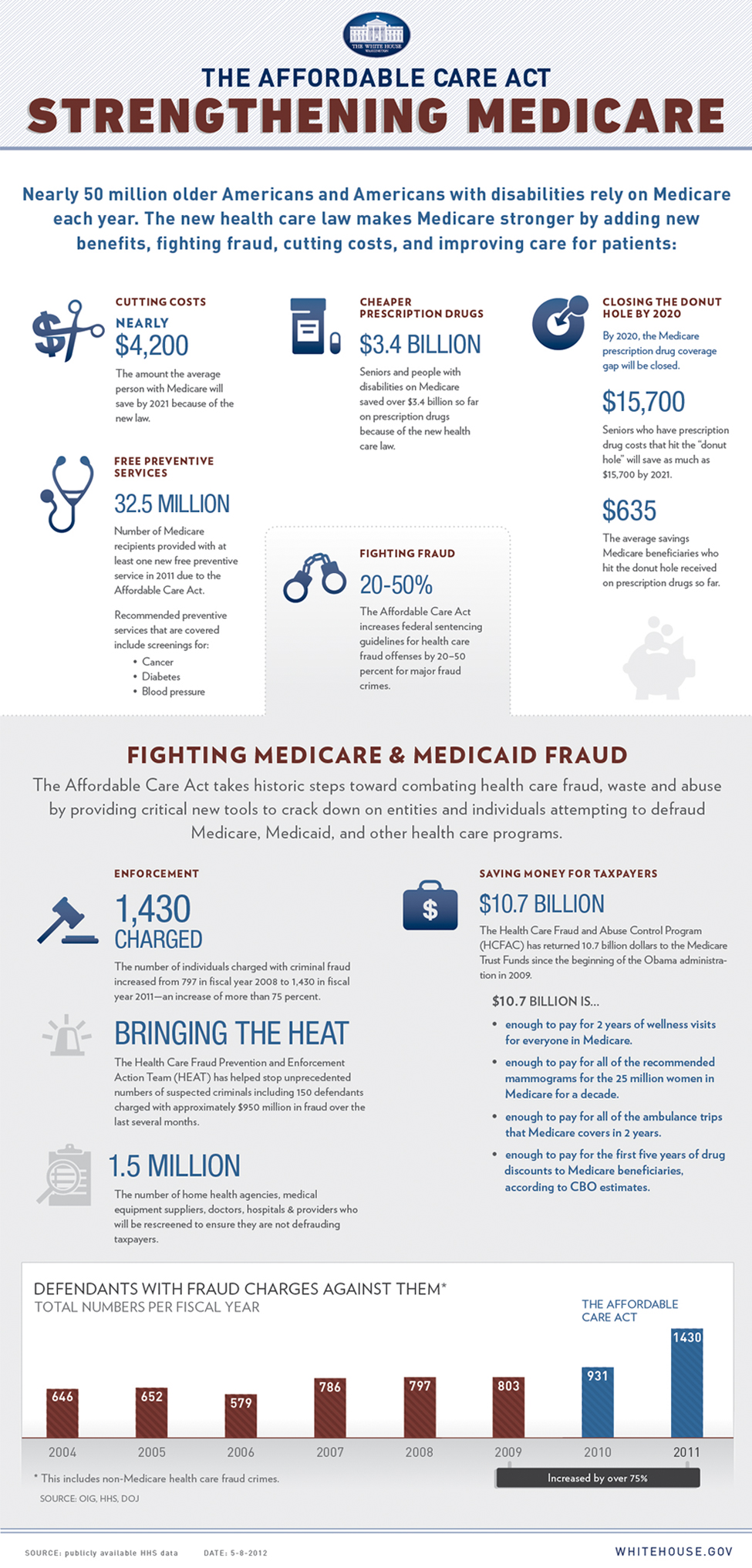

ObamaCare’s Medicare reforms improve and expand Medicare for seniors. One way it does this is by closing the Part D Donut hole (you have paid only 25% for covered brand-name and generic drugs during the gap since 2020). Another way is by expanding preventive services like mammograms or colonoscopies, without charging the Part B coinsurance or deductible and adding more wellness visits.

Let’s take a look at what ObamaCare’s Medicare reforms mean for seniors and how the ACA (ObamaCare) impacts Medicare and Medicare Advantage.

Medicare Advantage Plans Under ObamaCare

Medicare plans are still offered under the Affordable Care Act. The only real difference is now beneficiaries have some extra benefits and the donut hole is closed.

That means you can still get Original Medicare, Medicare Advantage, Part D, and Medigap through any licensed Medicare agent or broker (see a list of Medicare Advantage and Medicare Drug plans).

Now that you know how to get Medicare under the ACA, the rest of the page will focus on explaining changes to Medicare under the ACA. Let’s start by talking about the Medicare cuts and how they impacted Medicare Advantage.

A Summary of Medicare Cuts, Changes, and Improvements under ObamaCare

First off, let’s talk about the “cuts to Medicare” you may have heard of. While the cuts to Medicare under the Affordable Care Act (ObamaCare) were estimated at $716 billion, those cuts didn’t hurt Medicare; they improved it.

The Medicare cuts contained in the law were aimed at improving care by limiting fraud, waste, and abuse. The money saved from those cuts has been reinvested in Medicare and the ACA to improve care for seniors. Improvements include closing the Medicare Part D “donut hole,” reducing overpayments to hospitals, adding preventive services, supporting doctors, and protecting the Medicare Trust until 2029.

We’ll examine all the details related to Medicare improvements, changes, and cuts and try to address any questions you may have regarding your responsibilities under the Affordable Care Act below.

With the above said, the bottom line is this: Nothing much changes for Seniors under the Affordable Care Act in terms of how they get coverage, most of the changes are benefits like an extra preventive care visit a year and the closing of the donut hole.

ACA (ObamaCare) cut overpayment to hospitals and other wasteful Medicare spending to give seniors better benefits and to ensure the future of Medicare for years to come.

Is Medicare Part of the ACA (ObamaCare)?

ObamaCare makes some changes to Medicare (discussed below), but the ACA (ObamaCare) doesn’t replace Medicare. Medicare isn’t part of your State’s health insurance marketplace (sometimes called an exchange), so if you have Medicare keep it. You will still get all the new benefits, rights, and protections ObamaCare offers on your current Original Medicare or Medicare Advantage Plan.

Exceptions:

- If you have retiree insurance, aren’t old enough for Medicare, and don’t like it, you may choose to use the marketplace to replace that insurance. Find out more about retiree insurance.

- If you are over 65 you can only get Marketplace coverage under the ACA (ObamaCare) if you don’t have access to Medicare or employer-based coverage. Learn what to do if you don’t have access to Medicare.

Is Medicare “Minimum Essential Coverage?”

If you have Medicare Part A (Hospital Insurance), Part B (medical coverage), or Medicare Part C (Medicare Advantage), you’re considered to have “minimum essential coverage” and won’t owe the fee for not having health insurance in 2014.

Having Medicare Part B (Medical Insurance) alone doesn’t count as minimum essential coverage. Having Medigap insurance or a Part D drug plan doesn’t affect whether or not you owe a fee for not having insurance under the Affordable Care Act (ObamaCare), as they both require you already have Medicare Part A.

TIP: You can still owe the fee if you are over 65 and don’t have minimum essential coverage, or if you have a dependent who doesn’t have minimum essential coverage. Learn more about the individual shared responsibility payment rules.

Medicare and the Health Insurance Marketplace

Medicare isn’t part of the ACA’s (ObamaCare’s) Health Insurance Marketplace; no one has to replace their Medicare coverage with Marketplace-based health insurance. No matter how you get Medicare, through Original Medicare or a Medicare Advantage Plan, you’ll still have the same benefits and security you have now. You won’t have to make any changes.

FACT: ObamaCare doesn’t impact your Medicare choices, you’ll still have the same general choices you did before the law (Original Medicare, Medicare Advantage, Part D, and Medigap).

Can I get a Marketplace Plan in Addition to Medicare?

No. It’s against the law for someone who knows that you have Medicare to sell you a Marketplace plan. This is true even if you have only Part A or only Part B.

If you want coverage designed to supplement Medicare you’ll want to look at Medigap policies, Medicare Advantage Plans, and Part D drug coverage. More information can be found on Medicare.gov.

ACA (ObamaCare) Medicare Insurance Premiums For Seniors

The ACA (ObamaCare) doesn’t raise premiums for seniors. The AARP has predicted that it could hold the costs of Medicare Part B premiums down, if not lower them. The official formula for determining Medicare Part B premiums was established by Congress years ago and has not been negatively affected by the ACA (ObamaCare).

Despite the fact that ObamaCare does not affect seniors’ premiums, premiums for high-income seniors who earn more than $85,000 or couples with incomes over $170,000 will rise, as they would have done with or without the ACA (ObamaCare).

If you have heard any talking points on how Medicare costs are negatively impacted by the Affordable Care Act you can find them debunked here and here.

The ACA (ObamaCare) Medicare Reform

Even though ObamaCare “cuts” Medicare, it isn’t really a cut. Its health care reform aimed at improving care for seniors and their families. The fact is seniors will be continued to be covered by Medicare under the Affordable Care Act and will enjoy additional benefits like an extra wellness visit and reduced costs in the Part D ‘donut hole’. Here are some things that the program does to improve Medicare:

• The ACA (ObamaCare) closed the “donut hole” that was causing Seniors not to be able to afford their prescriptions. (The Medicare ‘donut hole’ is the Part D drug coverage limit where seniors must start paying out of pocket for their prescriptions). In 2012, seniors got a 50 percent discount when buying brand-name drugs and 14 percent discount on generic drugs covered by Medicare Part D. This reform increased coverage and closed the donut hole until it disappeared in 2020. From 2020 on, seniors have only paid usual drug co-pays.

•The ACA (ObamaCare) expands existing coverage for seniors, including preventive care and wellness visits without charging you for the Part B co-insurance or deductible. Seniors will no longer need to put off preventive care and check-ups due to costs. This reform has been active since 2011 and gives seniors better access to cancer screenings, wellness visits, personalized prevention plans, vaccines, flu shots, and more.

• New initiatives to support care coordination, your doctor may get additional resources to make sure that your treatments are consistent.

•The ACA (ObamaCare) does not cut any benefits from Medicare Advantage.

•The ACA (ObamaCare) reduces payments to Medicare Advantage rewarding those providers who increase the quality of their coverage. Medicare Advantage payouts are now more in line with other areas of Medicare.

•The ACA (ObamaCare) reins in excess spending on Medicare Advantage, which is currently causing a burden on the taxpayer that is disproportionate to the number of people it helps. Medicare Advantage is run by private insurers and costs $1,000 or more per person.

• According to the CMS Medicare beneficiaries are expected to save, on average, about $4,200 over the next 10 years due to lower drug costs, free preventive services, and reductions in the growth of health spending.

• The protection of Medicare is ensured for years to come. The life of the Medicare Trust fund will be extended to at least 2029—a 12-year extension due to reductions in waste, fraud, and abuse, and Medicare costs, which will provide you with future savings on your premiums and coinsurance.

The fact is, Medicare Reform under the Affordable Care Act does a lot to help seniors. The law addresses Medicare more than any other single issue. Many of the attacks against the ACA (ObamaCare) regarding Medicare are unfounded. Although the program isn’t perfect, one only needs to look at how seniors have benefited from the care and protections of Massachusetts health care reform under Governor Romney and how the Affordable Care Act has affected seniors so far to see what the long-term implications are.

Children under the age of 26 can be covered under their parent’s insurance. The caveat, however, is that if your parents are over 65 and therefore receive Medicare, you are no longer eligible to be covered under their insurance. While this may “make sense,” it comes as a low blow to those who took the law at face value.

Medicare and the Donut Hole

Most Medicare Prescription Drug Plans have a coverage gap called the “donut hole.” This means there’s a temporary limit on what the drug plan will cover for drugs. Seniors in the Medicare Part D “donut hole” can now get a 50% discount when buying Part D-covered brand-name prescription drugs and a 14% discount on generic drugs covered by Part D. The discount is applied automatically at the counter of the pharmacy so seniors don’t have to do anything to get the discount. By 2020, the donut hole is scheduled to be eliminated completely. Read more about the Medicare Part D Coverage Gap (Donut Hole).

The ACA (ObamaCare) is Improving Medicare: Updates From 2014

When we started this website, the law had not gone into full effect, and there was a lot of “what-if scenarios” thrown out there to scare seniors. By 2014, with a solid 4 years of healthcare reform, America is starting to see proof that the Affordable Care Act is living up to its promises and even exceeding expectations in some cases. Of course, what will happen in the future under President Trump, is very uncertain. According to a July 2014 report by the Medicare program’s Boards of Trustees:

• Medicare’s trust fund will be extended 13 more years, to 2030, under the ACA.

• Projected Part B premiums for 2015 will not increase for the second year in a row.

• The law’s provisions to reduce waste and fraud, strengthen benefits, and to promote value-based payments are working to reduce hospital spending, prevent admissions, and lower hospital costs. All of which help to extend the life of the trust fund by lowering spending.

• Per capita cost growth has slowed.

• Overall the trajectory of Medicare spending has seen a dramatic decline compared to what was expected before the ACA.

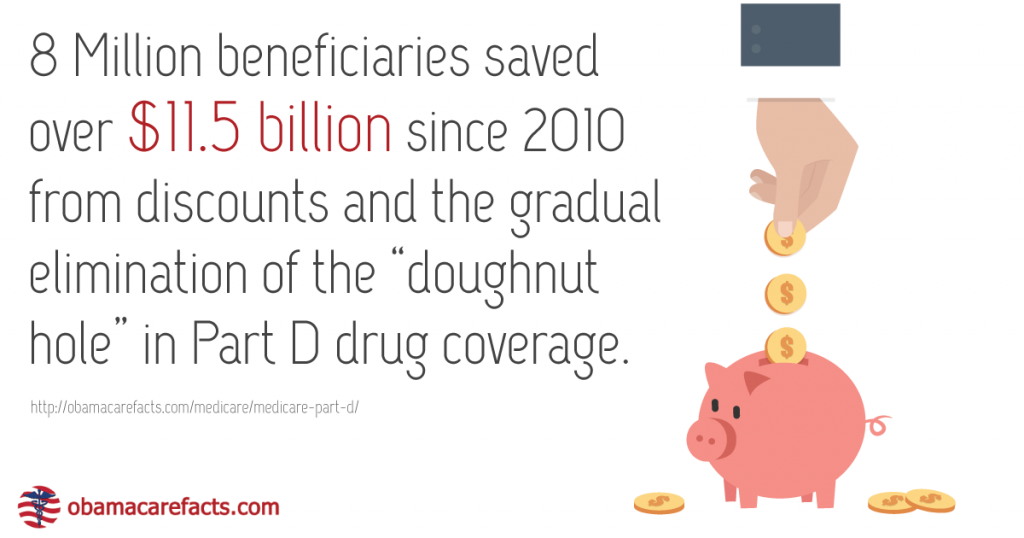

• Seniors have saved over $10 billion by the gradual closing of the Part D “donut hole.”

• The Partnership for Patients and other efforts to improve patient safety are estimated to have helped avoid 15,000 deaths and more than 560,000 patient harms over the past two years. This work is thanks to partnerships between HHS and hospitals, doctors, nurses, and others, and shows how we can save money while improving outcomes for patients.

• Patient safety efforts and new payment incentives for hospitals are estimated to have helped avoid 150,000 readmissions to hospitals over 2012 and 2013, providing better outcomes for patients and saving money for Medicare.

• More than 340 Accountable Care Organizations have been launched in Medicare in the last three years, providing care for more than 5 million Medicare beneficiaries. These organizations are accountable for the quality and cost of care they provide and have already saved hundreds of millions of dollars.

• The Departments of HHS and Justice have organized a crackdown on healthcare fraud, saving a record $19 billion over the past five years and putting in place innovative tools to prevent fraudulent claims from being paid.

Medicare Overview

We give a detailed overview of Medicare on our “what is Medicare?” page. But here is a quick primer to help you understand Original Medicare (Parts A and B), Medicare Advantage (Part C), Medicare Prescription (Drug Coverage Part D), and Medigap supplemental insurance.

Medicare Part A is hospital insurance and part of Original Medicare. Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Medicare Part B is medical insurance and part of Original Medicare. Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services.

Medicare Part C is Medicare Advantage and is Part of Medicare that bundles Part A and B, and sometimes Part D, to offers cost-sharing and benefits beyond what Original Medicare offers.

Medicare Part D is Medicare Prescription Drug Coverage and is supplemental insurance that pairs with Original Medicare, Medigap policies, and Advantage plan without drug coverage.

Medigap (Parts A through N) is supplemental insurance sold by private companies and is not part of Medicare. Medigap requires Part A and Part B, and includes many choices to help you better meet your medical needs and costs.

Part C, Part D, and Medigap are sold by private companies. Medigap is not part of Medicare.

How to Sign Up for Medicare

You can sign up for Original Medicare (Part A and Part B) online in under 10 minutes online, by visiting your local Social Security office, by calling Social Security at 1-800-772-1213. TTY users should call TTY 1-800-325-0778, or if you worked for a railroad, call the RRB at 1-877-772-5772.

Click here to sign up for Medicare Online.

Go here to learn more about the Medicare Enrollment process.

Confused about Medicare? Call 1-800-MEDICARE (1-800-633-4227). TTY users should call 1-877-486-2048.

Changes to Medicare Insurance in 2013 – 2014

There were not many changes for Seniors in 2013 – 2014. You can look back on the Affordable Care Act affecting your Medicare Insurance and see what changed for you as the Health Insurance Marketplaces were implemented. Changes to Medicare Insurance 2013 – 2014

ObamaCare Medicare Myths

Medicare is ending. False. ObamaCare is not replacing Medicare. In fact, many of the provisions contained within the new law strengthen Medicare, improve its quality, help lower costs and ensure Medicare for years to come.

Seniors on Medicare must buy more health insurance to comply with the ACA. False. Medicare (and all Medicare-related insurance plans such as Medigap and Medicare Advantage) count as minimum essential coverage, which means you are exempt from the mandate to buy insurance. Medicaid, CHIP, TRICARE, and other government programs all count has “having health insurance.”

Medicare beneficiaries will pay more for their medications under ObamaCare. Partially true. Under the ACA, higher-income Medicare beneficiaries, those who earn more than $85,000 per person or $170,000 per couple, pay slightly more for their prescription drug coverage or Medicare Part D. But this only affects about 5 percent of beneficiaries

Medicare beneficiaries won’t be able to see their current doctors. False. Nothing in the ACA changes which doctors Medicare patients can see.

Medicare premiums are rising. Partially true. Medicare premiums are calculated by the Medicare part B formula. This has nothing to do with ObamaCare, premiums do rise historically, but not due to the new health care law.

The ACA (ObamaCare) and Medicare Costs for High-Income Seniors

The formula for Medicare part B is unaffected by the ACA (ObamaCare) and most seniors won’t see a rise in the prices they pay. However, Medicare recipients with higher incomes have historically paid more for their Part B coverage, which is the “medical insurance” portion of the program and helps pay for outpatient medical care such as doctor visits, lab tests, and durable medical equipment. High-income seniors may still continue to pay higher rates despite the changes to Medicare.

The ACA (ObamaCare) Medicare Tax Increase

The ACA (ObamaCare) implements a Medicare tax part A increase of .9% for businesses making over $250,000 in profit and employees earning over $200,000 to help pay for the improvements to Medicare. So, while seniors will save money by closing the donut hole and overall reforms, some people will pay more to help support ObamaCare Medicare reform.

Accountable Care Organizations and Other Little Talked About Medicare Related Provisions in the Affordable Care Act

There are hundreds of little talked about provisions in the Affordable Care Act that are very effective but rarely talked about, and many of them pertain to improving Medicare. For example, Section 3022 of the PPACA includes guidelines for the establishment of accountable care organizations (ACOs) under the Medicare Shared Savings Program.

ACOs are groups of doctors, hospitals, and other health care providers, who come together voluntarily to give coordinated high-quality care to their Medicare patients. The goal of coordinated care is to ensure that patients, especially the chronically ill, get the right care at the right time, while avoiding unnecessary duplication of services and preventing medical errors. When an ACO succeeds both in both delivering high-quality care and spending health care dollars more wisely, shares in the savings it achieves for the Medicare program.

Know the Law. The Affordable Care Act contains 10 titles; each title addresses a different aspect of health care reform. Title III – Title III Improving the quality and efficiency of health care addresses most of the changes to Medicare. Check out our Summary of Provisions of the Patient Protection and Affordable Care Act for a plain English summary of each provision of the Affordable Care Act and Medicare.

The ACA (ObamaCare) Medicare: Value-based Payment Rewards Hospitals for Providing Quality Care

ObamaCare’s Medicare reform enacts a Value-Based Payment Provision. The Medicare provision states Hospitals can gain or lose 1% of Medicare funding or gain a 1% increase depending on 20 factors that gauge quality vs. quantity care.

Specifically, the factors include quality measures related to the treatment of patients with heart attacks, heart failures, pneumonia and certain surgical issues, as well as patient satisfaction.

In other words, if a hospital has a high re-admittance rate or poor treatment they can lose a percentage of funding whereas if they have a low re-admittance rate they can gain funding.

Some hospitals have already been hurt, while some have gained significant funding. Although the drawbacks are obvious in the short term, it has created an incentive to improve the quality of care in hospitals.

ACA (ObamaCare) Medicare penalties and rewards will rise over the next two years to a total of 2%.

During the last half of 2012, CMS reports that hospital readmissions dropped by 70,000 for the first time on record.

By December 1st, 2013 the ACA’s (ObamaCare’s) Medicare reforms had already increased the quality of care and decreased costs. Administration officials pointed to falling hospital readmission rates as one strong sign that cost-control provisions in the Affordable Care Act were working. Also, they noted that a growing number of insurers and health care providers were agreeing to contracts that pay for the quality of care, rather than the quantity, another indication that the law’s encouragement on that front had started to pay dividends.

Independent Payment Advisory Board (IPAB)

The ACA (ObamaCare) created a 15 member board called the Independent Payment Advisory Board (IPAB). The IPAB is appointed by the President and confirmed by the Senate to serve six-year terms. The purpose of the board is to oversee Medicare costs and to lower the per capita growth rate of Medicare spending.

The ACA (ObamaCare) recovered tens of billions of dollars from fraudulent Medicare and Medicare Advantage payments since the bill was signed into law in 2010.

ObamaCare and Medicare Advantage

Medicare Advantage is a private coverage option which has driven profits of private health insurance companies up, yet puts a larger burden on the government to fund Medicare. While some seniors may personally benefit from a Medicare Advantage plan, they have created some cost issues which the Affordable Care Act addresses in its long list of Medicare reforms. Luckily for beneficiaries and taxpayers the Affordable Care Act make some much-needed reforms to Medicare Advantage including the ones discussed on this page ensuring Medicare Advantage remains a viable supplement to Original Medicare.

ObamaCare Medicare Cuts, Changes in Medicare Spending

Over the ten year period between 2013 and 2022, ObamaCare will cut Medicare by $716 billion and spend nearly that much trying to reform it. In fact, all money cut from Medicare must be used to increase Medicare solvency, improve its services, or reduce premiums. Medicare currently affects over six hundred thousand physicians who care for nearly 100 times as many senior citizens who are provided for under Medicare and Medicare Advantage.

The concept behind the ACA (ObamaCare) Medicare cuts is simple, cut out the parts of Medicare and Medicare Advantage that aren’t working and use that money to fix the parts that need reform. The result should improve the system and result in curbed spending and a more effective program.

Although there can be a lot of debate about the Medicare cuts, the results for seniors is good. Millions of seniors are getting free preventive treatments, wellness visits, rebates for out-of-pocket costs on drugs and are saving money due to ObamaCare starting to close the “donut hole.”

ObamaCare cuts Medicare and Medicare Advantage $716 Billion 2013-2022. $415 Billion comes from cutting tax payer money that is going to doctors, hospitals and private insurance companies. Most health care officials, workers, and hospitals agree that the ACA (ObamaCare) helps the health care industry and specifically Medicare and Medicaid.

ObamaCare cuts Medicare and Medicare Advantage $716 Billion 2013-2022. $415 Billion comes from cutting tax payer money that is going to doctors, hospitals and private insurance companies. Most health care officials, workers, and hospitals agree that the ACA (ObamaCare) helps the health care industry and specifically Medicare and Medicaid.

The Affordable Care Plan (ObamaCare) Medicare cuts will mainly affect hospital reimbursement rates for hospitals and private health insurance companies. The claim is that by cutting the profit hospitals and insurance companies make off of Medicare and Medicare advantage, the less help seniors will be able to get. This, however, is nothing more than a “Medi-scare.”

ObamaCare Medicare Advantage Reform

When Medicare Advantage came onto the scene, it was supposed to decrease the costs placed on the government to provide “free” healthcare to seniors via Medicare. This would ultimately save the taxpayers’ money as private insurance companies would bid for contracts.

This isn’t what happened, however. It actually increased the amount we the taxpayers had to pay by driving costs up! So, of course, the private insurance companies don’t like the idea of being regulated. That means less “free” money from the government for them… This stands in a stark contrast to the “no government”-plea from the same side of the aisle who is propagating the “Medi-scare.”

ObamaCare also seeks to decrease the amount paid to hospitals for Medicare. However, hospitals have already agreed to this, since they know once everyone has insurance under the Affordable Care Act they will see a large influx in the number of visitors to their hospitals. Therefore, they will at least break even, if not profit, while saving the taxpayers money. This could potentially reform the healthcare system.

Advantage plans cannot charge enrollees more than traditional Medicare for chemotherapy administration, skilled nursing home care, and other specialized services. Starting in 2014, Medicare Advantage plans could not spend more than 15% of their Medicare payment on administrative costs, insurance company profits and non-healthcare related items. These cost-cutting measures are estimated to bring in $1,000 in savings to CMS per Advantage Plan member without reducing any benefits. This is expected to help decrease Medicare part B payments, especially for low-income seniors. Medicare Advantage Plans must provide at a minimum what Original Medicare covers.

While a 1.9% cut to the program had been planed, the federal government reversed course on the decision and increased the program by 0.4%, though insurers still say the payments are less.

Where Do the Rest of the Medicare and Medicare Advantage Cuts Come From

It’s no secret that the current Medicare system isn’t working as well as it could be. Especially before the ACA it was bankrupting itself and causing an increasing burden on the taxpayer. Today Medicare’s solvency has been expanded.

The rest of the cuts to Medicare include things like Medicare Disproportionate Share Payments (which hikes up rates for others by ensuring care to uninsured patients), lower payments to home health providers and other cuts that do not affect seniors care but essentially make the system run smarter, among other common-sense changes.

This isn’t to say that ObamaCare lays out the perfect plan for Medicare; it only is saying that the drastic number of $716 billion is meant to save Medicare, fix what is wrong with it, and ensure that it remains sustainable while providing quality, affordable healthcare to seniors.

So does ObamaCare Medicare reform cut Medicare and Medicare Advantage? Yes, But the Medicare cuts are a good thing. Millions of seniors will benefit from the ObamaCare Medicare reforms. Make sure to let the seniors in your life know that ObamaCare helps Medicare, bring costs down, provide better benefits, and ensure Medicare for years to come.

What ObamaCare Medicare Reform Means for Seniors

![]()