2018 Cost Sharing Reduction Subsidies (CSR)

How Do Cost Sharing Reduction Subsidies Work?

ObamaCare’s Cost Sharing Reduction Subsidies (CSR) lower out-of-pocket costs, based on income, for Silver plans bought on the Health Insurance Marketplace.[1]

Please note that CSR subsidies are paid to insurance companies, not to individuals. They are intended to offset the expenses of offering lower-cost health insurance to qualifying individuals. Eliminating CSR subsidies would have a minimal effect of people who qualified for them during the current year. However, the year following the reduction, insurance companies may exit the marketplaces. On the other hand, the insurers must still provide the lower out-of-pocket plans to those who qualify and can’t discriminate premium costs. This means that the insurers must raise all premiums for Silver Plans to offset the loss of CSR payments. The Premium Tax Credits are based on regional average cost of a Silver Plan and more people are eligible for PTC. Those not eligible for PTC (earning over 400% FPL) will likely see steep premium increases, while those eligible for premium assistance will find they’re eligible for more premium assistance.

You will have to fill out an application on the Marketplace to see if you qualify for premium tax credits based on household income and family size compared to the Federal Poverty Level. Remember, the open enrollment period was shortened this year and the official marketplace website Healthcare.gov site will be down for service during most Sundays this year. So, please plan.

To qualify for cost-sharing reduction subsidies, you must have a household income of 100-250% of the poverty level, be lawfully present in the United States, and cannot be incarcerated to qualify for a CSR.

If you qualify for CSRs, you must enroll in a silver plan sold on the health insurance marketplace. Only silver tier marketplace plans qualify for cost-sharing reduction subsidies (unlike tax credits which can apply to any marketplace plan). Plans that are not sold on the marketplace are not eligible for cost assistance.

Bottomline: Cost sharing Reduction Subsidies (CSR) covers the cost of lower out-of-pocket cost sharing amounts on Health Insurance Marketplace Silver plans for those making between 100% – 250% of the Federal Poverty Level in household income. These pair with Premium Tax Credits which lower premium costs for those making between 100% – 400% of the poverty level. In other words, along with Premium Tax Credits, the ACA’s Cost Sharing Reduction subsidies lower what you pay for health insurance costs.

FACT: Nearly 6 million Americans have relied on the CSRs implemented by ObamaCare (the Affordable Care Act or ACA).

ADVICE: One of the best deals anyone can get under the Affordable Care Act on health insurance is a high-end marketplace Silver plan with cost-sharing reduction subsidies applied. This will not only give you a solid network at a low premium (due to tax credits), it can also give you cost-sharing amounts in-line with the cost sharing of a Gold plan (due to the way Cost Sharing Reduction works). If you are in a position to pair a high deductible Silver plan with an HSA, you can even lower your Household Modified Adjusted Gross Income for maximum savings.

What Does the Future Hold for CSR Subsidies?

The future of all health care funding is uncertain as we head into open enrollment for 2018, and this is especially true for cost-sharing reduction subsidies.

Although the future of cost assistance is uncertain, the reality is that subsidy payments are unlikely to suddenly be eliminated from one day to the next.

CSRs and tax credits are expected by most people to be funded through 2020; after that, it looks as though some health insurance might revert to a state-by-state matter assisted by federal block grants.

NOTE: There is no guarantee the CSR program will be continued. Trump agreed to pay some past 2017 subsidies, but we cannot see the future. At present, it can sometimes seem as if the administration is using the month-to-month payments of CSR subsidies as a bargaining chip (sorry for the politics, but this is the case, see: Trump Threat to Obamacare Would Send Premiums and Deficits Higher By ROBERT PEAR and THOMAS KAPLANAUG. 15, 2017). Given this, anyone who qualifies should make sure to stay up-to-date on the news in respect to this.

What Costs Do Cost Sharing Reduction Subsidies Cover?

Cost Sharing Reduction Subsidies lower the amount you have to pay out-of-pocket for deductibles, coinsurance, and copayments. They can also reduce the maximum out-of-pocket costs you are responsible for in a policy period. More specifically, they do this by raising the actuarial value of your health plan.

Typically CSR subsidies only apply to covered benefits, meaning it won’t reduce costs on services your plan doesn’t cover.

What Is A Covered Cost?

CSR subsidies only apply to “covered costs” (in-network services covered on your plan). Covered costs usually include only items from ten categories of essential Health Benefits. When you compare plans, you’ll see what services are covered in-network and will see the plans out-of-pocket costs reflecting your Cost Reduction Subsidies.

Typically your insurer will only offer to cover part of your costs or count your costs toward your deductible if you use covered in-network services. Expect higher costs if you shop out-of-network.

How to Qualify For Cost Reduction Subsidies

To qualify for Cost Sharing Reduction Subsidies, you must:

- Shop on the Health Insurance Marketplace (or your state’s Marketplace)

- Make between 100% – 250% FPL

- Obtain a Silver plan (CSR subsidies are only offered on Silver plans)

ObamaCare’s Cost Sharing Subsidies are Based on Income

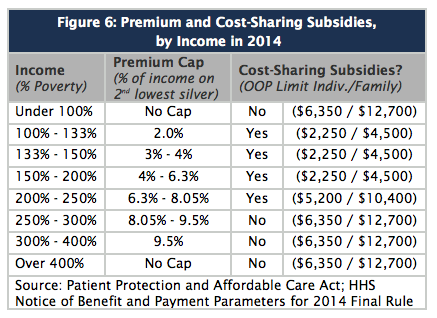

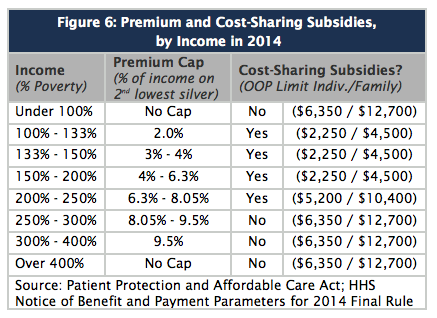

The amount of out-of-pocket assistance you are eligible for is based on your income. It is offered to people making between 100% to 250% of the Federal Poverty Level (FPL). CSR subsidies do not lower your premium like Advanced Premium Tax Credits since they apply only to cost-sharing amounts.

How Much Do CSR Subsidies Reduce My Costs?

CSR subsidies reduce your out-of-pocket expenses. They do it by raising the average out-of-pocket costs an insurer will pay on a plan. Technically, this is called the actuarial value of your plan. CSR subsidies lower your coinsurance, and lower copays, deductibles, and maximum out-of-pocket costs you will pay in a policy period. The provide subsidization. This means that some people will not only qualify for lower premiums on a Silver plan by getting tax credits, but may also get the low out-of-pocket costs similar to a Gold or Platinum plan.

There are three levels of CSR subsidies: CSR 73, CSR 87, and CSR 94. The numbers refer to the actuarial value (AV). Benefits sheets will include different summaries for different CSR levels. Please note values may adjust each year.

Income Level Actuarial Value (the costs a Silver plan will cover due to cost-sharing reduction subsidies for % of the Poverty Level).

100-150% FPL = 94% Actuarial Value (CSR 94)

150-200% FPL = 87% Actuarial Value (CSR 87)

200-250% FPL = 73% Actuarial Value (CSR 73)

More than 250% FPL = 70% Actuarial Value

An Example of Out-of-pocket maximum limits (equal to deductible limits):

We not yet have updated figures for 2018. The example below uses 2015 numbers. The 2018 limits for over 250% are $7,350 for an individual and $14,700 for a family and the same methodology (as described above) applies. CSR assistance is automatically calculated on plans when you buy them. Keep in mind not every plan uses the same deductible or out-of-pocket limit, but all have maximum limits that change each year.

The Limits for CSR assistance using 2015 figures as an example. These amounts raise slightly every year. They are based on the current out-of-pocket limit on all health plans for the year, as found in the Federal Register, reduced by the actuarial values noted, based on household income and family size as it relates to the Federal Poverty Level. The marketplace will help you determine your out-of-pocket assistance when you enroll.

- 100-200 percent of FPL,

- Your out-of-pocket limit won’t be more than $2,250 for an individual.

- Your out-of-pocket limit won’t be more than $4,500 for a family.

- 200-250 percent of FPL,

- Your out-of-pocket limit won’t be more than $5,200 for an individual.

- Your out-of-pocket limit won’t be more than $10,400 for a family.

- More than 250% percent of FPL,

- Your out-of-pocket limit won’t be more than $6,600 for an individual.

- Your out-of-pocket limit won’t be more than $13,200 for a family.

NOTE: If you’re a member of a federally recognized tribe or an Alaska Native Claims Settlement Act (ANCSA) Corporation shareholder, you may qualify for additional cost-sharing reductions.

See full Federal Poverty Level chart here.

Cost Sharing Reduction Examples

Here is an example from Health Care Reform Beyond the Basics that shows how the different CSR levels affect a Silver plan obtained on the Health Insurance Marketplace. The exact figures are subject to change each year. The chart below is an example from 2014 and is meant to give you an idea of how CSR assistance reduces costs.

| Table 1 | ||||

| How Does the Cost-Sharing Reduction Level Affect Cost-Sharing Charges? | ||||

| Standard Silver – No CSR | CSR Plan for 201-250% FPL ($22,981-$28,725) |

CSR Plan for 151-200% FPL ($17,236-$22,980) |

CSR Plan for up to 150% FPL (up to $17,235) |

|

| Actuarial Value | 70% AV | 73% AV | 87% AV | 94% AV |

| Deductible (Individual) | $2,000 | $1,750 | $250 | $0 |

| Maximum OOP Limit (Individual) | $5,500 | $4,000 | $2,000 | $1,000 |

| Inpatient hospital (After deductible) |

$1,500/ admission |

$1,500/ admission |

$250/ admission |

$100/ admission |

| Physician visit (After deductible) |

$30 | $30 | $15 | $10 |

Are Cost Sharing Reduction Subsidies Refundable? Do I have to Pay Back CSR Subsidies if my Income Changes?

Unlike Premium Tax credits, you won’t owe back any cost assistance you got on out-of-pocket costs via Cost Sharing Reduction subsidies.

In some instances, if your income ends up being lower than you project and you adjust your marketplace account, you can get credit (refund) for cost-sharing charges already paid in a calendar year! If you haven’t paid a claim yet, that charge is not affected by changing Cost Sharing levels. This fact essentially makes Cost Sharing Reduction subsidies one of the biggest, yet least talked about, perks of the Affordable Care Act.

Remember that cost-sharing reduction subsidies only affect your share of covered costs, so they only take effect when you use covered health care services.