What Happens if ObamaCare is Repealed?

Repealing ObamaCare would increase the federal deficit by at least $137 billion over ten years and increase the number of uninsured by 19 million by 2016. Also if the law is fully repealed, consumers would lose all of the new benefits, rights, and protections which you can read about here. This number is a net increase to the deficit after all money saved from subsidies is taken into account. You can go straight to the CBO report now and read the findings for yourself or keep reading for our simplified breakdown of how repealing the Affordable Care Act increases the deficit.

Summary of How Repealing ObamaCare Increases the Deficit in the Next Ten Years

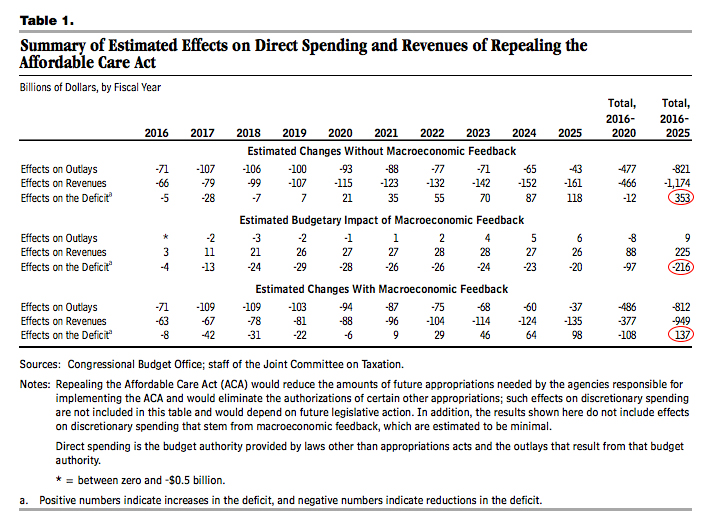

There are five factors which lead to an estimated net deficit of $137 from 2016 to 2025:

- $1,658 billion less spending on Marketplace subsidies and Medicaid expansion.

- $502 billion in revenue loss from eliminating new taxes related to health insurance like the excise tax, mandates, and payroll taxes. Bringing the total savings to $1,156 billion

- Repealing new rules and protections, specifically ones that target Medicare waste and fraud, increase federal spending by $879 billion. Bringing the total savings to $277 billion.

- $631 billion in revenue loss from repealing other taxes like the hospital insurance payroll tax for high-income tax payers and fees on insurers. Bringing the grand total savings to NEGATIVE $354 (CBO rounds this to $353 billion in increased deficits).

- Now a 5th factor, the elimination of the employer mandate stimulates job growth in the short term. “Macroeconomic feedback” like this could account for as much as $216 in revenue. This would then bring our grand total to NEGATIVE $137. In other words repealing the ACA costs $137 billion.

Conclusion: Hopefully this explains the $353 billion cost of repeal talking point (that is not the CBO’s bottomline conclusion, that is their estimate without macroeconomic feedback). This should also hopefully explain away the $1,658 billion (or so) saved from repeal talking point from the other media.

Keep reading to find out how the deficit gets even more out of hand post 2025 if the law is repealed.

How Does Repealing ObamaCare Increase the Deficit Beyond 2025?

The increased federal deficit may seem counter intuitive, the ACA includes lots of spending and obviously repealing the mandates and subsidies will mean big savings! After-all that is the punchline the GOP as been repeating since 2008 right? Well, that like many of the words that comes out of politicians mouths, is a convenient half-truth. Yes, repealing the ACA (or at least it’s key provisions) brings the deficit down by decreasing spending, but only a few of the 1,000 or so pages in the law actually include spending. Most of the law are reforms that curb healthcare spending over time and generates revenue. The longer the law sticks around the more long term deficit growth is curbed. Or as the CBO puts it, “Repealing the ACA would cause federal budget deficits to increase by growing amounts after 2025, whether or not the budgetary effects of macroeconomic feedback are included. That would occur because the net savings attributable to a repeal of the law’s insurance coverage provisions would grow more slowly than would the estimated costs of repealing the ACA’s other provisions—in particular, those provisions that reduce updates to Medicare’s payments. The estimated effects on deficits of repealing the ACA are so large in the decade after 2025 as to make it unlikely that a repeal would reduce deficits during that period, even after considering the great uncertainties involved.”

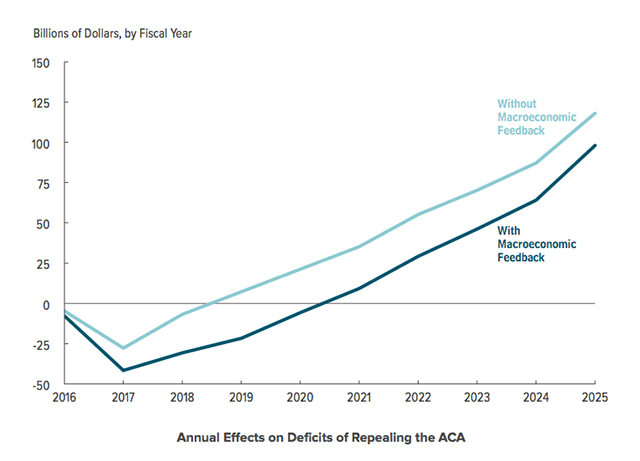

In the chart below we see the effects of repeal in the first ten years alone, even with macroeconomic feedback the deficit goes up by $137 billion. Another chart in the report itself shows the effects of repealing spending and revenue specifically.

Read more about the effects of the ACA on the deficit here.

Also, Human Lives Have Value? Right?

Remember, aside from our collective American pocketbook (which is continuing to look more like our personal college loan debt and credit card debt and is a serious problem even without adding $137 billion to the deficit) we are also talking tens of millions of people losing access to health insurance! Under a repeal employment may go up and that can have positive affects on coverage, but Medicaid and individual non-group coverage drops enough to leave about 24 million uninsured by 2025! That IS something.

The Increase Is Reported By the Non-Partisan Congressional Budget Office

See it’s not Bernie Sanders or Hillary Clinton telling us repeal would continue to bankrupt the country, this is the non-partisan Congressional Budget Office (CBO) and Join Committee on Taxation (JCT).

Go to page #1 of the June 2015 CBO report now and read the effects of repeal for yourself.

The truth might hit you like a ton of bricks if you are a repealer, but we all need to be on the same page here. After-all King V Burwell could have a decision as early as before we are done posting this article. At that moment, if SCOTUS rules that subsidies are illegal, the GOP will begin voting to repeal and replace the ACA and provide ACA alternatives. “alternative” could mean a few smart fixes, or it could mean a veiled attempt to repeal all the safety net features and pass pro-business reforms that do little to nothing to consider long term federal spending (we make this claim based off of their last proposal for an alternative).

Anyway, you have our summary of the effects of repeal based on the new CBO report… but we are arguably one step less unbiased than the CBO. So why not check out what they have to say:

Key Findings From the June 2015 CBO Report on Repealing ObamaCare:

“Including the budgetary effects of macroeconomic feedback, repealing the ACA would increase federal budget deficits by $137 billion over the 2016–2025 period (see Table 1).

That estimate takes into account the proposal’s impact on federal revenues and direct (or mandatory) spending, incorporating the net effects of two components:

• Excluding the effects of macroeconomic feedback—as has been done for previous estimates related to the ACA (and most other CBO cost estimates)—CBO and JCT estimate that federal deficits would increase by $353 billion over the 2016–2025 period if the ACA was repealed.

• Repeal of the ACA would raise economic output, mainly by boosting the supply of labor; the resulting increase in GDP is projected to average about 0.7 percent over the 2021–2025 period. Alone, those effects would reduce federal deficits by $216 billion over the 2016–2025 period, CBO and JCT estimate, mostly because of increased federal revenues.

For many reasons, the budgetary and economic effects of repealing the ACA could differ substantially in either direction from the central estimates presented in this report. The uncertainty is sufficiently great that repealing the ACA could reduce deficits over the 2016–2025 period—or could increase deficits by a substantially larger margin than the agencies have estimated. However, CBO and JCT’s best estimate is that repealing the ACA would increase federal budget deficits by $137 billion over that 10-year period.”

martin luther king jr.

what happens is that I gfet to KEEP my refund. WELFARE ABORTIONS SHOULD BE MANDATORY. Why are people who have no desire to contribute to society paid

to create more poeple?