What If I Didn’t Have Health Insurance?

Under the Affordable Care Act (ObamaCare) if you didn’t have health insurance for the whole year you may owe the fee, but if you had coverage for some of the year you may qualify for an exemption. Below we explain exemptions, and then show you how to claim exemptions and pay the fee for any months you don’t have coverage.

Common Exemptions

Here are some common exemptions to the fee claimed on the 8965 exemptions form. These exemptions all last the entire year (unlike coverage gap exemptions below). You can claim more than one exemption for the same month.:

- You don’t have to file taxes because your income is below the tax filing threshold

- Coverage would cost more than 8% of household income per person. (8% for one person after most deductions, or 8% aggregate; adjusted for inflation).

- You got denied Medicaid or CHIP

Get the details on exemptions and the fee.

Coverage Gap Exemptions

Here are how coverage gap exemptions (claimed on the 8965 exemptions form) apply for those who didn’t have coverage, or had a coverage gap:

I had coverage, but had a gap of less than three months. You can claim the “short coverage gap exemption” CODE “B”.

I had coverage, but had a gap of more than three months. You can claim the “short coverage gap exemption” CODE “B”. This only applies to the first gap in coverage of the year. If you got covered during open enrollment, don’t forget to take that exemption as well.

I had coverage and got covered before May 1st, 2014. You’ll claim the “gap in coverage at the beginning of 2014” exemption CODE “G”. (There is also a coverage gap exemption for CHIP).

I got covered during a special enrollment period, but didn’t have coverage until after May 1st, 2014. You can claim the “short coverage gap exemption” CODE “B”.

I had coverage during the year, but lost it and didn’t get covered. You can claim any exemption you qualify for, including the “short coverage gap exemption” CODE “B”. You’ll owe the fee for the months you didn’t have coverage.

I didn’t get coverage during the year. You can claim any exemption you qualify for, but not the “short coverage gap exemption” CODE “B”. You’ll owe the fee for the months you didn’t have coverage.

I had limited benefit coverage. For 2014 you may be able to claim the “minimum benefit Medicaid coverage” exemption. Limited benefit coverage, like short term, doesn’t protect you from the fee. However, for 2014 only, due to confusion, you may be able to get a special exemption from the Marketplace. You can claim any other exemption you qualify for. You’ll owe the fee for the months you didn’t have coverage.

Learn more about coverage gap exemptions.

NOTE: All coverage gap exemptions are claimed on the IRS form using CODE “B” or CODE “G”, other exemptions may require you apply for the exemption at the Health Insurance Marketplace.

How to Pay the Fee

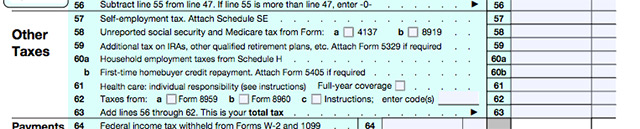

If you had a gap in coverage, and don’t qualify for an exemption for at least one full month during that gap, you’ll need to pay the fee. The fee is technically called a Shared Responsibility Payment. It’s made on your 1040 using the 8965 instructions.

Check out our simplified instructions Shared Responsibility Payment.

Velda Andujar

I have no income coming in. I can not afford health insurance and can’t get any medicial help