ObamaCare Employer Mandate

The Employer Mandate / Employer Penalty

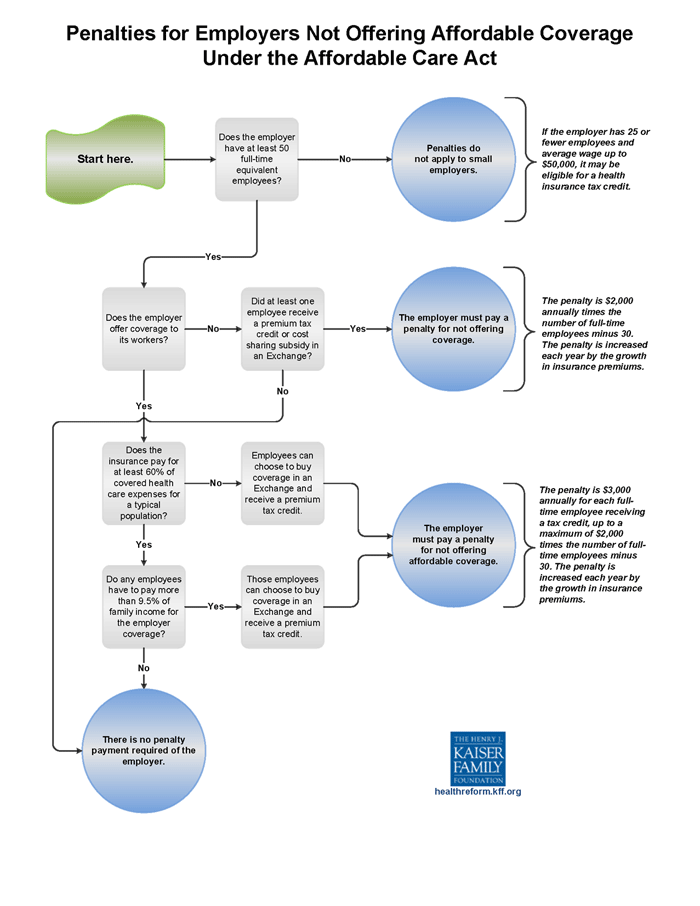

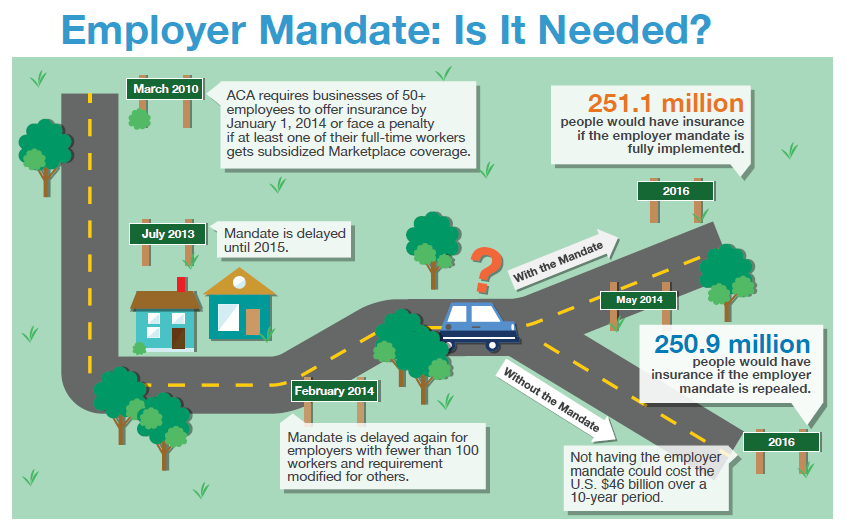

The ObamaCare Employer Mandate / Employer Penalty, originally set to begin in 2014, was delayed until 2015 / 2016. ObamaCare’s “employer mandate” is a requirement that all businesses with 50 or more full-time equivalent employees (FTE) provide health insurance to at least 95% of their full-time employees and dependents up to age 26, or pay a fee. Below we clarify how each aspect of the mandate affects employees and employers.

How the Employer Mandate Works

Firms with 100 or more full-time equivalent employees (FTE) needed to insure at least 70% of their full-time workers by 2015 and 95% by 2016. Small businesses with 50-99 FTE needed to start insuring full-time workers by 2016. Thus, the mandate is currently in effect for all qualifying employers. The mandate does not apply to employers with 49 or less FTE and doesn’t apply to part-time workers (those working less than 30 hours a week or 130 in a month, with measurement periods considered).

Employers with less than 25 FTE with average annual wages of less than $50,000 qualify for employer tax credits through ObamaCare’s SHOP. Those with 10 or less FTE with average annual wages of less than $20,000 qualify for the full credit of up to 50% of their share of employer premiums. To be eligible for a tax credit, the employer must contribute at least 50% of the total premium cost or 50% of a benchmark premium (second lowest cost Silver Plan in your state’s Marketplace).

If an employer doesn’t provide coverage, provides coverage that doesn’t offer minimum value, or provides coverage that is unaffordable, then they must make a per-employee, per-month “Employer Shared Responsibility Payment.” The IRS will provide the employer with a notice about the payment. Employers will not be required to include the Employer Shared Responsibility payment on any tax return that they file.

- The employer mandate is based on full-time equivalent employees, not just full-time employees.

- The fee is based on whether you offer Affordable Health Insurance to your employees that provide minimum value (explained below).

- Employers have to offer coverage to “substantially all” (95%) of their full-time employees (not all, or 100% of employees).

- Coverage must be offered to dependents up to age 26. Once a dependent turns 26, coverage no longer needs to be offered.

- Spouses do not count as dependents; coverage does not have to be offered to spouses.

- Employers must offer coverage, but employees don’t have to take it. That being said, they can’t get marketplace subsidies if coverage meets affordability and minimum value guidelines. Since the employee was offered qualifying coverage, the employer doesn’t owe the fee.

- Employees who work at least 30 hours per week or whose service hours equal at least 130 hours a month for more than 120 days in a year are considered full-time.

- Employers use measurement periods and look-back periods of 3 – 12 months to find out if they have to comply with the mandate or if an employee is full-time.

- Coverage offered to employees must be considered affordable (can’t cost more than 9.56% of employee household income) and must provide minimum value (must have an average cost-sharing of 60%). If coverage isn’t affordable employees can use the Marketplace and the employer can be fined.

- If an employee is not offered coverage under the law, then they can get cost assistance on the marketplace based on income. Full-time employees may need to have an employer fill out an employer coverage tool if they aren’t offered affordable coverage.

- For employers who don’t provide coverage, the fee is $2,000 per full-time employee (minus the first 30 full-time employees).

- For employers who do provide coverage but don’t provide coverage meeting minimum-value and affordability requirements, the fee is the lesser of $3,000 per full-time employee receiving subsidies, or $2,000 per full-time employee (minus the first 30).

- For plan years beginning in 2015 only, the penalty is $2,000 for each full-time employee minus the first 80 employees. For plan years beginning in 2016 and beyond, employers can exclude 30 full-time employees from the penalty calculation.

- In general, the fee is only “triggered” if at least one employee shops on the marketplace, and is eligible for a federal premium subsidy.

- The fee does not apply if a dependent shops on the marketplace and receives a subsidy. Rules only apply to employee-only coverage.

- Employers with over 200 FTE must auto-enroll full-time new hires and provide an opt-out.

- A part of the law that required employers to pay a fee for enacting a health insurance waiting period was removed before it took effect. As long as an employer has a waiting period of 90 days or less they are abiding by the law and don’t have to pay a fee. Under the old rule, employers with over 50 full-time equivalent employees were supposed to be responsible for $400 for any full-time employee in a 30-60 day waiting period, and $600 for any full-time employee in a 60-90 day waiting period.

- Employers must offer at least a 30 day Special Enrollment Period for employees or qualifying employee family members losing coverage from another source. This means an employee must be given 30 days to enroll in an employer plan after losing non-employer minimum essential coverage for any reason other than non-payment.

- The fee is a per-month fee. So it’s always 1/12 of the total fee for full-time workers for each month.

- To clarify, Full-time Equivalent Employee’s (FTE) is used to determine if an employer must comply with the mandate. However, fees are based on full-time workers and not FTE.

- FTE is calculated by averaging part-time and full-time hours worked (see below for more details).

See below for details on the employer mandate fee, how full-time hours are calculated, how to get cost assistance on employee coverage, what type of coverage must be provided, and more.

FACT: Approximately 96 percent of employers are small businesses and have fewer than 50 FTE workers and are exempt from the employer responsibility provisions (Treasury.gov). Of those who do have to comply with the mandate, only a fraction don’t already offer qualifying coverage to full-time employees.

Advice for Employees with Unaffordable Options

If employer-sponsored coverage is unaffordable (costs more than 9.5% of employee-only income) or doesn’t provide minimum value, you may be eligible for marketplace subsidies. If employer-sponsored health insurance (for self-only coverage for you or a family member) costs more than 8% of your household Modified Adjusted Gross Income, you may be exempt from the fee as well. You are not required to take the coverage that your employer offers. Learn more about affordable employer-sponsored coverage and what forms you need to fill out if coverage is unaffordable.

If you have access to Medicaid, you can reject employer-based coverage to go on Medicaid, and your employer will not have to pay the fee. The fee only pertains to Marketplace coverage. Thus, you may be eligible for free or low-cost family coverage even if employer-based coverage is unaffordable for you, but due to Medicaid expansion, not technically considered unaffordable.

ObamaCare Employer Mandate image from Robert Wood Johnson Foundation

The Employer Mandate Fee / Employer Shared Responsibility Payment

The employer mandate fee (officially called an Employer Shared Responsibility Payment) is a per-month, per-employee fee for employers who have more than 50 full-time equivalent employees and don’t offer health coverage to the required amount of full-time employees (as well as their dependents up to age 26).

Generally, an employer will owe the fee if:

(a) The employer does not offer health coverage or offers coverage to fewer than 95% of its full-time employees and the dependents of those employees, and at least one of the full-time employees receives a premium tax credit to help pay for coverage on a Marketplace;

OR

(b) The employer offers health coverage to all or at least 95% of its full-time employees, but at least one full-time employee receives a premium tax credit to help pay for coverage on a Marketplace. This may occur because the employer did not offer coverage to that employee or because the coverage the employer offered that employee was either unaffordable to the employee or did not provide minimum value.

What is “Minimum Value?”

Minimum value means that a plan provides the minimum essential coverage and cost-sharing in line with a Bronze plan on the marketplace and has a minimum average cost-sharing amount (actuarial value) of 60%. All marketplace coverage is minimum essential coverage. We suggest the Small Business Health Options Program (SHOP) to cover employees. This helps ensure that your plan complies with the law. More information on minimum value can be found below.

What is Affordable Employee Health Insurance?

Affordable means that a plan costs no more than 9.5% of employee’s household income for employee-only coverage. As a safe harbor, employers can simply make sure the plan costs no more than 9.5% of employee-only income. More information on safe harbors and affordability can be found below. See our page on affordable employer-sponsored insurance for an in-depth look at affordability.

How Much is the Employer Shared Responsibility Fee?

The Employer Shared Responsibility is $2,000 a year, per employee, 1/12 of which is owed for each month. If the employee got marketplace cost assistance, the fee is $3,000 per employee. However, there are some important details that affect what an employer will owe.

• The annual fee is $2,000 per employee if insurance isn’t offered at all (the first 30 full-time employees are exempt). This helps lower the fee for smaller firms who are still required to pay the fee.

• If at least one full-time employee receives a premium tax credit due to coverage either being unaffordable or failing to provide minimum value, the employer must pay the lesser of $3,000 for each of those employees receiving a credit or $2,000 for each of their full-time employees (minus the first 30 employees).

• Employers who pay the $3,000 per-employee fee don’t subtract the first 30 employees. An employer would only pay the $3000 if few enough employees weren’t adequately covered to make it the cheapest payment option.

• For 2015, the first 80 full-time employees are exempt from the fee – not just the first 30.

• The fee is a per-month fee, due annually starting in 2015 for small businesses with 100 or more full-time equivalent employees (2016 for those with 50-99). So, the per-month fee is 1/12 of the $2,000 or $3,000 per employee.

• Unlike employer contributions to employee premiums, the Employer Shared Responsibility Payment is not tax-deductible.

• Health care tax credits have been retroactively available to small businesses with 25 or less full-time equivalent employees since 2010.

• Transition relief is available to small businesses and large businesses transitioning into compliance with the new mandate. Please see the official IRS rules regarding transition relief here.

Official Resources

This page should give you a basic understanding of the employer mandate. For further details, check out the following official sources we used to create this page:

• You can read the shared responsibility provisions regarding employee health coverage under section 4980H of the Internal Revenue Code, enacted by the Affordable Care Act.

• The Internal Revenue Service has more information about the Employer Shared Responsibility Payment. You can also see the IRS Q&A on the mandate, which is very informative and detailed.

• You can also check out this U.S. Treasury Department facts sheet.

ADVICE: If you don’t find what you are looking for or want further details, read the final Regulations on the Shared Responsibility for Employers from the Federal Register / Vol. 79, No. 29.

Know the Law – Employer Shared Responsibility

The original PPACA includes two short sections that are important for employers: 1) Employer Responsibilities and 2) Premium Tax Credits. See our Summary of PPACA Provisions for a summary of those parts and our additional rules page for clarifications. More clarifications can be found at IRS.Gov. For all employer-related sections, open up the summary and use the find command on your keyboard to search for “employer.” You’ll find details on excise taxes for high-end plans, w2 requirements, and more.

Subtitle E—Affordable Coverage Choices for All Americans. Part I – Premium Tax Credits and Cost-Sharing Reductions

Subtitle F—Shared Responsibility for Health Care. Part II – Employer Responsibilities

The NFIB explains how full-time workers are defined for the ACA.How to Credit Hours Under the Affordable Care Act

Below we take a look at crediting hours under the Affordable Care Act to find out which employers have to pay the fee, how full-time is calculated, measurement periods, and more. First, let’s do a quick review.

- Employers determine full-time employees by hours of service (at least 30 hours per week or 130 hours per month). Employers can also use actual hours, days-worked equivalency, or weeks-worked equivalency. For new hires, employers use an initial measurement period; for existing employees, employers use a look-back period of 3 -12 months. Once an employee becomes full-time they must be offered coverage within 90 days, if an employee is hired as full-time they must be offered coverage within 90 days of their start date.

- For the mandate, each full-time employee counts as 1 full-time employee and every 30 hours worked by non-full-time workers equal 1 “full-time equivalent.” You must add full-time and “full-time equivalent” workers to find out the number of employees you have under the mandate.

- When seeing if you have to comply with the mandate, employers can use measurement periods of 3 – 12 months, typically starting at payroll or at the first of the month. There are a number of different types of measuring periods that are used for determining full-time equivalent employees.

- Different methods are used for calculating hours of non-traditional employees. There are also special rules for situations such as unpaid leave, rehires, termination, and more.

Read more about crediting hours and the mandate from ajg.com. This document does an excellent job at taking an extensive, 20 page, look into crediting different types of employee hours.

Understanding Full-time Equivalent Employees

In simple terms, FTE or “full-time equivalent” equals (the total number of full-time employees) plus (the combined number of part-time employee hours divided by 30).

Learn more (PDF) about how FTEs are counted for SHOP or check out the SHOP FTE calculator.

FACT: The requirement to insure employees is based on full-time equivalent employees (FTE), which includes Part-time hours. There are a few different methods for calculating FTE. Learn more about calculating FTE from the IRS.

More on FTE’s and the Employer Mandate.How Many Hours is Full-time Under ObamaCare?

Under the ACA, for providing an employee with health benefits, full-time is defined as working an average of 30 hours a week or more or 130 hours a month. To be considered full-time, the employee must work more than 120 days in a year. Learn more from the IRS.

How Many Hours is Part-time Under ObamaCare?

Under the ACA, for providing an employee with health benefits, part-time is defined as working an average of fewer than 30 hours a week or less than 130 hours a month. To be considered part-time, the employee must work more than 120 days in a year.

Since only full-time workers need to be provided with benefits under the law, some companies have chosen to employ more part-time workers to avoid providing benefits. See more on ObamaCare and jobs.

Measurement Periods and Lookback Periods

To find out if an employer has to comply with the mandate the government looks at initial measurement periods for new hires to determine full-time status. To find out if an existing employee is full-time they use look-back periods. Employers also use measuring periods of 3 – 12 months when looking at full-time equivalent employees to see if they have to offer full-time employees coverage for the mandate.

Look-back periods and initial measurement periods can be between 3 and 12 months, and are chosen by the employer. These periods can start on the 1st of the calendar month or at the start of payroll (with new hires being on the first on the month or the first payroll period after their start date).

Understanding measurement periods can get a little complicated, and employers who are subject to the mandate should seek professional legal advice.

How to Know if Your Coverage is Affordable

If an employee’s share of the premium costs for employee-only coverage (not the entire family) is more than 9.5% of their yearly household income, the coverage is not considered affordable.

Since you typically won’t know your employee’s household income, you can avoid a Shared Responsibility Payment for an employee if the employee’s share of the premium for employee-only coverage doesn’t exceed 9.5% of their wages for that year as reported on the employee’s W-2 form.

Here are three safe harbor methods for determining Affordability:

- 9.5% of an employee’s W-2 wages (reduced for any salary reductions under a 401(k) plan or cafeteria plan)

- 9.5% of an employee’s monthly wages (hourly rate x 130 hours per month)

- 9.5% of the Federal Poverty Level for a single individual

For additional information about this and other safe harbors see IRS.gov/aca.

How to Know if your Coverage Provides Minimum Value

A health plan meets minimum value if the plan’s share of the average total costs of covered services is at least 60%. In other words, it must meet the basic requirements of a plan sold on the health insurance marketplace.

If you purchase a group plan using the SHOP (Small Businesses Health Options Marketplace), it will qualify as having a minimum value, so we strongly suggest using the SHOP. Firms with over 100 full-time employees (50 in some States) can’t use the marketplace yet. Even if your firm can’t use the marketplace, you can use healthcare.gov to get an idea of what benefits and actuarial value bronze plans (the lowest-tier plan that provides minimum value) cover.

To determine whether other coverage meets minimum value, you can use the minimum value calculator provided by the U.S. Department of Health and Human Services. When you input certain information about the plan into the calculator (like deductibles and copayments), it will help you determine if the plan covers at least 60% of the total allowed costs of benefits provided under the plan.

How Do Employers Purchase Group Health Plans?

Employers with fewer than 100 full-time workers (or 50 in some States) will be able to use a SHOP exchange to compare and purchase group plans for their employees. Exchanges (marketplaces) create large pools of buyers, which offer the buying power that only large firms have had in the past. In theory, the increased buying power leads to better quality, more affordable plans. Smaller firms will see even greater affordability due to subsidies that are offered through the marketplace to employers with fewer than 25 full-time equivalent employees.

The marketplace helps to level the playing field for businesses that may have been overcharged in the past. Employers of all sizes can still shop outside the marketplace as long as they choose a plan that provides the minimum coverage offered on the marketplace (roughly a 60% actuarial value, and in compliance with the ACA).

See ObamaCare Small Business for more information small business rules and taxes. See Our SHOP Exchange Guide to learn more about purchasing health insurance for your employees.

Reasonable Methods for Crediting Hours

For normal full-time and part-time employees, there are a few ways to count hours.

(1) Actual Hours Worked: An employer may determine actual hours of service from records of hours worked, and hours for which payment is made or due, including hours of paid leave. For example, if payroll records indicate an employee worked 2,000 hours and was paid for an additional 80 hours on account of vacation, holiday, and illness, the employee must be credited with 2,080 hours of service (2,000 hours worked + 80 hours for which payment was made or due).

(2) Days-Worked Equivalency: An employer may use a days-worked equivalency whereby the employee is credited with 8 hours of service for each day that the employee would be required to be credited with at least one hour of service, including hours of paid leave. For example, if an employer uses the days-worked equivalency for an employee who works from 8:00a.m.–12:00p.m. every day for 200 days, the employee must be credited with 1,600 hours of service (8 hours for each day the employee would otherwise be credited with at least one hour of service x 200 days).

(3) Weeks-Worked Equivalency: An employer may use a weeks-worked equivalency whereby the employee is credited with 40 hours of service for each week for which payment is made or due including weeks of paid leave. For example, if an employee worked 49 weeks, took two weeks of vacation with pay, and took one week of leave without pay, the employee must be credited with 2,040 hours of service (51 weeks x 40 hours per week).

• Part-time employee hours can be averaged from anywhere between a 3 and 12-month span to determine FTE.

• Under the ACA, employees who work more than 30 hours a week or an average of 130 hours a month are considered full-time (see below for more details on determining full-time status).

• In 2015, employers with more than 100 FTEs will need to cover 70% of their full-time employees. By 2016, employers with more than 50 FTEs will need to provide coverage to “substantially all” (95%) of their full-time employees.

Seasonal employees, contractors, volunteers, educational employees, services provided by student work-study programs, adjunct faculty, and business owners either don’t count toward the total or count toward the total differently. For those who do count toward the total, employers should use a reasonable method of crediting hours of service that is consistent with section 4980H of the IRS tax code.

A method of crediting hours is not reasonable if it takes into account only a portion of an employee’s hours of service with the effect of characterizing, as a non-full-time employee, an employee in a position that traditionally involves at least 30 hours of service per week. For example, it is not a reasonable method of crediting hours to fail to take into account travel time for a traveling salesperson compensated on a commission basis.

The Truth About Who The Employer Mandate Affects

96% of all firms in the United States – or 5.8 million out of 6 million total firms – have under 50 employees, and will not be penalized for choosing not to provide health coverage to their employees. 96% of firms with 50 more full-time employees already offered coverage for full-time workers before the ACA. Less than .2% of small businesses (10,000 out of 6 million) will actually have to provide insurance to full-time employees or pay the shared responsibility fee due to ObamaCare. The caveat, of course, is that some of those companies are some of Americas largest employers, and thus we are talking millions of folks getting covered through the mandate.

More than half of all Americans have health coverage through an employer, including nearly two-thirds of the adult workers who are too young to qualify for Medicare.

ObamaCare Mandate Rules: What about Businesses With Under 50 Full-time Equivalent Employees?

One thing that seems to get ignored when discussing the employer mandate is the fact that employers with under 50 full-time equivalent employees almost universally benefit from ObamaCare. If a small business has 25 or fewer full-time employees with less than $50,000 per employee in average annual wages, they can apply for tax breaks of up to 50% (35% for non-profits) of their contribution to their employees’ premiums. This provision began in 2014. Businesses must pay for at least 50 percent of their employees’ premiums and their worker’s average annual wages can’t be more than $50,000 to qualify.

• Insurance must be purchased on the Affordable Insurance Exchange for at least two years to qualify for tax credits. Credits can be claimed on your income tax return with an attached Form 8941 showing calculations for the credit.

• Businesses with 10 or fewer full-time employees and average annual wages of $20,000 or less were eligible for the full 35% credit between 2010 and 2013 and now receive a 50% tax credit, which began in 2014.

• Small business employers with more than 25 full-time equivalent employees will not have access to the same tax breaks as those small businesses with fewer than 25 employees. Tax credits are available for small businesses on a sliding scale depending on the number of employees and average annual wages.

• Employer-based plans that provide health insurance to retirees ages 55-64 can get financial help via the Early Retiree Reinsurance Program – a program designed to lower the cost of premiums for all employees and reduce employer health costs.

• Tax credits are available retroactively since 2010, so you can still claim unclaimed credits.

Avoiding the Mandate by Moving Employees from Full-time to Part-time

To avoid the employer mandate, some employers who have to comply with the mandate are moving employees to a workweek of about 27 hours a week. The law originally lowered part-time status to 30 hours a week for health benefits to get more employers to comply. This has backfired in cases in which employers have decreased employee hours to the 27-hour mark instead of complying. They allow for fluctuations in employee hours while avoiding the 30 or more hours that would qualify them for full-time benefits. While this may save money for very large firms, smaller firms have a lot of flexibility built into the law, and shouldn’t find cutting back hours necessary.

While some are using part-time status to avoid the mandate, many employers are embracing the mandate and using benefits to retain happy, healthy employees. Small businesses with less than 25 FTE and less than $50,000 in annual wages can get tax credits for insuring employees. This means that larger businesses that move workers to part-time status may find that they lose employees to smaller businesses who, over time, will be able to offer better hours and benefits.

ADVICE: An employer won’t have to make a payment on the first 30 full-time employees (80 in 2015). So, some businesses with just over the 50 FTE mark paid the fee (or didn’t offer benefits to some full-time employees) rather than cutting back hours. Lower-earning employees will almost certainly get cheaper coverage through the marketplace due to cost assistance. For instance, if an employer has 60 FTE but only 30 full-time workers, they can go without insuring their employees, since the first 30 are exempt from the fee.

Sec. 1558. Protection for employees. Amends the Fair Labor Standards Act to ensure that no employer shall discharge or discriminate in any manner against any employee on his or her compensation, terms, conditions, or other privileges of employment because the employee has received a premium tax credit or for other reasons.

Understanding How the Mandate Affects Your Business and Employer Mandate Loopholes

ObamaCare helps small businesses via the SHOP marketplace and tax credits, costs large firms a little more due to the employer mandate, and leaves a few mid-sized firms stuck in the middle. Let’s take a look at how ObamaCare’s mandate affects a business with just over 50 full-time equivalent employees.

Consider a firm with the equivalent of 60 full-time employees. To comply with the employer mandate, they could either cut back worker hours by over 10 full-time equivalent workers, choose not to insure some or all their full-time workers and pay a fee (the first 30 full-time employees are exempt), or cut back full-time workers to part-time and insure fewer employees.

If the firm kept only 30 workers at full-time and didn’t offer any employees health insurance, they would avoid the fee completely since their first 30 workers are exempt, yet their total number of full-time equivalent employee hours wouldn’t have changed. Unfortunately, it is loopholes like this, which have caused some businesses to cut employee hours down to a 27-hour part-time status. While this is cost-effective for the firm, it’s not good for employees, who will see a lower income and be left without employer-based health coverage.

The point of the law is not for small businesses to find loopholes; the point is to hold larger firms accountable for employee healthcare. Getting a break on their first 30 employees is next to meaningless for a company like Walmart, but to a firm that employs 40 full-time workers, it is a pretty fair way to ask them to help ensure all Americans have access to affordable health care.

- In general, the fee is only “triggered” if at least one employee shops on the marketplace and is eligible for a federal premium subsidy. So, failing to provide benefits to workers who make too much for cost assistance won’t count toward the fee.

ObamaCare means that small employers with less than 50 full-time equivalent employees won’t pay a fine if they do not provide health insurance and those with less than 25 full-time equivalent employees can get tax breaks of up to 50% of the cost of their employees’ premium costs via their State’s Health Insurance Marketplace.

ObamaCare Employer Mandate and Job Loss

Some companies cut back hours to avoid the mandate, but companies like Walmart decided it was better to embrace the law than to fight it, and are now moving 35,000 workers from part-time to full-time status and giving them and their domestic partner’s health benefits.

How the ObamaCare Employer Mandate Will Affect You

If you work for a company that doesn’t currently provide health insurance to their full-time workers and you work 30 hours a week or more, you are at the highest risk of having a negative impact from the provision. Although the “mandate” is meant to help provide this demographic insurance, it has backfired with some of America’s largest employers and, ironically enough, with many government institutions. While only a small portion of the companies affected have responded by cutting hours, the number of Americans affected is staggeringly high. If you have been affected by the ObamaCare “employer mandate,” please write us using the contact button on the right sidebar and tell us your story so we can share it.

ObamaCare Employer Mandate Penalty Facts

ObamaCare’s “employer mandate” is officially a “shared responsibility fee.” Like the “individual mandate,” it is a tax penalty to ensure that companies who choose not to provide health care for their workers are still paying into the healthcare system. The law assumes that the employee will purchase insurance elsewhere.

Many news outlets report the “employer mandate” as a $3000 fee. This isn’t true. The penalty for small businesses not covering their workers is $2000 per employee minus the first 30 full-time employees. If an employer doesn’t offer coverage, or for employers who do provide coverage but offer coverage that doesn’t provide minimum value or isn’t affordable, the fee is the lesser of $3,000 per full-time employee receiving a subsidy, or $2,000 per full-time employee minus the first 30.

• In total, 6 million people are estimated to gain insurance through employer-based health insurance due to the mandate.

• The total cost of single coverage was $10,266 in 2013 of which employees contributed $2,355. That total cost is projected to rise to $11,304 by 2015. Although the rise is significant, the cost of health care has been rising regardless of ObamaCare. This number has a greater impact on larger businesses. Smaller businesses will be able to obtain premium tax credits through the SHOP exchange saving up to half of this cost considering the average factors in high-end insurance plans.

ObamaCare Individual Mandate

Both the Individual Mandate and Employer Mandate are part of the same Shared Responsibility Provision. See our Individual Shared Responsibility page more information on the ObamaCare individual mandate.

What is the Impact of the ObamaCare Employer Mandate

The ObamaCare employer mandate has already caused many companies to cut hours from full-time workers to ensure that they are given part-time status. Although less than a fraction of a percent of firms in the US have over 50 full-time equivalent employees and don’t provide health insurance, many Americans are finding their hours cut. See our page on the Affordable Care Act and jobs for a detailed discussion on how the mandate has affected employment.

ObamaCare Employer Mandate

![]()