Employer Tax Credit Form 8941 and Instructions

Employers can get a Tax Credit for up to 50% of their contribution to employee premiums by filing Form 8941, Credit for Small Employer Health Insurance Premiums. Get detailed HTML based instructions on Form 8941 from the IRS, simplified instructions ObamaCare’s employer tax credit form can be found below.

What is Form 8941, Credit for Small Employer Health Insurance Premiums?

Form 8941 is the form that small employers use to claim the tax credit.

If you are a small business employer, you may be able to carry the credit back or forward. And if you are a tax-exempt employer, you may be eligible for a refundable credit.

Who Can Get the Employer Tax Credit for Health Insurance?

- Firms with less than 25 full-time equivalent employees (FTE), making less than $50,000 in average annual wages, can get the credit.

- Only those with less than 10 FTE, making less than $10,000 in average annual wages, who pays at least 50% of employee premiums, will get the full credit.

How Much is the Employer Tax Credit For?

- Starting in 2013 for-profit employers can use the form to get up to 50% of their contribution to employee premiums. Non-profit employers can get up to 35%.

- For 2009-2012 for-profit employers can use the form to get up to 35% of their contribution to employee premiums. Non-profit employers can get up to 25%.

NOTE: You must reduce your deduction for the cost of providing health insurance coverage to your employees by the amount of any credit for small employer health insurance premiums allowed with respect to the coverage.

What Years Can I Claim Employer Tax Credits for HealthCare?

- Eligible small employers (defined below) use Form 8941 to figure the credit for small employer health insurance premiums for tax years beginning in 2010.

- Starting in 2014, the employer tax credit is only offered for a 2 consecutive tax year credit period.

- Tax Credits are retroactive for tax years 2010 – 2012, meaning you can file for those tax credits if you haven’t already.

- So a company who qualified since 2010 can claim 2010-2015, but not beyond. You also can’t claim in 2014 and 2016, as the years must be consecutive.

How to File the Employer Tax Credit?

- An eligible small employer (or any predecessor) files an income tax return with an attached Form 8941, or

- A tax-exempt eligible small employer (or any predecessor) files Form 990-T with an attached Form 8941.

What Counts as Employer Premiums Paid?

Only premiums you paid for health insurance coverage under a qualifying arrangement for individuals considered employees are counted when figuring your credit.

State premium subsidy or tax credit. If you are entitled to a state tax credit or a state premium subsidy paid directly to you for premiums you paid, do not reduce the amount you paid by the credit or subsidy amount. Also, if a state pays a premium subsidy directly to your insurance provider, treat the subsidy amount as an amount you paid for employee health insurance coverage.

Wellness programs. A wellness program is generally an insurance program of health promotion or disease prevention. If you pay part or all of the cost of an employee’s participation in a wellness program, use the amount you paid to figure your employer premiums paid.

Tobacco surcharges. A tobacco surcharge is generally an additional amount charged for insurance for a tobacco user. If you pay part or all of an employee’s tobacco surcharge, you cannot use the amount you paid to figure your employer premiums paid.

Dependent coverage. Dependent coverage is generally coverage offered separately to an individual who is or may become eligible for coverage under the terms of a group health plan because of a relationship to a participant-employee, whether or not a dependent of the participant-employee. Dependent coverage does not include coverage, such as family coverage, which includes coverage of the participant-employee. If you pay part or all of the cost of an employee’s dependent coverage, use the amount you paid to figure your employer premiums paid.

Portion of premiums paid. If you pay only a portion of the premiums and your employees pay the rest, only the portion you pay is taken into account. For this purpose, any premium paid through a salary reduction arrangement under a section 125 cafeteria plan is not treated as an employer paid premium. For more information on cafeteria plans, see section 1 of Publication 15-B, Employer’s Tax Guide to Fringe Benefits.

Exception for Certain SHOP Plans.

If you got your employee’s coverage through the SHOP (the employer Marketplace website) for and meet the following requirements, it will count as having coverage for the full year:

- As of August 26, 2013, the employer offered coverage in a plan year that did not begin on the first day of its tax year.

- The coverage provided by this plan during the employer’s 2014 tax year would have qualified for the credit under the pre-2014 credit rules.

- The employer began offering coverage through a SHOP Exchange as of the first day of its plan year that began in 2014.

A stand-alone dental plan offered through a SHOP exchange will be considered a qualified health plan for purposes of the credit.

Qualifying Arrangement

A qualifying arrangement is generally an arrangement that requires you to pay a uniform percentage (not less than 50%) of the premium cost for each enrolled employee’s health insurance coverage. An arrangement that offers different tiers of coverage (for example, employee-only and family coverage) is generally a qualifying arrangement if it requires you to pay a uniform percentage (not less than 50%) separately for each tier of coverage you offer. However, an arrangement can be a qualifying arrangement even if it requires you to pay a uniform percentage that is less than 50% of the premium cost for some employees. See 8941 instructions for details.

WorksSheets for Employer Tax Credit

The employer tax credit worksheets can be found in the instructions for 8941 and are used for most calculations required by the form. We will provide simplified instructions for using the worksheets to fill out the form below.

Who has to File the 8941 Form?

Partnerships, S corporations, cooperatives, estates, trusts, and tax-exempt eligible small employers must file this form to claim the credit. All other taxpayers must not complete or file this form if their only source for this credit is a partnership, S corporation, cooperative, estate, or trust. Instead, they must report this credit directly on line 4h in Part III of Form 3800.

Exception for certain employers in Washington and Wisconsin. For calendar year 2014, SHOP Marketplaces in certain counties of Washington and Wisconsin will not have qualified health plans available for employers to offer to employees. Transition relief allows employers with a principal business address in the counties listed below to claim the credit for their tax year beginning in 2014. For details, see Notice 2014-6, 2014-2 I.R.B. 279, available at www.irs.gov/irb/2014-2_IRB/ar16.html.

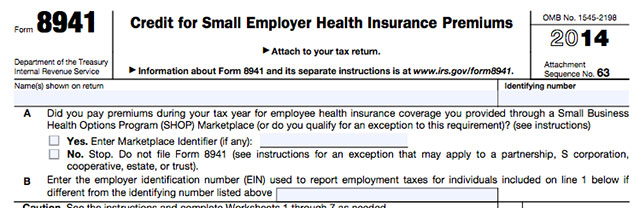

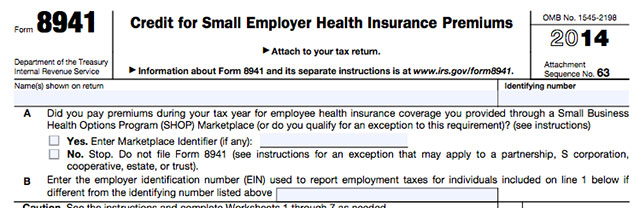

Simplified Instructions for 8941

Line A. Did you use the Small Business Health Options Program (SHOP)?

If yes simply report your Marketplace ID number. (you also answer yes if you are a small employer from Wa or Wi who meets criteria above)

If no, don’t file Form 8941 unless you are filing it for a partnership, S corporation, cooperative, estate, trust, or tax-exempt eligible small employer that received from another entity a credit that must be reported on line 15.

Line B. Your EIN number.

Worksheets needed for Calculating Full-time Equivalent Employees (FTE) and average annual wages (needed for Line 1-3). You’ll use the following worksheets from 8941 instructions to show you meet the requirements to get a tax credit. Essentially it walks you through figuring out total full-time equivalent hours and average annual wages. It’s not as complex as it looks.

Worksheet 1 on page 5 of 8941 instructions. Information Needed To Complete Line 1 and Worksheets 2 and 3:

| (a) Individuals Considered Employees |

(b) Employee Hours of Service |

(c) Employee Wages Paid |

|---|---|---|

| 1. | ||

| 2. etc… | ||

| Totals |

Worksheet 2. Information Needed To Complete Line 2 (FTEs)

Your credit is reduced if you had more than 10 full-time equivalent employees (FTEs) for the tax year. If you had 25 or more FTEs for the tax year, your credit is reduced to zero.

| 1. | Enter the total employee hours of service from Worksheet 1, column (b) | 1. | |

| 2. | Hours of service per FTE | 2. | 2,080 |

| 3. | Full-time equivalent employees. Divide line 1 by line 2. If the result is not a whole number (0, 1, 2, etc.), generally round the result down to the next lowest whole number. For example, round 2.99 down to 2. However, if the result is less than one, enter 1. Report this number on Form 8941, line 2 | 3. |

Worksheet 3. Information Needed To Complete Line 3 (Average Annual Wages)

Your credit is reduced if you paid average annual wages of more than $25,000 for the tax year. If you paid average annual wages of $51,000 or more for the tax year, your credit is reduced to zero.

| 1. | Enter the total employee wages paid from Worksheet 1, column (c) | 1. | |

| 2. | Enter FTEs from Worksheet 2, line 3 | 2. | |

| 3. | Average annual wages. Divide line 1 by line 2. If the result is not a multiple of $1,000 ($1,000, $2,000, $3,000, etc.), round the result down to the next lowest multiple of $1,000. For example, round $2,999 down to $2,000. Report this amount on Form 8941, line 3 | 3. |

Worksheet 4. Information Needed To Complete Lines 4, 5, and 13 and Worksheet 7

| (a) Enrolled Individuals Considered Employees |

(b) Employer Premiums Paid |

(c) Adjusted Average Premiums |

(d) Enrolled Employee Hours of Service |

|---|---|---|---|

| 1. | |||

| 2… Etc. | |||

| Totals |

Do not complete column (d) of Worksheet 4 if Form 8941, line 12, is zero.

Line 1. Number of employees. This doesn’t include owners, partners, and dependents of employees and is the total from column a of worksheet 1. Check out instructions for how to credit employee hours.

Line 2. Number of Full-time Equivalent Employees. This is the total number of credited hours of all employees divided by 30.(from Worksheet 2, line 3). If you entered 25 or more, skip lines 3 through 11 and enter -0- on line 12. (ie. you don’t get a tax credit).

Line 3. Average Annual Wages. This is the average annual wages of all FTE (from Worksheet 3, line 3). If you entered $51,000 or more, skip lines 4 through 11 and enter -0- on line 12. (ie. you don’t get a tax credit).

Line 4. Your contribution. How much you paid for employee premiums for health insurance that meets a qualifying arrangement (generally you paid 50% of the premium). (total from Worksheet 4, column (b))

Line 5. Adjusted Premiums. See the average premium tables starting on page 10 of the instructions (it’s long, so we aren’t printing it). If your premiums were higher than your regions average premium, then you adjust your premiums by that amount. In other words you’ll get less tax credits for offering a higher premium plan, and more for lower premiums. (total from Worksheet 4, column (c)).

Line 6. Which number is larger Adjusted Premiums or your Contribution? Enter the smaller of line 4 or 5. Whatever number is smaller is the amount you get tax credits on!

Line 7. Max Credit. Time to start adding up that max tax credit, unfortunately you’ll be adjusting it back down to your actual amount shortly.

• Tax-exempt small employers, multiply line 6 by 35% (.35)

• All other small employers, multiply line 6 by 50% (.50)

Worksheets Needed for Line 8 and 9. These worksheets help you figure out the actual credit you are owed.

Worksheet 5. Information Needed To Complete Line 8 (If Line 2 is More Than 10)

| 1. | Enter the amount from Form 8941, line 7 | 1. | |||

| 2. | Enter the number from Form 8941, line 2 | 2. | |||

| 3. | Subtract 10 from line 2 | 3. | |||

| 4. | Divide line 3 by 15. Enter the result as a decimal (rounded to at least 3 places) | 4. | |||

| 5. | Multiply line 1 by line 4 | 5. | |||

| 6. | Subtract line 5 from line 1. Report this amount on Form 8941, line 8 | 6. | |||

Worksheet 6. Information Needed To Complete Line 9 (If Line 3 is More Than $25,000)

| 1. | Enter the amount from Form 8941, line 8 | 1. | |||

| 2. | Enter the amount from Form 8941, line 7 | 2. | |||

| 3. | Enter the amount from Form 8941, line 3 | 3. | |||

| 4. | Subtract $25,400 from line 3 | 4. | |||

| 5. | Divide line 4 by $25,400. Enter the result as a decimal (rounded to at least 3 places) | 5. | |||

| 6. | Multiply line 2 by line 5 | 6. | |||

| 7. | Subtract line 6 from line 1. Report this amount on Form 8941, line 9 | 7. | |||

Line 8. If you have a mom and pop, you get the full credit. This is the part where the tax credit is adjusted for FTE, adjusting for average annual wages comes next. If line 2 is 10 or less (10 or less FTE), enter the amount from line 7 . Otherwise, enter the amount from Worksheet 5, line 6.

Line 9. Average Annual Wages over $25,000. Adjust the max tax credit for average wages between $25,000 – $50,000, don’t adjust if less than $25,000. If line 3 is $25,000 or less, enter the amount from line 8. Otherwise, enter the amount from Worksheet 6, line 7 .

Line 10. Adjust for state premium assistance. Factor in employee premium assistance from the state. (

Line 11. Compare state premiums with amount you paid. If the state paid your premiums already, you obviously don’t get a Federal tax credit.

Worksheet 7. Information Needed To Complete Line 14 (If Line 12 is More Than Zero)

| 1. | Enter the total enrolled employee hours of service from Worksheet 4, column (d) | 1. | |

| 2. | Hours of service per FTE | 2. | 2,080 |

| 3. | Divide line 1 by line 2. If the result is not a whole number (0, 1, 2, etc.), generally round the result down to the next lowest whole number. For example, round 2.99 down to 2. However, if the result is less than one, enter 1. Report this number on Form 8941, line 14 |

Line 12. The Tax Credit after state assistance. Enter the smaller of line 9 or line 11. This is the tax credit after state assistance and adjusting for annual average wages.

If line 12 is zero, skip lines 13 and 14 and go to line 15.

Line 13. Enrolled individuals considered employees. Enter the total from Worksheet 4, column (a).

Line 14. Actual FTE’s vs. FTE’s counted for Tax Credit. Enter the number of FTEs you would have entered on line 2 if you only included employees included on line 13 (from Worksheet 7, line 3)

Line 15. Credits for partnerships, S corporations,cooperatives, estates, and trusts. Enter any credit for small employer health insurance premiums from:

- Schedule K-1 (Form 1065), box 15 (code P);

- Schedule K-1 (Form 1120S), box 13 (code P);

- Schedule K-1 (Form 1041), box 13 (code G); and

- Form 1099-PATR, Taxable Distributions Received From Cooperatives, box 10, or other notice of credit allocation.

Line 16. Directions for Line 15. Partnerships, S corporations, cooperatives, estates, trusts, and tax-exempt eligible small employers must always report the above credits on line 15. All other filers figuring a separate credit on earlier lines must also report the above credits on line 15. All others not using earlier lines to figure a separate credit must report the above credits directly on Form 3800, Part lll, line 4h.

Line 17. Cooperatives. A cooperative described in section 1381(a) must allocate to its patrons the credit in excess of its tax liability. Therefore, to figure the unused amount of the credit allocated to patrons, the cooperative must first figure its tax liability. While any excess is allocated to patrons, any credit recapture applies as if the cooperative had claimed the entire credit. If the cooperative is subject to the passive activity rules, include on line 15 any credit for small employer health insurance premiums from passive activities disallowed for prior years and carried forward to this year. Complete Form 8810, Corporate Passive Activity Loss and Credit Limitations, to determine the allowed credit that must be allocated to patrons. For details, see the Instructions for Form 8810.

Line 18. Estates and trusts. Allocate the credit on line 16 between the estate or trust and the beneficiaries in the same proportion as income was allocated and enter the beneficiaries’ share on line 17. If the estate or trust is subject to the passive activity rules, include on line 15 any credit for small employer health insurance premiums from passive activities disallowed for prior years and carried forward to this year. Complete Form 8582-CR, Passive Activity Credit Limitations, to determine the allowed credit that must be allocated between the estate or trust and the beneficiaries. For details, see the Instructions for Form 8582-CR.

Line 19. Total Payroll Taxes. Enter the amount you paid in 2014 for taxes considered payroll taxes for purposes of this credit.

Line 20. Tax Exempt Employers. Tax-exempt small employers, enter the smaller of line 16 or line 19 here and on Form 990-T, line 44f.