The Psychology of ObamaCare’s Advanced Tax Credits and Repayment Limits

Psychology, Loopholes, Welfare Traps, and Other Considerations of the Affordable Care Act’s Advanced Premium Tax Credits

When it comes to Advanced Premium Tax Credits, it is always tempting to take the maximum amount you qualify for. However, repayment limits can mean owing back credits. This has a lot of complex implications.

On this page we look at tax strategy and psychology related to Advanced Premium Tax Credits and the corresponding repayment limits.

The Problems and Loopholes With Advanced Premium Tax Credits

On paper, those making between 100% – 400% FPL are better off taking the maximum amount of Advanced Premium Tax Credits up front, and then paying back the IRS as needed, than they are being “conservative” and taking a reduced amount or waiting to take them until the end of the year.

This is especially true if a person is self employed, takes contract work, or otherwise has income they can’t predict.

Essentially, borrowing money from the government at zero interest and paying it back later (if needed; and even if not needed, potentially not even the full amount)… is better than paying money upfront and then taking the credits at tax time (or in the case of Medicaid/CHIP, getting that up front until you don’t qualify for it any more).

This is true for a few different reasons:

- Many people can’t properly predict their income, thus estimated toward the low end works if it ends up that way and only results in you having to make up the difference if you make more money. It is like a useful zero interest loan from the IRS. Great for the self employed!

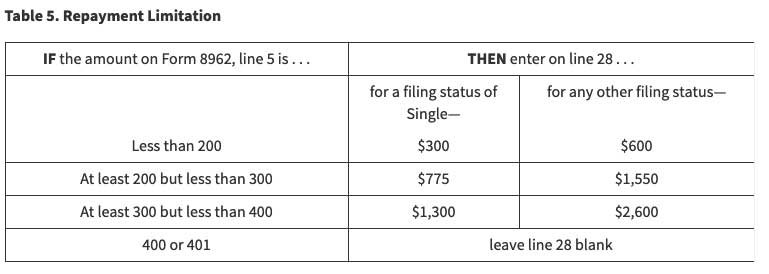

- Repayment limits mean that in some income brackets you won’t have to pay back the full amount of the tax credit borrowed if you end up making more than you projected.

- You don’t have to pay back cost sharing reduction subsidies (CSR) AKA out-of-pocket assistance (meaning if you can reasonably qualify for it, you should generally take it).

- Inflation is a thing, and thus borrowing money interest free and then paying it back over a year later is always in your favor.

- If you know you won’t have income for the first part of the year, you and/or your family may qualify for free or low income Medicaid/CHIP in the meantime (taking this assistance may be a better choice than predicting you’ll make enough to need credits).

With that said, all of that is just “on paper.”

In reality, the complexity of the tax code and tax credits mean that people are bound not to fully understand their choices and the consequences of their actions regarding Advanced Tax Credits.

This can lead to people having a negative experience in owing back tax credits, even when overestimating the amount they needed was a net benefit to them.

Let me illustrate the above with a few examples (all based on real stories):

Consider a situation where a family saves $20k on premiums via Advanced Tax Credits, but then draws $11k out of the 401k in December only to push their total income over the 400% poverty level, thus triggering an event where they owe back the $20k on their tax returns.

That is a bad situation to be in. Had they waited one month to draw money out of their 401k, they would have kept their assistance. Instead, because they didn’t understand one part of the tax code, they owe back $20k for taking $11k.

Or, consider an example where a self-employed person who makes over just 400% of the poverty level goes without tax credits, but then loses income later in the year and ends up qualifying for tax credits at tax time. They miss out on a year worth of “zero interest loans.” Not the end of the world, but not ideal.

Or, consider the story of a self-employed gentlemen who paid his full premiums all year thinking that he would get payment from a big contract in December. The payment didn’t come until after the 1st of January, and given this, his income for the previous year was about $5,000. This means he should have qualified for Medicaid the whole year, for free. Had he projected say “110%” FPL he would have gotten nearly free coverage through the marketplace after tax credits and out-of-pocket subsidies (100% a legal and legitimate thing to project in his shoes).

Had the payment come in in December, oh well, so he pays back the part of the tax credit he owed (cost sharing isn’t owed back). No big deal if planned for. The IRS only wants the full amount back if you go over 400% FPL, otherwise limits are reasonable (see repayment limits).

On the flip side, go below 100% and the IRS doesn’t even care if you file taxes (as you are below the tax filing threshold).

NOTE: The exact limits are subject to change each year, please see the current repayment limits.

The repayment amounts from the 2019 8962 form for advanced premium tax credits under the ACA.

The Negative Psychology of Repayment (and the Positive Psychology of Refund)

I think in general we all understand that repaying excess tax credits feels bad and getting a refund feels good.

Sure, this logically doesn’t make a ton of sense. A refund is money you didn’t owe but paid, a repayment is money you weren’t owed but were given.

So logically, a refund should feel bad and a repayment should feel good.

However, we know that human psychology doesn’t work like this.

Especially when the system behind it is confusing, like the tax system is, people are bound to appreciate a refund and get upset over a repayment.

There is a lot of positive psychology in a refund, and some people get refunds, but repayment actually eats in to people’s overarching refund about 1/2 the time in practice with the ACA, and these people tend to be more vocal.

This means every year people are upset with the ACA in practice.

This is made worse by high deductibles and insurance people feel like they aren’t using.

So while the mechanics aren’t broke mathematically speaking, when we factor in the human condition, we see a glaring problem with the way Advanced Credits work.

In Truth, on Paper, This is All Fair

As I hope I’ve already made the case, advanced tax credits are a smart and fair system that favors the user, the government, and the industry on paper.

The faults of this aspect are largely just psychological (negative for under- and over-taking) and incentive-based (it incentivizes “hogging” and disincentives thrift) and technical (in respect to people not understanding how taking a lump sum payment will cause repayment or losing income can mean missing out on assistance).

The root of the problem and the benefit is found in the fact that the system incentivizes borrowing tax credits from the government, which get paid to insurers today, for coverage today, but with repercussions tomorrow.

And while the repercussions are clear if you know the tax code, most people don’t and thus they are not clear.

Heck, it is even hard to figure out how to adjust your credits on the website if you wanted to. So people will just estimate their income once and not touch the site again for a year. That means many people end up with refunds or repayments.

The reality is, a year and a half later when taxes and credits are owed people no longer feel the “value” of their coverage or loan, and instead are just pissed about owing money, or pissed about not taking enough up-front, or happy for a day about the extra money in their return until it is spent.

Then, this is only made more complex by the inflation in plan costs.

Would someone making $40,000 a year really want to spend $3,500 on coverage if it wasn’t subsidized? How can you get someone to value you that? This is largely an issue of psychology over economics.

Tax Tips For Avoiding the Repayment Blues and Refund Should-be-Blues

I haven’t yet, and will not, write a “grey-hat ObamaCare tax tips” page, but if I did, let’s just say it wouldn’t be blank (see our white-hat tax tips and white-hat subsidy tips pages).

I am a blogger, and our team helps people understand the ACA, we aren’t “insiders” and we aren’t beholden to a party or industry.

In our years of studying the law and helping people, a few sticking points have popped up. This is one glaring sticking point in respect to the different ways you can take advantage of Advanced Credits and the different ways they can really feel like they are taking advantage of you.

How credits relate to inflation in health insurance costs aside, the overarching problem with the credits isn’t that they don’t work or aren’t fair, it is that the complex system they are part of means that people people end can end up in really psychologically intense situations without ever understanding how they got there.

In fact, the range of situations and what to do about them are so complex, I can’t even fit them in this page and keep it at a reasonable length.

I will say this though, be careful of the subsidy cliff. Going over 400% FPL after taking credits can mean repaying a ton of money. And that means going over it by a little is almost never the right move… yet, still, if you think you might go over and want health insurance, it is still a good move to project under and just be ready to pay back your credits. Odd, but that is the reality.

TIP: The ACA gets a lot right, but it also has a few sticking points like the psychological effect of having to repay tax credits when one’s income changes. We cover the major ACA sticking points, so click that link to learn more about other problems with the ACA.

Beverly Gafa

I just got hit with a $5400 tax bill because of going over 400%, which I was not aware of. I lost my job in January 2019 and received a severance, then filed for unemployment. While unemployed, I filed under Covered California and got the subsidy for health insurance and was grateful for the much needed the health insurance subsidy. I was unemployed from February through mid-October 2019. While employed earlier in the year, I had insurance through my employer through January, and then when I was employed again, I received insurance through the new employer in November through the end of the year. But the IRS takes the total amount I earned for the year (A total of $69K) and not the time while unemployed ($11,700), which is when I needed assistance in buying insurance. Also, I would not have purchased a higher level of insurance had I known they were basing this on the entire year’s income and I would have to pay that back. Though I don’t know how I would have been able to predict when I was going to find a job to estimate my annual income. While unemployed, I needed the assistance for premiums, especially at my age being 63, I’m sure I had to pay more $$’s. The IRS should base it on the period of the income you earned while having subsidy assistance (for me, Feb-Oct), vs. annual income. That clearly is not explained when applying online through Covered California. I am so upset about paying this money back and think the whole system is UNFAIR!!

ObamaCareFacts.comThe Author

Thank you for the comment. Totally agree that annual periods that start Jan 1 and end Dec 31 can feel arbitrary in many ways with healthcare. This is one such case. I am sorry to hear about your struggle.

Joan

My husband and I were getting a ACA health plan due to our low income. He got a job in May but had a probation period before he could get healthcare. I called the ACA and told them we had a life change and my husband got healthcare beginning in August. So the ACA cancelled our subsidy as of 7/31/18. All good right, NOT. Because my husband got a job (sales is hard to predict) and made 400% over the FPL we have to pay all our subsidy back! A real hardship. It is not FAIR. We only took the ACA plan when we were not making the income but from August to December we made too much so we are being penalized for getting a job! Why do we have to pay back when we only used it when we need it and were below FPL.

ObamaCareFacts.comThe Author

It is a super frustrating aspect of the ACA for sure. Subsidy cliffs that disincentivize making additional income make near zero sense to me personally. Always happy to see people speaking up. Thanks for sharing your story.

Harold Hutchison

My question is “Why isn’t healthcare a ‘right’ for all U.S. citizens?” Most of us take for granted the infrastructure that allows us to work and function day-to-day (I’m referring to our roads, water, power, police and fire protection, etc.), but many think that healthcare should be an option to use or not use as you choose. It is not. It is a necessity (just like the roads, etc.). Let’s pay for it like we do the rest, through the general fund (which is largely based on income tax). Income tax would probably have to be raised to pay for it, but that increase would be offset by the reduction (to zero!) in monthly insurance premiums. Do away with a personal option: everybody receives the same level and quality of coverage/care. No “premium” packages (with their low deductibles, high monthly rates, and good coverage), no “basic” plans (with high deductibles, lower rates, and poor coverage). All doctors, everywhere (in the States) would be available to everyone, all the time, and receive payment for their services from the general fund. No special plans for congressmen or government officials: everyone would receive the same level of good care (if the authorities had to suffer the same as our general population does now, our current problems with the system would have long since been fixed). Good doctors would flourish; poor doctors would not see many patients (why go to anybody but the best? what incentive is there to “be a bad doctor”? Bad providers would either get better, find a new field, or starve;’).

Okay, enough. You get the idea. Now, let the onslaught from the nay-sayers begin…

Alice Hutchings

My daughter makes less than 20thousand a year. She paid the premiums quoted but after filing income taxes they took over $600 from her refund. Why?

Erin

It depends on a lot of more specific details that your daughter should seek advice from an IRS taxpayer advocate to discuss her specific case. It may have been in error and an advocate can help her file an amended return or guide her on how to correct it. Here is more online Tax Payer Advocate resources.

Some people are simply misinformed/unaware that they are not eligible for Premium Tax Credits, like people who are claimed as dependents on another persons tax return. Dependents need to get health insurance through the person claiming them and the person claiming them will owe the fee if dependents are not covered. Another example is if the tax family is offered affordable minimal essential coverage through a spouse’s employer.

Cindy

When we signed up for obamacare we were never asked if there was employer sponsored insurance, so according to obamacare we qualified for tax credits. Then come to find out in July they were going to make employer help pay for what we were getting. We received 2600 in tax credits, and had to drop obamacare and cant afford the insurance through work, so getting fine for the rest of year. How are we supposed to pay that back???? And how is this fair.

tracy burgess

Anger at subsidy payback psychological? Look, I have wracked up 6K in medical debt in the last 2 years, upwards of 10K over the last three (I paid some of it off) because the deductibles are so high and nothing is ever covered or is subject to the deductible so to my family, not covered. If I get the bonus I worked my butt off for, that would help pay off the debt and give my family some breathing room, I have to pay every dime of it to pay back the subsidy. I’m telling my boss to keep it.

The premium for 3 people with these out sized deductibles is $2,195. per month before the subsidy. With the subsidy, we are still paying way more than 8% of income. Most of us getting the subsidy actually qualify for an exemption because it’s not affordable if over 8% of income. With subsidy, we are at about 13% of income, not counting what we pay monthly towards the medical debt. So, according to this law, IT IS NOT AFFORDABLE!!!

And lastly, folks at 100% or less of poverty level, you said they don’t have to file taxes, oh yes they do. They won’t get the medicaid without it. I just had the subsidy yanked MIDTERM AND WITHOUT MORE THAN 10 DAYS NOTICE effective 11/1 because the exchange says the IRS did not notify them that I filed my taxes. After 11 hours on the phone with the exchange over 3 days I am now told I get to spend God knows how much time on the phone with the IRS to get this done, meanwhile, it’s open enrollment and I can’t enroll unless I enroll in a subsidy free policy and pony up 3K for November and December.

Since this sucker was laid down upon our family, I have lost countless work hours on the phone dealing with bureaucratic mistake after mistake after mistake, our insurance and finances ALWAYS hanging in the balance. I have NOTHING good to say about it and it is NOT working at all for a heck of a lot of us who are sick and tired of hearing about how more people have insurance – no, more people are paying legally forced extortion with premiums over the 8% of income level and deductibles so high you are still effectively uninsured. And please, don’t tell me at least my screening exams are free – they are only free if they don’t find anything. Got a polyp, now it’s diagnostic and you pay full price because a colonoscopy runs about $2,500 and the deductible is $3,500. A big fat joke and a bit of a dirty trick if you ask me.

tracy

Anger at subsidy payback psychological? Look, I have wracked up 6K in medical debt in the last 2 years, upwards of 10K over the last three (I paid some of it off) because the deductibles are so high and nothing is ever covered or is subject to the deductible so to my family, not covered. If I get the bonus I worked my butt off for, that would help pay off the debt and give my family some breathing room, I have to pay every dime of it to pay back the subsidy. I’m telling my boss to keep it.

The premium for 3 people with these out sized deductibles is $2,195. per month before the subsidy. With the subsidy, we are still paying way more than 8% of income. Most of us getting the subsidy actually qualify for an exemption because it’s not affordable if over 8% of income. With subsidy, we are at about 13% of income, not counting what we pay monthly towards the medical debt. So, according to this law, IT IS NOT AFFORDABLE!!!

And lastly, folks at 100% or less of poverty level, you said they don’t have to file taxes, oh yes they do. They won’t get the medicaid without it. I just had the subsidy yanked MIDTERM AND WITHOUT MORE THAN 10 DAYS NOTICE effective 11/1 because the exchange says the IRS did not notify them that I filed my taxes. After 11 hours on the phone with the exchange over 3 days I am now told I get to spend God knows how much time on the phone with the IRS to get this done, meanwhile, it’s open enrollment and I can’t enroll unless I enroll in a subsidy free policy and pony up 3K for November and December.

Since this sucker was laid down upon our family, I have lost countless work hours on the phone dealing with bureaucratic mistake after mistake after mistake, our insurance and finances ALWAYS hanging in the balance. I have NOTHING good to say about it and it is NOT working at all for a heck of a lot of us who are sick and tired of hearing about how more people have insurance – no, more people are paying legally forced extortion with premiums over the 8% of income level and deductibles so high you are still effectively uninsured. And please, don’t tell me at least my screening exams are free – they are only free if they don’t find anything. Got a polyp, now it’s diagnostic and you pay full price because a colonoscopy runs about $2,500 and the deductible is $3,500. A big fat joke and a bit of a dirty trick if you ask me.

Tito J

Just to make sure I understand. If someone estimates that their income will be over the amount required to get the healthcare credit applied but then they make less than 10,000 for that year then their max repayment penalty is $300?

Ryan

Since I am self-employed, if I underestimate my income and have to pay back my subsides at tax time, am I allowed to deduct that repayment amount from my self-employed insurance premiums (form 1040 line 29)?

So for example, let’s say my insurance premiums cost $100 a month and the subsidy is $50. I’m paying $50 a month out of my pocket (or $600 a year). If I get to the end of the year and find out my income is too high for any subsidy, and I’m forced to pay back my subsidy of $600, can I deduct the entire $1200 for tax purposes? Or just the $600 I paid throughout the year?

The line of work I’m it makes it almost impossible to estimate income, and can even result in negative income. I’ve been paying the full premium amount for the last few years, with no subsidy assistance since my income is usually too high. But I don’t want to fall into the trap of where I pay the full premium amount, then possibly report negative income for the year, and then can’t recoup any money since I’d fall below 100% of the poverty line.

Thanks.

Kim

I would love to know the answer to Ryan’s question too. Thanks!

ObamaCareFacts.comThe Author

Great question. I’m not 100% sure. If anyone figures that out i’d love to have the answer here.

MY THOUGHTS: Noting that I don’t know. Here are some thoughts. I would assume no. If the government gives you $600 and then you give $600 back then the net effect is $0 and thus there is nothing to deduct. Still, from an investors standpoint, you are sort of better off with money up front even if you owe it all back (as the person who holds capital for a year and half until tax time can use it, and that is a benefit). From an accounting and psychological standpoint… probably better off not taking the money as its hard to mentally prepare for paying back credits. I can’t see how taking too many tax credits could be an official tax advantage though.

joe Roma

Ryan, I don’t know if you already got an answer to your question but I just did a test run of my tax return using H&R Block software and it allowed me to deduct as self-employed insurance premium all the repayment money which in case was all the subsidy (I am not an accountant so I am not giving any professional advise, just sharing my experience). This helps some of the financial pain but it seems grossly unfair to be penalized for unexpected changes. In my case I had ACA coverage for only 3 months since I turned 65 in April and then had to start using Medicare. My income unexpectedly increased significantly in August, 4 months after being off ACA coverage, and I had to unexpectedly take some money out of my IRA in December that pushed to where I didn’t qualify for any subsidy. Bottom line is that it is an extremely unfair and punitive system when expected income changes occur.

John Henry

This system is broken! I find myself in the position of owing 100% of the money initially credited to me because my business had an unexpected windfall in October of 2015. My wife and I are in our 50’s and self-employed and based on our 2014 income we were expecting to make about $45,000 jointly in 2015. We opted for the cheapest “Bronze” coverage with the highest deductible because we rarely get sick and were required to have some kind of coverage or face penalties, In our area that coverage costs $913 per month! Not cheap, but with the expected tax credit we figured it was affordable. I unexpectedly was able to sell a business asset in October 2015 which put our joint AGI at $66,000, about $4000 over the 401% payback threshold. We were shocked to find that we now owe all of the $9000 advanced to us back to the government! What we had hoped would help towards retirement now goes back to the government. Since when is being forced to pay 16% of your annual income for unwanted or unused health insurance “fair” or “affordable”! We’ll be digging into our retirement funds to pay the bill. I’m sure there are many other people in a similar situation. This system needs to change!

Vicki

Us to…..except we owe $13,000 and we have to go into our retirement to pay it and guess what….that $13,000 looks like income to the IRS so everything goes up for next year. Premiums, deductibles etc…. we live on SS and disability and retirement as needed. My husband had a liver transplant this year and after the $8,000 ded ( which of course came from retirement) and all the expense for travel and lodging for Emory Hospital for 9 months which again came out of retirement this year, it looks like we are screwed for next year. I hate this system……and feel like retirement should not be considered income…….it should be based on earned income.

Michael J Luzzo

Vicki…we hear you. Bottom line my wife and I were ‘saddled’ with a $13238 tax bill due to ACA credits!!! We made $64,381 in income, paid $3876 in ACA insurance premiums and got a BIG FAT TAX BILL at year’s end. How would anyone in their right mind would think paying $17,144 (Tax credits + premium) which = 26.58% of our income for Healthcare is justified.

We all got duped by Obamacare ! I have talked to a multitude of attorneys and accountants and basically they all echo the same thing: “Obamacare was nothing but an income tax, under the guise of health care” …take your ticket and join the line. Absolute BS! If I ever met Obama I’d [offer him my opinion in a civil manner]!

katie

I think this is total BS. Due to the fact that my husband makes decent money we have to spend an outrageous amount of money on Health Insurance for our family. To be exact we pay $12,000 a year for myself and 2 children to be on his health Insurance through his employer. I have been looking on the marketplace and it is going to cost me the same thing to have okay insurance but if he made half of what he makes we would get financial help. Why do we get penalized for being hard working, law abiding, tax paying citizens?

Lisa F

I COULD NOT AGREE MORE. My husband and I run a small business, and we, too, must pay outrageous amounts of money for Health Insurance; all the while knowing that: 1) We are subsidizing people who don’t even WANT health insurance, and 2) God only knows what the government is actually doing with all of the money they collect, directly or indirectly, related to health insurance premiums.

Thank you, God, for finally putting a man with some cajones in our Presidential office!! Life for middle-and high-income brackets is about to become much fairer.

We have always wondered your exact question: Why do we get penalized for being hard working, law abiding, tax paying citizens? My answer: The democrats are doing everything they can to socialize this country. Read a bit on the ObamaCare website about subsidies–They COMPLETELY, and subversively, converted our heathcare (from #1 spot in the world of healthcare) to socialized medicine. SHAME, SHAME, SHAME. If one is going to make such significant transformations in ANY law or area of government, then one should be completely transparent in doing so.

Last Comment: Do you REALLY believe that the astounding amount of confusion regarding Sociopath…er, ObamaCare was UNINTENTIONAL???