SHOP Exchange: Small Business Health Options Program

The Small Business Health Insurance Marketplace

Employers can use the SHOP Marketplace (Small Business Health Options Program) to get lower costs on group plans and claim tax credits. In 2015, employers with less than 50 full-time equivalent workers (FTE) can use the SHOP. In 2016, the SHOP opens for businesses with 100 or less FTE.

How to Apply For SHOP Coverage

Under ObamaCare (the Affordable Care Act) small businesses can apply for SHOP coverage any time, all year. However, the SHOP wasn’t accessible through the website until November 15th, 2014 (due to a delay). Luckily, small businesses are able to apply for SHOP plans and tax credits using a paper application.

With one online application, on your own or with the help of an agent, broker, or other assister, you can compare price, coverage, and quality of plans in a way that’s easy to understand.

For 2015, the SHOP Marketplace is open to employers with 50 or fewer full-time equivalent employees (FTEs). By 2016 those with 100 or fewer FTE can use the SHOP. The advantages of using SHOP include:

• You control the coverage you offer and how much you pay toward employee premiums.

• You can compare health plans online on an apples-to-apples basis, which helps you make a decision that’s right for your business.

• You may qualify for a small business health care tax credit worth up to 50% of your premium costs.

• You can still deduct from your taxes the rest of your premium costs not covered by the tax credit.

• Beginning 2015 the tax credit is available only for plans purchased through SHOP.

Watch this video about ObamaCare’s Small Business Health Options Program

• You can enroll starting November 15, 2014 for coverage starting as soon as January 1, 2015 through the marketplace. You can also use an agent to apply for tax credits and choose compliant plans in the meantime.

• There will be a SHOP Marketplace in each state. You must have an office or employee work site within the SHOP’s service area to use that particular SHOP.

• If you’re self-employed with no employees, you can get coverage through the individual market Health Insurance Marketplace, but not through SHOP.

• If you plan to use SHOP, you must offer coverage to all of your full-time employees–generally those working 30 or more hours per week on average.

• In many states, at least 70% of your full-time employees must enroll in your SHOP plan. See “How many of my employees must enroll in SHOP?” on the dropdown menu below for more information.

Have questions about the SHOP Marketplace for businesses with 50 or fewer employees? Call 1-800-706-7893 (TTY users: 1-800-706-7915). Hours: Monday through Friday, 9 a.m. to 5 p.m. EST. Agents and brokers may also use this number.

File Taxes to Claim Tax Credit

In order to claim the SHOP tax credit, you’ll need to file form 8941. See our ObamaCare Facts simplified instructions for Form 8941, Credit for Small Employer Health Insurance Premiums.

When Does the SHOP Marketplace Open?

The SHOP exchange originally were set to open on October 1st, 2013 on the same day that the individual health insurance marketplaces opened up. However, the SHOP was delayed until November 15th, 2014 which is the start of ObamaCare’s 2015 open enrollment period.

ObamaCare SHOP Delay UPDATE: The SHOP was delayed until November 15th, 2014 (i.e. open enrollment for 2015). Small businesses could still claim their tax breaks for insuring employees and the maximum break still increases from 35% to 50% starting January 1st, 2014. Small businesses have the option to purchase SHOP health insurance plans through a broker or agent, who will assist the employer with filing a paper application.

Who Can Purchase Insurance Through the SHOP Marketplace

All employers who qualify as a Small Business can use the exchange to purchase employee health insurance. Larger firms with over 100 full-time employees will not be able to use the exchanges until 2016 and thus will continue to only have the option of using private brokers to purchase insurance.

List of Small Business Health Options (SHOP) Websites

Here is the list of SHOP websites where small businesses can find employee coverage and apply for tax credits.

- California

- Colorado

- Connecticut

- District of Columbia

- Hawaii

- Idaho

- Kentucky

- Maryland

- Massachusetts

- Minnesota

- Mississippi

- Nevada

- New Mexico

- New York

- Oregon

- Rhode Island

- Utah

- Vermont

- Washington

- All other State’s go here

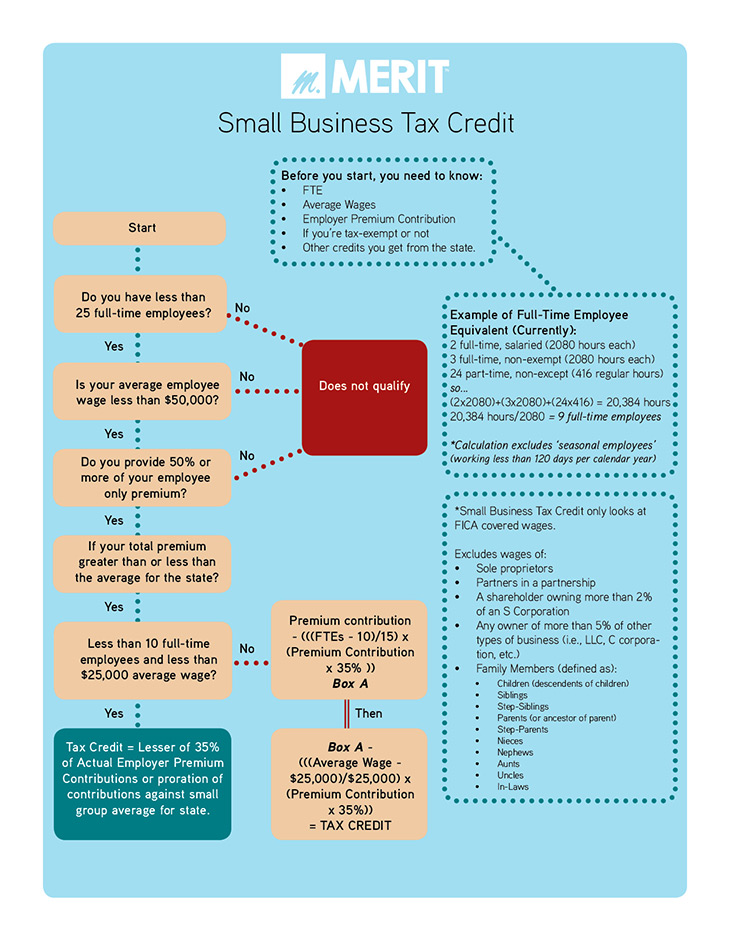

Who Qualifies For Small Business Tax Credits

To be eligible for ObamaCare’s small business tax credit employers must cover at least 50 percent of the cost of employee-only (not family or dependent) health care coverage for each of your employees.

Small businesses with fewer than 25 full-time equivalent workers, making less than $50,000 in average annual wages, qualify for tax credits through the shop to help them provide health benefits to employees. Those with 10 or fewer full-time equivalent employees, with average annual wages of less than $10,000, can get the full tax credit of up to 50% of their share of employee premiums.

Starting in 2014 employers must use the SHOP (either the website, or using a paper application) to be eligible for a health insurance tax credit.

Learn more about calculating the small business tax credit.

How to Claim the Tax Credit

To claim the tax credit you can use the SHOP or use form 8941, Credit for Small Employer Health Insurance Premiums. You’ll include the amount as part of the general business credit on your income tax return. For detailed information on filling out this form, see the Instructions for Form 8941. Use form 990-T for Exempt Organization Business Income Tax Return.

Tax credits are even available retroactively from 2010 when the Affordable Care Act signed into law. If you haven’t claimed your tax break yet make sure to talk to your insurance agent.

Starting in 2014, an employer may claim the credit for no more than two-consecutive taxable years, beginning with the first taxable year in or after 2014 in which the eligible small employer attaches a Form 8941, Credit for Small Employer Health Insurance Premiums, to its income tax return, or in the case of a tax-exempt eligible small employer, attaches a Form 8941 to the Form 990-T, Exempt Organization Business Income Tax Return.

SHOP Insurance Costs, Taxes and More

Before using the SHOP the big question is, “how much will it cost to provide my employees with health insurance?” Here is a quick list of factors that affect your cost.

- If you are self employed you will use the individual marketplace instead of the SHOP exchange.

- If you use the exchange you must cover all of your full-time workers.

- In most states at least 70% of your employees must enroll in the SHOP exchange (you can purchase private insurance for the other x percent).

- Employers must provide at least 50% of premium costs of employees health coverage to claim tax credits.

- Health coverage purchased for an employee cannot exceed 9.5% of their gross family income for employee only coverage.

- Employers must insure their employees if they have over 50 full time workers or they will face a penalty or “shared responsibility fee“.

- The penalty for small businesses not covering their workers is $2000 per employee and $3000 if they purchase health insurance through the exchange with premium credits

- The first 30 workers are excluded from the penalty.

- High end insurance plans will be subject to a 40% excise tax.

- Employers with less than 25 full-time workers making less than $50,000 a year may be eligible for cost assistance via premium tax credits.

Learn more about tax breaks and how ObamaCare affects small business on our ObamaCare Small Business page.

The Benefits of Health Insurance Purchased Through the Marketplace

All plans must include the 10 essential health benefits mandated by ObamaCare. From emergency services to newborn care ObamaCare ensures that some of your most essential benefits are covered under every plan. Find out more about the essential health benefits here.

New consumer protections in the SHOP Marketplace

You and your employees will also benefit from new protections that help you get real value for your premium dollars. There are new limits on the higher premiums insurance companies can charge businesses with older employees, and an employee with high health care costs no longer increases your group’s premium. There are also new limits on the share of premiums going to insurance companies’ profits and administrative costs

SHOP Exchange: Small Business Health Options Programs and Purchasing Qualified Health Plans (QHPs)

Starting in 2014 small businesses employers with less than 100 employees (50 in some states) will be able to use the SHOP exchange. This is the small business section of the “ObamaCare” health insurance exchange. The SHOP exchange, or Small Business Health Options Programs, offer small businesses a large variety of Qualified Health Plans (QHPs) that allows employers and employees to choose insurance that meets their budgets.

SHOP Choices. The SHOP exchanges provide side-by-side comparisons of Qualified Health Plans, benefits, costs, and quality.

SHOP Employee Options. SHOPs allow small business employers to offer workers Qualified Health Plans from several insurers, just like larger employers.

SHOP Employer Control. Small Business employers control when they participate as well as their own level of contribution towards coverage. SHOPs allow you to make a single monthly payment via SHOP rather than to multiple plans.

SHOP Affordability. SHOP can save your business money by spreading insurers’ administrative costs across more employers. Small Businesses with may be eligible for tax credits and subsidies on the SHOP exchange as well.

Small businesses with less than 25 full-time equivalent employees will be able to apply for tax credits to cover up to 50% of premium costs of low to moderate wage employees when the SHOP marketplaces open in 2014. in the meantime small business tax credits are retroactive since 2010 and can be applied for by hand with the help of an agent.

How the SHOP Marketplace Works

Using the SHOP Marketplace is easy. The online marketplace works just a car insurance or travel website where you enter the necessary information and they provide you with side by side price and plan comparisons.

Here are the steps you need to use the SHOP exchange to get your employees covered. You can find our full list of SHOP’s above or go to Healthcare.gov to find your state’s SHOP.

Create a SHOP account

First provide some basic information. Then choose a user name, password, and security questions for added protection.

Applying For Eligibility

In order to be eligible to use SHOP, your business must meet certain eligibility requirements. Starting November 15th, 2014 you’ll enter information about your business, including all employees eligible for coverage.

Here is an example of the health insurance marketplace application for employees.

Here is an example of the health insurance marketplace application for employers.

Applying For the SHOP by Mail

Your agent, broker, or insurance company may provide the SHOP application and help you fill it out and mail it in. If not, you can handle the application yourself by following the directions below.

- Download an application for SHOP eligibility. Important: Right-click the link and select “Save As.” After you save the file, open it using Adobe Reader. Adobe Reader is available as a free download.

- Fill out the application on your computer and print it out. Or call the SHOP Small Employer Call Center at 1-800-706-7893 to apply for SHOP eligibility by phone. (TTY: 711)

- Mail the completed application to:Health Insurance Marketplace

465 Industrial Blvd.

London, KY 40750-0001

Pick a Health Insurance Plan

You’ll see all the plans available to you and can compare price, coverage, and other features side-by-side. Choose a plan that meets your needs and decide how much you’ll pay toward employee coverage.

Enroll Your Employees

Let your employees know they can sign up for coverage. Coverage starts as soon as January 1, 2015 and can begin any time after that.

Here is a quick and easy to read brochure to help you get ready for the SHOP Health Insurance Marketplace.

Small Business Marketplace: Qualifying for Small Business Health Care Tax Credits

Small Businesses may qualify for health care tax credits using the health insurance marketplace. These Premium tax credits can cover up to 50% of the cost of employee health insurance! The uncovered amount can be deducted from your taxes as usual. The tax credits are available through plans offered on the SHOP marketplace exclusively.

Tax credits are highest for small businesses with 10 employees or less and who’s full-time employees make less than $25,000. About half of the small businesses in America have 10 or less full-time employees.

You can start calculated credits and creating a plan for how you will purchase health insurance before the shop even opens by following by visiting IRS.gov or consulting your advisor or accountant.

Contacting the SHOP Marketplace by Phone

Have questions about the SHOP Marketplace for businesses with 50 or fewer employees? Call 1-800-706-7893 (TTY users: 1-800-706-7915). Hours: Monday through Friday, 9 a.m. to 5 p.m. EST.

Learning More About the SHOP Marketplace

Now that you have a basic idea of what the SHOP marketplace is and how you can use it to provide your employees with health care coverage please take some time to read our ObamaCare small business page before you “SHOP” to get the inside scoop on the tips and tricks you’ll need to get the best insurance for your employees. If you didn’t find information you were looking for see HealthCare.gov’s SHOP page.

Using SHOP Marketplace

![]()