Uninsured Rate Below 10% Under ObamaCare

A new 2015 CDC study shows the uninsured rate below 10% at 9.2% for the first 3 months of 2015.

A new 2015 CDC study shows the uninsured rate below 10% at 9.2% for the first 3 months of 2015.

Here is the official clip of John Oliver’s bit on sex education. The video may be funny, but the debate over sex education is very real.

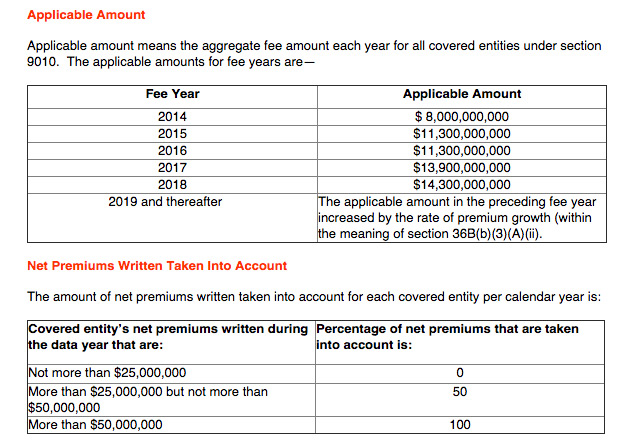

Section 9010 of the Affordable Care Act includes a tax on America’s largest insurers, the one’s who profit the most off of ObamaCare.

Long story short, I am looking for a pcp for my boss that is in his network with his insurance company. There are 154 doctors within ten miles of him all of which have a contract to accept his insurance. Every doctor out of the 154 doctors have said they will not accept his insurance… Read More

I was optimistic about health care reform and voted for Obama both times! However, I’m more disgusted everyday. I should have known that seeing what a debacle Medicare part D is that ACA wouldn’t help either. I am a physician in internal medicine in Peoria IL. Luckily my practice has lower than average medicare participants… Read More

I am trying to find a primary care doctor, seems like the majority of doctors do not accept my Coventry Carelink HMO plan. After talking with a few offices if I had regular Coventry health insurance they would accept that but not my “obamacare” insurance. I just want a English speaking, American trained doctor. I CAN’T… Read More

The senate voted down a GOP attempt to repeal ObamaCare (the Affordable Care Act) 49-43, 60 votes would have been needed to repeal the law. This is the first repeal attempt since the party took control of the chamber in January 2015.

Even if all states expand Medicaid, we need Planned Parenthood. ObamaCare’s expansion of coverage options provides free sexual and reproductive health services, but millions fall in the Medicaid gap in state’s that didn’t expand.

My parents have to use obamacare because they are not 65 yet. They have been over charged because the market place did not turn their information in on time. They had their bank account over drawn due to their premium being more than they were told and it being directly withdrawn (of the higher amount)… Read More

710,000 who got subsidies through ObamaCare have yet to file tax returns, while 9% (7.5 million) who did file paid $1.5 billion in penalties (although many qualified for additional exemptions).

Alaska is joining many states and expanding Medicaid under ObamaCare. Individuals making less than 138% FPL (roughly $20,000) will qualify for Medicaid.

What Obamacare provides is a Health Insurance Reform. The Government throws out some arbitrary number, based on what it considers “poverty level” of Americans who qualify. That number was developed by a woman in the 1960’s who took a basket of food for a family of 4 for a week and multiplied it 4 to… Read More

I wanted to write and say how thankful I am for OBAMA Care!!! About 6 years ago I had gotten Toxic Shock Syndrome. This involved being in a coma for 2 1/2 weeks, kidney failure, a heart attack, and many other complications. By the time I woke from the coma, I had a pick line,… Read More

My best friend had a harsh life and has worked hard all her life. Two years ago she was diagnose with Cancer when things finally settle down for her. She has been through surgery and treatments and is on so many medication for all her symptoms everyday. She pay top for her insurance and they… Read More

A new proposal by the Centers for Medicaid and Medicare would pay doctors to consult with Medicare beneficiaries on end-of-life treatments, giving the patient their own decision on the type of care they wish to pursue.

In June of 2014, I terminated my employment and called 1800 ASK Blue to assist in finding an affordable Health Plan. The representative was very helpful and I chose the HMO Silver at cost of she noted I could be approved for a subsidy that bring the cost down to $105.70. We could make a… Read More

Employees can get free contraceptive coverage on employer plans, even if an employer is exempt from offering contraception for religious reasons. Coverage is provided through a third party and is not provided by the employer.

A second quarter 2015 Gallup-Healthways poll shows only 11.4% of Adults lack health insurance. This is down 6 points from late 2013 before key ACA changes took effect.

A 2015 Health Affairs study shows out-of-pocket spending on the pill decreased nearly 50%, saving women an estimated $1.4 billion per year on birth control

Just days after the Supreme Court Declared subsidies legal many major health insurance companies declared mergers. Mergers include Aetna (AET) buying Humana (HUM) for $230 a share, 23% higher then Market price the day before the announcement.

Employers who reimburse employees for individual non-group health plans face a $100 a day or $36,500 per year, per employee excise tax. This rule applies to all employers, but the fine itself is only levied on those who have to comply with ObamaCare’s mandate (firms with 50 or more full-time equivalent employees).

The Supreme Court has been busy making America awesome, not only did they uphold subsidies they also declared same-sex couples have a right to marriage. Generally almost all of their recent decisions have fought back against discrimination, repression of freedom speech, repression of freedom of religion, and repression of individual liberty. It hasn’t seemed to matter… Read More

On June 25th the supreme court upheld ObamaCare’s subsidies in King V Burwell ruling 6-3. Millions will keep their legal HealthCare.Gov subsidies

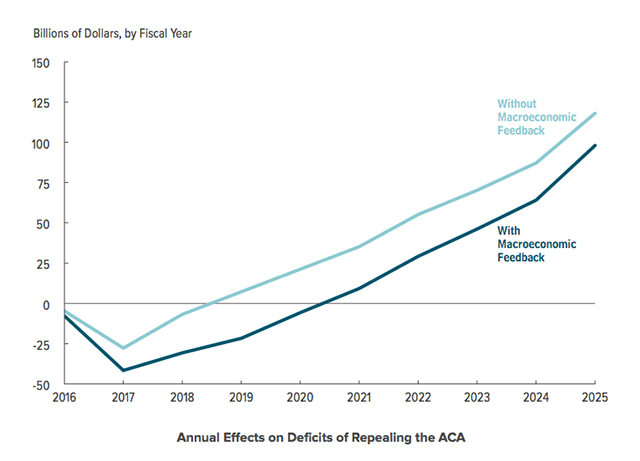

Repealing ObamaCare would increase the federal deficit by at least $137 billion over ten years and increase the number of uninsured by 19 million by 2016.

More Americans approve of ObamaCare’s subsidies than not with 55% against repealing subsidies according to a Washington Post poll and our own polls.