ObamaCare’s Sticking Points

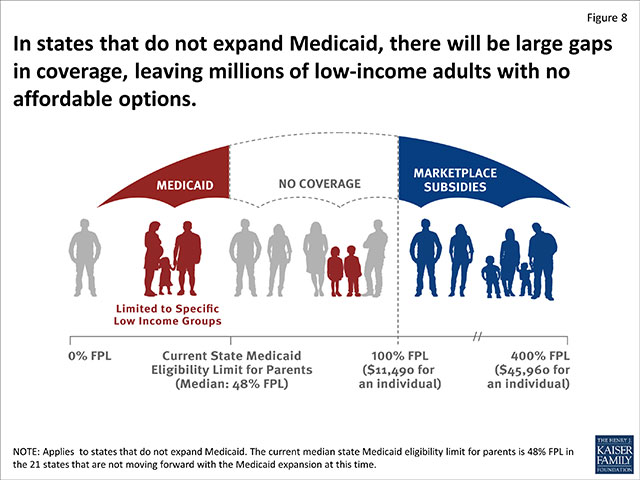

Out-of-pocket costs, the GOP’s rejection of Medicaid, the family glitch, and premium increases. These are ObamaCare’s sticking points.

Out-of-pocket costs, the GOP’s rejection of Medicaid, the family glitch, and premium increases. These are ObamaCare’s sticking points.

In 2012, I spent over $30K in out of pocket expenses trying to find doctors that can actually help my daughter. My family now has a portfolio of effective doctors, but they are all at different facilities. None of them is covered by Medicaid; none of them is covered by any one provider network except… Read More

Sunmitted by family member. Employee has worked “part time” 40 hours a week for Kroger Fuel Center for more than three years. Their Full-line (grocery employees) are considered “full-time” if they work more than 20hrs a week, including their store managers. The “full-time” employees are offered the equivalent of a Silver plan on the marketplace…. Read More

If you were trying to enroll in ObamaCare coverage, re-enroll, or adjust assistance for Jan 1st coverage the deadline has been extended to Dec 17, 2015.

Each year, in general, December 15th is your last chance to get health coverage during open enrollment. This means updating info, shopping for plans, and re-enrolling must all be done no later than December 15th.

Dennis Daugaard of South Dakota pitched his plan to expand Medicaid to 55,000 South Dakotans under ObamaCare. He is the latest Republican governor to choose people over politics.

Thankfully, my children have been able to qualify for Medicaid in the State of Nebraska. But our State does not want to have expanded Medicaid. My husband and I are self-employed and do not make enough money to be able to qualify for tax subsidized health insurance for ourselves. So we fall into the “Opt… Read More

Obama will veto the bill senate Republicans passed using “budget reconciliation” that repeals ObamaCare and cuts off Medicaid funding to Planned Parenthood.

Below is the HHS 2016 marketplace facts sheet on ObamaCare provided by CMS.gov. There lots of interesting facts in here including new updates on percentages of existing customers who can get plans for less than $100 or $75 (this goes hand-in-hand with the 1 in 6 non-marketplace customers who qualified for plans of $100… Read More

I am very lucky. I work hard. 60 hours per week. My small business supplies health insurance for all employees. Yes, our rates have about doubled in 4 years. I am not at all surprised. This is what happened right before our eyes. Pres Bobo tricked insurance companies into the ACA. Of course they supported… Read More

ObamaCare created “risk corridors” to spread the risk of taking on the uninsured between insurers and taxpayers. The profitable insurers pay in each year, the unprofitable one’s take money out, the government puts a little money in the pot, and everyone except the GOP is happy. Essentially risk corridors work like this: Risk corridors keep the price of… Read More

I signed up for my insurance in May, my first payment was in June. My monthly payments at the time were $77.13 a month. Come October 1, 2015, my premium went up to $149.13. I called and waited on hold for more than 30 minutes total of my 3 attempts… and no one could explain… Read More

I am back in college and unable to work the minimum required hours to keep me and my husbands insurance through my work. My only option was “the marketplace”, every “private” insurance I look into seems to be linked back to Obamacare. Last year I purchased the absolute lowest catastrophic plan, since our $60k income… Read More

Under ObamaCare the best plan is generally a Silver plan with an HSA, for low income it’s Medicaid / CHIP, and for Seniors at least Medicare A & B. There is a bit more to it, but if we only had one sentence to convey a blanket answer that would be it. If we get one… Read More

As of January, 2016, our Healthcare provider has notified us that our rates will more than double. They increased by almost 20% from 2013 to 2014. There is no logic in not having every single American citizen pay on some level for care they receive, barring the elderly and disabled.

People of all income levels, news sources, insurers, and providers have expressed frustration over rising health premiums and deductibles going into 2016.

Hi I would like to point out a HUGE problem with the health care as it stands. My question is “what can I do about getting it changed?” I’m sure your answer will be “absolutely nothing…good luck.” but I’ll ask anyway. My husband and I are low income. when he was working for an employer… Read More

Everyone with a health plan needs to re-enroll in the same plan or a new plan by Dec 15, 2015 and verify their cost assistance for 2016.

As a healthy 30 year old male with no prior history of illness beyond typical colds, the occasional flu, and a few stitches here and there, seeing my health insurance premiums go from $150 before the Affordable Health Care Act was implemented to $250/month for 2015, and now $425/month for 2016 for the Gold Plan… Read More

I applied to ObamaCare and it was the only thing that kept us going. I have one medication that costs over $3,500 a month, and between us our SS payments are around $2500 a month. With ObamaCare we were able to manage my medications. Next year I have to sign up for Medicare and I… Read More

They just redefined all these 2-person businesses so they could force us to go onto the individual health insurance market to fund all the subsidies.

What we need is a government plan modeled after the Canadian health plan of which everyone is treated the same and paying his own fair share.

My health insurance for a large company I’ve been working for 25 years cut my coverage and added the High deductible plan. So the company wouldn’t be subject to the Cadillac tax in 2018

Tea Party favorite Matt Bevin (R) is the new Governor of Kentucky and that is bad news for 400,000 Kentuckians who qualify for Medicaid under ObamaCare.

It was not about making healthcare more affordable but driving everyone to a single payor system – touche.