Do Distributions from IRAs Count as Income For Subsidies?

Taxable social security payments, IRA contributions, and taxable IRA interest aren’t deducted from Modified AGI. Your Modified AGI is used to determine subsidies.

Taxable social security payments, IRA contributions, and taxable IRA interest aren’t deducted from Modified AGI. Your Modified AGI is used to determine subsidies.

Only those with Silver marketplace plans, who make less than 250% FPL, can get cost assistance to lower deductibles. $6,600 for an individual $13,200 for a family.

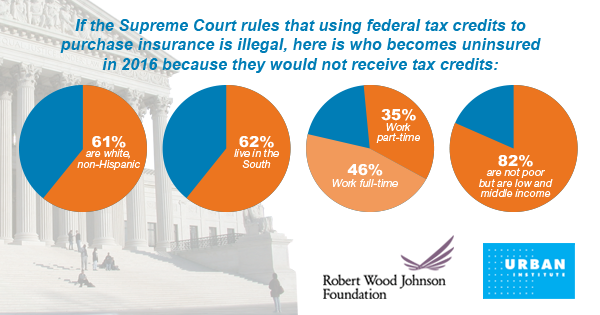

King V. Burwell is a lawsuit that challenges the legality of subsidies issued by the IRS on behalf of HealthCare.Gov under the Affordable Care Act (ObamaCare).

Good morning. I currently make $3250 a month NET. After withholdings like Taxes, SS, Medicare etc, I receive $2632.08. Of that amount child support is automatically taken out in the amount of $1311.54 which is 50% of my current salary. I get the burden of paying taxes on the child support. I get that. What… Read More

I have been trying to get an answer to the following two questions, but no one seems to know the answer and instead of useful information tries to give me the party line. As you know a case is in the Supreme Court to determine if the government can actually give subsidies to anyone who… Read More

How Do Cost Sharing Reduction Subsidies Work? ObamaCare’s Cost Sharing Reduction Subsidies (CSR) lower out-of-pocket costs, based on income, for Silver plans bought on the Health Insurance Marketplace. Along with Premium Tax Credits, ObamaCare’s Cost Sharing Reduction subsidies lower what you pay for out-of-pocket costs like deductibles, copays, and coinsurance, making health insurance coverage more affordable and… Read More

How to Calculate Tax Credits and Subsidies for Health Insurance Sold on the Health Insurance Marketplace Our ObamaCare calculator will help you calculate tax credits and subsidies for health insurance sold on the Health Insurance Marketplace. Use this quick health insurance tax credit guide to help you understand the process. Or, just use one of the… Read More

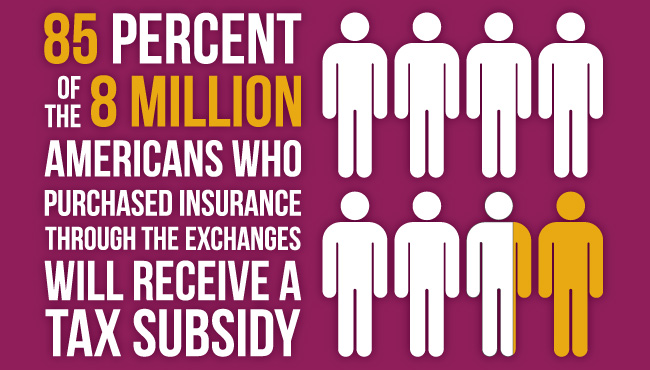

ObamaCare Subsidies – Premium and Out-of-Pocket Cost Assistance on Marketplace Plans Explained ObamaCare subsidies save you money on your premium and out-of-pocket expenses based on income. Subsidies are only available on plans sold on the Marketplace. Let’s take a look at what subsidies are, how they work, and how you can apply for free or… Read More

This page features a 2025 ObamaCare eligibility chart, the 2024 federal poverty level used for 2025 subsidies, and a subsidy calculator. ObamaCare Cost Assistance To get assistance under the Affordable Care Act, you generally must earn between 100% – 400% of the poverty level. For 2024 coverage, that is $15,060-$60,240 for an individual and $31,200-… Read More

The 2024 Federal Poverty Guidelines (for 2025 Cost assistance and 2024 Medicaid/CHIP) Below are the 2024 Federal Poverty Guidelines that went into effect in early 2024 (the ones you use for 2024 Medicaid/CHIP and for 2025 marketplace cost assistance). These guidelines are the key to all cost assistance under the Affordable Care Act. Specifically, these guidelines… Read More

ObamaCare Health Insurance Deadline 2025 ObamaCare’s Open Enrollment period for 2025 health plans starts November 1, 2024, and ends January 15, 2025, in most states. Plans sold during Open Enrollment start as early as January 1, 2025. Open enrollment is the only time of year you can enroll in a health plan, switch plans, or… Read More

The 2024 open enrollment season, from November 1, 2023, to January 15, 2024, in most states, introduces several updates in the Marketplace, particularly in terms of subsidies.

The Affordable Care Act (ACA) open enrollment for 2024 is here. Running from November 1, 2023, through January 15, 2024, open enrollment allows individuals and families to either sign up for new health insurance plans or make changes to their existing ones.

What Happens if I Missed the Deadline for ObamaCare? If you miss the annual deadline for ObamaCare Open Enrollment, you might miss your opportunity for cost-assisted coverage. However, you may still have options for obtaining health insurance. Open enrollment for private individual and family health plans is limited each year. For example, most states have… Read More

The Premium Tax Credit Subsidy Caps By Percentage of Household Income for SLCSP 2024 Premium tax credit caps on 2024 marketplace coverage range from 1.92% to 9.12% of income based on the 2023 federal poverty level. Premium tax credits are tax credits that can be taken in advance as Advanced Premium Tax Credits or at… Read More

Everything You Need to Know About Obamacare Cost Assistance For 2024 We cover everything you need to know about cost assistance for 2024 health plans under the Affordable Care Act (ObamaCare). In other words, here is everything you need to know about Premium Tax Credits, Cost Sharing Reduction Subsidies, Medicaid and CHIP, HSAs, and Medical… Read More

A Groundbreaking Proposal The Republican Study Committee (RSC), a group that includes 175 GOP members of the U.S. House of Representatives, has recently proposed two substantial changes to Social Security and Medicare as part of their federal budget for the fiscal year 2024. These proposals represent significant shifts in the structure and delivery of these… Read More

This page features a 2024 ObamaCare eligibility chart, the 2023 federal poverty level used for 2024 subsidies, and a subsidy calculator. ObamaCare Cost Assistance To get assistance under the Affordable Care Act, you generally must earn between 100% – 400% of the poverty level. For 2024 coverage, that is $14,580-$58,320 for an individual and $30,000-… Read More

The 2023 Federal Poverty Guidelines (for 2024 Cost assistance and 2023 Medicaid/CHIP) Below are the 2023 Federal Poverty Guidelines that went into effect in early 2023 (the ones you use for 2023 Medicaid/CHIP and for 2024 marketplace cost assistance). These guidelines are the key to all cost assistance under the Affordable Care Act. Specifically, these guidelines… Read More

ObamaCare Health Insurance Deadline 2024 ObamaCare’s Open Enrollment period for 2024 health plans started November 1, 2023, and ends January 15, 2024, in most states. Plans sold during Open Enrollment start as early as January 1, 2024. Open enrollment is the only time of year you can enroll in a health plan, switch plans, or… Read More

Income limits for ObamaCare depend on family size and are based on the federal poverty guidelines published each year. 2025 ObamaCare Income Limit Chart Here is an income limit chart for ObamaCare for 2025. See our 2025 ObamaCare Eligibility Chart and Subsidy Calculator for more details. Types of Cost Assistance For 2025 Individual Annual Income… Read More

Each year the ACA sets new limits for out-of-pocket maximums and deductibles. Here are the limits for 2023 plans for individuals and families. For 2023, your out-of-pocket maximum can be no more than $9,100 for an individual plan and $18,200 for a family plan before marketplace subsidies. These numbers have been revised up for 2023,… Read More

The Premium Tax Credit Subsidy Caps By Percentage of Household Income for SLCSP 2023 Premium tax credit caps on 2023 marketplace coverage range from 1.92% to 9.12% of income based on the 2022 federal poverty level. This an increase from the 2022 range of zero to 8.5%. Premium tax credits are tax credits that can… Read More

This page features a 2023 ObamaCare eligibility chart, the 2022 federal poverty level used for 2023 subsidies, and a subsidy calculator. ObamaCare Cost Assistance To get assistance under the Affordable Care Act you must earn between 100% – 400% of the poverty level. For 2023, that is $13,590-$54,360 for an individual and $27,750- $111,000 for… Read More

Everything You Need to Know About Obamacare Cost Assistance For 2023 We cover everything you need to know about cost assistance for 2023 health plans under the Affordable Care Act (ObamaCare). In other words, here is everything you need to know about Premium Tax Credits, Cost Sharing Reduction Subsidies, Medicaid and CHIP, HSAs, and Medical… Read More