What are ACA Rules for Employer Payment Plans?

Employer payment plans are valid under the ACA, count as group health plans, and are subject to market reforms (no pre-exiting conditions, no dollar limits, etc).

Employer payment plans are valid under the ACA, count as group health plans, and are subject to market reforms (no pre-exiting conditions, no dollar limits, etc).

Why do I Need to Know Which Drugs are Preferred in my Insurance Formulary or Which Physicians are In Network? We ask what drug formularies and preferred providers are and why you need to consider them when choosing a Medicare plan or any health insurance policy. Every insurance plan has a list of which drugs… Read More

President Trump signed an executive order on Oct 12, 2017 to expand access to “association health plans,” to expand these across state lines, to expand short-term coverage, and to expand HRAs.

We explain the Trump administration plan to roll back the mandate for employers to provide plans that cover birth control.

In the simplest way possible, here is what TrumpCare should look like. We explain how to synthesis all current GOP plans with the ACA to create something awesome.

Updated Cost Assistance Information for 2017 For 2017, shoppers can get three types of health insurance cost assistance under the ACA: Premium Tax Credits, Cost Sharing Reduction Subsides, and Medicaid/CHIP. Below is updated cost assistance information for 2017 plans, including all plans purchased during 2017 open enrollment Nov 1. 2016 – Jan. 31. 2017. TIP: Seniors… Read More

Employers can only reimburse group health plans except in very specific instances (such as if they have one employee).

Employees can get free contraceptive coverage on employer plans, even if an employer is exempt from offering contraception for religious reasons. Coverage is provided through a third party and is not provided by the employer.

Employers who reimburse employees for individual non-group health plans face a $100 a day or $36,500 per year, per employee excise tax. This rule applies to all employers, but the fine itself is only levied on those who have to comply with ObamaCare’s mandate (firms with 50 or more full-time equivalent employees).

If an employer offers a wellness program and you don’t participate, and thus your premium is “unaffordable” you can use the Marketplace.

If an employee changes employers often they should get a full-priced health plan on or off the Marketplace. This will avoid gaps in coverage.

Employers can use health care arrangements like employee payment plans to reimburse health premiums and costs, but these can’t be paired with non-group plans.

Employers can use Health Reimbursement Arrangements (HRAs), Employer Payment Plans, and Flexible Spending Accounts (FSAs) to save money on healthcare. We take a look at healthcare arrangements to find out how they can benefits employers and employees alike. We will also look at how they affect employer and employee taxes and penalties. It’s important to understand… Read More

You can decline your employer’s offer and opt for a MarketPlace Health Insurance Plan. However, this probably won’t be more affordable for you unless you qualify for Health Care Subsidies. Since you’re offered an employer-sponsored plan, you will not be eligible for ObamaCare Cost Assistance subsidies unless the plan is unaffordable or inadequate.

A spouse or dependent can’t get cost assistance on the Marketplace if they have access to an affordable employer plan that costs less than 9.56% household income per person.

ObamaCare’s Cadillac Tax is a 40% excise tax on high end plans above $10,200 for individuals and $27,500 for family coverage that was set to start in 2018 but was been delayed. This tax is not deductible. The excise tax is one of the main revenue sources for the ACA, helps curb healthcare costs, and… Read More

Out-of-pocket cost sharing amounts are based on policy periods and holding a specific policy. So don’t switch health plans mid-year if you have already paid a considerable amount in.

Under ObamaCare when a child turns 26, and loses family plan coverage, it triggers a 120 day Special Enrollment Period. This is true for employer family plans and private ones.

Smaller firms get tax credits that mean better employee benefits at better prices. However, some larger firms who had great plans going into 2014 saw rate hikes.

Maternity care is covered under all private health plans sold in the Individual and Family market, but employer plans can include an opt-out.

Starting in 2015, employers who don’t offer qualifying coverage, will make a Employer Shared Responsibility Payment. Get simplified instructions on the fee below. This page covers employer responsibility under the ACA and the payment. For more details see Employer Mandate. What is Shared Responsibility? Shared Responsibility is part of the ACA’s Title I. Subtitle F—Shared Responsibility for… Read More

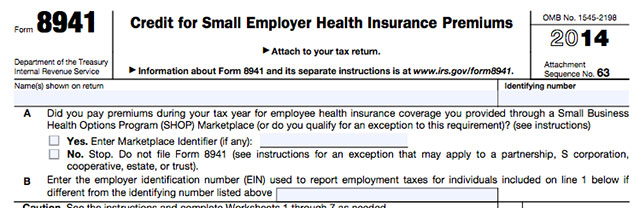

Employers can get a Tax Credit for up to 50% of their contribution to employee premiums by filing Form 8941, Credit for Small Employer Health Insurance Premiums. Get detailed HTML based instructions on Form 8941 from the IRS, simplified instructions ObamaCare’s employer tax credit form can be found below. What is Form 8941, Credit for Small Employer Health Insurance Premiums?… Read More

If you are under 30 or obtained a “hardship exemption” you qualify for a high deductible, low premium, catastrophic plan. Catastrophic health plans are the cheapest plan you can get that counts as minimum essential coverage. Catastrophic plans can be good for those who want cheap, barebones care. Catastrophic plans tend to trade a low… Read More

Learn how to compare health plans to get the best deals on health insurance and health care. Compare your health needs with your plans costs and coverage, to find an affordable plan with benefits that are designed to cover you. No matter how you shop, and boy are there a lot of different options under… Read More

Understanding Affordability Exemptions for Individual and Employer-Sponsored Health Coverage Under ObamaCare employer-sponsored coverage must cost no more than 8% (adjusted each year), after the employer’s contribution, to be considered affordable. If the amount exceeds 9.5% (adjusted each year), then the person can get an exemption to use the marketplace. This applies to employee-only coverage, family-member-only coverage, and… Read More