Does TrumpCare Repeal Pre-Existing Conditions Protections?

TrumpCare weakens (not eliminates) key protections for those with pre-existing conditions, which could result in some being excluded from the market due to cost.

TrumpCare weakens (not eliminates) key protections for those with pre-existing conditions, which could result in some being excluded from the market due to cost.

Does TrumpCare Cover Pre-Existing Conditions? We explain how TrumpCare affects those with pre-existing conditions to help clear up the confusion regarding TrumpCare and Pre-existing conditions. UPDATE 2019: This plan never passed, and thus the specifics here are of historical interest only. The Basics of TrumpCare and Pre-Existing Conditions Generally speaking, Under ObamaCare (the Affordable Care Act) no one with pre-existing conditions… Read More

The 2017 Federal Poverty Level Guidelines (Used in 2017 and 2018) Understanding the Federal Poverty Guidelines for Determining Cost Assistance For 2017 Medicaid and CHIP and Cost Assistance on Health Plans Held in 2018 Below are the 2017 Federal Poverty Guidelines used for Medicaid/CHIP in 2017 – 2018 and cost assistance on 2018 health plans under the… Read More

We explore how conservatives can seek market-based universal healthcare by examining the market-based universal healthcare systems of Singapore and Switzerland.

We review and explain each of the provisions in the House bill to repeal and replace ObamaCare, “The American Health Care Act”.

We review “the American Health Care Act” (The New ObamaCare Replacement Plan) to help everyone understand the proposed changes.

We explain what happens to cost assistance (Tax Credits, CSR, and Medicaid) if ObamaCare is repealed by congressional Republicans under Trump.

An old lawsuit is rearing its ugly head again and it could lead to ObamaCare’s cost sharing assistance being defunded under Trump.

Información Actualizada de Asistencia en Costos para el 2017 Para el 2017, los compradores pueden adquirir tres tipos de seguro médico bajo ACA: Créditos fiscales sobre primas, Subsidios de Reducción de Costos Compartidos, y Medicaid / CHIP. A continuación, se encuentra la información actualizada de asistencia en costos para los planes del 2017, incluyendo todos… Read More

The 2016 Federal Poverty Level Guidelines (Used in 2016 and 2017) Understanding the Federal Poverty Guidelines for Determining Cost Assistance For 2016 Medicaid and CHIP and Assistance on Plans Active in 2017 Below are the 2016 Federal Poverty Guidelines used for cost assistance on 2017 health plans, 2016 Medicaid / CHIP, and taxes filed April 15, 2018…. Read More

Updated Cost Assistance Information for 2017 For 2017, shoppers can get three types of health insurance cost assistance under the ACA: Premium Tax Credits, Cost Sharing Reduction Subsides, and Medicaid/CHIP. Below is updated cost assistance information for 2017 plans, including all plans purchased during 2017 open enrollment Nov 1. 2016 – Jan. 31. 2017. TIP: Seniors… Read More

A Quick and Simple Guide to Health Insurance Costs and Assistance Types of health insurance costs include: monthly premiums and out-of-pocket costs / cost sharing (copays, coinsurance, deductible, out-of-pocket maximum). Here the premium is what one pays for the policy, and then cost sharing is a reference to the part of the costs the plan covers… Read More

House Republicans won the 2nd round of a Court case that makes it so Congress must approve funding for cost sharing reduction subsidies. 7 million could go without cost sharing assistance.

When it comes to Advanced Premium Tax Credits, it is always tempting to take the maximum amount you qualify for. However, repayment limits can mean owing back credits.

What is TrumpCare? “TrumpCare” describes health care reform under Donald Trump. We explain TrumpCare and how it is different than ObamaCare. An Introduction to the Many HealthCare Bills, Regulations, and Ideas We Call “TrumpCare.” Below we explain different aspects of TrumpCare. When people say “TrumpCare” they are essentially referring to healthcare changes made, attempted to be… Read More

Subsidios de ObamaCare en el Mercado de Seguros Médicos de su Estado Los subsidios de ObamaCare pueden ahorrarle dinero en sus primas y pagos adicionales. Los subsidios de ObamaCare solo están disponibles a través del Mercado de seguros, veamos que son los subsidios, cómo funcionan y cómo los puede aplicar para lograr un seguro médico… Read More

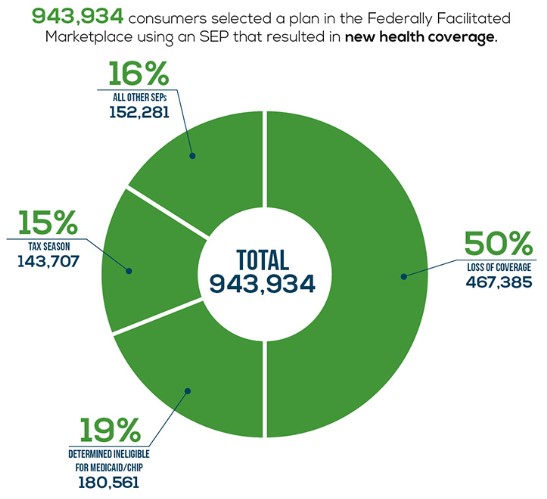

According to CMS nearly 950,000 Americans selected a plan through the HealthCare.gov via Special Enrollment between February 23 and June 30, 2015. What Is Special Enrollment? A Special Enrollment Period (SEP) is a time outside of open enrollment where people can get a Marketplace plan that is eligible for cost assistance and protects them from the fee. There are a number… Read More

College students have a number of health plan options including the Marketplace, Medicaid, school health plans, catastrophic plans, and their parents plan. Below we take a look at student health options under the Affordable Care Act (ObamaCare). FACT: A university health plan counts as Minimum Essential Coverage for ObamaCare if it’s fully insured or self insured. Aside… Read More

How IRA’s and HSAs work with the ACA Before-tax and tax deductible contributions (like to a traditional IRA) lower MAGI and increase subsidies. After-tax contributions lower MAGI on withdrawal (like the Roth IRA). HSA’s are tax free in and tax free out, which make them especially cool. This is generally true for ObamaCare’s tax credits… Read More

Tax credits are based on annual household income, not monthly income. If projected annual income changes you can adjust cost assistance to avoid repayment. Quick Facts on Cost Assistance and Changes to Income There are three important things to understand about cost assistance and changes to income: Marketplace cost assistance is based on projected annual household income,… Read More

ObamaCare isn’t “socialism”. Under ObamaCare we have a regulated private health care industry that uses a mix of public and private funding..

The best health insurance plan for an individual or family is going to depend on the income and needs of that family. With that said, many will find a marketplace plan that qualifies for cost assistance to be the best value for them. Very generally speaking the best health plan when it comes to benefits… Read More

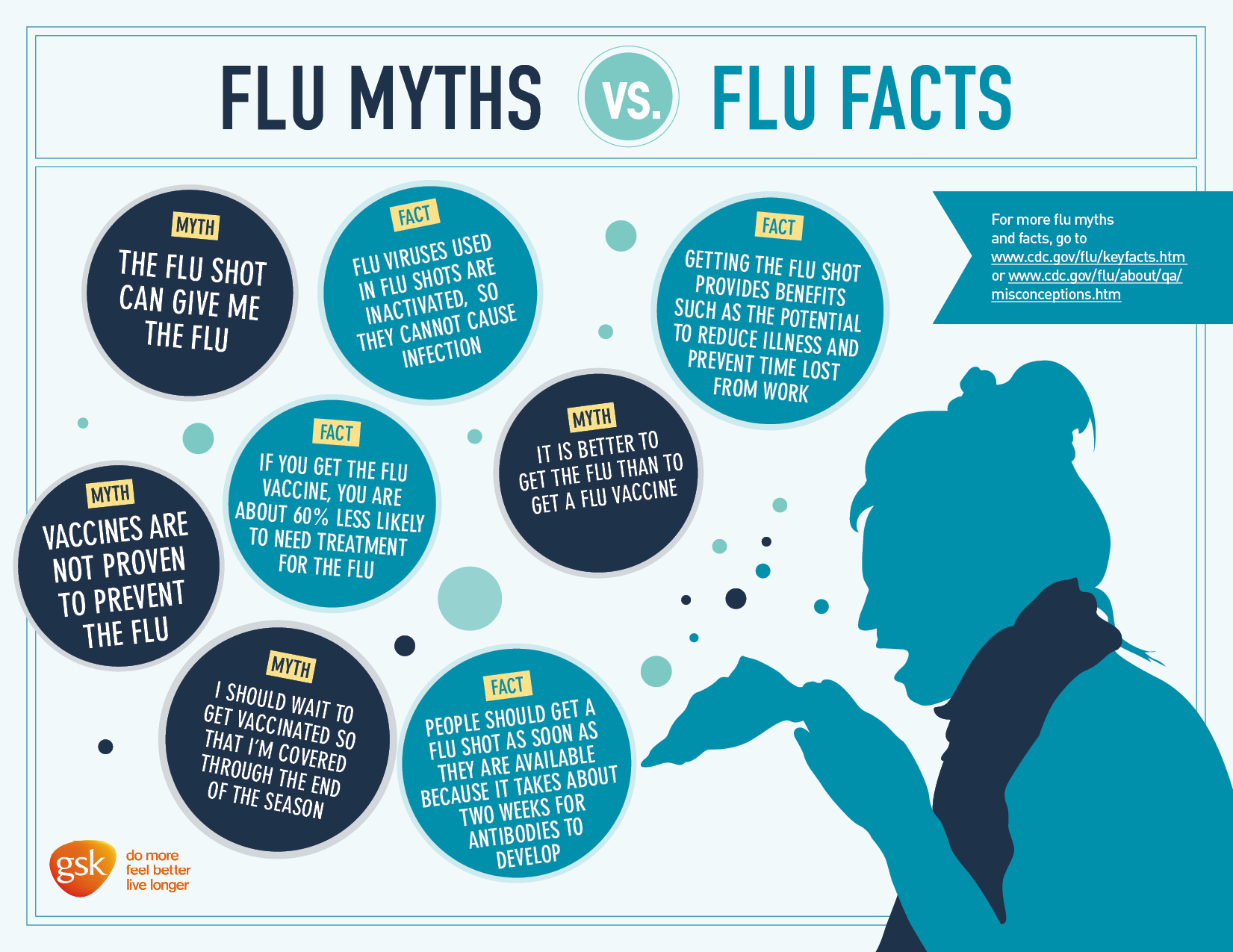

You’ve heard about vaccination and its dangers. Let’s look at the facts and myths on vaccines covered under ObamaCare at no out-of-pocket costs.

Get the facts on vaccines. Should we vaccinate our children, should I get the flu shot, what are the risks, pros, cons, and myths? We uncover the truth. FACT: The flu vaccination and other vaccinations are covered at no out-of-pocket cost on all major medical plans under the Affordable Care Act (ObamaCare). That means if you… Read More

Cost-sharing in health insurance is your share of costs (copays, coinsurance, deductible, out-of-pocket maximum) for covered benefits in a policy period. Typically cost-sharing does not apply to Premiums, uncovered costs, or balance billing. TIP: In simple terms, cost-sharing describes your share of the costs vs. your insurer’s share of the cost in respect to your… Read More