What Are Disability Requirements for MAGI?

Social Security Disability payments count as income for MAGI. Medicaid doesn’t count this income, but the Marketplace cost assistance does.

Social Security Disability payments count as income for MAGI. Medicaid doesn’t count this income, but the Marketplace cost assistance does.

Health insurance tax credits are based on Modified Adjusted Gross Income. Social Security survivors benefits only count toward MAGI of tax filers.

Social Security payments are deducted from AGI, but added back in for MAGI. Therefore they generally do count as income for ACA cost assistance.

What is Modified Adjusted Gross Income (MAGI), Adjusted Gross Income (AGI), Gross Income (GI), Family Income, Household Income, Etc? Modified Adjusted Gross Income (MAGI) is Gross Income (GI) Adjusted for deductions (AGI) and then Modified by adding some deductions back in (MAGI). On this page, we cover MAGI as it applies to Medicaid and the Marketplace…. Read More

A universal healthcare initiative to the people was filed in Washington State on January 23, 2018. If supporters are able to gather valid voter signatures by July 6th, 2018 (about 260,000) I-1600 will appear on the 2018 general election ballot in November. I-1600 Brief Summary of Parts I, II, III Part I creates a new… Read More

The Issue We all need healthcare and health insurance, and the cost of medical care has exploded. We need to find a good way to manage the cost of insurance and care. The difficulty is compounded because wages and income have been stagnant for most of us. Even if you have a full-time job, you… Read More

We review and explain each of the provisions in the House bill to repeal and replace ObamaCare, “The American Health Care Act”.

We review “the American Health Care Act” (The New ObamaCare Replacement Plan) to help everyone understand the proposed changes.

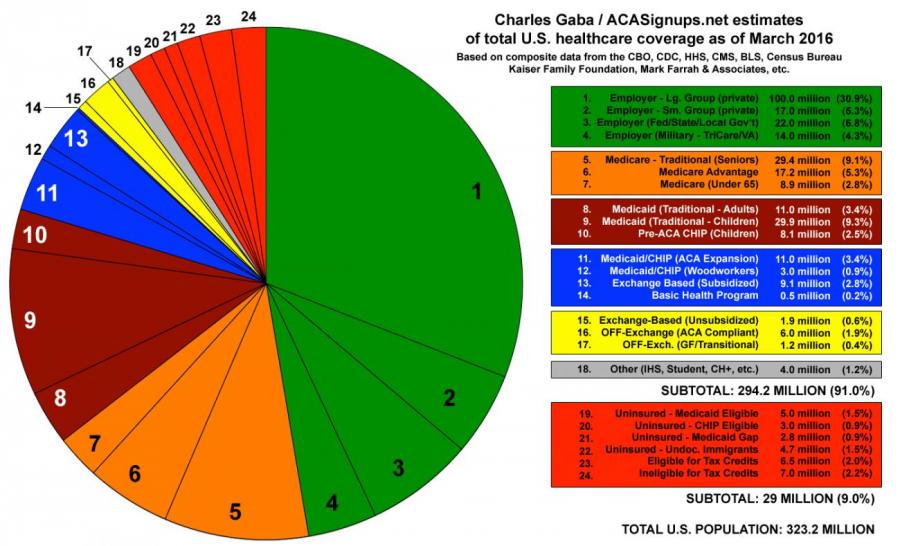

Nearly everyone’s health coverage is highly subsidized (via tax breaks, if not credits). The group that costs tax payers the most money in healthcare is employees.

We present a summary of each provision in the 21st Century Cures Act which aims to tackle mental health, addiction issues including the opioid crisis, and more.

We explain the House GOP Better Way Plan (the House Republicans’ ObamaCare replacement plan) and how it could change ObamaCare.

Using a Sec. 1332. Waiver for State innovation states can create their own ACA alternative, including a state-based single payer system.

I am 50 years old and have never had health insurance, I always pay out of pocket in FULL for every doctors visit, every ER visit and have always had a reserve of $25,000 dollars saved up through small monthly contributions to draw on in case of emergencies. This is how I figured all American’s… Read More

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA aka the “doc fix”) replaces the SGR formula, cuts Medicare spending, and extends CHIP. In this video President Obama Signs ‘Doc Fix’ Law Into Effect Thursday, April 16, 2015. The information below is a summary of the passing of MACRA and why it is important. See the… Read More

The IRS has very specific, sometimes confusing, rules for caregivers. Under ObamaCare there are extra deductions to claim as a caregiver that can affect MAGI

A list of ObamaCare’s Exemptions, including Hardship Exemptions, you can apply for in order to qualify for Special Enrollment or be exempt from the fee can be found below. This page just covers the basics, see our page on ObamaCare Exemptions for further details on exemptions and the fee (active on plans held in 2014 –… Read More

Everything You Need to Know About the Tax Filing Thresholds Federal Tax Filing Requirement Thresholds are used to determine if you file your taxes or not. Filing threshold is based on Gross Income and filing status. What is the tax filing threshold? The tax filing threshold for a single adult under 65 in 2018 is $12,000…. Read More

The Forms Needed if You Got Marketplace Tax Credits Under the Affordable Care Act (ObamaCare) Find out how to fill out Premium Tax Credit Form 8962, the form for reporting ObamaCare Tax Credits. We’ll review MAGI, FPL, and Adjusting credits. The form can seem daunting at first, but by understanding what all the fields mean,… Read More

How to Calculate Tax Credits and Subsidies for Health Insurance Sold on the Health Insurance Marketplace Our ObamaCare calculator will help you calculate tax credits and subsidies for health insurance sold on the Health Insurance Marketplace. Use this quick health insurance tax credit guide to help you understand the process. Or, just use one of the… Read More

The following is a summary of every provision in the Patient Protection and Affordable Care Act HR3590. Most of what you need to know about the PPACA is contained in title I – Quality, Affordable Health Care For All Americans. Title I contains almost all of the new benefits, rights, and protections, rules for employers,… Read More

What is Single Payer Health Care? Single payer health care is a health care system where a “single” fund pays for health care costs (rather than private insurers). There are many different ways single payer can work, but the general idea is 1. to create a universal healthcare system (a system that covers everyone) where, 2…. Read More

We Asked You How You’ve Been Affected By ObamaCare, Here is What You Said Below are Real ObamaCare Stories from our readers. We asked you to share your ObamaCare stories on how health care reform has affected you. Thank you for the overwhelming amount of responses. We have done our best to answer your questions… Read More

The ObamaCare Mandate Exemption and How You Can Qualify for an Exemption from the Tax “Penalty.” From 2014 – 2018, who chose not to purchase insurance had pay a tax “penalty” unless they qualified for an exemption. Exemptions from ObamaCare’s tax “penalty” mandate are available to a number of Americans. We will cover all of… Read More

ObamaCare’s Individual Mandate: What is the Tax Penalty for Not Having Health Insurance? ObamaCare’s individual mandate had required most Americans obtain and maintain health insurance, or an exemption, each month or pay a tax penalty. However, the fee has been reduced to $0 on a federal level starting in 2019. That said, some states have… Read More

What are Federal Poverty Levels Used for? Federal Poverty Levels (which are also called Federal Poverty Guidelines, Federal Poverty Line, or simply FPL) are used to see if you qualify for cost assistance when buying insurance through the State or Federal Health Insurance Marketplace. Federal Poverty Levels are also used to help determine Medicaid and CHIP eligibility and to help… Read More