Scott Walker’s Plan to Repeal & Replace ObamaCare

We explain Scott Walker’s plan to repeal and replace ObamaCare. We compare it to the ACA and examine what it gets right and wrong.

Read: “The Day One Patient Freedom Plan – My Plan to Repeal & Replace ObamaCare” By Scott Walker

The Day One Patient Freedom Plan Background

Gov. Scott Walker (R-WI), one of 17-ish Republican candidates, announced on Tuesday August 18th that like the other 16 candidates he plans to repeal the Affordable Care Act if elected President. Unlike some of the other candidates, Scott Walker has laid out his plan to repeal and replace ObamaCare.

Summary of the Scott Walker Repeal and Replace Plan

For those who don’t want to read the whole thing, here is a quick summary of Walker’s ObamaCare repeal and replace plan.

First it repeals the Affordable Care Act (ObamaCare) without taking into account the parts that are working and that are supported by the majority of people like many of the Medicare fixes for wasteful spending. The CBO projects that alone to cost $137 billion. Then it:

- Cuts taxes for large businesses and makes it so they don’t have to offer health coverage to employees. According to one recent study over 9.6 million were covered due to the ACA’s mandate for large employers to provide health coverage.

- Replaces tax credits based on income with tax credits based on age. As Vox put it “Under Walker’s plan, Taylor Swift would get $1,200 to help buy coverage because she’s 25, while Obamacare would give her nothing on the grounds that she’s superrich. While a 25-year-old earning $17,000 at a low-wage job would get a $1,962 credit under Obamacare.”

- Incentivizes HSA’s by doubling limits and giving $1,000 tax credit to anyone who opens one. HSA contribution limit hikes are awesome, if you have a spare $6,250 as an individual or $12,500 as a family.

- Let’s insurers sell across state lines. Find out why that matters here.

- Makes it so the only way to be accepted for having a preexisting condition is to maintain health insurance without a gap in coverage. 89 million people had at least a one month gap in coverage between 2004 – 2007. In other words most people in the current health insurance market would essentially have a preexisting clause by over-time unless they maintained employment. One of the cool things the ACA did was free people up from feeling trapped by their jobs.

- Changes Medicaid to give states less rules for how to operate the program, limiting Medicaid instead of expanding it. Or more exactly, he wants a “block grant” system which gives all money to states and lets them operate instead of an “open-ended matching system” like we have now. This is meant as a way to allow states to defund Medicaid, similar to how the 2012 Supreme Court Ruling that allowed states to rejected Medicaid led to states not expanding coverage to millions.

- Deregulates the health care industry. The ACA regulated the health care industry to decrease wasteful spending, part of that regulation included taxes. This is a large part of why this adds $137 billion while cutting over a trillion in spending!

- Allows groups to form together to offer plans with little restrictions on covered benefits.

- Incentivizes wellness programs.

- Creates new solutions for long term care insurance.

- Limits litigation in healthcare by limiting what patients can sue over.

What all of this boils down to is we get:

Tax cuts and deregulation for high-earners, businesses, and the healthcare industry and less tax credits and coverage options for everyone else. Not all the ideas are bad on paper, but the effects of the way this plan handles tax credits, Medicaid, and preexisting conditions and the way it glazes over all of the good the ACA has done without addressing it should be cause for alarm. Actually, what should be cause for alarm is that this is essentially a carbon copy of previous Republican plans for healthcare reform.

Scott Walker ObamaCare Repeal and Replace Plan Explained and Reviewed

Below we take a look at the “The Day One Patient Freedom Plan – My Plan to Repeal & Replace ObamaCare” By Scott Walker which is contained on pages 8 – 13 of the PDF. This section of the page will try to look at each part of his plan a little closer. This is in part important since it share similarities with many other Republican plans so you can expect to see these same ideas coming up again with other candidates.

1. Repeal ObamaCare in it’s entirety.

All this section says is, “ObamaCare must be repealed immediately.”

Repealing ObamaCare means repealing all 1,000 pages including all Medicare reforms and adding back in wasteful spending to Medicare, taking coverage away from somewhere around 16.9 million (depending upon what study you look at), and repealing all benefits, rights, and protections, all reforms, all cost curbing measures, and adding billions to the deficit.

NOTE: According to the Congressional Budget Office the estimated cost of repealing the ACA is $137 billion over the next 10 years and as much as $6.2 Trillion over the next 75 years (estimate based on a 2013 GAO report).

2. Ensure Affordable and Accessible Health Insurance For Everyone

The last step took away affordable coverage, unfortunately this part does little to help as it just reaffirms coverage is taken away and gives a tax credit oddly based on age rather than income.

A. LOWER HEALTH INSURANCE PREMIUMS

What “lower health insurance premiums” actually means here is eliminate regulations on businesses so they don’t have to offer coverage. Scott projects this to lower costs by 25%. He doesn’t back it up with any facts.

This argument is oddly weak and short sighted. All he said is that he is going to make it so employers don’t have to offer coverage (and undo other employer regulations in the ACA). Those left over will theoretically pay less, however a recent RAND cooperation study (not HHS) showed the actual number of newly insured at 16.9 million (not 16.4 like HHS) and showed 9.6 million in new employer based plans. So this part of the replacement plan means roughly 9.6 million hardworking American families would potentially lose health insurance. However, this is addressed in “b”

B. PROVIDE TAX CREDITS TO ANYONE WITHOUT EMPLOYER-SPONSORED HEALTH INSURANCE

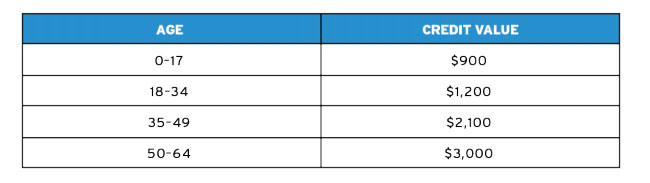

Scott replaces ObamaCare’s idea of “giving cost assistance to people without employer based coverage” and replaces it with Scott’s idea of “giving cost assistance to people without employer based coverage”. The ACA already does that, but Walker bases tax credits on age rather than income.

Scott claims a 35-year-old woman who makes $35,000 per year and has no children gets $0 in ObamaCare subsidies. Everything about that sentence is rhetoric and wrong. 1) ObamaCare doesn’t give subsidies based on age 2) The cut-off for subsidies $47,080 for a single adult in 2015. This is really insulting because it assumes the reader doesn’t understand the ACA and hints that Walker doesn’t understand the ACA either.

Anyway, under Scott Walker’s ObamaCare replacement plan the woman in the above example get’s a $2,100 tax credit to shop for health insurance. We can’t really compare this to the ACA because the ACA caps maximum costs and then provides a tax credit for the rest. But at $35,000 the tax credit amount could be comparable depending upon the state.

NOTE: Under the ACA the credit is only $0 if the second lowest cost silver plan in her state marketplace is less than 9.56% of $35,000, as her maximum cost at her income is roughly 9.56% of MAGI. To make this even more factual it’s worth pointing out that the cutoff for 9.56% is actually $35,310 not $35,000 which means the true number is more like 9.4 or 9.3. See form 8962 for yourself if you want to explore this more.

Oddly, Scott’s credits are based on age and are essentially less generous than the ACA’s credits. The average family plan without cost assistance can cost about $20,000 (before the ACA). The plan doesn’t mention if each member gets a credit, just tax filers, or just head-of-household. But assuming it’s everyone, this is at best on par with the ACA and at worst not enough. This being said, the concept of giving tax credit vouchers (which has always been the Republican preferred plan) isn’t wrong or bad… it just lacks the nuance needed to really address our nations healthcare crisis because it’s such a simple blanket solution. Learn more about the “voucher thing” here.

Bottom line. Scott takes away tax credits based on income and replaces them with tax credits based on age. That is one of the better ideas so far and… well it’s a poor one.

C. GIVE ALL AMERICANS MORE CHOICES AND MORE ACCESS BY IMPROVING HEALTH SAVINGS ACCOUNTS (HSAs)

All Americans who open an HSA get $1,000 refundable tax credit for out-of-pocket spending. Limits are doubled for HSAs to $6,250 for individuals and $12,500 for families. This is awesome for tax filers as contributions are tax deductible, this is not awesome for the federal budget as people will pay less taxes. We should flat out do this and nothing else Scott has mentioned so far.

This is great for those with an extra $6,250 for individuals and $12,500 for families. For the other 50% of America it’s a little less attractive. This is more attractive in general if it’s an annual $1,000 credit, but it seems like a one time incentive credit.

NOTE: If you can figure out how to fund an HSA we strongly suggest it. Find out why here.

D. ALLOW ALL AMERICANS TO SHOP FOR INSURANCE IN ANY STATE

Republicans have always wanted to allow insurers to sell across state lines and for people to be able to shop across state-lines. There are pros and cons, but to be honest health insurance networks are not all that user friendly. While they help keep costs down, they could use reform.

E. PROTECT ALL AMERICANS WITH PRE-EXISTING CONDITIONS

This is important, now we are at the part where we address pre-existing conditions. You may think most Republicans support the ban on pre-existing conditions, but you are dead wrong (dead is appropriate in this case). They support that for people with money and jobs, but they don’t support it for everyone.

Scott allows you to keep coverage, if you have coverage. In practice tens of millions have gaps in their coverage. Imagine you switch credit cards and forget to change your auto renew on your coverage. You have an emergency and owe $100,000. Under the ACA you wouldn’t owe more than like $6,000 with a low-end bronze plan. Now you are uninsurable. A rich person could absorb this cost, most people can’t.

This preexisting conditions part is perhaps the worst idea in the whole plan, aside from perhaps blanket cuts to the Affordable Care Act. You have to be very rich and healthy (and I guess selfish) for this to favor you, but not for you to favor it of course.

To be fair, high-risk pools are included. Those at least offer a solution for what to do with the sick and poor, but truth is this is part of what wasn’t working with the old system.

3. Make Health Care More Efficient, Effective and Accountable by Empowering the States

This is the part of the law that cuts a few holes in the safety net, specifically Medicaid and clarifies that plans won’t have essential health benefits.

A. RETURN REGULATORY AUTHORITY OVER HEALTH CARE COVERAGE TO THE STATES

This makes Medicaid expansion and young people staying on their parent’s plans optional for states, the way it was before the ACA. In practice we know most states (and almost all “Red” states) choose to have narrow Medicaid eligibility. Without the funding for Medicaid in the ACA it’s likely most states would revert back to pre-ACA eligibility limits for young adults and Medicaid.

The main way this is done is by switching to a “block grant” system which gives all money to states and lets them operate instead of an “open-ended matching system” like we have now.

B. REFORM MEDICAID

Scott discusses Medicaid and how the current payment system incentivizes spending over care (open-ended matching system) and points out that Medicaid is projected to cost $786 billion (3.1 percent of GDP) in 2022 – up from $25 billion (0.9 percent of GDP) in 1980. This information can be found in 2014 Actuarial Report on the Financial Outlook for Medicaid, Centers for Medicare & Medicaid Services. See Table 18, p. 64.

He then lays out three ways in which he would reorganize Medicaid.

The thing to note here is that Medicaid isn’t perfect the way it is, it’s not fair to try to discuss the ins-and-outs of Medicaid in a paragraph or two. But, the takeaway to balance this seemingly good argument is that the average cost of insuring a person on Medicaid is $3,247 for an adult and $2,463 for a child. That is pretty much on par with the cost of subsidies per person and less than the cost of many private plans.

The reason the cost goes up is because of the rising cost of healthcare and the increase in the amount of insured. The ACA boosts the insured rate (especially for low-income) increasingly until 2025. So of course the cost of that goes up. Still this is essentially why $700 billion in wasteful spending is cut from Medicare, it wasn’t blindly done, it was in part meant to balance this.

A focused and reformed Medicaid program is good, but using a good idea as an excuse to let states cut holes in the safety net isn’t very cool and that is what this section seems to do.

The bottom line here is that Republicans tend to want to cut Medicaid spending by cutting care rather than making the program more efficient. Scott Walker’s Medicaid plan for a ‘block grant” system could easily lead to this.

One data point sorely lacking from “3-b” is how many people would be covered under this system. 21 million (if all states expand) would be covered under the ACA, how many of those 21 million go uninsured under Scott’s plan?

4. Increase Quality and Choice Through Innovation.

This part of the plan deregulates the health care industry to let private businesses decide how to operate. Few will deny that an over-regulated system is an efficient one, but on that same token many regulations are in place to correct long-time bad practices that have led to unsustainable healthcare spending. The problem with Scott’s solutions as we will see is that his obsession with deregulation and big business would undo the reforms that are working instead of simply addressing the one’s that aren’t.

A. EXPAND COVERAGE OPTIONS BY ALLOWING CONSUMERS TO POOL TOGETHER AND PURCHASE INSURANCE AS A GROUP

We already allow people to group together to buy plans through businesses, ACOs, the Marketplaces, Health Ministries, and more. But Walker’s plan takes it a step further. Unfortunately it puts no regulations on what these plans could be, so not only are essential services not guaranteed, the incentive seems more on cherry picking what is covered to ensure low costs. It’s sort of an attractive idea, but without any smart regulation it seems like a slippery slope.

B. SUPPORT WELLNESS INCENTIVE PROGRAMS

Wellness programs are already incentivized in the ACA. There are employer wellness incentivizes and a surcharge for smokers. Still taking this idea further is a smart concept. Scott doesn’t say much else, isn’t much else for us to say either.

C. REFORM LONG-TERM SERVICES & SUPPORTS (LTSS) PROTECTION

Long term care is insanely expensive and a real issue for families. Scott Walker seems to want to push long-term care insurance more. Would really just depend on what he meant by this if it was a good idea or not. Certainly a poorly regulated life insurance product focused on long-term care could be a nightmare, but not planning for long-term care and then depending upon Medicaid, Medicare, and families is also not ideal.

D. LIMIT EXCESSIVE LITIGATION THROUGH INNOVATIVE LAWSUIT REFORM

Walker wants to simplify litigation in healthcare. Litigation, claims, and billing could all use a better look. This could make sense depending upon specifics.

5. Provide Financial Stability for Families and Taxpayers.

This section is unfortunately more rhetoric.

Scott says, “the costs associated with my plan would not be funded through new taxes and mandates. In fact, my plan would repeal all of ObamaCare’s $1 trillion in new taxes and provide new tax cuts.” He also says his solution for Medicaid expansion was better than the Government’s… but read this.

Unfortunately, when you look at healthcare spending and the budget, Walker’s conclusion falls short.

You can’t give everyone tax credits and put $1,000 in HSA’s, give tax breaks, take away taxes, increase HSA limits, put hundreds of billions in spending back in to Medicare, eliminate reforms, and still somehow expect to not explode the debt and deficit. As for people’s health, it still leaves millions uninsured and offers no solution to Americans struggling financially.

The sad truth here is that for the few good ideas and some admirable idealism the plan doesn’t seem to make much sense for getting people insured or bringing down the deficit and rather just heavily favors businesses, upper middle-class, high earners, and dismantles the safety-net.

The scary thing is that Walker’s plan is essentially a carbon copy of every other Republican plan. The only glimmer of hope here is that Trump is leading the polls and he is just as likely to implement single payer as he is to win the Republican nomination.

Spoiler. the rest of the PDF is blank space, rhetoric, and pictures. Make sure to read “The Day One Patient Freedom Plan – My Plan to Repeal & Replace ObamaCare” By Scott Walker for yourself.

Jean C

Walker’s plan will have people bear more financial burden than Obamacare.. Why would we do that?